A New York Loan Modification Agreement — Multistate is a legal contract that allows homeowners in New York to modify the terms of their existing mortgage loan to make it more affordable and manageable. This agreement is typically used when borrowers are facing financial hardships that prevent them from making their mortgage payments. The purpose of a loan modification agreement is to negotiate new loan terms with the lender in order to prevent foreclosure and allow the homeowners to keep their property. The agreement is a written contract that outlines the changes in the loan terms, such as interest rate adjustments, the extension of loan repayment period, or changes in monthly payment amounts. There are different types of New York Loan Modification Agreements — Multistate depending on the specific terms negotiated between the borrower and the lender: 1. Temporary Loan Modification Agreement: This type of agreement allows borrowers to temporarily reduce their mortgage payments for a certain period of time. It may include a lower interest rate, a lower principal balance, or a combination of both. This temporary relief is often offered as a solution during a financial crisis and requires the borrower to meet specific criteria to qualify. 2. Permanent Loan Modification Agreement: Unlike the temporary modification, a permanent loan modification agreement provides long-term changes to the mortgage loan terms. This type of agreement is typically sought after a successful trial period under the temporary modification agreement. It aims to establish new loan terms that make the mortgage payments more affordable for the borrower in the long run. 3. Interest Rate Reduction Modification Agreement: This type of loan modification agreement focuses on reducing the interest rate on the mortgage loan. By lowering the interest rate, the borrower's monthly payments decrease, making it more feasible for them to keep up with their mortgage obligations. 4. Principal Reduction Modification Agreement: In certain cases, borrowers may be able to negotiate a reduction in the principal balance of their loan through a modification agreement. This type of modification aims to lower the overall loan amount, ensuring that the borrower owes less to the lender. It can significantly reduce the monthly payments and make the loan more affordable for the borrower. 5. Combination Modification Agreement: A combination loan modification agreement combines multiple modifications to the borrower's mortgage loan terms. For example, it may include a reduction in interest rate, an extension of the loan term, and a principal reduction, depending on the borrower's financial circumstances and the lender's policies. In conclusion, a New York Loan Modification Agreement — Multistate is a legal contract that offers homeowners in New York the opportunity to modify their existing mortgage loan terms. By negotiating changes such as interest rate adjustments, principal reductions, or temporary payment reductions, borrowers can aim to make their mortgage payments more affordable and avoid foreclosure.

New York Loan Modification Agreement - Multistate

Description

How to fill out New York Loan Modification Agreement - Multistate?

You can spend time on-line trying to find the authorized document format that meets the federal and state specifications you require. US Legal Forms supplies a large number of authorized varieties that are reviewed by pros. It is possible to download or print the New York Loan Modification Agreement - Multistate from our services.

If you have a US Legal Forms account, it is possible to log in and click the Down load button. Afterward, it is possible to comprehensive, change, print, or sign the New York Loan Modification Agreement - Multistate. Each authorized document format you purchase is the one you have permanently. To acquire yet another copy of any acquired form, check out the My Forms tab and click the related button.

If you are using the US Legal Forms site the very first time, stick to the basic recommendations beneath:

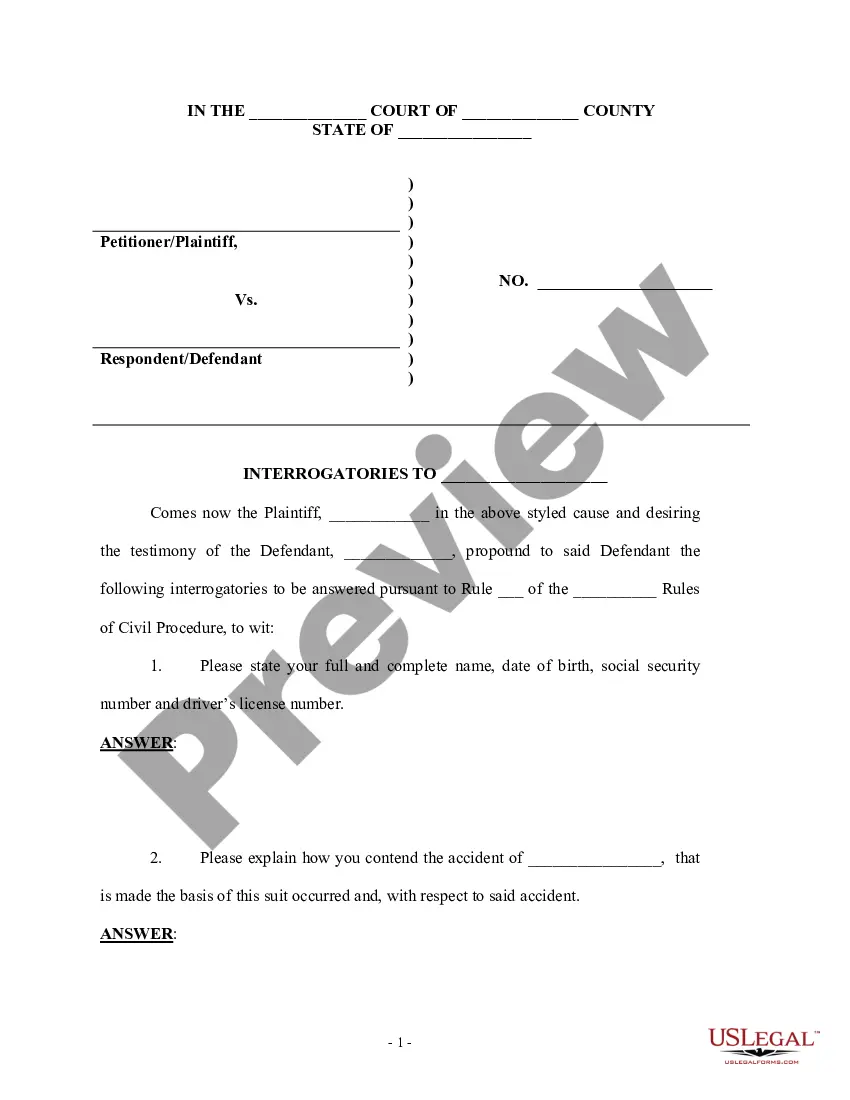

- Very first, make sure that you have chosen the correct document format to the area/area of your choice. See the form information to make sure you have picked out the appropriate form. If accessible, make use of the Preview button to appear through the document format too.

- If you wish to discover yet another model from the form, make use of the Look for area to find the format that suits you and specifications.

- Once you have identified the format you need, click on Buy now to proceed.

- Pick the pricing plan you need, key in your qualifications, and register for your account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal account to purchase the authorized form.

- Pick the formatting from the document and download it for your system.

- Make adjustments for your document if required. You can comprehensive, change and sign and print New York Loan Modification Agreement - Multistate.

Down load and print a large number of document layouts while using US Legal Forms web site, which offers the greatest assortment of authorized varieties. Use skilled and state-specific layouts to handle your organization or personal needs.