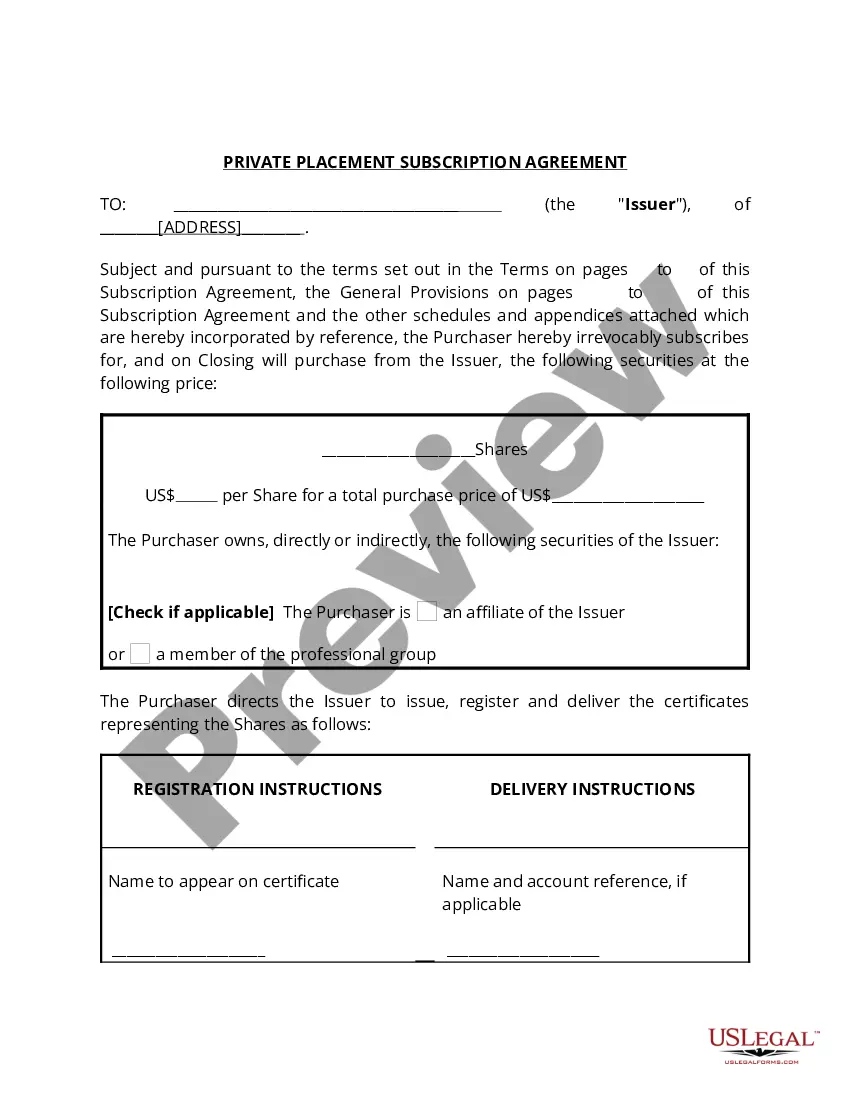

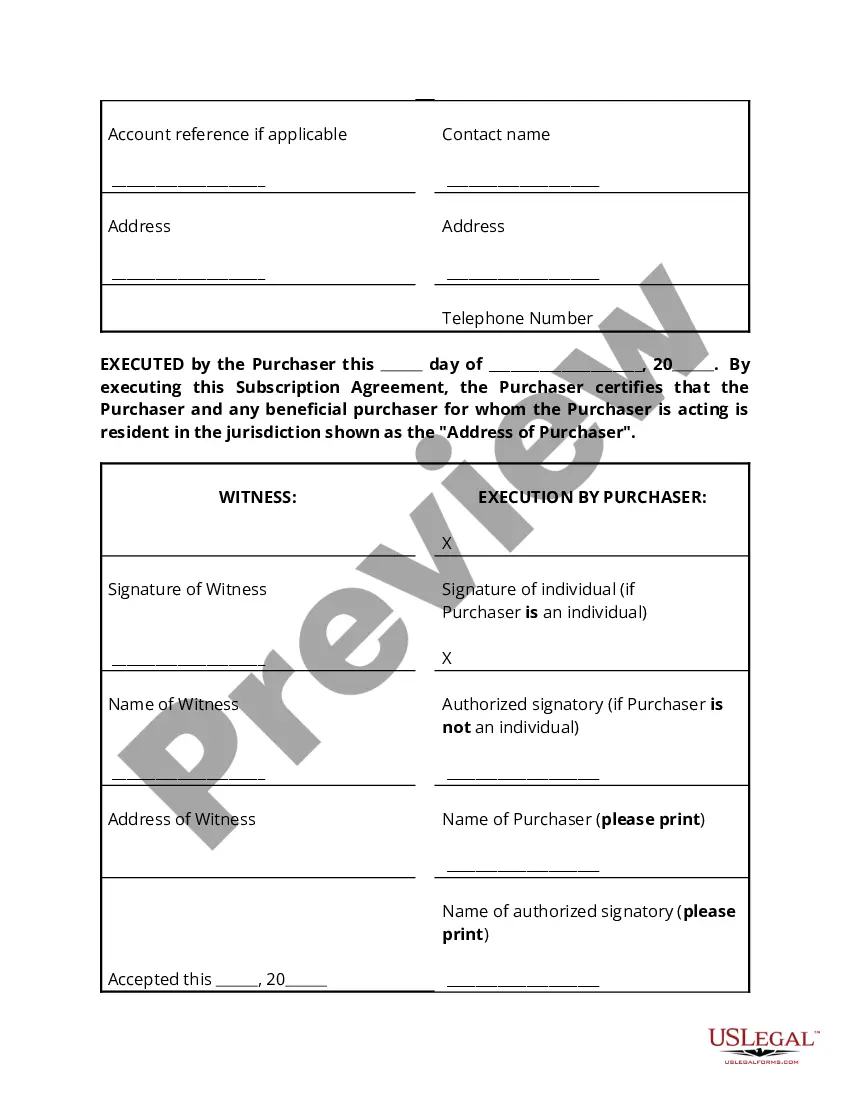

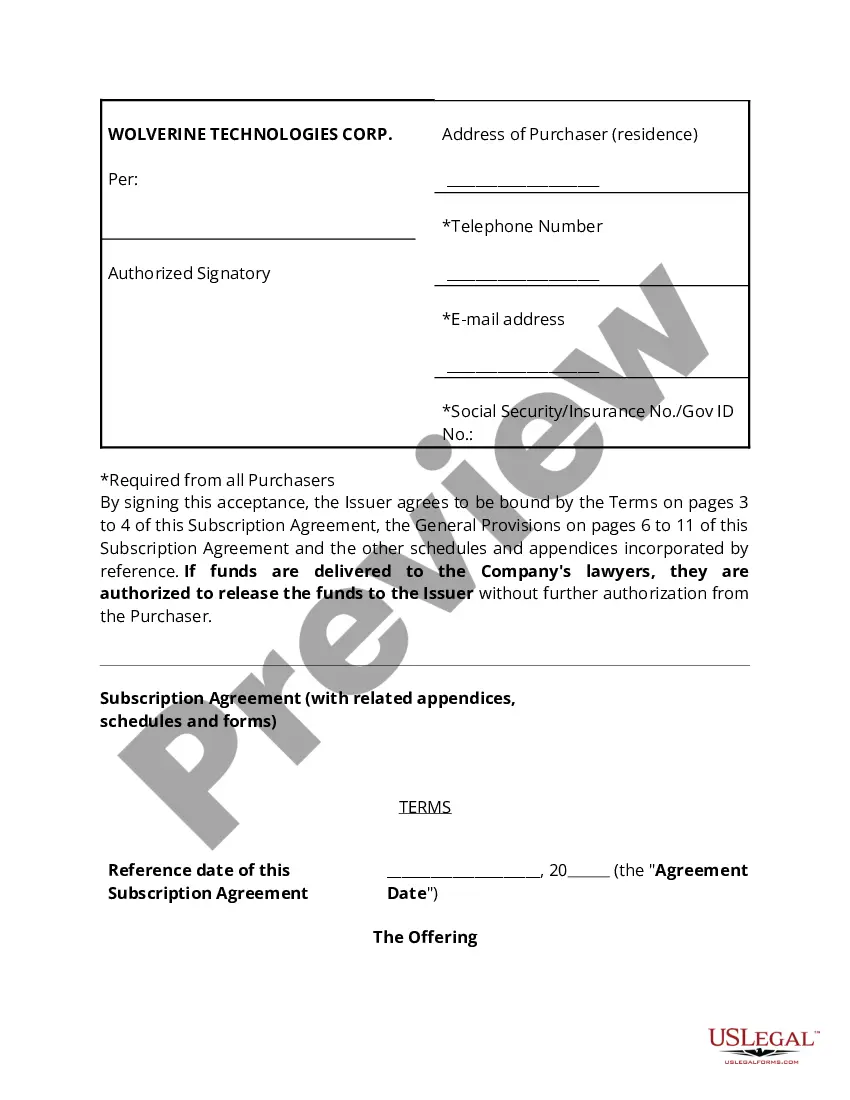

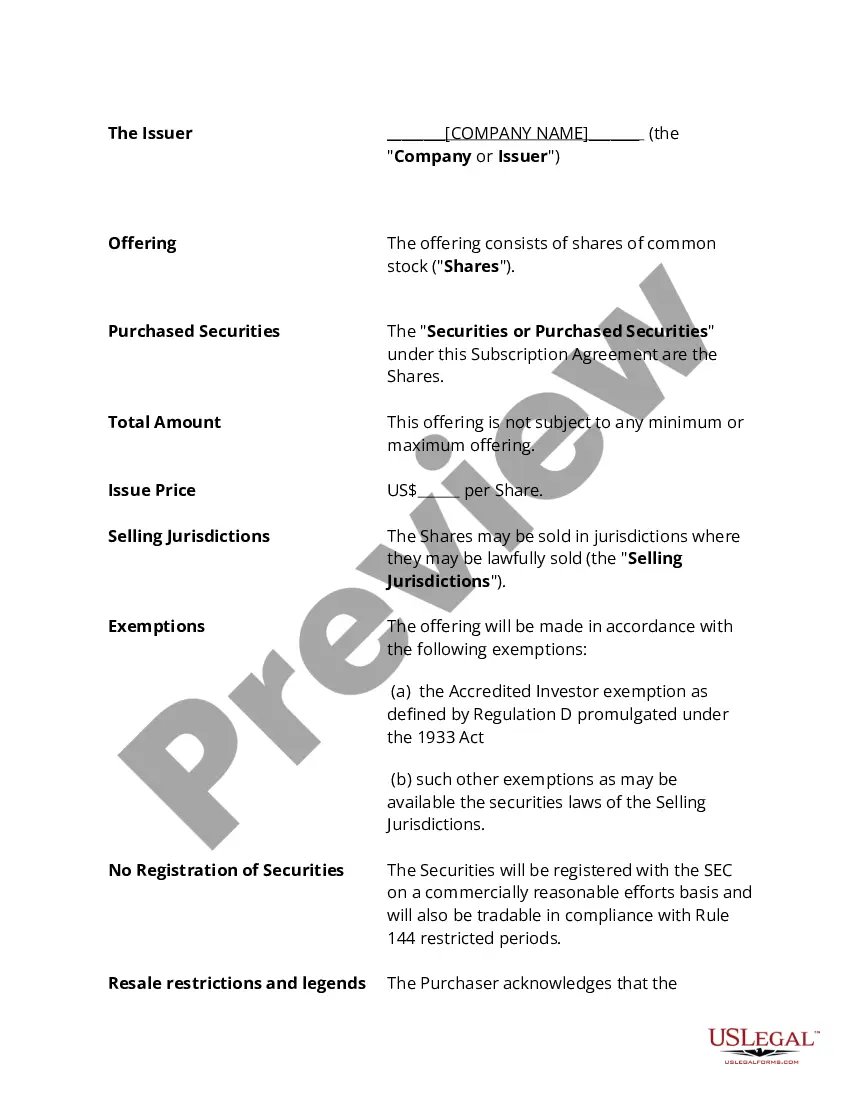

A New York Private Placement Subscription Agreement is a legally binding document that outlines the terms and conditions of an investment in a private placement offering in the state of New York. This agreement allows individuals or entities, referred to as subscribers, to invest in private securities offerings, typically not available to the public. The New York Private Placement Subscription Agreement covers various essential elements related to the investment, including the type and amount of securities being purchased, the purchase price, payment terms, and the representations and warranties of both the issuer and the subscriber. It also includes provisions regarding the transferability of the securities, any applicable restrictions or limitations, and the governing law for the agreement. There are different types of New York Private Placement Subscription Agreements, each specifically tailored to suit various investment opportunities. Some common types include: 1. Equity Subscription Agreement: This agreement is used when the investor is purchasing equity securities, such as shares or stocks, in a private company. It outlines the number of shares being purchased, the purchase price per share, and any additional rights or restrictions associated with the investment. 2. Debt Subscription Agreement: In this case, the investor is purchasing debt securities, such as bonds or promissory notes, from the issuer. The agreement specifies the principal amount of the debt, the interest rate, repayment terms, and any other relevant provisions related to the debt instrument. 3. Convertible Subscription Agreement: This agreement is used when the securities being purchased by the investor have the option to convert into a different type of security, typically equity, at a later date. It outlines the conversion terms, such as the conversion price, conversion ratio, and any applicable conversion restrictions or adjustments. 4. Mezzanine Subscription Agreement: Mezzanine financing is a hybrid form of financing that combines debt and equity. This agreement is used for investors who provide capital in the form of subordinated debt or preferred equity, which sits between senior debt and common equity in the capital structure of a company. When entering into a New York Private Placement Subscription Agreement, it is crucial for both the issuer and the subscriber to seek professional legal advice to ensure full compliance with applicable securities laws and to protect their interests. These agreements help facilitate investment opportunities in private offerings while providing clarity and security for both parties involved.

New York Private Placement Subscription Agreement

Description

How to fill out New York Private Placement Subscription Agreement?

You may commit several hours online trying to find the lawful document design which fits the federal and state specifications you need. US Legal Forms gives a huge number of lawful types which are reviewed by specialists. It is possible to obtain or produce the New York Private Placement Subscription Agreement from the service.

If you already have a US Legal Forms profile, you may log in and click the Down load switch. Following that, you may comprehensive, edit, produce, or indication the New York Private Placement Subscription Agreement. Each and every lawful document design you acquire is yours forever. To obtain yet another version associated with a acquired form, proceed to the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms site initially, follow the easy recommendations below:

- Initial, be sure that you have chosen the best document design for the area/town of your liking. Look at the form information to ensure you have picked out the right form. If available, make use of the Review switch to check through the document design at the same time.

- If you would like locate yet another edition of your form, make use of the Search field to discover the design that fits your needs and specifications.

- Once you have located the design you would like, click on Get now to carry on.

- Choose the rates program you would like, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal profile to purchase the lawful form.

- Choose the formatting of your document and obtain it for your product.

- Make modifications for your document if possible. You may comprehensive, edit and indication and produce New York Private Placement Subscription Agreement.

Down load and produce a huge number of document layouts while using US Legal Forms Internet site, that offers the biggest collection of lawful types. Use specialist and status-certain layouts to handle your organization or specific requires.

Form popularity

FAQ

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

The following are among the key sections of a PPM: Summary of Offering Terms. ... Risk Factors. ... Estimated Use of Proceeds/Expenses Disclosures. ... Description of the Securities. ... Business & Management Section. ... Other Offering Documents.

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

Outline of a PPM Introduction. ... Summary of Offering Terms. ... Risk Factors. ... Description of the Company and the Management. ... Use of Proceeds. ... Description of Securities. ... Subscription Procedures. ... Exhibits.

How is a Subscription Agreement different from a Private Placement Memorandum (PPM)? The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.