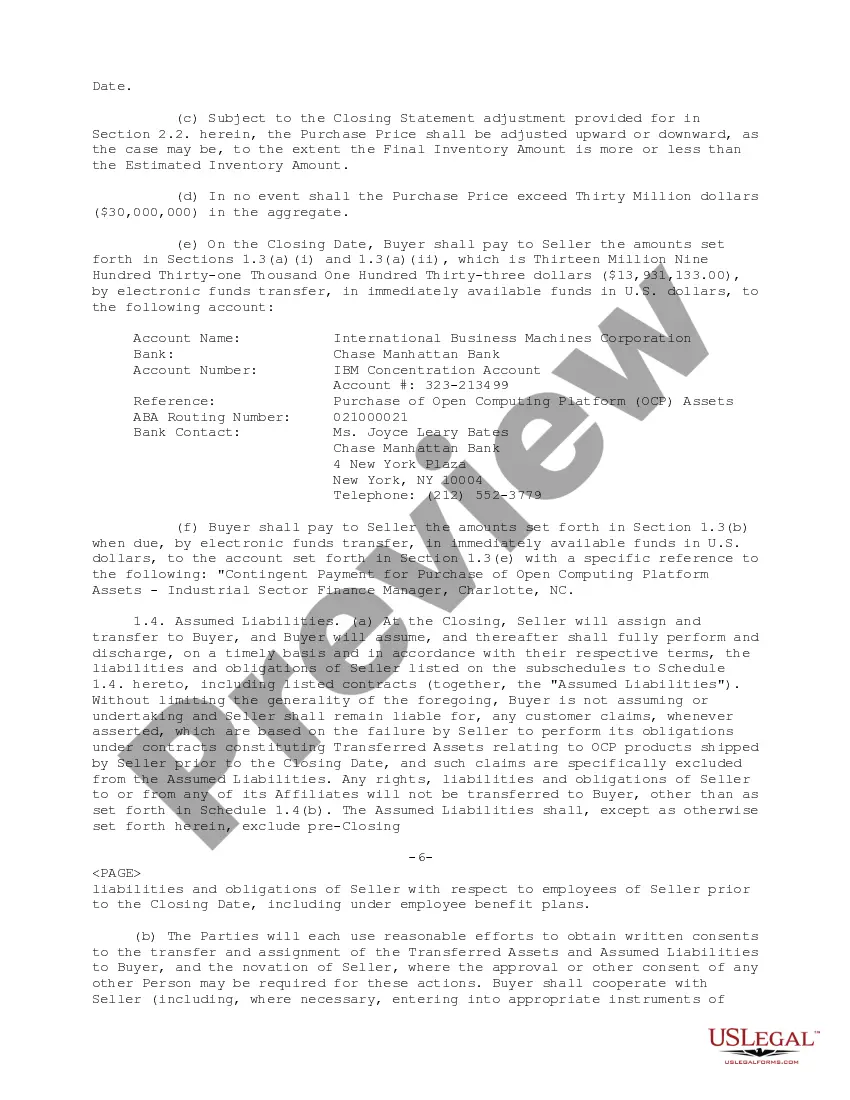

New York Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation — Sample: A Comprehensive Overview Introduction: The New York Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation (IBM) is a legally binding document that outlines the terms and conditions for the acquisition of assets by IBM from Radius. This agreement is specifically tailored for transactions in New York state and serves as a template for similar asset purchase agreements. Key Keywords: 1. Asset Purchase Agreement: An asset purchase agreement is a legal contract that governs the sale and purchase of specific assets between two parties. It details the terms, conditions, and rights associated with the transaction. 2. Radius Corporation: Radius Corporation is the selling party in this agreement. It is a technology company that provides open standards-based solutions for telecommunications networks. 3. International Business Machines Corporation (IBM): IBM is the purchasing party in this agreement. It is a multinational technology company that offers various products and services, including hardware, software, and consulting. 4. New York: The agreement is specific to transactions taking place in New York state, meaning it abides by New York laws and regulations. This ensures compliance with the state's specific legal requirements. Types of New York Sample Asset Purchase Agreements: 1. Stock Purchase Agreement: In some cases, the acquiring party may choose to acquire the target company's stock instead of its assets. A stock purchase agreement outlines the terms and conditions of buying shares or equity interests in the target company. 2. Intellectual Property (IP) Assets Purchase Agreement: In certain transactions, the focus may be on the purchase of intellectual property assets, such as patents, copyrights, trademarks, or trade secrets. An IP assets purchase agreement explicitly addresses the rights and transfer of these intangible assets. 3. Real Estate Assets Purchase Agreement: If the target company owns real estate properties, a separate agreement may be necessary to address the purchase of those assets. This type of agreement focuses specifically on the sale and transfer of real estate assets, including land, buildings, or leased properties. 4. Financial Assets Purchase Agreement: In cases where the target company holds financial assets, such as stocks, bonds, or securities, a financial assets purchase agreement may be used. This agreement outlines the terms and conditions for the acquisition of these financial instruments. Conclusion: The New York Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation serves as a valuable reference for businesses engaging in similar transactions. By comprehensively addressing the terms and conditions of the asset purchase, it provides a framework that can be customized and adapted to fit specific requirements and legalities for different types of asset purchases, such as stock, intellectual property, real estate, or financial assets.

New York Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out New York Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

If you wish to total, down load, or print authorized document templates, use US Legal Forms, the greatest selection of authorized kinds, that can be found online. Make use of the site`s simple and handy lookup to find the files you want. Numerous templates for organization and specific functions are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to find the New York Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample with a handful of click throughs.

Should you be presently a US Legal Forms customer, log in in your bank account and click on the Acquire option to find the New York Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample. You can also access kinds you in the past saved within the My Forms tab of your bank account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape to the proper metropolis/country.

- Step 2. Make use of the Review choice to check out the form`s content. Never overlook to read the explanation.

- Step 3. Should you be unsatisfied with the develop, make use of the Look for discipline towards the top of the display to get other versions of the authorized develop format.

- Step 4. Upon having identified the shape you want, select the Buy now option. Select the rates program you prefer and add your qualifications to sign up on an bank account.

- Step 5. Method the financial transaction. You can use your charge card or PayPal bank account to complete the financial transaction.

- Step 6. Select the structure of the authorized develop and down load it on the system.

- Step 7. Full, change and print or signal the New York Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Every single authorized document format you purchase is your own permanently. You may have acces to every develop you saved in your acccount. Click on the My Forms area and choose a develop to print or down load again.

Be competitive and down load, and print the New York Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample with US Legal Forms. There are many skilled and express-distinct kinds you can use for your organization or specific requirements.

Form popularity

FAQ

What's the Difference? Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

The purpose of an asset purchase agreement It lets your business get exactly the assets it wants without purchasing anything it does not. It also helps a business limit the potential liabilities it could face. For example, asset purchase agreements are commonly used to purchase: Intellectual property.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

In an asset sale, the employment relationship is terminated and a new one is created. This means that the seller needs to do all the things that an employer would normally do when terminating an employee, including paying out final wages and vacation pay (where required by contract or state law).