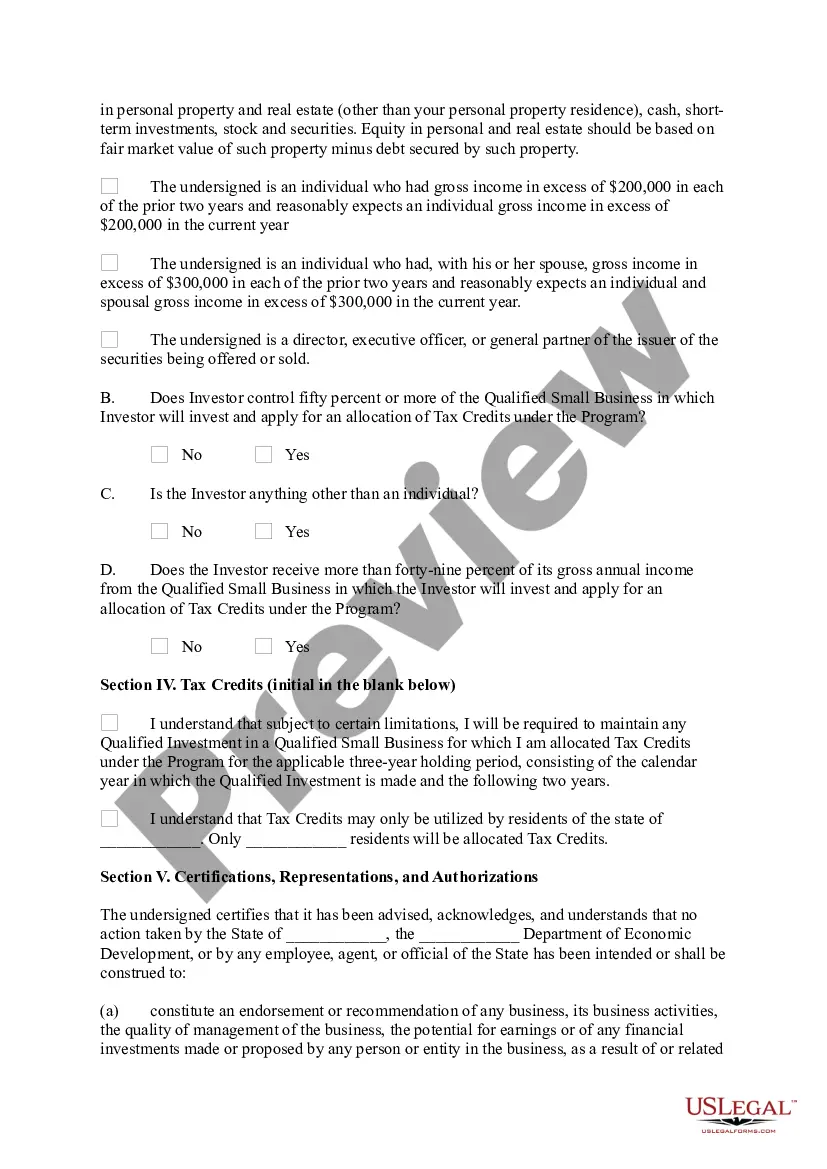

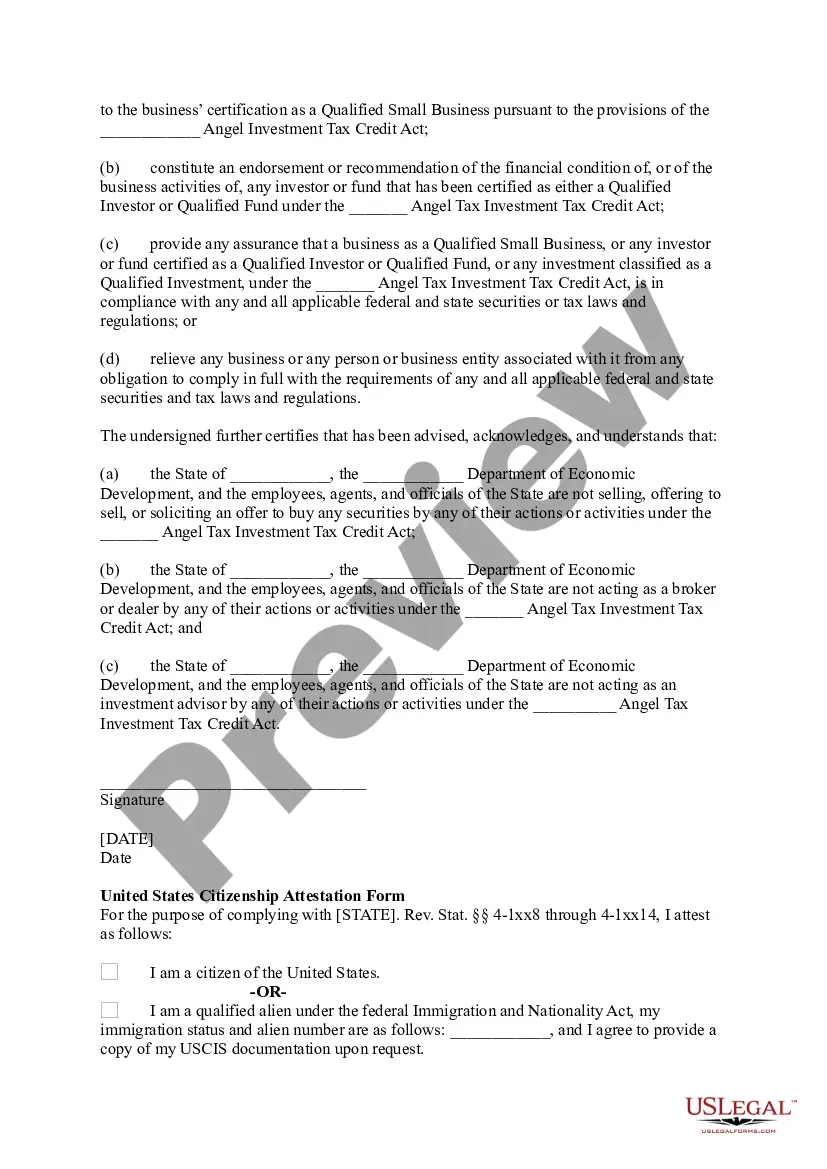

The New York Qualified Investor Certification Application is a formal process that individuals or entities must undergo to establish their qualification as an investor in the state of New York. This certification grants the applicant access to various investment opportunities and exemptions available only to qualified investors. Keywords: New York, qualified investor, certification application, investment opportunities, exemptions. There are different types of New York Qualified Investor Certification Applications available, depending on the nature of the applicant: 1. Individual Investors: Individual applicants can submit a New York Qualified Investor Certification Application to demonstrate their personal qualifications as an investor. This type of application is suitable for high-net-worth individuals who meet specific financial thresholds or possess relevant professional experience in the investment field. 2. Institutional Investors: Institutional applicants, such as corporations, organizations, trusts, or partnerships, can also complete a New York Qualified Investor Certification Application. These entities must prove their eligibility based on criteria such as the net worth, size of assets under management, or membership in professional investment associations. 3. Investment Advisors: Investment advisors who provide financial advice or manage investment portfolios on behalf of clients in New York can pursue a specialized New York Qualified Investor Certification Application. This application is designed to evaluate their expertise, knowledge, and ethical standards, ensuring they are qualified to serve their clients in compliance with regulatory requirements. 4. Private Funds: New York Qualified Investor Certification Application is pertinent for private funds, including hedge funds, private equity funds, and venture capital funds, to establish their eligibility under the state's regulations. This certification enables the funds to solicit investments from qualified investors and enjoy exemptions or benefits provided exclusively to this category of investors. By completing the New York Qualified Investor Certification Application, individuals and entities can unlock numerous investment opportunities otherwise restricted to non-qualified investors. It allows them to participate in sophisticated investment strategies, access private placements, venture capital investments, and navigate through regulatory frameworks with greater ease. It is important to note that the specific requirements, documentation, and regulations associated with the New York Qualified Investor Certification Application may vary depending on the applicant's category, the nature of investments, and the regulatory framework in force at the time of the application. Interested parties should consult relevant authorities, legal experts, or investment advisors for the latest information and compliance guidelines.

New York Qualified Investor Certification Application

Description

How to fill out New York Qualified Investor Certification Application?

If you want to comprehensive, acquire, or produce legitimate file templates, use US Legal Forms, the most important collection of legitimate forms, which can be found on the web. Use the site`s simple and easy hassle-free research to obtain the files you need. Different templates for organization and personal uses are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the New York Qualified Investor Certification Application with a few clicks.

If you are presently a US Legal Forms customer, log in for your profile and click on the Obtain key to get the New York Qualified Investor Certification Application. You can also access forms you previously delivered electronically inside the My Forms tab of your own profile.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for the appropriate town/land.

- Step 2. Use the Review choice to look through the form`s content. Don`t overlook to read the description.

- Step 3. If you are not satisfied with all the develop, utilize the Search discipline at the top of the display to locate other versions in the legitimate develop template.

- Step 4. Once you have located the form you need, go through the Get now key. Pick the costs program you choose and put your accreditations to sign up to have an profile.

- Step 5. Procedure the purchase. You can use your bank card or PayPal profile to accomplish the purchase.

- Step 6. Select the formatting in the legitimate develop and acquire it in your product.

- Step 7. Comprehensive, change and produce or indicator the New York Qualified Investor Certification Application.

Every legitimate file template you acquire is the one you have forever. You have acces to each and every develop you delivered electronically in your acccount. Go through the My Forms segment and pick a develop to produce or acquire again.

Remain competitive and acquire, and produce the New York Qualified Investor Certification Application with US Legal Forms. There are many professional and condition-distinct forms you may use for your personal organization or personal demands.