The New York Investor Rights Agreement is a legal contract that outlines the specific rights and obligations of investors who purchase Series C Preferred Stock shares in a company. These agreements are designed to protect the interests of investors by providing them with certain rights, benefits, and protections. Under the New York Investor Rights Agreement, investors purchasing Series C Preferred Stock shares gain the right to participate in future financing rounds of the company, ensuring that they have the opportunity to maintain their ownership percentage. This right is commonly known as the "right of first refusal." Investors also obtain the right to receive financial information and updates from the company, keeping them informed about the company's financial health and performance. In addition, the agreement grants investors the right to vote on certain corporate matters, such as mergers, acquisitions, and board appointments. This gives the investors a say in important decision-making processes and ensures that their interests are represented. Moreover, the agreement provides investors with the right to be notified and given the opportunity to sell their shares in the event of a proposed sale or public offering of common stock by the company. To further safeguard their investment, the agreement often includes certain "protective provisions." These provisions may limit the ability of the company to take certain actions without the approval or consent of the investors, such as increasing the number of shares or changing the rights of the preferred stock. Different types of New York Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares may include variations in the specific terms and conditions. For example, there can be agreements with different levels of rights and benefits depending on the size of the investment or the strategic significance of the investor. Some agreements may also have specific clauses related to liquidation preferences, dividend rights, or anti-dilution provisions. It is important to carefully review and understand the specific terms outlined in each agreement before making any investment decisions. Overall, the New York Investor Rights Agreement is a crucial legal document that protects the rights and interests of investors who purchase Series C Preferred Stock shares. By comprehensively outlining the rights, benefits, and protections investors have, these agreements provide clarity and assurance to investors in their investment journey.

New York Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares

Description

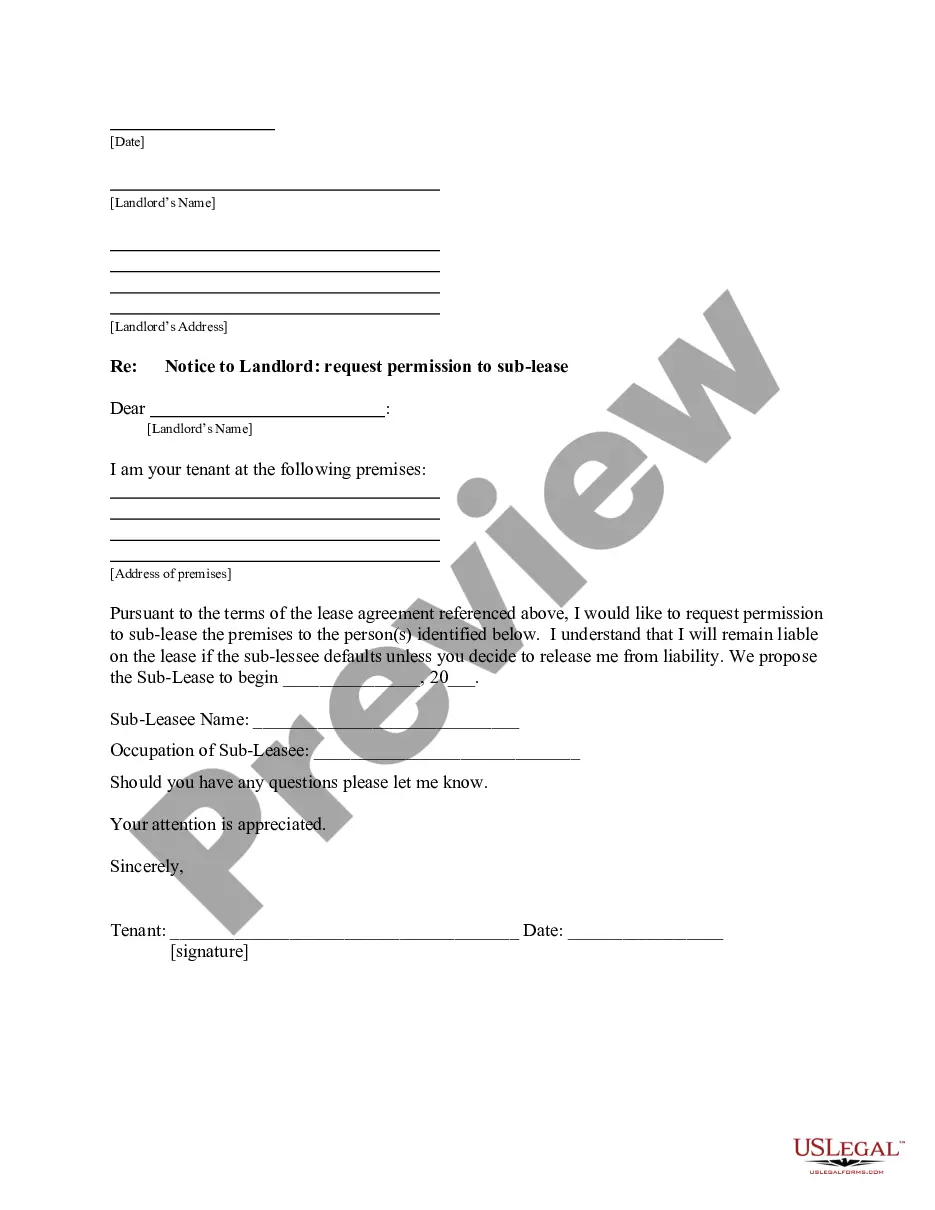

How to fill out New York Investor Rights Agreement Regarding The Purchase Of Series C Preferred Stock Shares?

Choosing the best legal papers template can be a have difficulties. Needless to say, there are tons of web templates accessible on the Internet, but how will you find the legal kind you require? Take advantage of the US Legal Forms internet site. The assistance delivers 1000s of web templates, including the New York Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares, that you can use for company and personal needs. All of the kinds are examined by experts and meet federal and state needs.

When you are currently signed up, log in in your profile and click on the Down load option to find the New York Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares. Utilize your profile to search throughout the legal kinds you might have acquired earlier. Check out the My Forms tab of your respective profile and obtain another duplicate of the papers you require.

When you are a new customer of US Legal Forms, here are basic guidelines that you should comply with:

- Very first, be sure you have selected the correct kind for the area/region. You are able to check out the form utilizing the Preview option and read the form outline to make sure this is basically the best for you.

- When the kind does not meet your requirements, make use of the Seach industry to get the correct kind.

- Once you are certain the form is acceptable, go through the Purchase now option to find the kind.

- Select the pricing strategy you need and enter in the essential information and facts. Design your profile and pay money for the order with your PayPal profile or charge card.

- Opt for the data file formatting and down load the legal papers template in your system.

- Comprehensive, revise and printing and signal the obtained New York Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares.

US Legal Forms is the most significant catalogue of legal kinds in which you can find a variety of papers web templates. Take advantage of the company to down load professionally-created papers that comply with express needs.

Form popularity

FAQ

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

This might include provisions for price and payment, conditions precedent to sale, completion arrangements, warranties, restraints and miscellaneous provisions (such as indemnity clauses, tax provisions or confidentiality agreements).

In a stock acquisition, a buyer acquires a target company's stock directly from the selling shareholders. Under this structure, the buyer is assuming ownership of all of the target's assets and liabilities, including potential liabilities from past actions of the target.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A stock purchase agreement is a two-party contract that dictates transactions around a company's shares. Stock purchase agreements are standard among small corporations; they provide capital while allowing business owners to retain a controlling interest.

Common due diligence issues unique to stock purchases include the seller's title to the target company's stock, terms of key contracts, identifying the target company's liabilities, and the nature and condition of the target company's assets.