To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

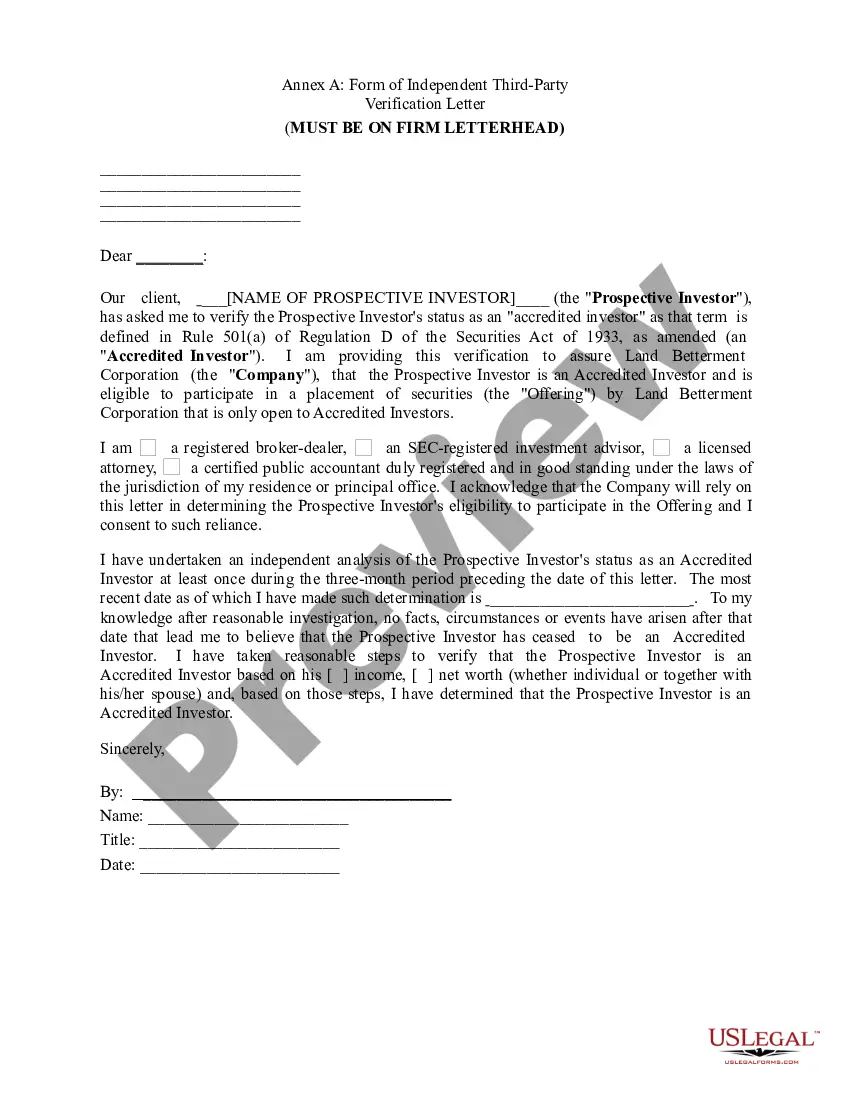

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

New York Accredited Investor Certification Letter is a document that confirms an individual's status as an accredited investor in accordance with the regulations set by the New York State Department of Financial Services (NY SDFS). This letter provides evidence to financial institutions, investment firms, and other entities that the individual meets the requirements to participate in certain investment opportunities that are only available to accredited investors. Keywords: 1. New York: Refers to the state of New York, which has specific regulations related to investor accreditation. 2. Accredited Investor: Describes an individual who meets certain income and net worth thresholds, as defined by the Securities and Exchange Commission (SEC), allowing them to invest in certain private equity offerings, venture capital funds, hedge funds, and other types of alternative investments. 3. Certification Letter: A formal document that confirms and verifies the individual's accredited investor status, providing proof of eligibility to participate in specific investment opportunities. 4. New York State Department of Financial Services (NY SDFS): The regulatory body responsible for overseeing and enforcing financial regulations within the state of New York. 5. Financial Institutions: Entities such as banks, credit unions, investment banks, brokerage firms, and insurance companies that offer various financial services and products. 6. Investment Firms: Businesses engaged in providing investment management services, including the buying, selling, and analysis of securities on behalf of clients. 7. Investment Opportunities: Refers to various ventures, such as private equity, hedge funds, real estate partnerships, and other alternative investment options, typically available only to accredited investors. 8. Regulation: Rules and guidelines established by regulatory bodies to govern the operations of financial institutions and protect investors. Types of New York Accredited Investor Certification Letters: 1. Individual Certification Letter: This type of certification letter is issued to an individual investor who meets the eligibility criteria as an accredited investor on their own. 2. Joint Certification Letter: If a married couple or business partners collectively meet the accredited investor requirements, a joint certification letter may be issued to enable joint investment opportunities. 3. Entity Certification Letter: Sometimes, institutions or organizations seek accreditation as investors. An entity certification letter is provided in such cases, affirming the accredited investor status for the specific entity. In summary, the New York Accredited Investor Certification Letter is a crucial document used to certify an individual's eligibility as an accredited investor in accordance with the state's regulations. It provides proof of accreditation and enables individuals to access investment opportunities that are exclusive to accredited investors in the state of New York.