New York Term Sheet - Convertible Debt Financing

Description

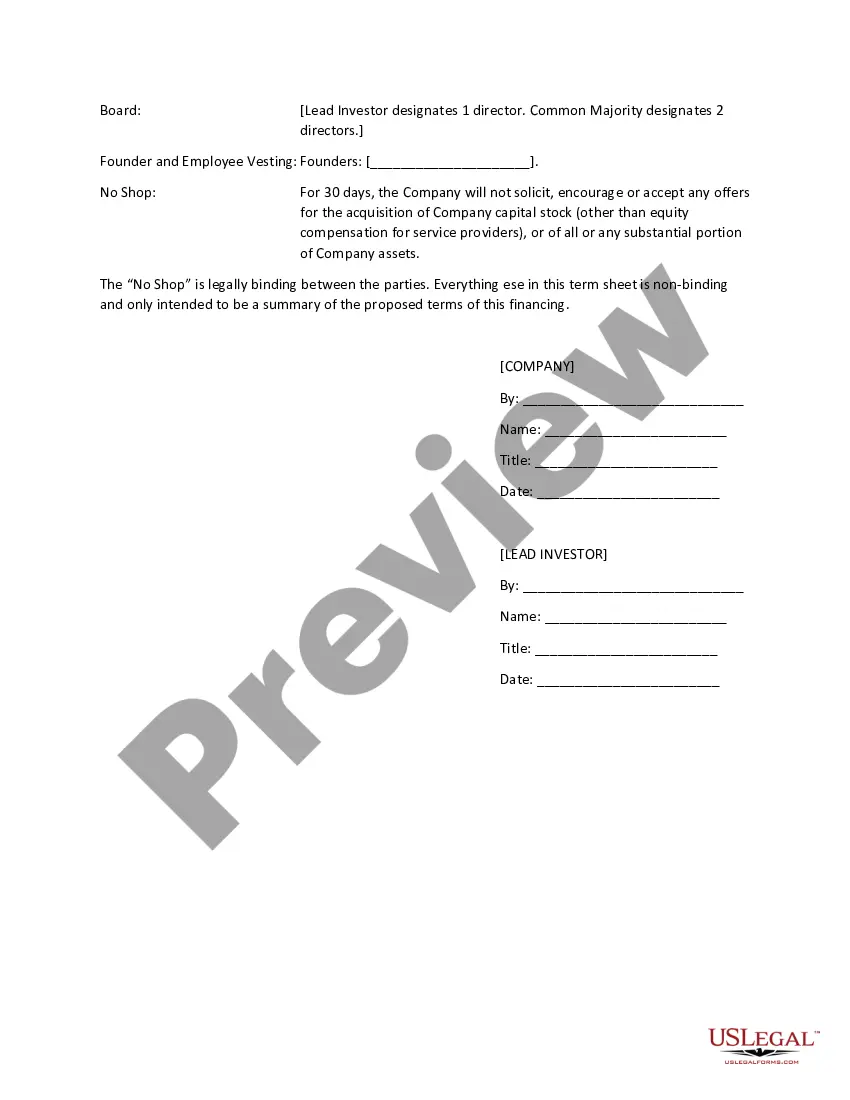

How to fill out Term Sheet - Convertible Debt Financing?

If you need to comprehensive, down load, or print out legal document themes, use US Legal Forms, the greatest selection of legal types, which can be found on the web. Utilize the site`s simple and easy practical lookup to get the files you need. A variety of themes for business and specific purposes are categorized by types and claims, or keywords. Use US Legal Forms to get the New York Term Sheet - Convertible Debt Financing within a couple of click throughs.

If you are already a US Legal Forms client, log in to your account and click the Obtain switch to have the New York Term Sheet - Convertible Debt Financing. You can also accessibility types you earlier downloaded within the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for the correct city/country.

- Step 2. Take advantage of the Preview method to check out the form`s information. Don`t neglect to see the outline.

- Step 3. If you are unhappy using the type, utilize the Search area at the top of the screen to locate other models from the legal type design.

- Step 4. Once you have found the shape you need, select the Purchase now switch. Choose the pricing prepare you favor and put your accreditations to sign up for the account.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Choose the structure from the legal type and down load it in your device.

- Step 7. Full, edit and print out or indicator the New York Term Sheet - Convertible Debt Financing.

Every legal document design you purchase is yours eternally. You may have acces to each type you downloaded inside your acccount. Select the My Forms portion and select a type to print out or down load once more.

Compete and down load, and print out the New York Term Sheet - Convertible Debt Financing with US Legal Forms. There are millions of skilled and express-specific types you can utilize for the business or specific requires.

Form popularity

FAQ

Value of convertible bond = independent value of straight bond + independent value of conversion option. Convertible Bond vs. Traditional Bond Valuations: What's the Difference? investopedia.com ? ask ? answers ? how-co... investopedia.com ? ask ? answers ? how-co...

The conversion price of the convertible security is the price of the bond divided by the conversion ratio. If the bonds par value is $1000, the conversion price is calculated by dividing $1000 by 5, or $200. If the conversion ratio is 10, the conversion price drops to $100. Conversion Price: Definition and Calculation Formula Investopedia ? ... ? Investing Basics Investopedia ? ... ? Investing Basics

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future. What is convertible debt? | BDC.ca BDC ? ... ? Glossary BDC ? ... ? Glossary

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity. Conversion Ratio: Definition, How It's Calculated, and Examples Investopedia ? ... ? Financial Ratios Investopedia ? ... ? Financial Ratios

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.