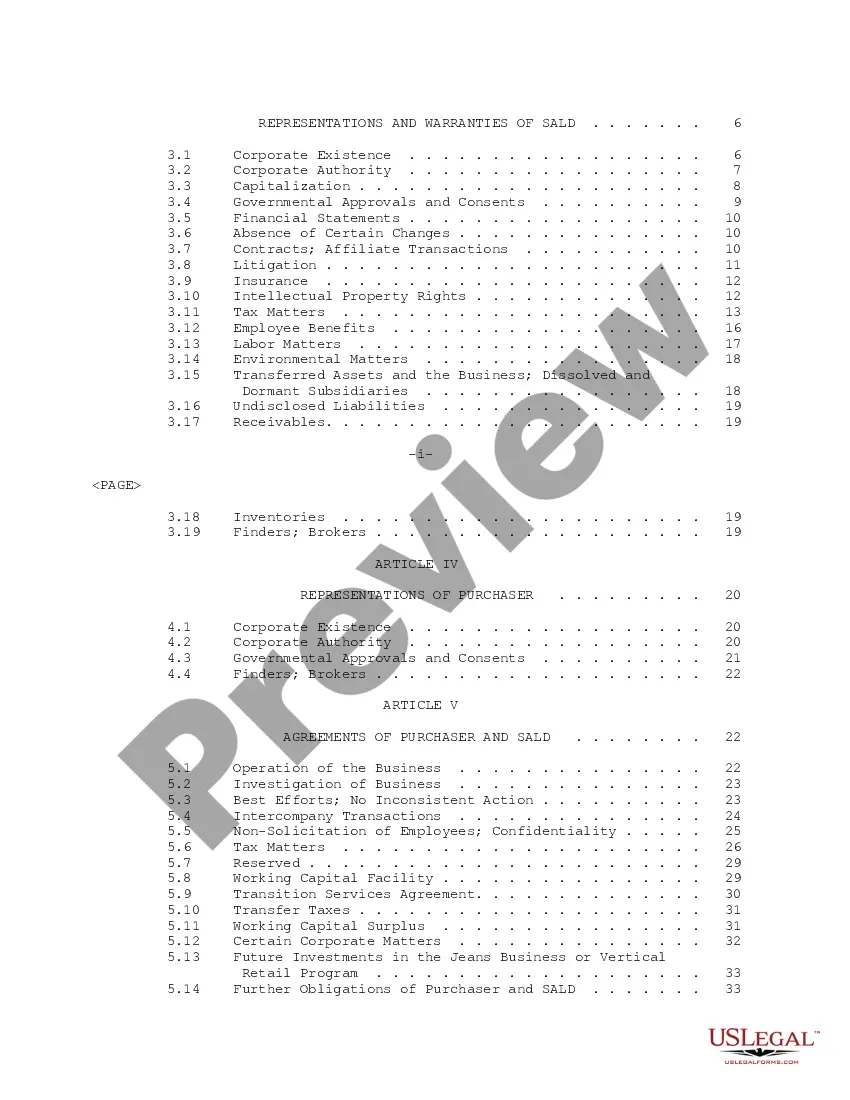

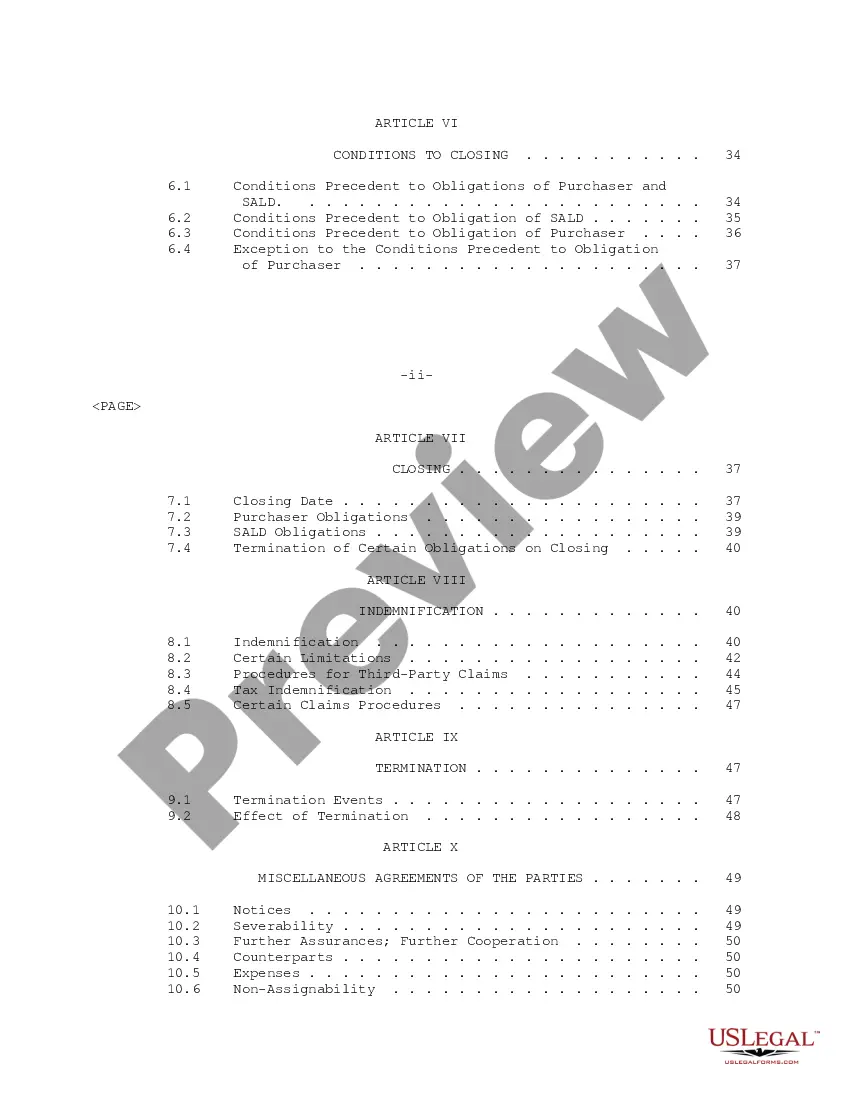

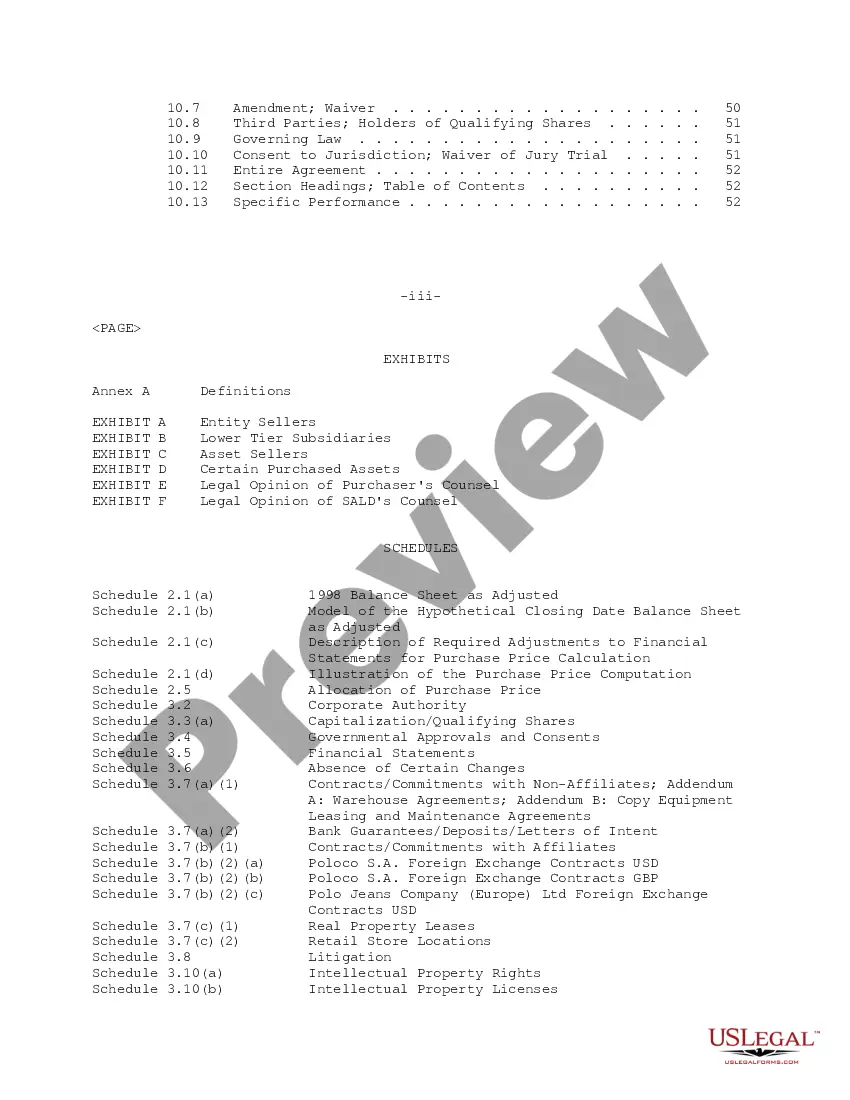

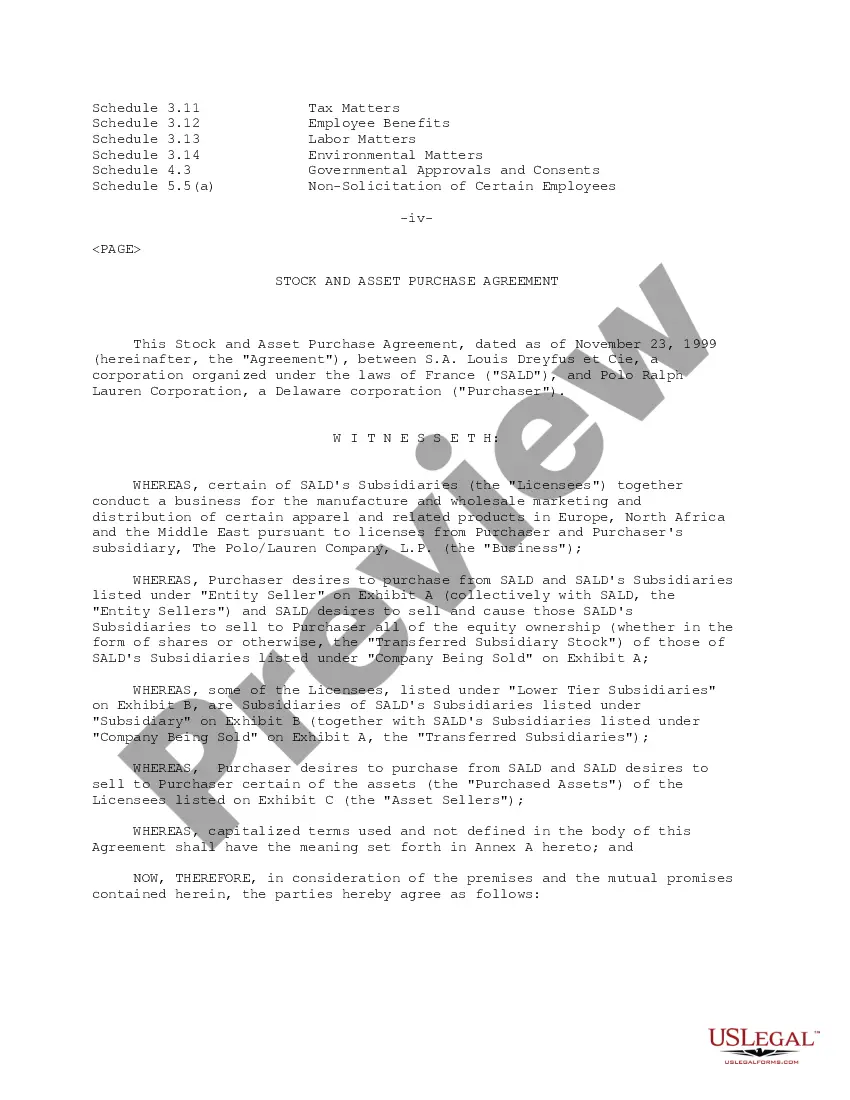

A stock purchase agreement is a legally binding document that outlines the terms and conditions of the acquisition of shares in a company. The agreement governs the transfer of ownership and establishes the rights and obligations of both the buyer and the seller. In this case, we will focus on the New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation, two prominent entities in the fashion industry. The New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation can encompass various types, each with its own specific focus. Some of these include: 1. Traditional Stock Purchase Agreement: This type of agreement involves the acquisition of common stock in Polo Ralph Lauren Corporation by S.A. Louis Dreyfus Et CIE. It includes provisions related to the purchase price, the number of shares being acquired, representations and warranties made by both parties, conditions to closing, and any restrictive covenants. 2. Preferred Stock Purchase Agreement: This agreement variant involves the purchase of preferred stock rather than common stock. Preferred stockholders typically have certain additional rights and benefits, such as priority in dividends or liquidation. 3. Minority Stock Purchase Agreement: In certain situations, S.A. Louis Dreyfus Et CIE may opt to acquire a minority stake in Polo Ralph Lauren Corporation instead of a majority interest. This type of agreement would cover the specifics of such a transaction, including governance rights, minority protections, and any potential board representation. 4. Restricted Stock Purchase Agreement: In this scenario, the purchase agreement may involve the acquisition of restricted stock, which is subject to certain restrictions or vesting conditions. These restrictions typically include a waiting period before the shares can be sold or transferred. 5. Stock Purchase Agreement with Voting Agreement: This type of agreement can be executed when S.A. Louis Dreyfus Et CIE desires to acquire stock in Polo Ralph Lauren Corporation while also entering into a separate voting agreement. The voting agreement may outline the terms by which Louis Dreyfus can exercise its voting rights on certain matters, ensuring alignment with the corporation's strategic direction. The New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation would cover essential elements such as the purchase price, representations and warranties, conditions to closing (including any required regulatory approvals), indemnification provisions, and dispute resolution mechanisms. Please note that this is a general description and the actual content of the New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation would be tailored to the specific transaction and circumstances involved.

New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation

Description

How to fill out New York Sample Stock Purchase Agreement Between S.A. Louis Dreyfus Et CIE And Polo Ralph Lauren Corporation?

Finding the right legitimate document web template might be a battle. Naturally, there are plenty of layouts available online, but how can you obtain the legitimate form you want? Use the US Legal Forms internet site. The services delivers thousands of layouts, like the New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation, which you can use for business and personal needs. All of the varieties are inspected by professionals and meet up with federal and state needs.

When you are already authorized, log in for your accounts and click the Obtain key to get the New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation. Make use of accounts to check throughout the legitimate varieties you might have purchased formerly. Check out the My Forms tab of your accounts and obtain another copy from the document you want.

When you are a brand new user of US Legal Forms, allow me to share simple recommendations so that you can adhere to:

- First, be sure you have chosen the right form for your city/region. It is possible to look over the form utilizing the Preview key and read the form information to make certain it will be the best for you.

- If the form will not meet up with your expectations, take advantage of the Seach field to find the appropriate form.

- When you are certain that the form is proper, click the Purchase now key to get the form.

- Select the costs program you would like and enter in the required information. Build your accounts and pay for the order using your PayPal accounts or bank card.

- Choose the file format and obtain the legitimate document web template for your device.

- Total, edit and printing and indicator the acquired New York Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation.

US Legal Forms may be the largest catalogue of legitimate varieties that you can find different document layouts. Use the service to obtain professionally-manufactured papers that adhere to state needs.