Title: Exploring the New York Trust Agreement Reference Trust Agreement for Select Equity Trust Introduction: The New York Trust Agreement Reference Trust Agreement serves as a crucial legal document governing the relationship between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust. This article aims to provide a detailed description of this trust agreement, shedding light on its purpose, unique features, and potential types. 1. Purpose of the Trust Agreement: The primary objective of the New York Trust Agreement Reference Trust Agreement is to outline the responsibilities, obligations, and rights of both Dean Witter Reynolds, Inc. and The Bank of New York related to the management and administration of Select Equity Trust. It aims to establish clear guidelines to ensure transparency, accountability, and efficient conduct in managing the trust. 2. Key Features of the Trust Agreement: a. Investment Management: The trust agreement delineates the roles and responsibilities of Dean Witter Reynolds, Inc. as the investment manager, outlining the authority, investment strategies, and performance benchmarks for managing the underlying assets of Select Equity Trust. b. Trustee's Duties: The Bank of New York, acting as the trustee, diligently executes its fiduciary duties, such as safeguarding the trust's assets, maintaining accurate records, and distributing income according to the agreement's provisions. c. Distribution Framework: The trust agreement defines the terms and conditions under which income and capital distributed by Select Equity Trust are allocated among beneficiaries or other designated entities. d. Reporting and Record keeping: It outlines the frequency and content of the reporting that Dean Witter Reynolds, Inc. provides to The Bank of New York, ensuring transparency and monitoring of the trust's financial performance. 3. Types of New York Trust Agreement Reference Trust Agreement: While the specific types of trust agreements between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust may vary, here are a few common types: a. Select Equity Trust for Individual Investors: This type of trust agreement may cater to individual investors seeking exposure to a diversified equity portfolio, managed in-line with their investment objectives and risk tolerance. b. Select Equity Trust for Institutional Investors: This variant of the trust agreement could be tailored for institutional investors, such as pension funds or endowments, offering customized investment strategies and provisions specific to their requirements. c. Select Equity Trust for Charitable Trusts: These trust agreements may address the unique needs of charitable organizations, considering payout requirements, tax implications, and alignment with the organization's mission. d. Select Equity Trust for Retirement Plans: Trust agreements designed for retirement plans might incorporate provisions specific to regulatory frameworks like ERICA, focusing on considerations such as income distribution during retirement, diversification, and participant communication. Conclusion: The New York Trust Agreement Reference Trust Agreement is an essential legal framework governing the Select Equity Trust relationship between Dean Witter Reynolds, Inc. and The Bank of New York. By understanding its purpose, key features, and potential types, stakeholders can ensure effective management and smooth operation of the trust, aligning it with the specific needs and objectives of the beneficiaries.

New York Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust

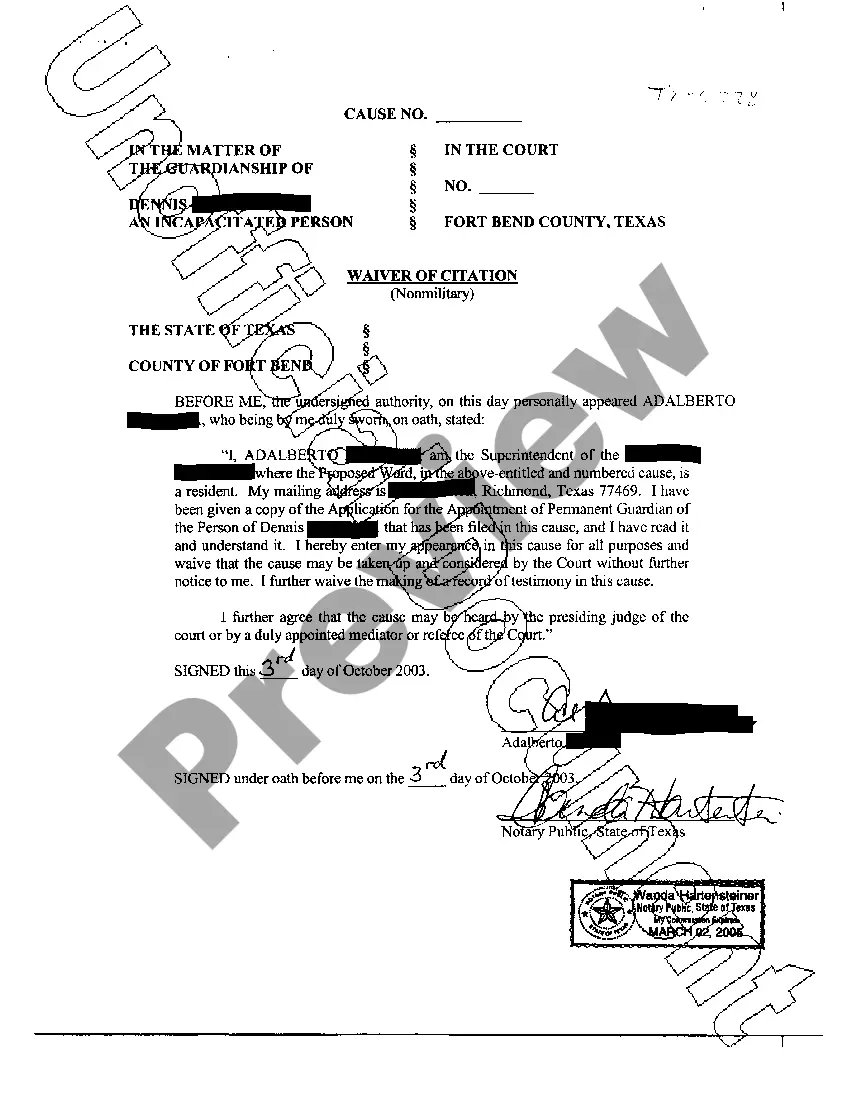

Description

How to fill out New York Trust Agreement Reference Trust Agreement Between Dean Witter Reynolds, Inc. And The Bank Of New York Regarding Select Equity Trust?

You are able to invest time online trying to find the authorized papers design which fits the federal and state specifications you need. US Legal Forms provides 1000s of authorized varieties which are reviewed by pros. You can actually acquire or produce the New York Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust from the assistance.

If you have a US Legal Forms account, it is possible to log in and click on the Acquire switch. Afterward, it is possible to complete, change, produce, or indicator the New York Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust. Each and every authorized papers design you buy is the one you have permanently. To get yet another duplicate of any purchased develop, check out the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms site for the first time, keep to the easy directions listed below:

- Very first, ensure that you have selected the proper papers design for the county/town of your choosing. Read the develop explanation to make sure you have picked out the correct develop. If available, make use of the Preview switch to look through the papers design as well.

- In order to discover yet another edition of the develop, make use of the Lookup industry to obtain the design that suits you and specifications.

- Once you have found the design you need, click Purchase now to move forward.

- Find the pricing strategy you need, key in your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal account to cover the authorized develop.

- Find the structure of the papers and acquire it to your system.

- Make adjustments to your papers if necessary. You are able to complete, change and indicator and produce New York Trust Agreement Reference Trust Agreement between Dean Witter Reynolds, Inc. and The Bank of New York regarding Select Equity Trust.

Acquire and produce 1000s of papers templates using the US Legal Forms site, which offers the biggest assortment of authorized varieties. Use professional and status-distinct templates to handle your company or personal requires.