To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

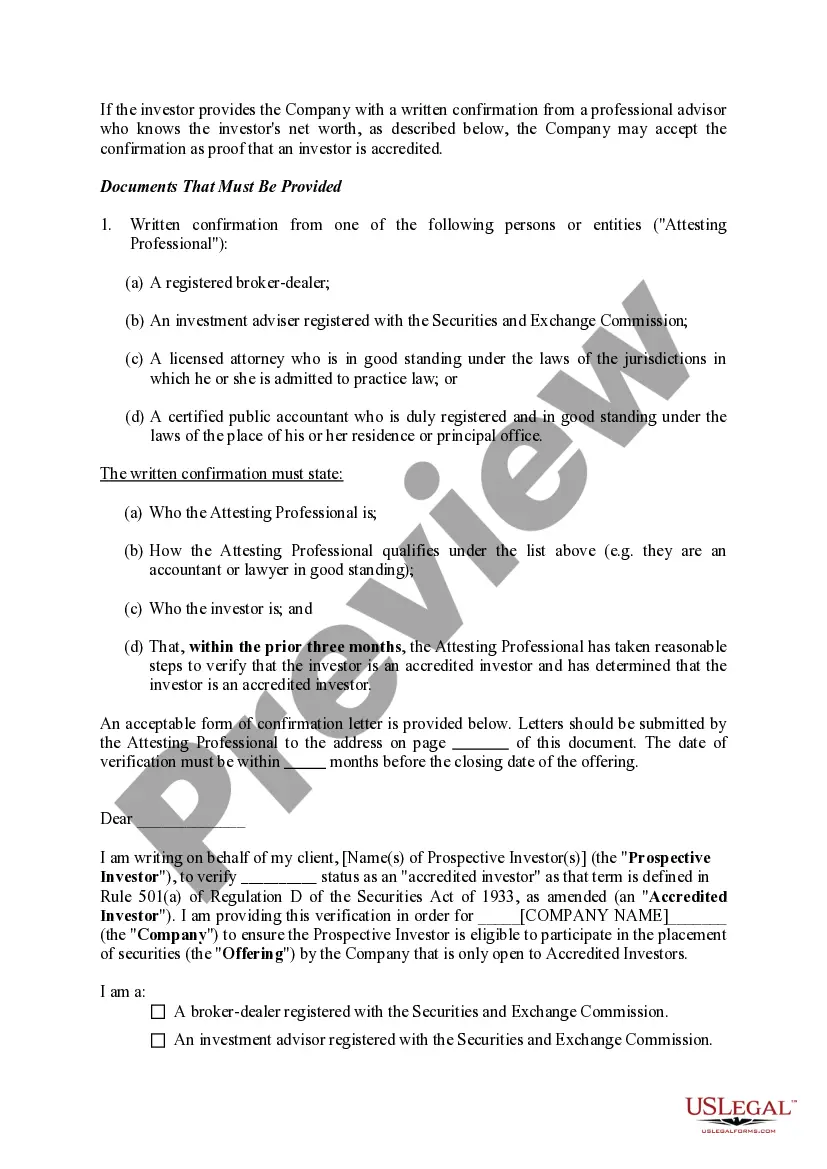

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

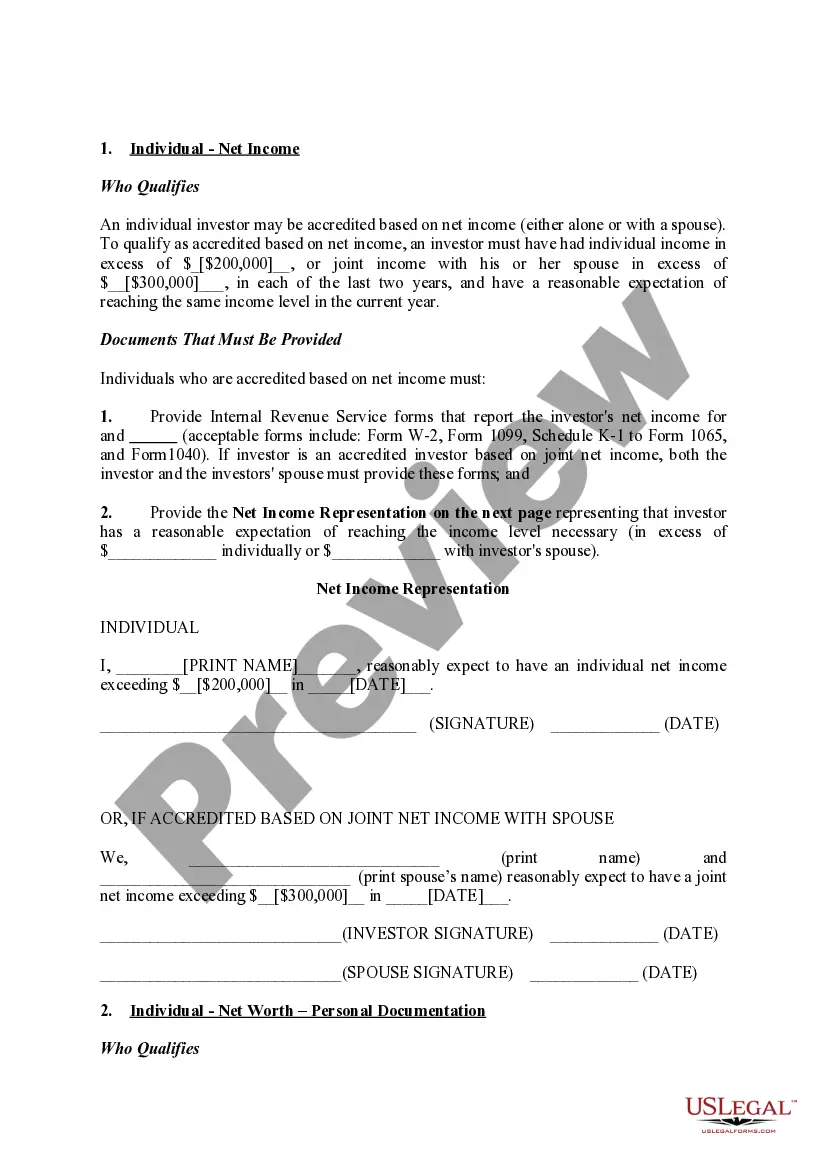

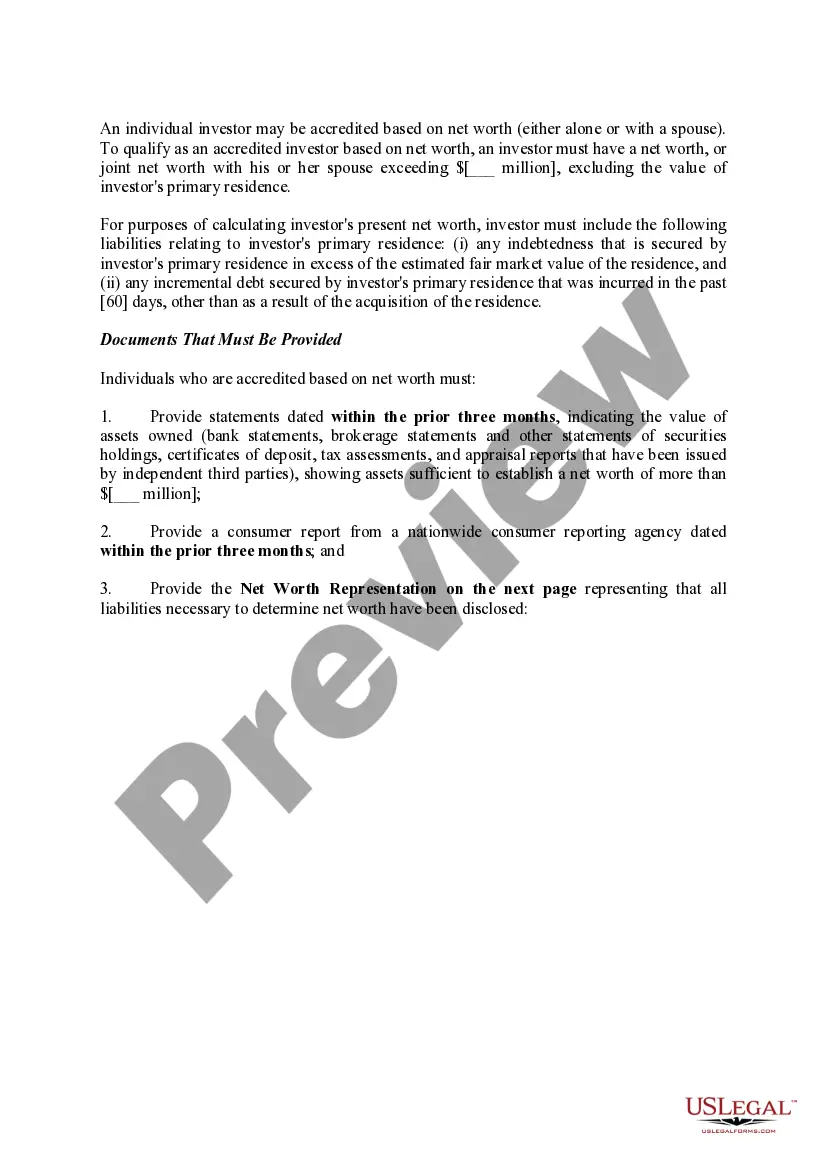

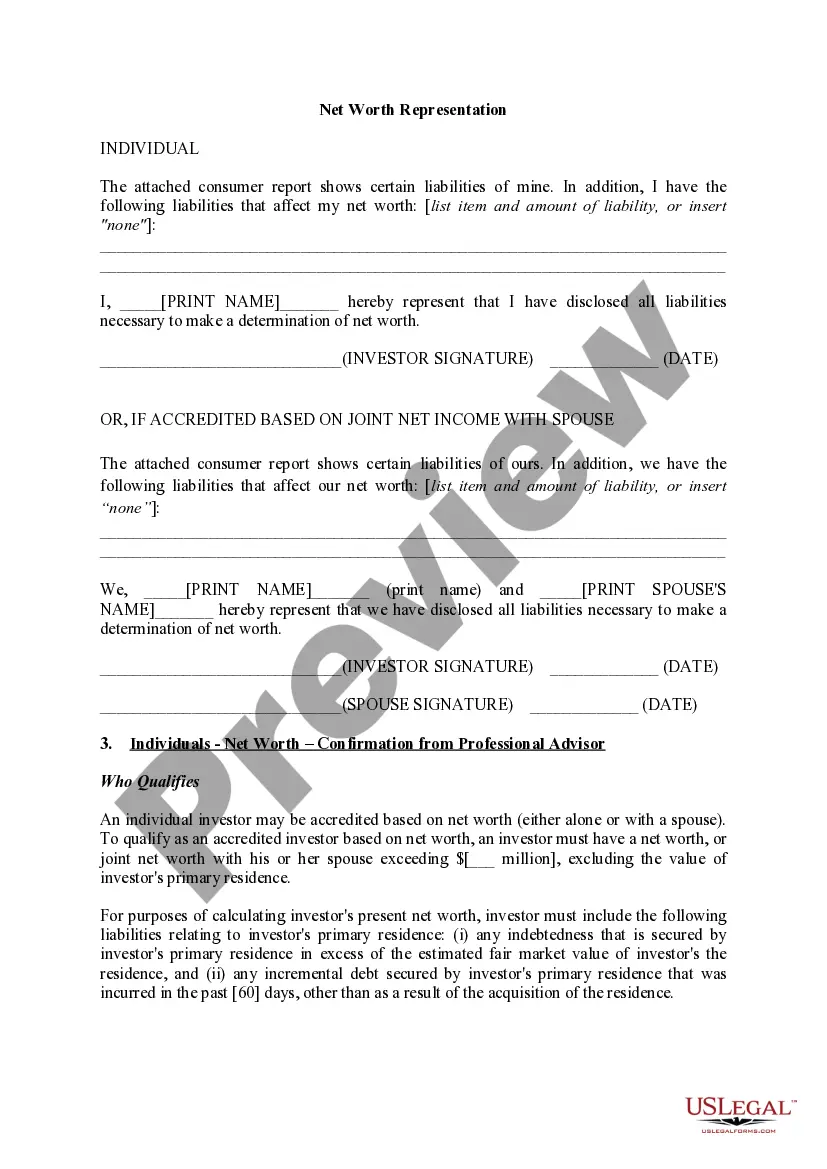

Title: New York Documentation Required to Confirm Accredited Investor Status: A Comprehensive Guide Introduction: When it comes to obtaining accredited investor status in New York, specific documentation is often required to prove your eligibility. Meeting the requirements is crucial, as accredited investors gain access to exclusive investment opportunities and private placements. This article serves as a detailed guide to understanding the various types of New York documentation that are commonly required to confirm accredited investor status. 1. New York State-Operated Investment Funds Documentation: For individuals seeking accredited investor status through New York State-operated investment funds, documentation such as a completed application, personal identification proof (ID), and financial statements may be needed. These funds aim to fuel economic growth within the state and often offer unique investment avenues. 2. Securities and Exchange Commission (SEC) Documentation: Many accredited investor requirements are mandated by the Securities and Exchange Commission (SEC). These regulations apply nationwide, including New York. It is crucial to keep in mind that specific SEC documentation might be requested to determine accredited investor status. Some common documents include: a) Net Worth Verification: Proof of a minimum net worth is a common requirement, and individuals must provide relevant documents such as bank statements, brokerage statements, tax assessments, or credit reports. In New York, different net worth thresholds may apply depending on the investment opportunity. b) Income Verification: Alternatively, proving a specific income level can also grant accredited investor status. Documents such as tax returns, W-2 forms, 1099 forms, or other forms of income verification may be requested. 3. Certificates of Accreditation: Some New York institutions may issue certificates of accreditation, confirming an individual's accredited investor status. These certificates can be obtained through approved entities or organizations that have vetted the investor's eligibility. This documentation streamlines future investment opportunities as it demonstrates prior verification. 4. Self-Accreditation Documentation: In specific cases, and primarily for sophisticated investors, self-accreditation documentation may be allowed in New York. This involves the individual filling out a detailed questionnaire providing information about their financial knowledge, investment experience, and assets. However, it is advisable to consult with legal and financial professionals to ensure compliance with the regulatory requirements. Conclusion: New York Documentation Required to Confirm Accredited Investor Status encompasses various types of documentation, including New York State-operated investment funds documentation, SEC-mandated documentation, certificates of accreditation, and self-accreditation documentation. Each type serves to evaluate an individual's financial qualifications and verify their eligibility for accredited investor status. It is essential to consult with legal and financial experts to navigate through the complex requirements and ensure compliance with relevant regulations.