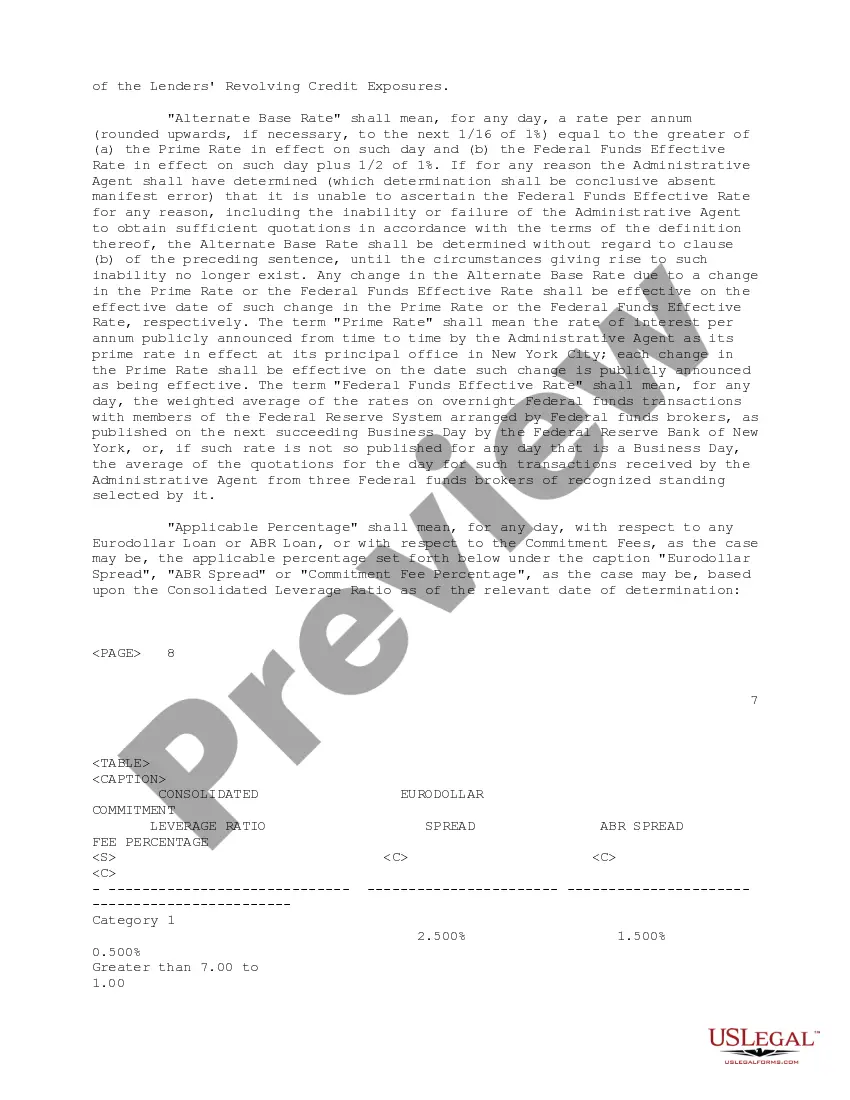

New York Credit Agreement is a legal document that sets out the terms and conditions for extending credit between a lender and a borrower in the state of New York. It serves as a contract, outlining the rights and obligations of both parties involved in a credit transaction. The agreement typically includes comprehensive details such as the loan amount, interest rate, repayment terms, and any collateral or guarantees provided by the borrower. Moreover, it specifies the rights and remedies available to both parties in case of default or breach of the agreement. There are various types of New York Credit Agreements regarding the extension of credit based on the specific needs and circumstances of the parties involved. Some common types include: 1. Revolving Credit Agreement: This type of credit agreement establishes a pre-approved credit line that the borrower can access repeatedly. It allows them to borrow, repay, and borrow again up to a set credit limit, providing flexibility in managing their financing needs. 2. Term Loan Credit Agreement: A term loan credit agreement is used when a lender provides a fixed amount of money to the borrower, which is then repaid over a predetermined period. It generally consists of regular repayments of principal along with accrued interest. 3. Syndicated Credit Agreement: A syndicated credit agreement involves a group of lenders, referred to as a syndicate, who jointly provide credit to a borrower. This agreement allows for larger loan amounts than a single lender could provide alone, and each lender has a proportional share of the loan. 4. Secured Credit Agreement: In a secured credit agreement, the borrower pledges specific assets or collateral to the lender as security for the loan. If the borrower defaults, the lender has the right to seize and sell the collateral to recover their money. 5. Unsecured Credit Agreement: Unlike a secured credit agreement, an unsecured credit agreement does not require collateral. In this case, the lender relies solely on the borrower's creditworthiness when extending credit, making it a riskier proposition for the lender. New York Credit Agreements are crucial in protecting the rights and interests of both borrowers and lenders. It is essential for all parties involved to review and understand the terms and conditions before entering into such an agreement to ensure a mutually beneficial and secure credit arrangement.

New York Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

If you wish to full, acquire, or print authorized record layouts, use US Legal Forms, the biggest selection of authorized kinds, that can be found online. Take advantage of the site`s simple and convenient look for to find the files you require. Numerous layouts for organization and specific reasons are sorted by types and claims, or key phrases. Use US Legal Forms to find the New York Credit Agreement regarding extension of credit in just a handful of clicks.

In case you are already a US Legal Forms customer, log in in your account and then click the Down load option to find the New York Credit Agreement regarding extension of credit. You can also access kinds you in the past saved from the My Forms tab of your account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the form for the appropriate city/region.

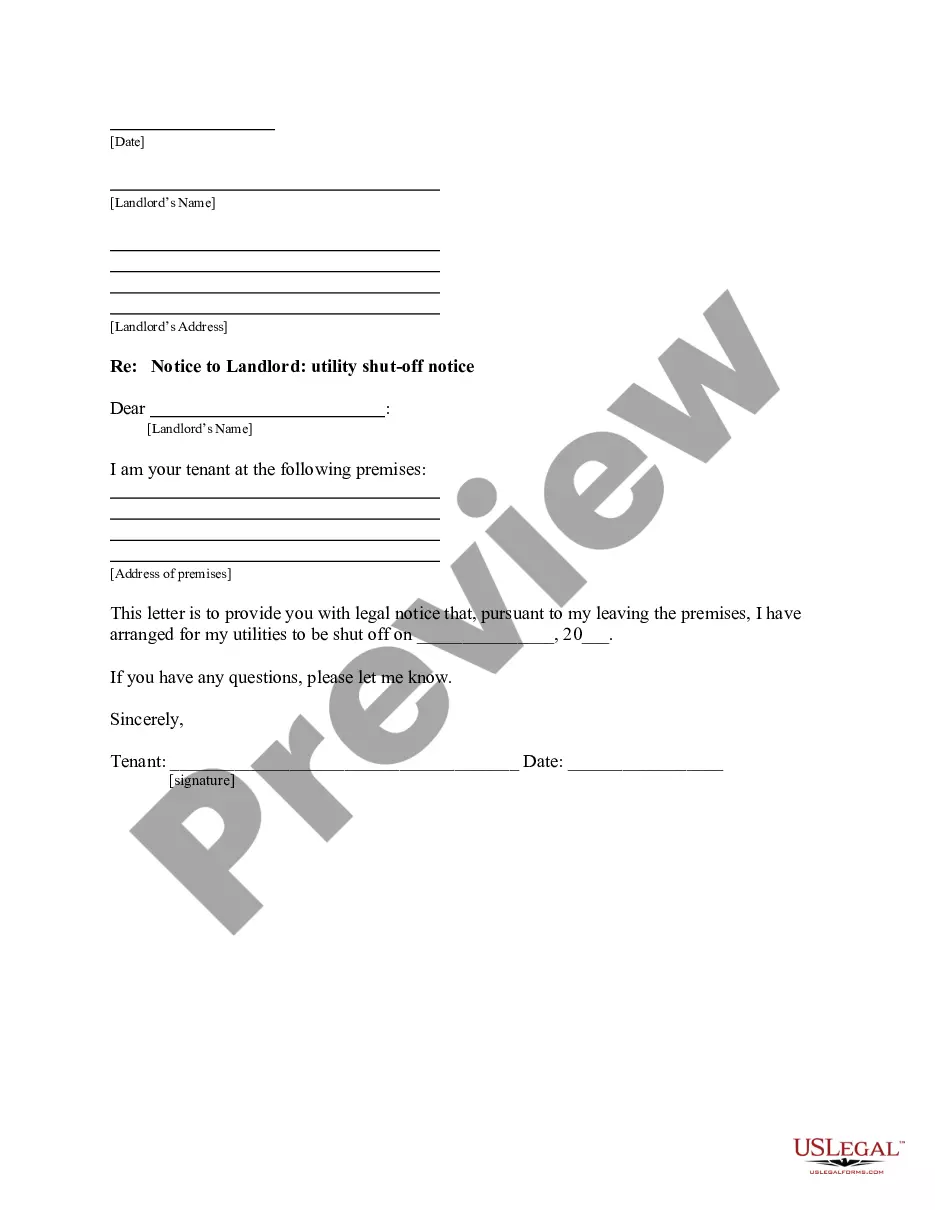

- Step 2. Use the Preview solution to look through the form`s content material. Do not overlook to learn the description.

- Step 3. In case you are not satisfied together with the develop, use the Lookup area near the top of the monitor to find other types from the authorized develop format.

- Step 4. Upon having discovered the form you require, select the Acquire now option. Opt for the pricing prepare you prefer and include your qualifications to register to have an account.

- Step 5. Process the deal. You can use your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Select the structure from the authorized develop and acquire it on your own device.

- Step 7. Comprehensive, revise and print or indication the New York Credit Agreement regarding extension of credit.

Each and every authorized record format you get is the one you have for a long time. You have acces to every single develop you saved within your acccount. Click the My Forms portion and pick a develop to print or acquire again.

Be competitive and acquire, and print the New York Credit Agreement regarding extension of credit with US Legal Forms. There are millions of professional and express-particular kinds you may use for the organization or specific needs.

Form popularity

FAQ

The core elements include: Parties, Permitted Loan Amount, Payment, Interest Rate, Maturity Date, Default, Security Interest, Collateral, Warranties, Termination and Survival.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes.

A credit agreement is a legally binding contract between two parties in which a loan is offered. These agreements detail all the conditions of the loan and the repayment process and are signed by both the Lender and the Borrower. Credit agreements are also often referred to as loan agreements.

The Lender agrees to loan _________ (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before _________ , along with any interest incurred on the unpaid monies at the rate of ____% per year, beginning on _________ (date).

A credit agreement can be (i) a credit facility; (ii) a credit transaction; (iii) a credit guarantee; or (iv) an incidental credit agreement. Below, each of these types of credit agreement is defined and illustrated with examples.