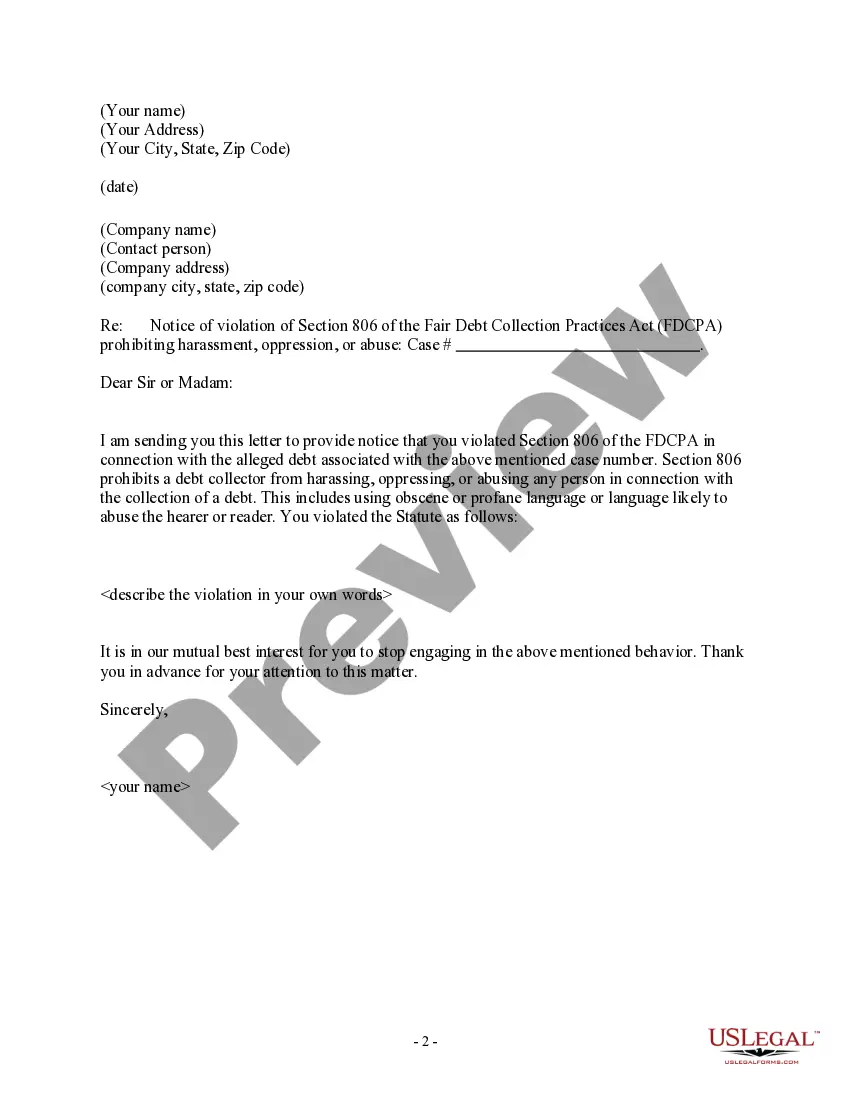

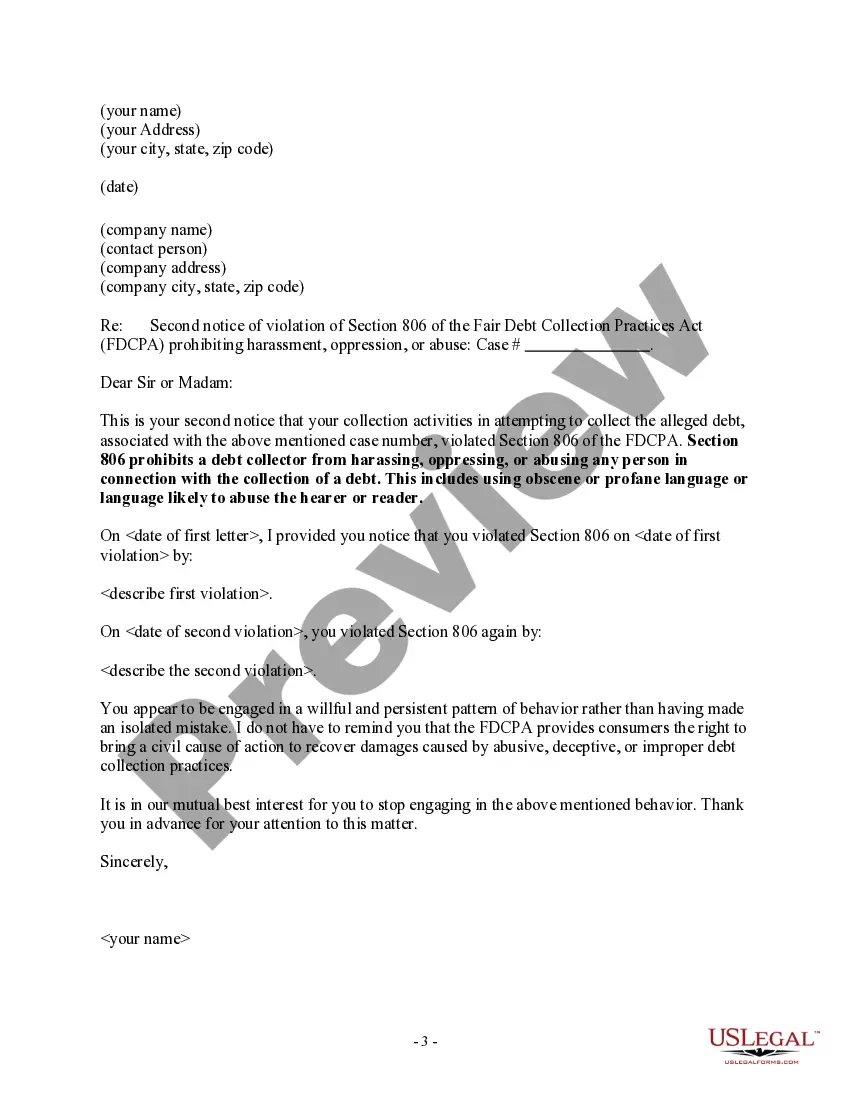

A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

New York Notice to Debt Collector - Use of Abusive Language

Description

How to fill out New York Notice To Debt Collector - Use Of Abusive Language?

You can commit time on the web trying to find the lawful record design that fits the state and federal specifications you require. US Legal Forms offers thousands of lawful forms that are analyzed by professionals. You can actually down load or produce the New York Notice to Debt Collector - Use of Abusive Language from our services.

If you already possess a US Legal Forms profile, you may log in and then click the Down load switch. After that, you may total, revise, produce, or indication the New York Notice to Debt Collector - Use of Abusive Language. Every lawful record design you acquire is yours eternally. To have yet another backup of the obtained kind, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms website for the first time, follow the simple directions below:

- First, ensure that you have selected the right record design for the region/area of your choice. Read the kind description to ensure you have picked out the appropriate kind. If offered, use the Preview switch to check with the record design too.

- If you wish to find yet another model of the kind, use the Search field to find the design that meets your needs and specifications.

- After you have identified the design you would like, just click Purchase now to move forward.

- Select the rates prepare you would like, type in your qualifications, and register for your account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal profile to cover the lawful kind.

- Select the structure of the record and down load it to the system.

- Make alterations to the record if possible. You can total, revise and indication and produce New York Notice to Debt Collector - Use of Abusive Language.

Down load and produce thousands of record layouts utilizing the US Legal Forms website, which offers the biggest assortment of lawful forms. Use professional and express-specific layouts to deal with your company or specific demands.

Form popularity

FAQ

Yes. The federal Fair Debt Collection Practices Act specifically gives you the right to sue a debt collector for harassment. If a debt collector is found to have engaged in harassing behavior, you are entitled to up to $1,000 in damages, along with court costs and attorney fees.

How to Stop Debt Collector HarassmentWrite a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

9 Ways to Turn the Tables on Debt CollectorsDon't Wait for Them to Call. Consider picking up the phone and calling the debt collector yourself.Check Them Out.Dump it Back in Their Lap.Stick to Business.Show Them the Money.Ask to Speak to a Supervisor.Call Their Bluff.Tell Them to Take a Hike.More items...?

7 Ways To Defend a Debt Collection LawsuitRespond to the Lawsuit or Debt Claim.Challenge the Company's Legal Right to Sue.Push Back on Burden of Proof.Point to the Statute of Limitations.Hire Your Own Attorney.File a Countersuit if the Creditor Overstepped Regulations.File a Petition of Bankruptcy.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

No. It is illegal for a debt collector to use profane or abusive language in order to strongarm you into making payments. That's a violation of the Fair Debt Collection Practices Act. Debt collectors can be very aggressive when trying to settle an account.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .