New York Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Have you been within a situation the place you will need documents for both enterprise or specific functions almost every working day? There are a lot of legitimate record templates available on the net, but getting kinds you can rely on isn`t effortless. US Legal Forms delivers 1000s of form templates, such as the New York Term Sheet - Series A Preferred Stock Financing of a Company, which can be published to meet state and federal specifications.

In case you are already familiar with US Legal Forms web site and have your account, just log in. Following that, you can obtain the New York Term Sheet - Series A Preferred Stock Financing of a Company template.

If you do not offer an bank account and want to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for that appropriate metropolis/area.

- Take advantage of the Review key to review the form.

- Look at the outline to actually have chosen the correct form.

- When the form isn`t what you`re searching for, take advantage of the Research discipline to find the form that meets your needs and specifications.

- When you obtain the appropriate form, simply click Get now.

- Select the prices program you desire, fill in the desired info to create your money, and pay for the transaction making use of your PayPal or bank card.

- Choose a hassle-free file file format and obtain your copy.

Locate all the record templates you might have bought in the My Forms food list. You can obtain a further copy of New York Term Sheet - Series A Preferred Stock Financing of a Company anytime, if needed. Just click the required form to obtain or printing the record template.

Use US Legal Forms, probably the most substantial variety of legitimate varieties, to conserve efforts and avoid mistakes. The services delivers skillfully produced legitimate record templates which can be used for a range of functions. Produce your account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable). Preference Shares Investment Term Sheet - Zegal zegal.com ? preference-shares-investment-term-sh... zegal.com ? preference-shares-investment-term-sh...

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions. The 6 key components of a term sheet - Espresso Capital espressocapital.com ? resources ? blog ? term-she... espressocapital.com ? resources ? blog ? term-she...

6 Tips in Making a Term Sheet Make A List Of Terms. Condense The Terms. Describe The Dividends In Detail. Determine And Include Liquidation Preference In Your Term Sheet. Include Agreement On Voting And Closing Issues. Read, Amend, And Prepare For Signatures.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights. Deciphering a preferred stock term sheet - WilmerHale Launch wilmerhale.com ? Explore ? Financing ? d... wilmerhale.com ? Explore ? Financing ? d...

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters. How to Prepare a Term Sheet: A Step-By-Step Guide westchesterangels.com ? how-to-prepare-a-term-s... westchesterangels.com ? how-to-prepare-a-term-s...

Format of Term Sheet Business Information. This section includes the name of the parties involved. ... Security Type. This segment identifies the type of security offered and the price per share of that security. ... Valuation. ... Amount. ... Liquidation Preference. ... Stake in Percentage. ... Voting Rights. ... Miscellaneous.

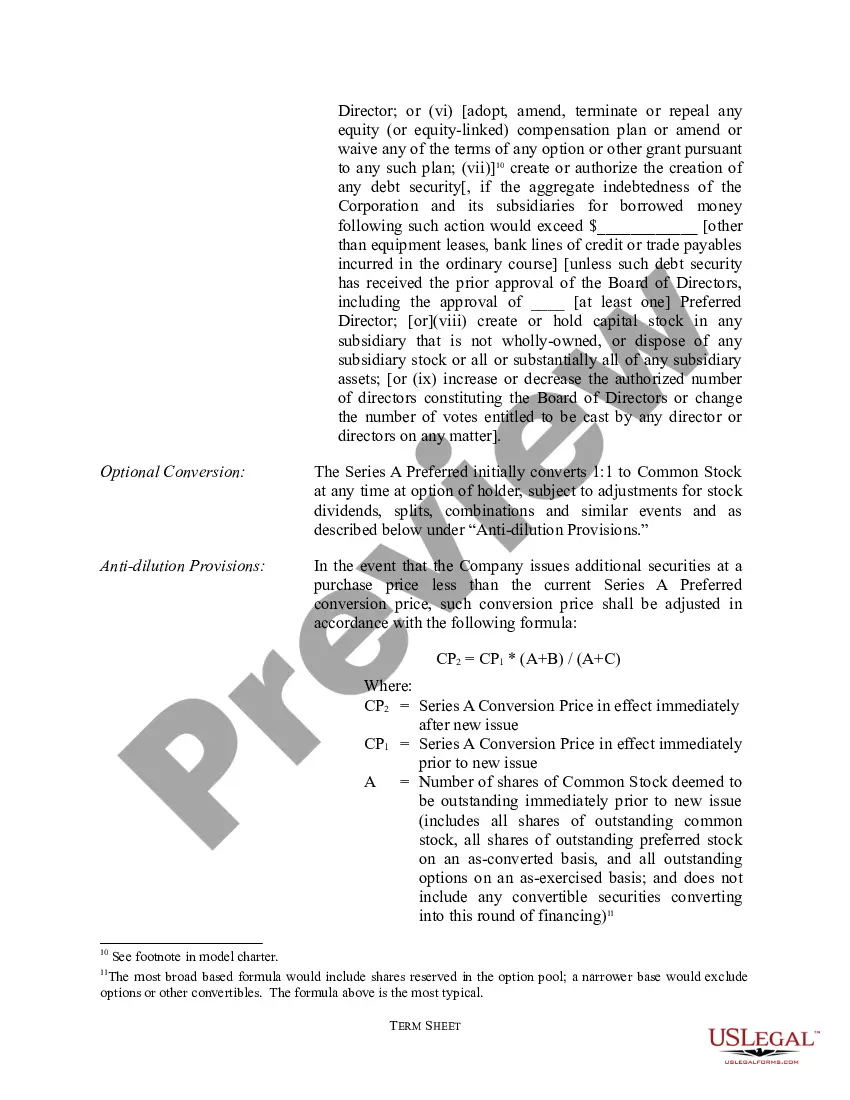

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.