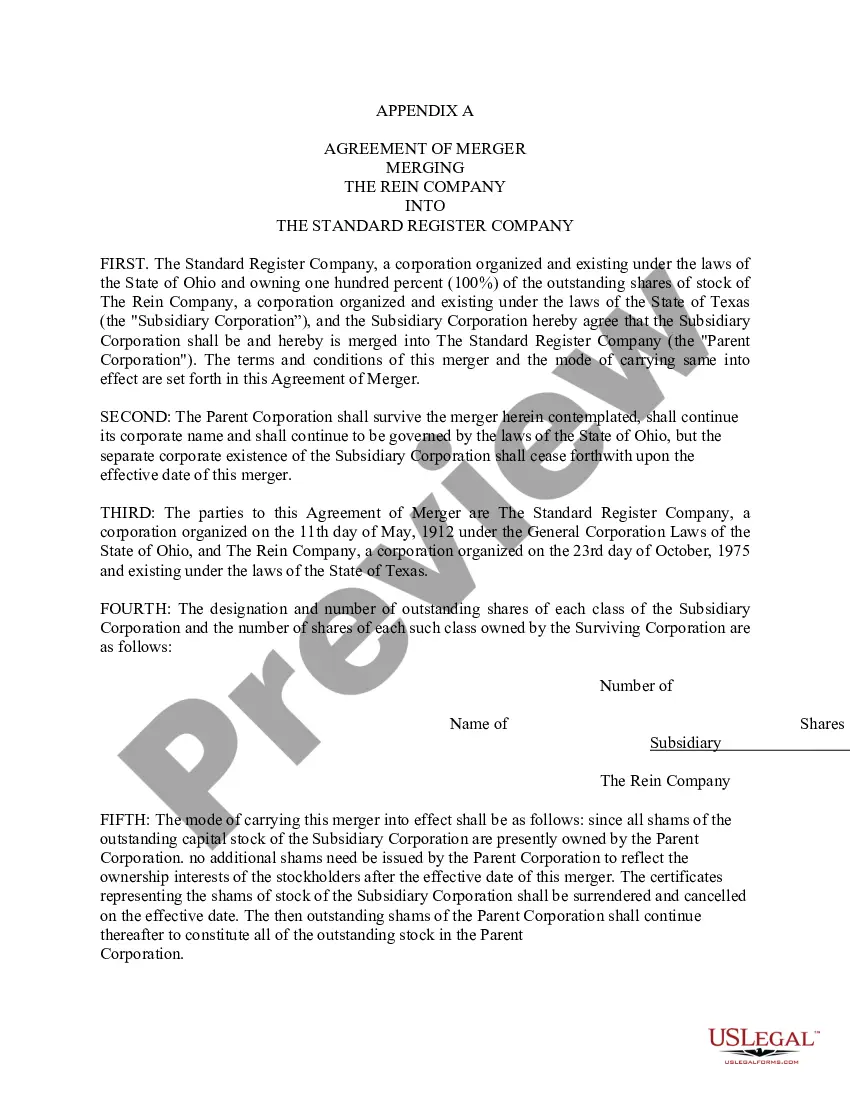

New York Proposal to approve agreement of merger with copy of agreement

Description

How to fill out Proposal To Approve Agreement Of Merger With Copy Of Agreement?

US Legal Forms - one of the biggest libraries of lawful varieties in the States - offers an array of lawful record web templates it is possible to obtain or printing. Using the web site, you can get 1000s of varieties for organization and person functions, sorted by classes, states, or keywords.You can find the most recent versions of varieties such as the New York Proposal to approve agreement of merger with copy of agreement in seconds.

If you currently have a membership, log in and obtain New York Proposal to approve agreement of merger with copy of agreement in the US Legal Forms catalogue. The Down load option will show up on each and every form you see. You get access to all earlier delivered electronically varieties in the My Forms tab of your profile.

If you would like use US Legal Forms the first time, here are easy recommendations to help you started off:

- Be sure to have selected the best form for the area/region. Click on the Review option to analyze the form`s content. See the form outline to actually have selected the correct form.

- If the form does not fit your demands, utilize the Research area on top of the monitor to get the one which does.

- If you are pleased with the form, validate your option by clicking on the Buy now option. Then, choose the costs plan you favor and give your qualifications to sign up on an profile.

- Approach the financial transaction. Make use of bank card or PayPal profile to perform the financial transaction.

- Select the format and obtain the form on your gadget.

- Make changes. Fill out, revise and printing and signal the delivered electronically New York Proposal to approve agreement of merger with copy of agreement.

Every single web template you put into your bank account does not have an expiry day which is your own permanently. So, if you want to obtain or printing an additional backup, just visit the My Forms portion and click on about the form you will need.

Get access to the New York Proposal to approve agreement of merger with copy of agreement with US Legal Forms, by far the most comprehensive catalogue of lawful record web templates. Use 1000s of specialist and condition-distinct web templates that meet up with your organization or person needs and demands.

Form popularity

FAQ

While the day-to-day operations of a corporation, and even the policies governing its ongoing operations, are generally left to the corporation?s officers and directors, any "extra-ordinary" matter -- such as a merger or consolidation -- must be approved by the corporation's shareholders.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

Certifications & Education Formal education is non-negotiable. A bachelor's degree in business, accounting, finance, economics, or other related fields is essential to perform the job at the highest level. Other companies even require candidates with master's degrees in business management or finance.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

First, the corporation's board of directors must approve the plan of merger, consolidation, or share exchange. The plan must set forth the terms and conditions of the proposed transaction. Next, the merger plan usually is submitted to the corporation's shareholders for their approval.

How to Prepare for and Handle a Merger or Acquisition Step 1: Meet with the Executive Board to Set Goals. ... Step 2: Nominate Members of a "Transition Team" ... Step 3: Conduct Due Diligence or "Cultural Compatibility Assessment" ... Step 4: Report Findings to the Executive Board. ... Step 5: Prevent Loss of Productivity.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.