The New York Agreement and plan of merger by Gel co Corp. and Grossman Corp. is a legally binding document that outlines the terms and conditions for the merger between the two companies. This merger is a strategic move aimed at enhancing their market presence and creating synergistic benefits. The agreement entails a comprehensive plan that covers various aspects of the merger process, ensuring a smooth transition and successful integration of the two companies. It outlines the terms of the merger, including the exchange ratio of shares, the rights and obligations of both parties, and the financial considerations involved. One type of New York Agreement and plan of merger often used is the "Stock-for-Stock Merger". This type involves exchanging the shares of one company (Grossman Corp.) for the shares of another (Gel co Corp.) at a predetermined ratio. This allows the shareholders of both companies to become stakeholders in the newly formed entity. Another type of New York Agreement and plan of merger is the "Cash-and-Stock Merger". In this type, a combination of cash and stock is used as consideration for the merger. Gel co Corp. may offer cash payments along with shares of its company to the shareholders of Grossman Corp. The New York Agreement and plan of merger also includes provisions related to governance structure, management team, employee retention, asset distribution, and potential antitrust or regulatory approvals. It ensures that the merger is compliant with applicable laws and regulations. Keywords: New York Agreement, plan of merger, Gel co Corp., Grossman Corp., merger process, strategic move, market presence, synergistic benefits, exchange ratio of shares, rights and obligations, financial considerations, Stock-for-Stock Merger, shares, stakeholders, Cash-and-Stock Merger, cash payments, governance structure, management team, employee retention, asset distribution, antitrust, regulatory approvals.

New York Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

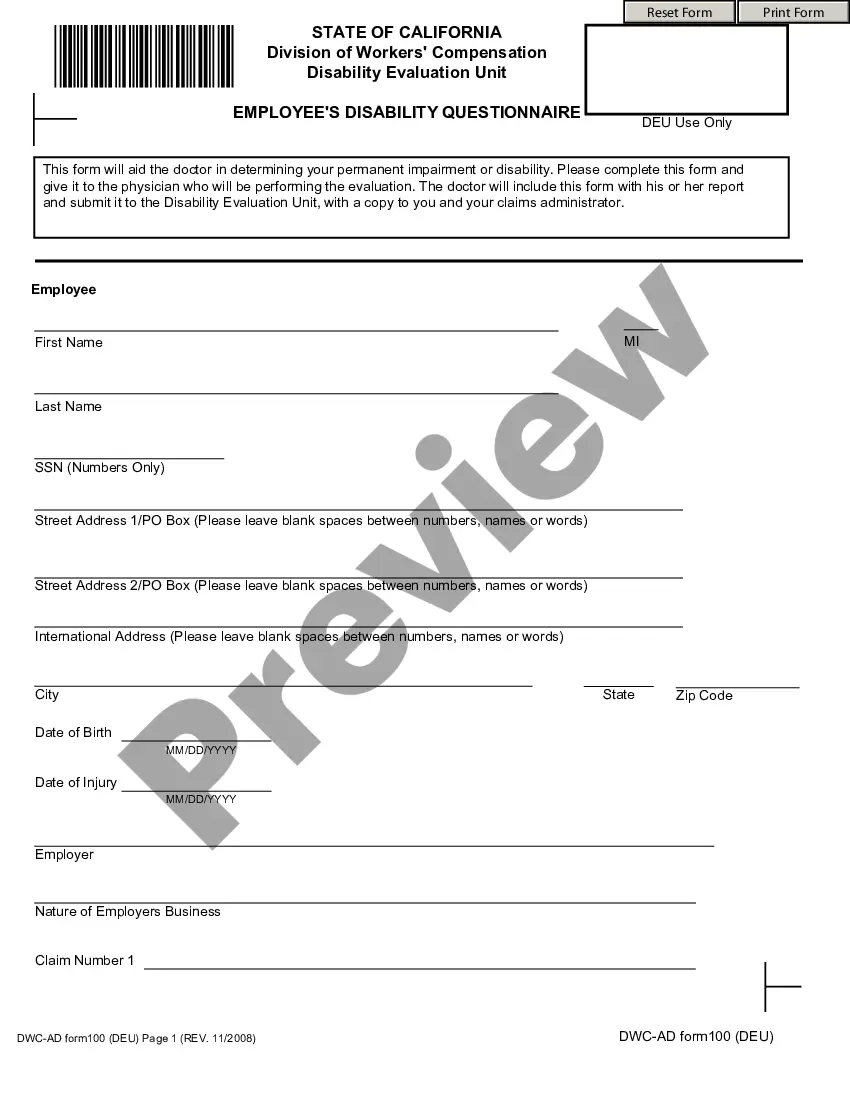

How to fill out New York Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

It is possible to spend hrs on-line looking for the legal file web template which fits the federal and state demands you will need. US Legal Forms offers a large number of legal types that are evaluated by professionals. You can easily download or printing the New York Agreement and plan of merger by Gelco Corp. and Grossman Corp. from your services.

If you have a US Legal Forms profile, you can log in and click the Obtain switch. Afterward, you can total, revise, printing, or signal the New York Agreement and plan of merger by Gelco Corp. and Grossman Corp.. Each and every legal file web template you acquire is your own property forever. To get another duplicate of the obtained form, check out the My Forms tab and click the related switch.

If you use the US Legal Forms internet site the first time, keep to the simple instructions beneath:

- Initial, be sure that you have chosen the correct file web template to the area/area of your choice. Look at the form description to ensure you have picked out the right form. If accessible, utilize the Preview switch to appear with the file web template too.

- If you wish to get another variation in the form, utilize the Search discipline to obtain the web template that suits you and demands.

- After you have found the web template you want, click Acquire now to continue.

- Select the prices prepare you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal profile to purchase the legal form.

- Select the format in the file and download it for your product.

- Make modifications for your file if necessary. It is possible to total, revise and signal and printing New York Agreement and plan of merger by Gelco Corp. and Grossman Corp..

Obtain and printing a large number of file templates utilizing the US Legal Forms Internet site, that offers the largest collection of legal types. Use expert and state-specific templates to tackle your small business or specific needs.

Form popularity

FAQ

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity. The firms that agree to merge are roughly equal in terms of size, customers, and scale of operations. For this reason, the term "merger of equals" is sometimes used.

Steps for the buyer in the M&A process Step 1: Develop an acquisition strategy. ... Step 2: Set the M&A search criteria. ... Step 3: Search for potential acquisition targets. ... Step 4: Begin acquisition planning. ... Step 5: Perform valuation analysis. ... Step 6: Begin negotiations. ... Step 7: Perform M&A due diligence.

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

Mergers and acquisitions (M&As) are the acts of consolidating companies or assets, with an eye toward stimulating growth, gaining competitive advantages, increasing market share, or influencing supply chains.

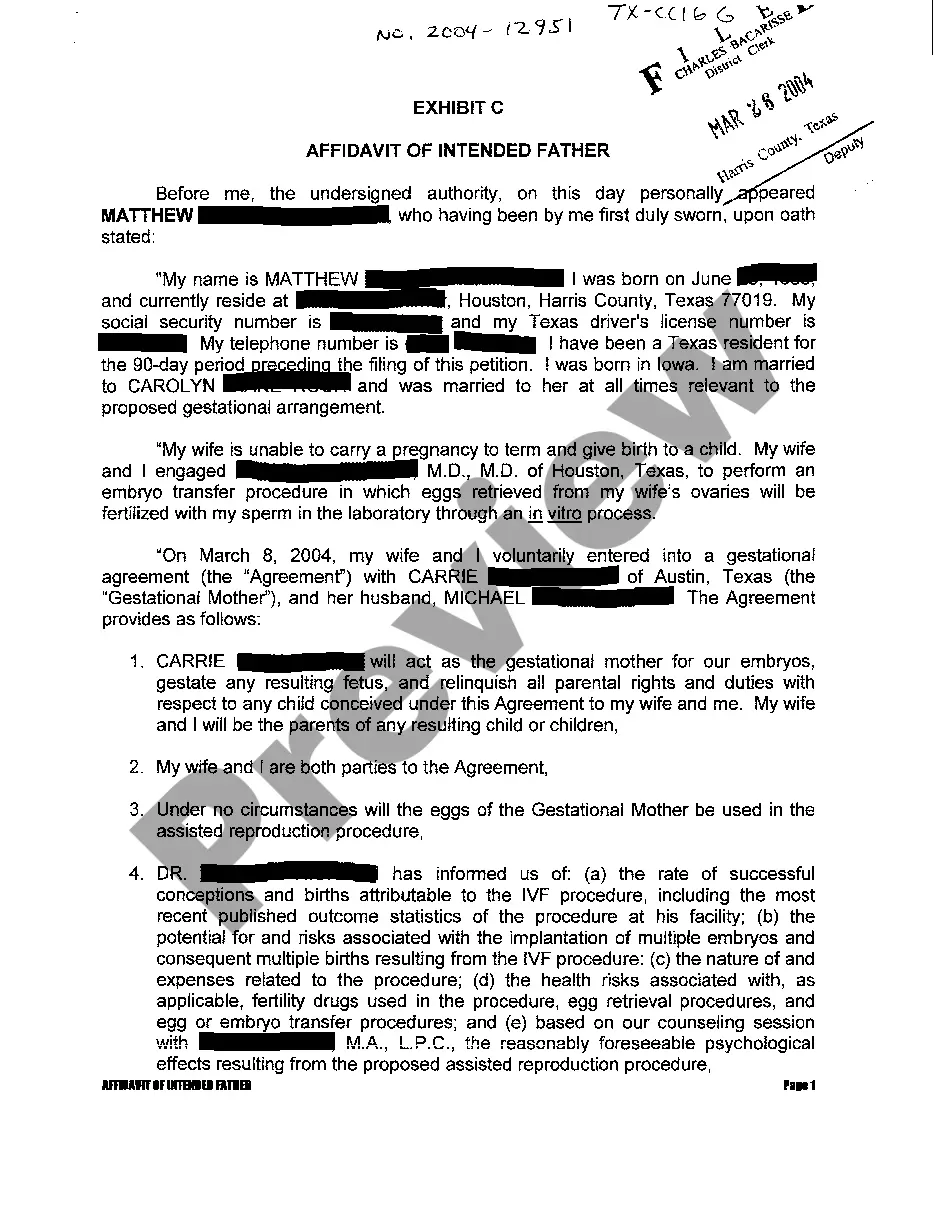

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.