A New York Call Agreement is a legal contract between Also and Company, LP, Unilab Corporation, and Bankers Trust Company, specific to the state of New York. This agreement serves as an agreement between the parties involved for executing specific financial operations. This agreement establishes the terms and conditions related to the "call" option, which refers to the right to purchase an asset at a predetermined price within a specified time frame. Also and Company, LP, Unilab Corporation, and Bankers Trust Company enter into this agreement to outline their roles, responsibilities, and obligations regarding call options. One type of New York Call Agreement between Also and Company, LP, Unilab Corporation, and Bankers Trust Company is the Simple New York Call Agreement. In this agreement, all parties agree on the basic terms for executing a call option, including the price, assets involved, and the timeframe for execution. This agreement is commonly used when the terms and conditions are straightforward and do not require further customization. Another type of New York Call Agreement is the Complex New York Call Agreement. This agreement is employed when the call option transaction involves intricate financial products, such as derivatives, structured products, or complex assets. In such cases, the agreement includes more detailed provisions to address the complexity of the transaction and protect the rights and interests of all parties involved. The New York Call Agreement includes key terms and provisions such as the option strike price, expiration date, exercise rights, transferability, delivery obligations, and any associated fees or expenses. It also covers the events of default, dispute resolution, governing law, and jurisdiction to provide a comprehensive framework for executing the call option. Within this agreement, Also and Company, LP, Unilab Corporation, and Bankers Trust Company establish their respective roles. Also and Company, LP may act as the buyer or the seller of the call option depending on their investment strategies and goals. Unilab Corporation may be the counterparty buying or selling the call option, while Bankers Trust Company may function as the intermediary and custodian of the assets involved in the transaction. Overall, the New York Call Agreement between Also and Company, LP, Unilab Corporation, and Bankers Trust Company serves as a legal document that defines the rights, obligations, and terms for executing call options in the state of New York. It provides a structured framework for the parties to engage in financial transactions involving call options and ensures the smooth execution of such operations while safeguarding their interests.

New York Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company

Description

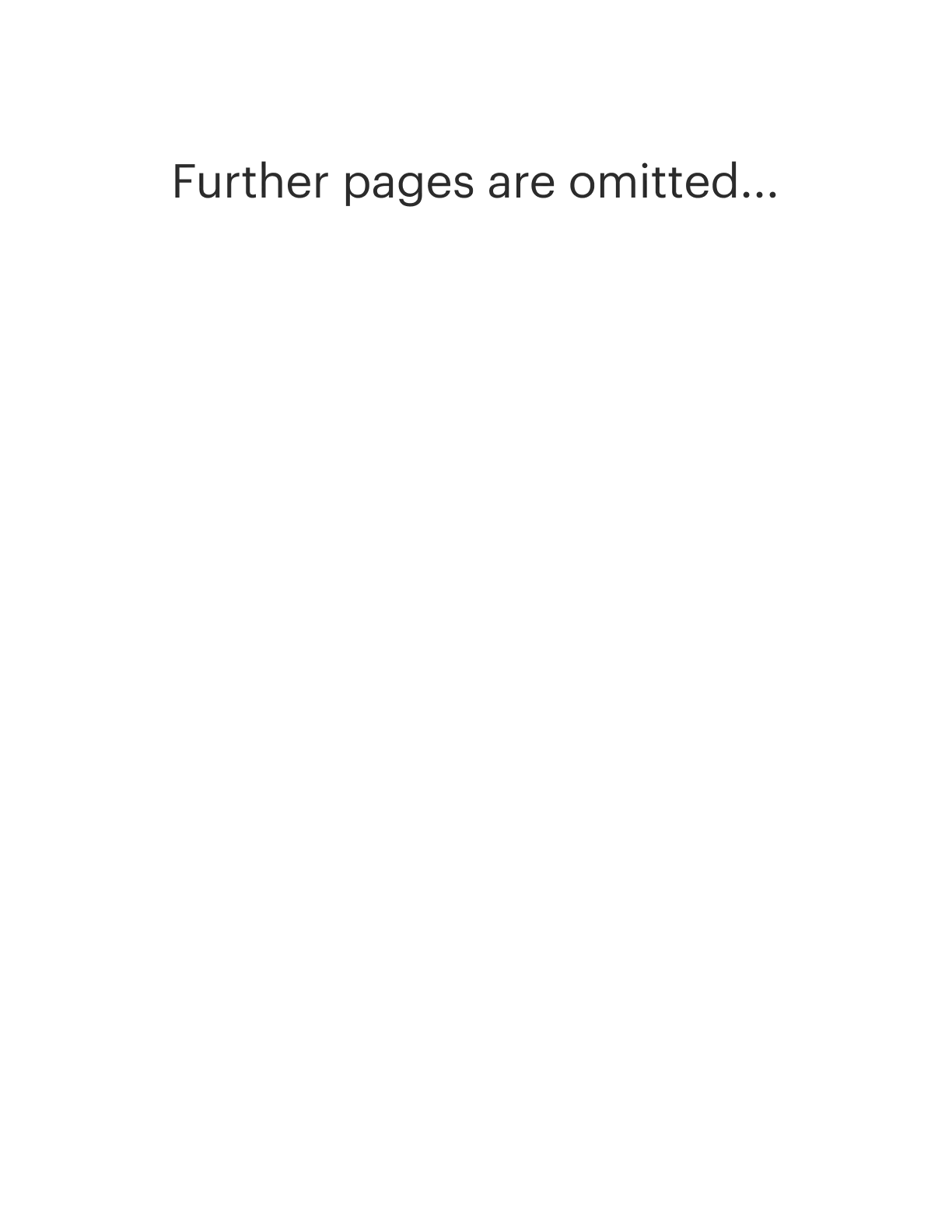

How to fill out New York Call Agreement Between Kelso And Company, LP, Unilab Corporation And Bankers Trust Company?

Are you presently inside a situation where you need to have paperwork for possibly company or person uses just about every working day? There are tons of authorized record templates available on the net, but discovering types you can trust is not simple. US Legal Forms delivers thousands of kind templates, like the New York Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company, which are published in order to meet federal and state needs.

When you are previously informed about US Legal Forms website and also have a merchant account, simply log in. After that, you may obtain the New York Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company design.

Should you not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is to the correct city/region.

- Utilize the Review button to examine the form.

- See the outline to ensure that you have chosen the correct kind.

- In case the kind is not what you`re looking for, utilize the Research area to discover the kind that suits you and needs.

- Once you get the correct kind, just click Acquire now.

- Select the rates strategy you would like, fill in the specified information and facts to make your account, and pay for the transaction with your PayPal or Visa or Mastercard.

- Decide on a handy paper structure and obtain your backup.

Find all the record templates you have purchased in the My Forms food selection. You may get a more backup of New York Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company whenever, if necessary. Just select the necessary kind to obtain or print out the record design.

Use US Legal Forms, one of the most comprehensive selection of authorized kinds, to conserve time as well as prevent mistakes. The service delivers skillfully manufactured authorized record templates that you can use for a range of uses. Make a merchant account on US Legal Forms and begin creating your daily life easier.