This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

New York Acquisition Divestiture Merger Agreement Summary

Description

How to fill out New York Acquisition Divestiture Merger Agreement Summary?

You can commit several hours online attempting to find the legal papers format that meets the federal and state needs you require. US Legal Forms supplies thousands of legal varieties which can be analyzed by experts. You can actually obtain or print out the New York Acquisition Divestiture Merger Agreement Summary from your services.

If you already possess a US Legal Forms bank account, you may log in and then click the Download key. Afterward, you may full, change, print out, or sign the New York Acquisition Divestiture Merger Agreement Summary. Every single legal papers format you buy is your own for a long time. To get yet another backup associated with a bought type, proceed to the My Forms tab and then click the related key.

Should you use the US Legal Forms site the first time, keep to the easy recommendations below:

- First, make certain you have selected the right papers format for the area/area of your choosing. Browse the type information to make sure you have picked out the proper type. If available, use the Preview key to search throughout the papers format as well.

- If you would like find yet another variation of your type, use the Search industry to find the format that suits you and needs.

- Upon having located the format you desire, just click Purchase now to continue.

- Pick the costs plan you desire, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal bank account to purchase the legal type.

- Pick the formatting of your papers and obtain it to the system.

- Make changes to the papers if possible. You can full, change and sign and print out New York Acquisition Divestiture Merger Agreement Summary.

Download and print out thousands of papers templates using the US Legal Forms site, that provides the most important variety of legal varieties. Use expert and condition-specific templates to deal with your organization or individual requires.

Form popularity

FAQ

The complete list of due diligence documents to be collectedShareholder certificate documents.Local/state/federal business licenses.Occupational license.Building permits documents.Zonal and land use permits.Tax registration documents.Power of attorney documents.Previous or outstanding legal cases.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including:Confidentiality Agreements.Letters of Intent.Exclusivity Agreements.Disclosure Schedules.HSR Filings.Third Party Consents.Legal Opinions.Stock Certificates.More items...

Documents to be submitted by Transferee:Memorandum and Articles of Association. Audited Balance Sheet. Board Resolution for approval and authorization of the Scheme. List of Equity Shareholders.

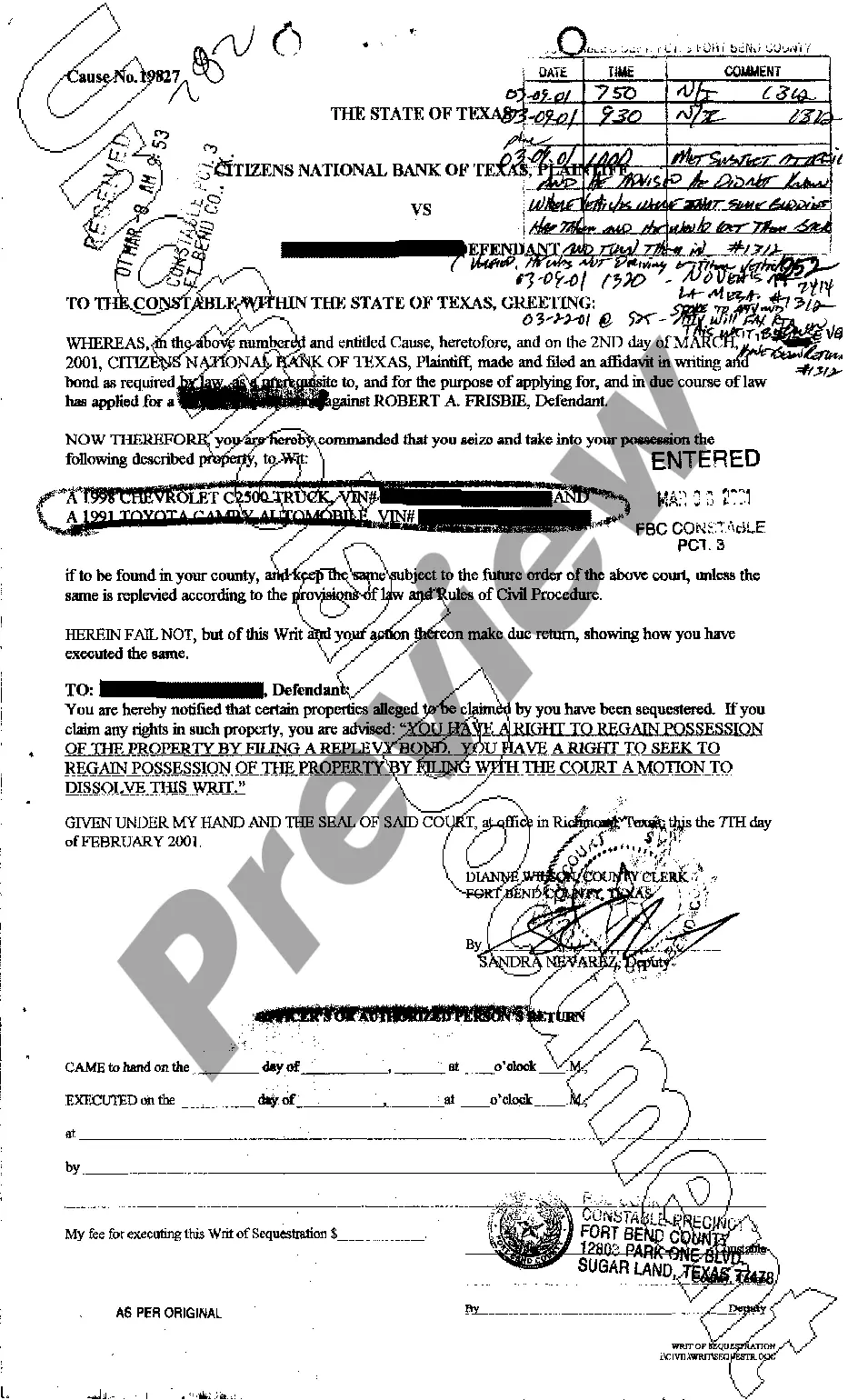

Divestitures are the flip side of corporate growth involving mergers and acquisitions. Divestiture involves a corporation's sale of one or more of its constituent parts (i.e., a branch, subsidiary or facility) or some or all of its productive assets in an effort to reduce its size.

Key Components of a Strong Merger & Acquisition Communication. As in most aspects of business, communication is a vital key to ensuring your merger or acquisition goes smoothly and is the right move for both companies. Win-Win. Shared Vision/New Identity. Well-Planned. Integration.

It includes a detailed description of the business and its operations, a company summary and overview, financial information, deal structure, etc.

There are generally three options for structuring a merger or acquisition deal:Stock purchase. The buyer purchases the target company's stock from its stockholders.Asset sale/purchase. The buyer purchases only assets and assumes liabilities that are specifically indicated in the purchase agreement.Merger.

8 Step in the Mergers and Acquisitions (M&A) Process#1 Developing Strategy.#2 Identifying and Contacting Targets.#3 Information Exchange.#4 Valuation and Synergies.#5 Offer and Negotiation.#6 Due Diligence.#7 Purchase Agreement.#8 Deal Closure and Integration.

What Are the Steps in the Merger and Acquisition Process?Develop an acquisition strategy. The first thing a buyer needs to do is strategize about how they will pursue an acquisition.Set M&A search criteria.Search for potential target companies.Start acquisition planning.Perform valuation.

Deal structuring consists of determining the acquisition vehicle, post-closing organization, the form of payment, the form of acquisition, legal form of selling entity, and accounting and tax considerations.