The New York Investors Rights Agreement is a legal document that outlines the rights and protections afforded to investors in companies based in New York. This agreement serves as a safeguard for investors, providing them with certain privileges and safeguards in order to protect their investments. One key aspect of the New York Investors Rights Agreement is the protection of minority investors. In many cases, minority investors may not have the same level of power or control as majority investors or company founders. However, this agreement helps level the playing field by granting certain rights and protections to these minority investors. Some rights included in the New York Investors Rights Agreement may include: 1. Information rights: Minority investors have the right to access information and financial statements of the company, enabling them to stay informed about the company's performance and make informed decisions regarding their investment. 2. Board representation: In some cases, the New York Investors Rights Agreement grants minority investors the right to have a representative serve on the company's board of directors. This allows them to have a voice in the decision-making process and actively participate in the company's governance. 3. Preemptive rights: This provision enables minority investors to maintain their proportional ownership in the company when new shares are issued. It ensures that their ownership percentage remains intact and prevents dilution of their investment. 4. Anti-dilution protection: The New York Investors Rights Agreement may include provisions that protect investors from suffering significant loss in the event of a down-round financing or a decrease in the valuation of the company. This protection assists in mitigating the risk associated with the fluctuation of a company's value. 5. Liquidation preference: This feature ensures that investors receive a certain level of priority when it comes to the distribution of proceeds in the event of a company liquidation or sale. It establishes the order of payment, ensuring investors are compensated for their investment before other stakeholders. It is important to note that there may be variations of the New York Investors Rights Agreement depending on the specific needs and circumstances of the parties involved. Different types of agreements may exist, such as those tailored for early-stage startups versus mature companies, or agreements specifically designed for venture capital investors versus angel investors. In conclusion, the New York Investors Rights Agreement is a crucial legal document that protects the rights of investors in New York-based companies. By establishing rights, privileges, and protections, this agreement facilitates a fair and equitable environment for minority investors and safeguards their investments.

New York Investors Rights Agreement

Description

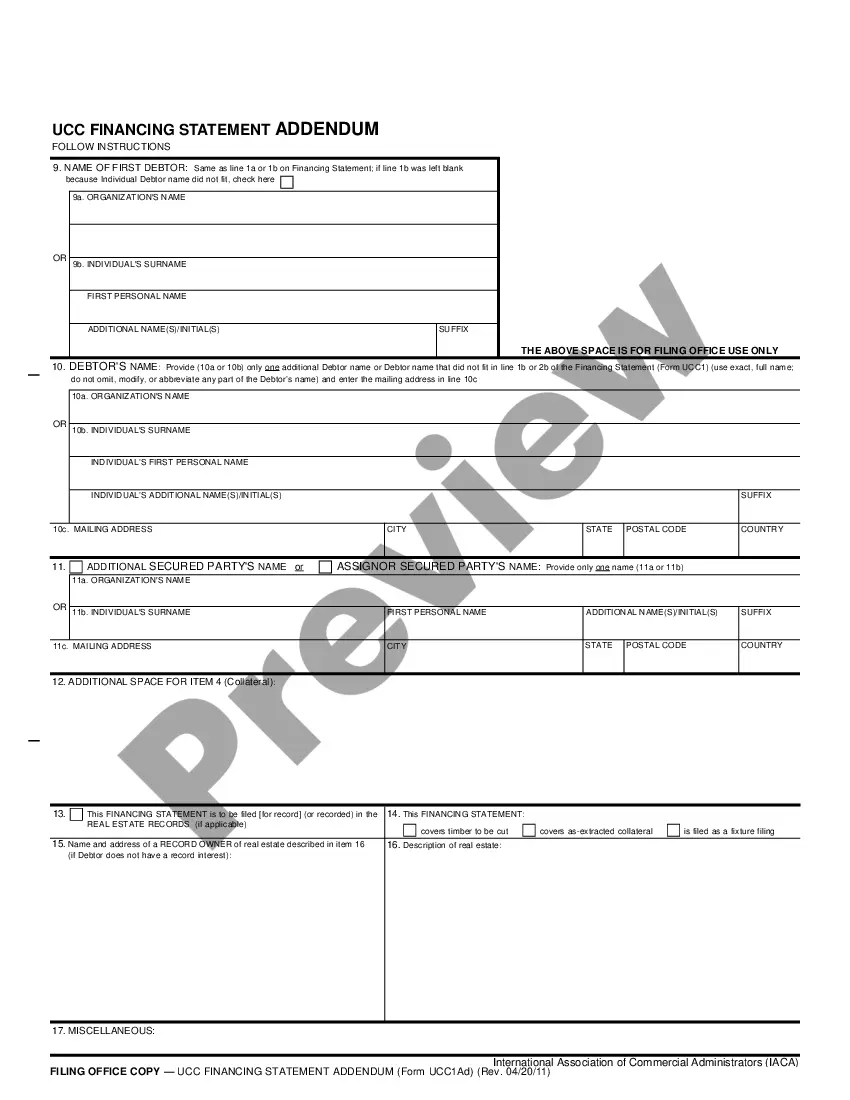

How to fill out New York Investors Rights Agreement?

You can spend hrs online attempting to find the legitimate document template which fits the federal and state requirements you require. US Legal Forms supplies thousands of legitimate varieties that happen to be evaluated by specialists. You can easily download or print the New York Investors Rights Agreement from our services.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Obtain switch. Afterward, it is possible to full, edit, print, or sign the New York Investors Rights Agreement. Each legitimate document template you buy is your own forever. To obtain another version associated with a acquired kind, check out the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site initially, follow the easy instructions under:

- Initially, make certain you have selected the correct document template to the area/city that you pick. Browse the kind explanation to make sure you have picked out the right kind. If available, make use of the Preview switch to check through the document template too.

- In order to find another variation from the kind, make use of the Search industry to get the template that fits your needs and requirements.

- Upon having identified the template you need, simply click Purchase now to move forward.

- Choose the rates strategy you need, type your qualifications, and register for your account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal bank account to fund the legitimate kind.

- Choose the format from the document and download it to your gadget.

- Make modifications to your document if necessary. You can full, edit and sign and print New York Investors Rights Agreement.

Obtain and print thousands of document themes using the US Legal Forms website, that provides the most important variety of legitimate varieties. Use professional and express-distinct themes to take on your business or individual requires.

Form popularity

FAQ

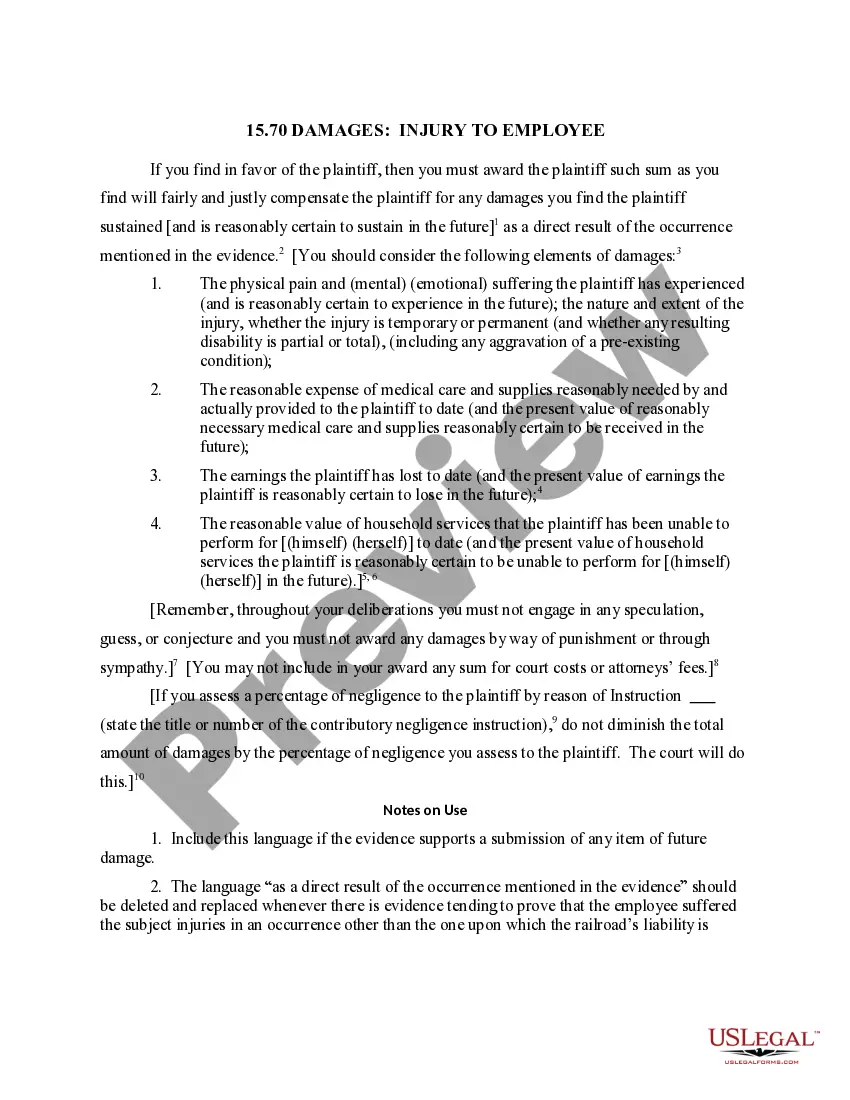

Investor rights are the rights granted to shareholders in the corporation. Those rights include: The right to attend the annual general meeting (AGM) and any other called meetings. The right to vote on resolutions, both ordinary and special. The right to propose your own resolutions.

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity. How to Write an Investor Agreement - U.S. Chamber of Commerce uschamber.com ? run ? finance ? how-to-wr... uschamber.com ? run ? finance ? how-to-wr...

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights. Investor Rights Agreement (IRA) | Dallas & Austin Business Lawyers velawood.com ? glossary-term ? investor-rights-a... velawood.com ? glossary-term ? investor-rights-a...

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

Investor agreements generally cover any transaction that gives other people or businesses ownership interest in the company. This could be of interest now or into the future and could be in exchange for anything of value such as cash, labor, an asset, and more.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards. Investment vs Shareholders Agreement | LegalVision NZ legalvision.co.nz ? corporations ? investment-vs-s... legalvision.co.nz ? corporations ? investment-vs-s...