The New York Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. is a legal document that outlines the terms and conditions of the underwriting agreement between ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. for a specific mortgage loan trust. This agreement is specific to the state of New York and encompasses various aspects of the underwriting process. The underwriting agreement serves as a contractual agreement between ABCs Mortgage Loan Trust 1999-4, which acts as the issuer of the mortgage-backed securities, and Prudential Securities, Inc., which acts as the underwriter. The underwriter's role is to assess the risk profile of the mortgage loan trust and purchase the securities from ABCs Mortgage Loan Trust 1999-4 for resale to investors. This agreement ensures that Prudential Securities, Inc. agrees to purchase and distribute the offered securities in compliance with applicable laws and regulations. It also outlines the responsibilities, obligations, and compensation terms for both parties involved. The New York Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. may have different types or variations depending on the specific characteristics of the mortgage loan trust being underwritten. These variations can include different loan terms, interest rates, maturity dates, or other unique features of the mortgage loans within the trust. Overall, this underwriting agreement is crucial in establishing a clear understanding between ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. It serves to protect both parties' interests and ensures that the underwriting process for the mortgage loan trust is conducted in a legally compliant manner in the state of New York.

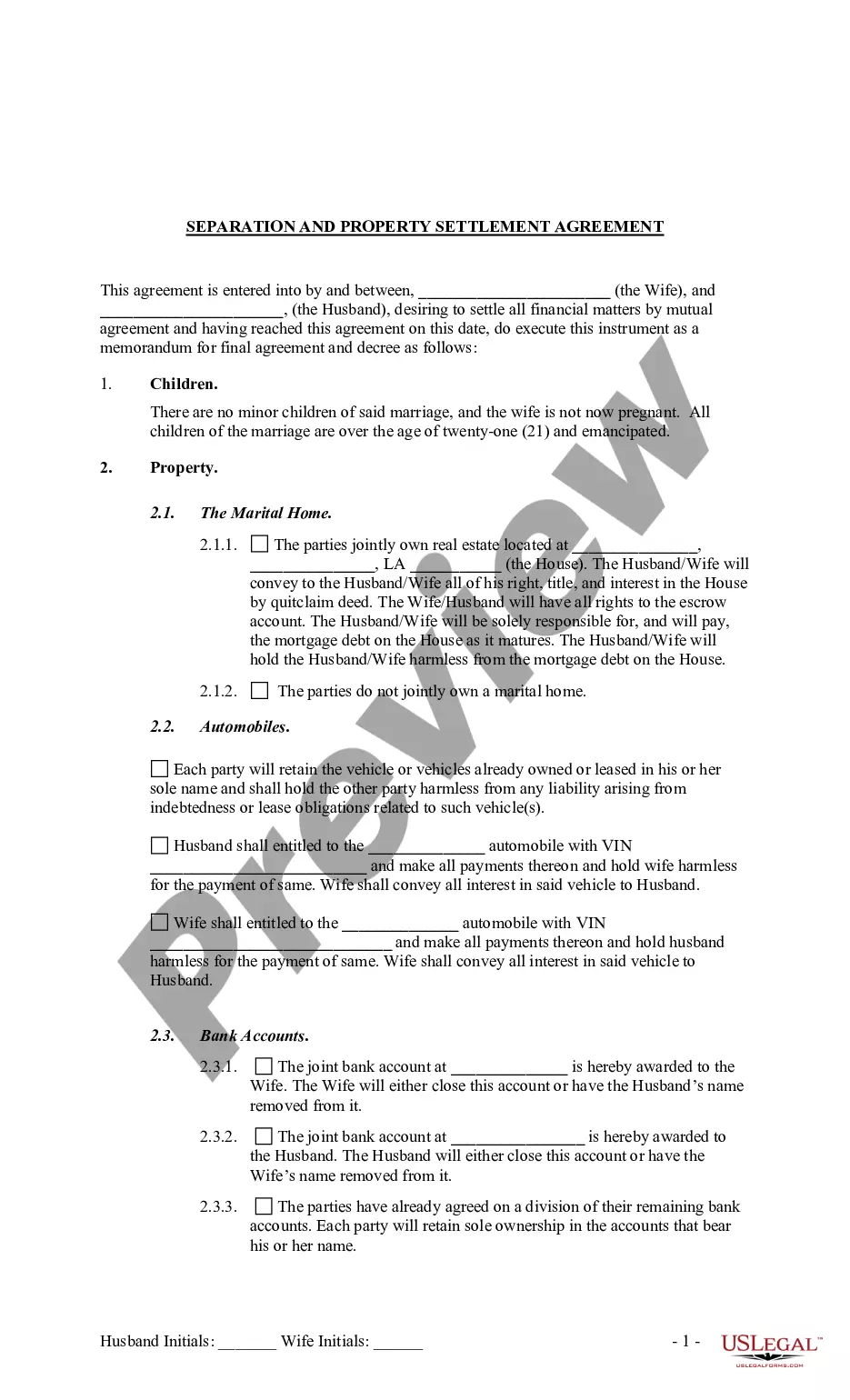

New York Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.

Description

How to fill out Underwriting Agreement Of ABFS Mortgage Loan Trust 1999-4 And Prudential Securities, Inc.?

Discovering the right authorized papers template can be quite a struggle. Needless to say, there are a lot of layouts available on the net, but how would you get the authorized type you require? Take advantage of the US Legal Forms site. The services gives thousands of layouts, such as the New York Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc., which can be used for enterprise and personal requirements. All of the kinds are inspected by professionals and satisfy state and federal requirements.

If you are previously authorized, log in in your account and then click the Down load switch to have the New York Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.. Utilize your account to check with the authorized kinds you may have ordered previously. Proceed to the My Forms tab of your own account and get one more copy from the papers you require.

If you are a brand new end user of US Legal Forms, listed here are easy guidelines for you to follow:

- First, make sure you have selected the correct type for your personal metropolis/region. You may check out the shape while using Review switch and browse the shape description to make sure this is basically the best for you.

- If the type will not satisfy your requirements, use the Seach area to get the appropriate type.

- When you are certain the shape is acceptable, go through the Get now switch to have the type.

- Select the prices program you need and enter the required information and facts. Make your account and buy the transaction with your PayPal account or credit card.

- Choose the data file format and acquire the authorized papers template in your system.

- Complete, change and produce and indicator the attained New York Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc..

US Legal Forms is definitely the most significant library of authorized kinds that you will find numerous papers layouts. Take advantage of the company to acquire appropriately-manufactured files that follow state requirements.

Form popularity

FAQ

Benefits of having a mortgage Although your credit might take a temporary hit when you get your mortgage, over time, paying down the balance can help improve or maintain your credit score. A higher credit score translates to everything from better interest rates to more loan options.

A mortgage loan application can be denied for many reasons, including a borrower's low credit score, recent employment change or high debt-to-income ratio. We'll go over the underwriting process in more detail, explore several reasons a borrower may not succeed in the underwriting process, and what to do about it.

A mortgage is a type of loan that's used to finance property. Mortgages are ?secured? loans. With a secured loan, the borrower promises collateral to the lender in the event that they stop making payments. In the case of a mortgage, the collateral is the home.

In simple terms, a home loan is a loan taken to buy or construct a new home ? i.e. the property is not owned by the loan applicant. A mortgage loan, also known as a loan against property, is a loan secured by a property that the loan applicant already owns.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own. Seven things to look for in a mortgage.

Your final conditions may include things like bringing in your down payment, paying off an outstanding judgment or closing certain accounts. Conditions can include just about anything that a lender needs to be confident that you can repay your mortgage as agreed.