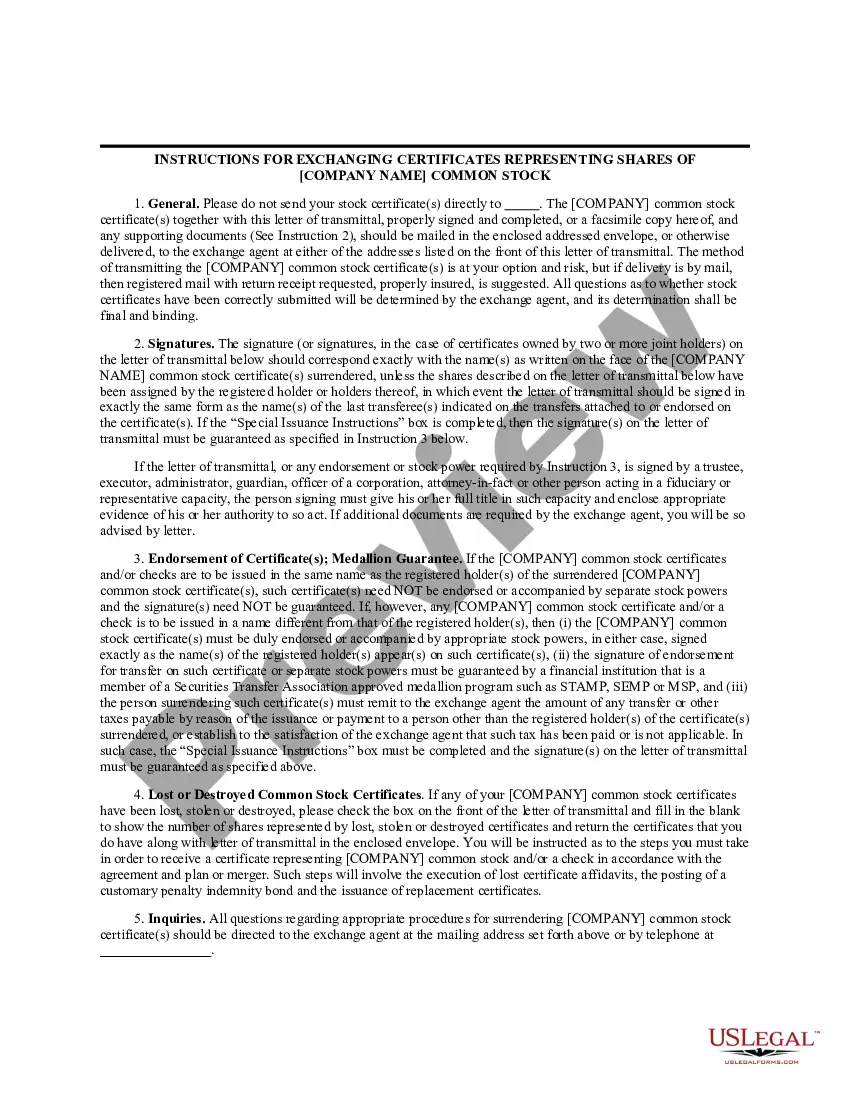

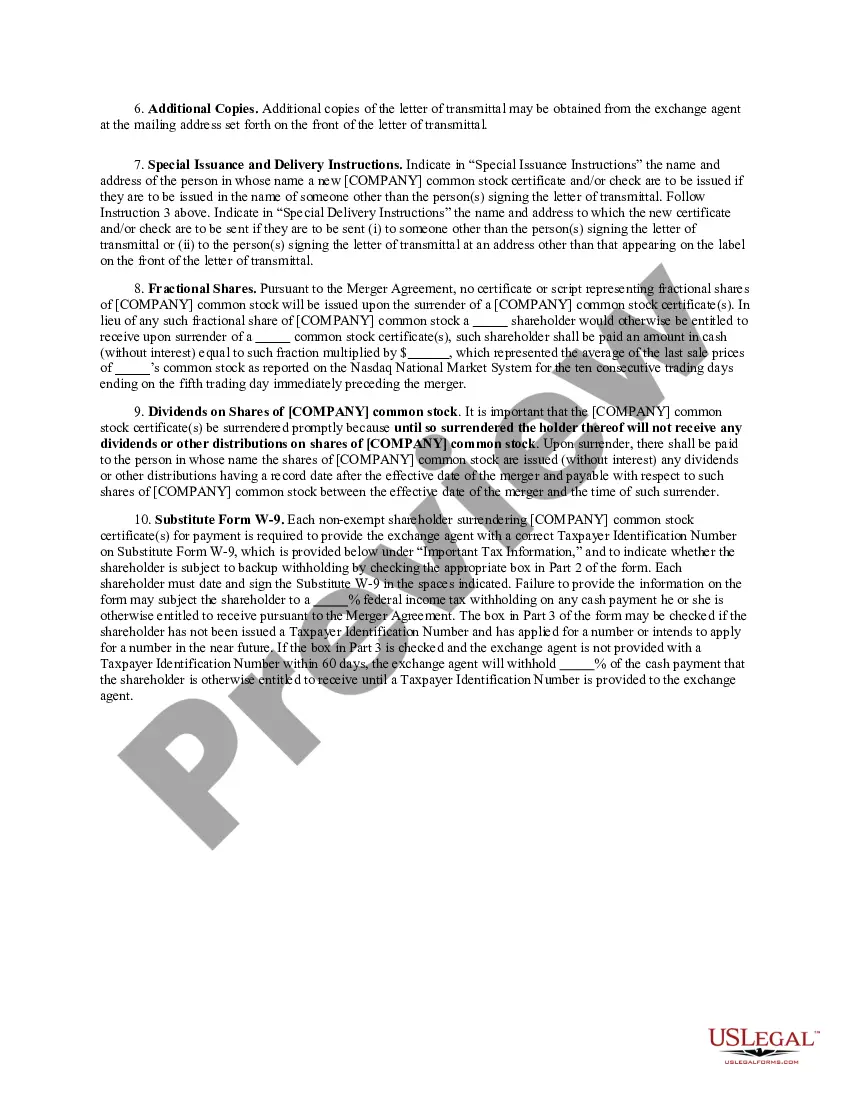

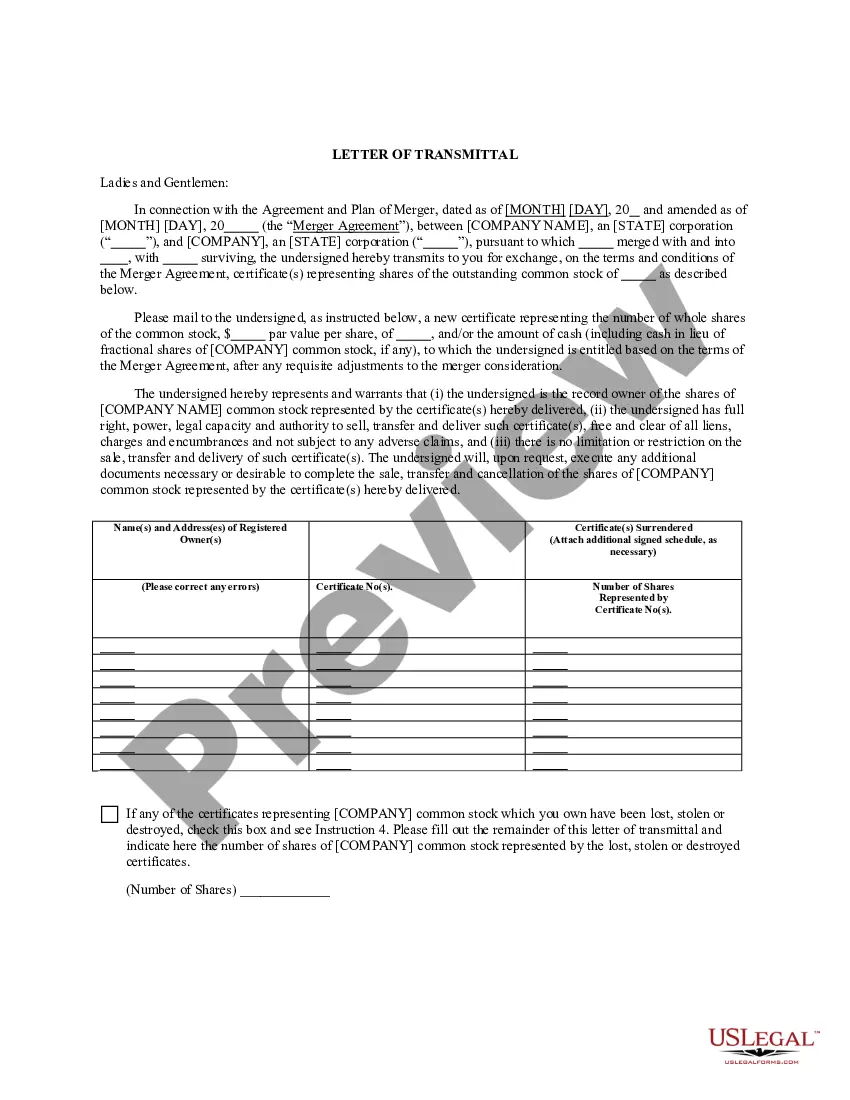

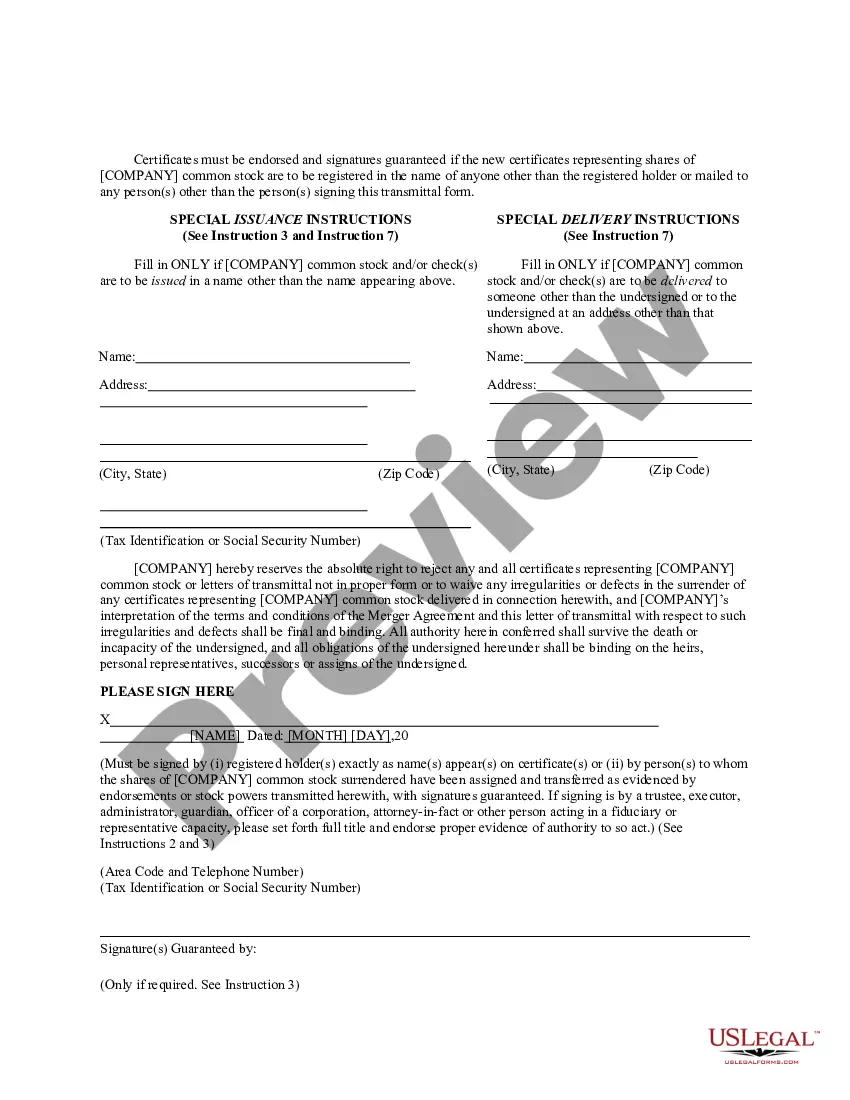

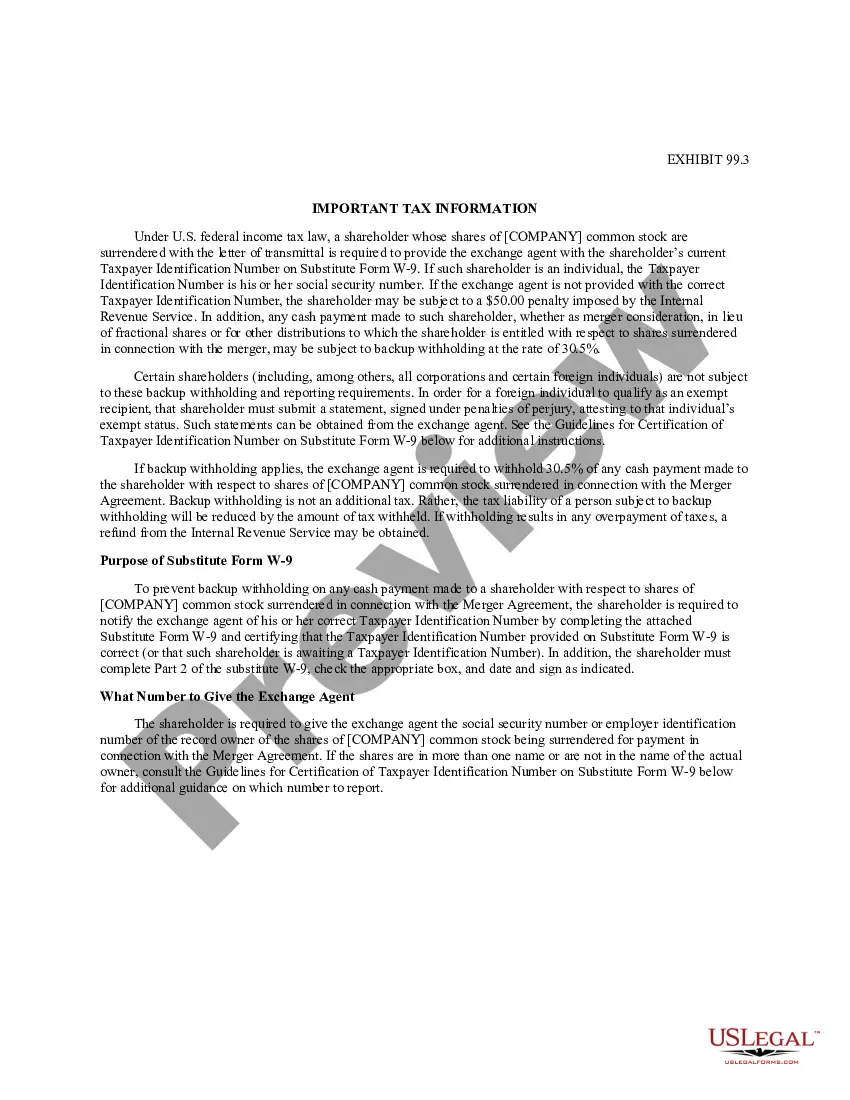

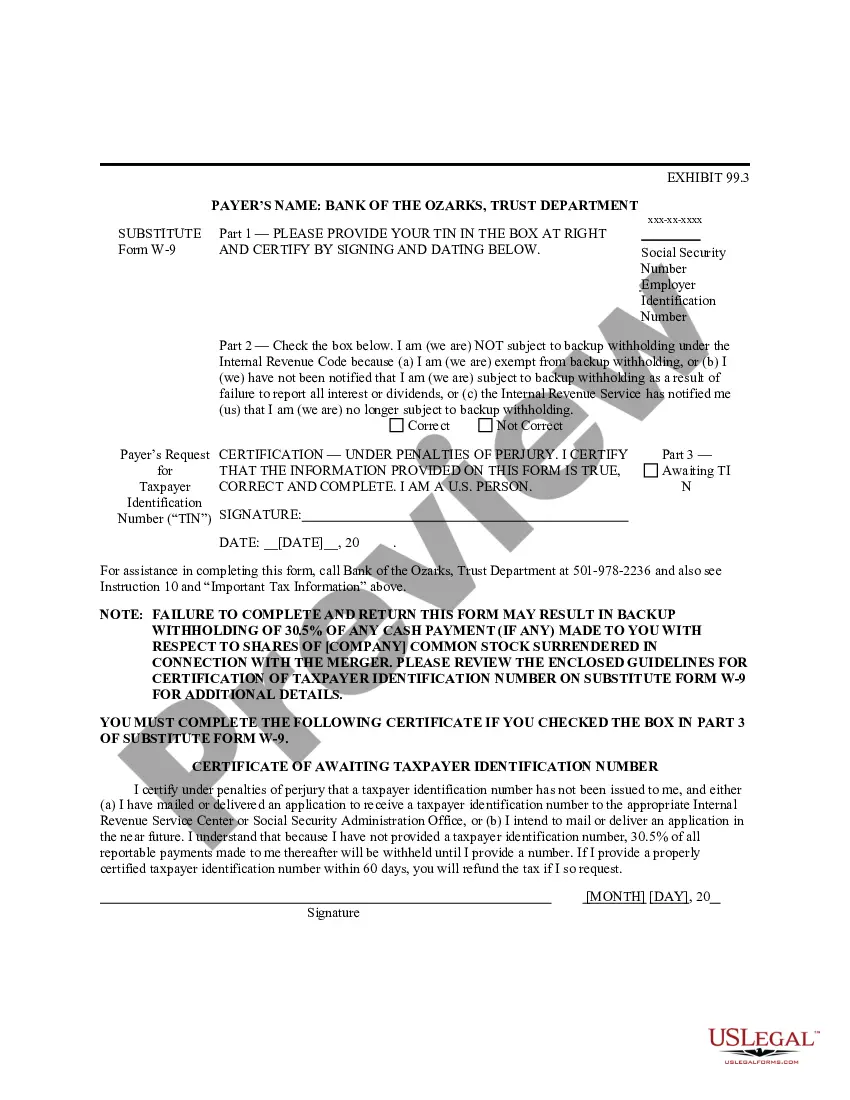

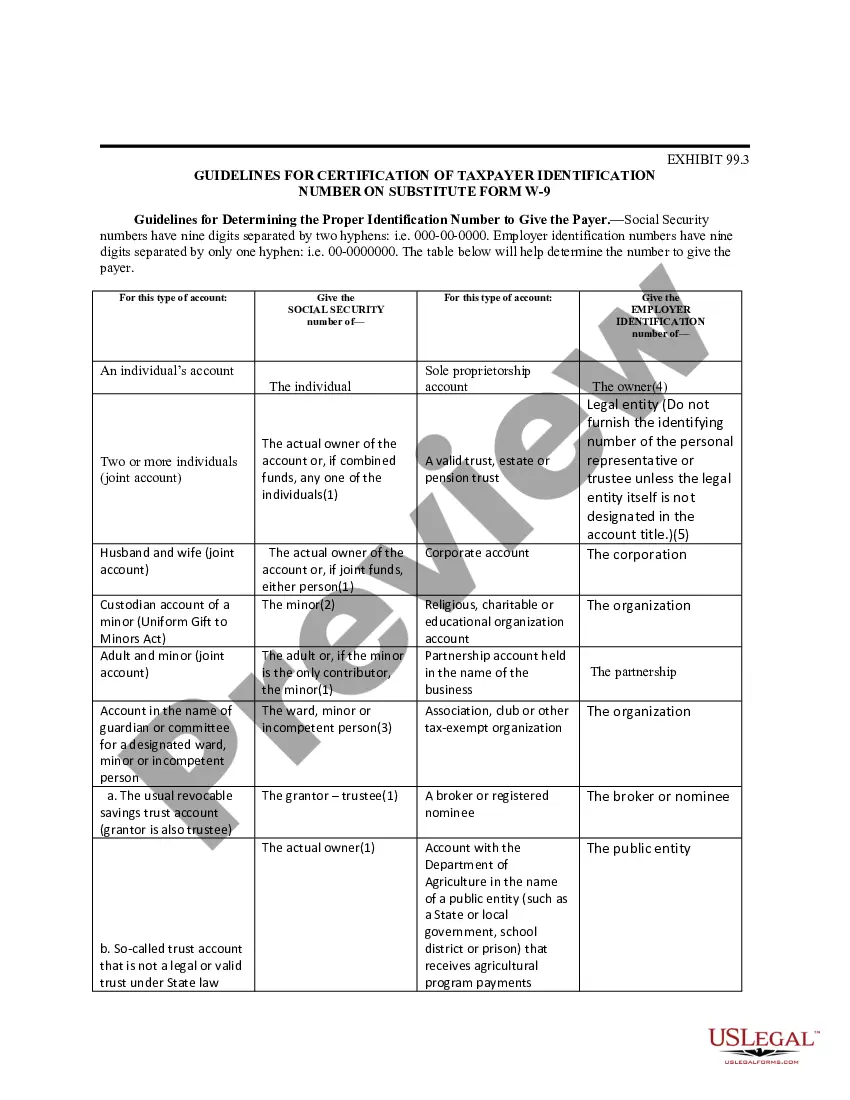

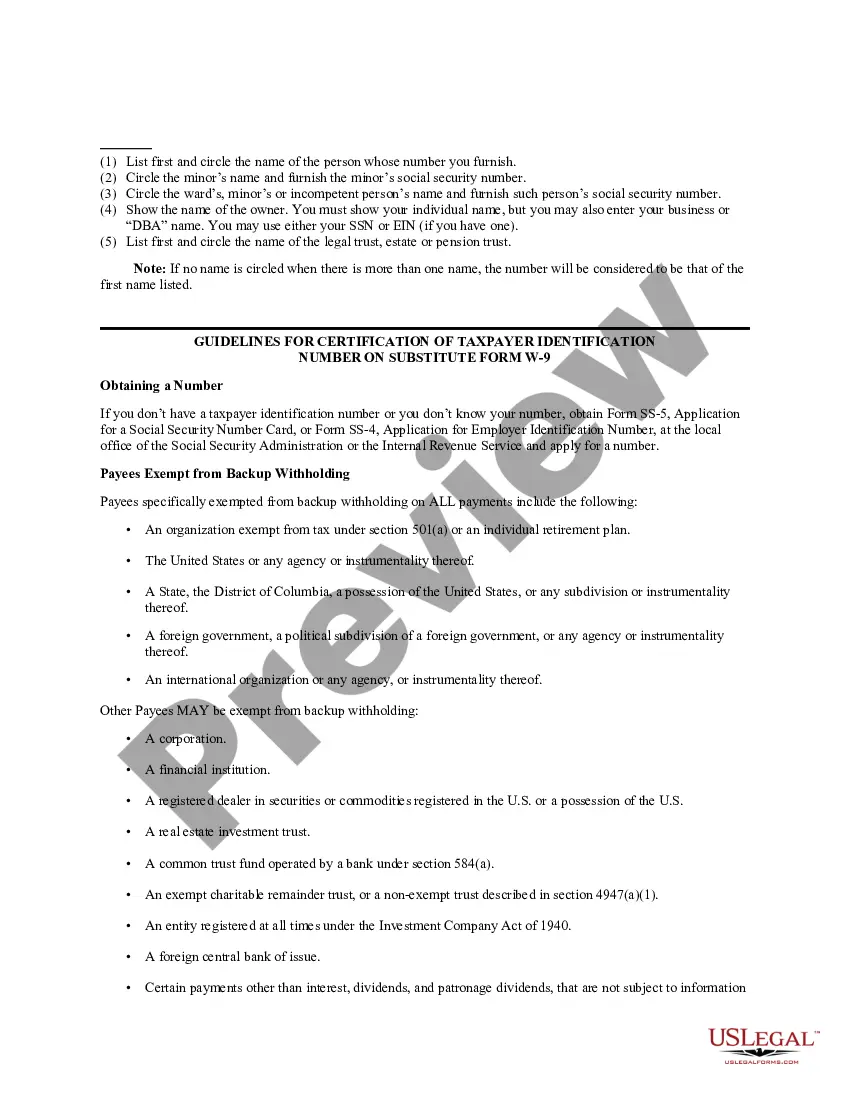

Title: Exploring the Different Types of New York Letter of Transmittal Introduction: A New York Letter of Transmittal is a vital document exchanged during various financial transactions, serving as a formal means to transmit assets, securities, or documents from one party to another. It provides essential information, instructions, and authorization related to the transfer. In this article, we will delve into the details of what a New York Letter of Transmittal entails and explore its different types. Types of New York Letter of Transmittal: 1. Stock Transfer Letter of Transmittal: This type of New York Letter of Transmittal is primarily used during stock transfer transactions. It allows shareholders to transfer their shares to another individual, entity, or official repository, providing all necessary details such as the number of shares, stock certificate numbers, and relevant stock transfer instructions. 2. Bond Letter of Transmittal: When dealing with bond transactions, a Bond Letter of Transmittal is employed. This document facilitates the transfer of bond ownership from the current bondholder to the intended recipient. It typically includes details like bond numbers, quantities, maturity dates, and instructions for the transfer process. 3. Real Estate Letter of Transmittal: In real estate transactions, a Real Estate Letter of Transmittal is utilized to transfer property-related documents from one party to another. It ensures that all necessary paperwork, such as titles, deeds, or leases, are properly transmitted, providing comprehensive information about the property being transferred. 4. Mergers & Acquisitions Letter of Transmittal: During a merger or acquisition deal, a Letter of Transmittal acts as a crucial component to transfer ownership and control of assets. Typically, prepared by the acquiring company, it outlines the terms and conditions of the transaction, including the identification of the acquired entity, payment details, and instructions for shareholders to surrender their shares. 5. Estate Planning Letter of Transmittal: In the context of estate planning or inheritance, this type of Letter of Transmittal serves as a communication channel among beneficiaries, legal representatives, and asset administrators. It facilitates the proper transfer of assets or funds from the deceased individual to the rightful beneficiaries as designated in the will or trust. Conclusion: New York Letter of Transmittal is a versatile document applicable to a wide range of financial and legal transactions. Whether it involves transferring stock, bonds, real estate documents, or facilitating mergers and acquisitions, these letters play a crucial role in ensuring a smooth transfer process. Understanding the different types of New York Letter of Transmittal allows individuals and organizations to navigate these transactions confidently and efficiently.

New York Letter of Transmittal

Description

How to fill out New York Letter Of Transmittal?

US Legal Forms - one of several largest libraries of lawful kinds in the United States - delivers an array of lawful papers web templates it is possible to acquire or produce. Using the website, you can get 1000s of kinds for company and specific uses, sorted by types, says, or keywords.You can find the most recent models of kinds like the New York Letter of Transmittal in seconds.

If you currently have a subscription, log in and acquire New York Letter of Transmittal through the US Legal Forms library. The Acquire option will appear on every single kind you see. You gain access to all previously downloaded kinds from the My Forms tab of your respective account.

In order to use US Legal Forms the first time, listed below are basic directions to obtain began:

- Ensure you have chosen the right kind to your city/state. Click on the Review option to review the form`s content material. Browse the kind description to actually have selected the correct kind.

- In the event the kind doesn`t fit your demands, make use of the Search industry towards the top of the display screen to find the one that does.

- When you are happy with the form, validate your decision by visiting the Buy now option. Then, select the prices program you like and offer your accreditations to register to have an account.

- Approach the purchase. Use your bank card or PayPal account to finish the purchase.

- Choose the file format and acquire the form on the device.

- Make alterations. Fill out, edit and produce and sign the downloaded New York Letter of Transmittal.

Each web template you included with your account lacks an expiry date which is the one you have for a long time. So, if you wish to acquire or produce another duplicate, just visit the My Forms section and then click in the kind you require.

Obtain access to the New York Letter of Transmittal with US Legal Forms, one of the most extensive library of lawful papers web templates. Use 1000s of skilled and condition-particular web templates that meet your company or specific needs and demands.