The New York Polaris 401(k) Retirement Savings Plan Trust Agreement is an important legal document between Polaris Industries, Inc. and Fidelity Management Trust Co. This agreement establishes a trust for the purpose of managing the retirement savings plan for Polaris Industries employees. The trust agreement outlines the specific terms and conditions that govern the establishment and operation of the 401(k) retirement savings plan. It serves as a binding agreement between the two parties involved, ensuring that the plan is managed and administered in compliance with applicable laws and regulations. The New York Polaris 401(k) Retirement Savings Plan Trust Agreement addresses various aspects of the trust, including the roles and responsibilities of the plan fiduciaries, investment options, contribution rules, distribution policies, and administrative procedures. It also covers provisions related to communication with plan participants and the reporting of plan activity. Keywords: New York Polaris 401(k) Retirement Savings Plan Trust Agreement, Polaris Industries, Inc., Fidelity Management Trust Co., establishment of trust, retirement savings plan, legal document, trust agreement, employees, terms and conditions, compliance, plan fiduciaries, investment options, contribution rules, distribution policies, administrative procedures, plan participants, reporting. Different types of New York Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding the establishment of trust can include specific provisions tailored to meet the unique needs of different employee groups or circumstances. For instance, there might be variations in the trust agreement for executives, union members, or employees in different divisions of Polaris Industries. Each of these variations would address specific objectives, eligibility criteria, matching contributions, vesting schedules, and other plan design elements. However, the core structure and purpose of the trust agreement would remain consistent. Overall, the New York Polaris 401(k) Retirement Savings Plan Trust Agreement serves as a crucial framework for the effective management and operation of the retirement savings plan, ensuring that the best interests of plan participants are protected and their contributions are effectively managed for their future financial security.

New York Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description

How to fill out New York Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

If you have to total, download, or print authorized file web templates, use US Legal Forms, the greatest variety of authorized kinds, which can be found on-line. Utilize the site`s simple and easy handy look for to obtain the paperwork you will need. A variety of web templates for business and personal functions are categorized by types and claims, or keywords and phrases. Use US Legal Forms to obtain the New York Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust in a number of click throughs.

In case you are previously a US Legal Forms client, log in to your account and click on the Obtain switch to find the New York Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust. Also you can entry kinds you earlier delivered electronically from the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate city/nation.

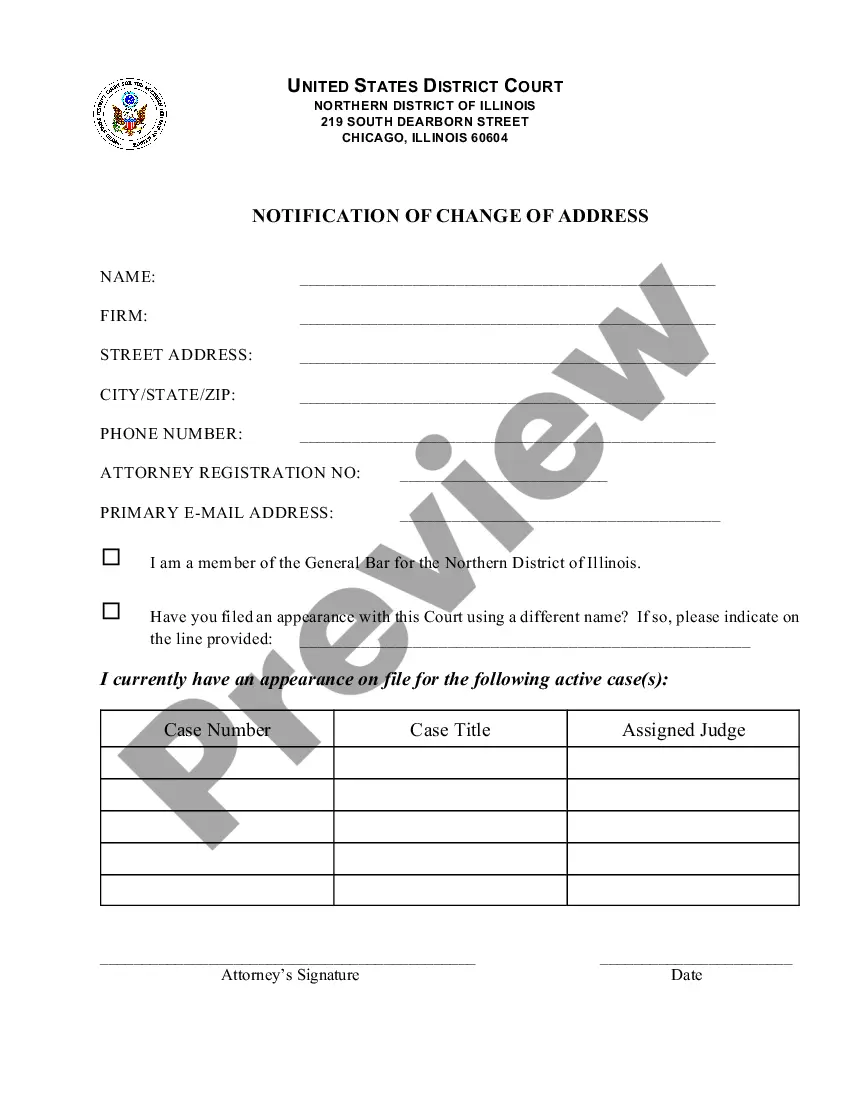

- Step 2. Take advantage of the Preview option to look over the form`s articles. Do not forget to learn the description.

- Step 3. In case you are not satisfied together with the kind, make use of the Search area towards the top of the monitor to discover other versions from the authorized kind format.

- Step 4. When you have identified the form you will need, click the Get now switch. Choose the prices strategy you prefer and add your qualifications to sign up for the account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to accomplish the purchase.

- Step 6. Find the file format from the authorized kind and download it in your product.

- Step 7. Complete, revise and print or indicator the New York Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust.

Each authorized file format you acquire is the one you have for a long time. You may have acces to every single kind you delivered electronically in your acccount. Click on the My Forms area and choose a kind to print or download yet again.

Be competitive and download, and print the New York Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust with US Legal Forms. There are many skilled and state-particular kinds you can utilize to your business or personal needs.