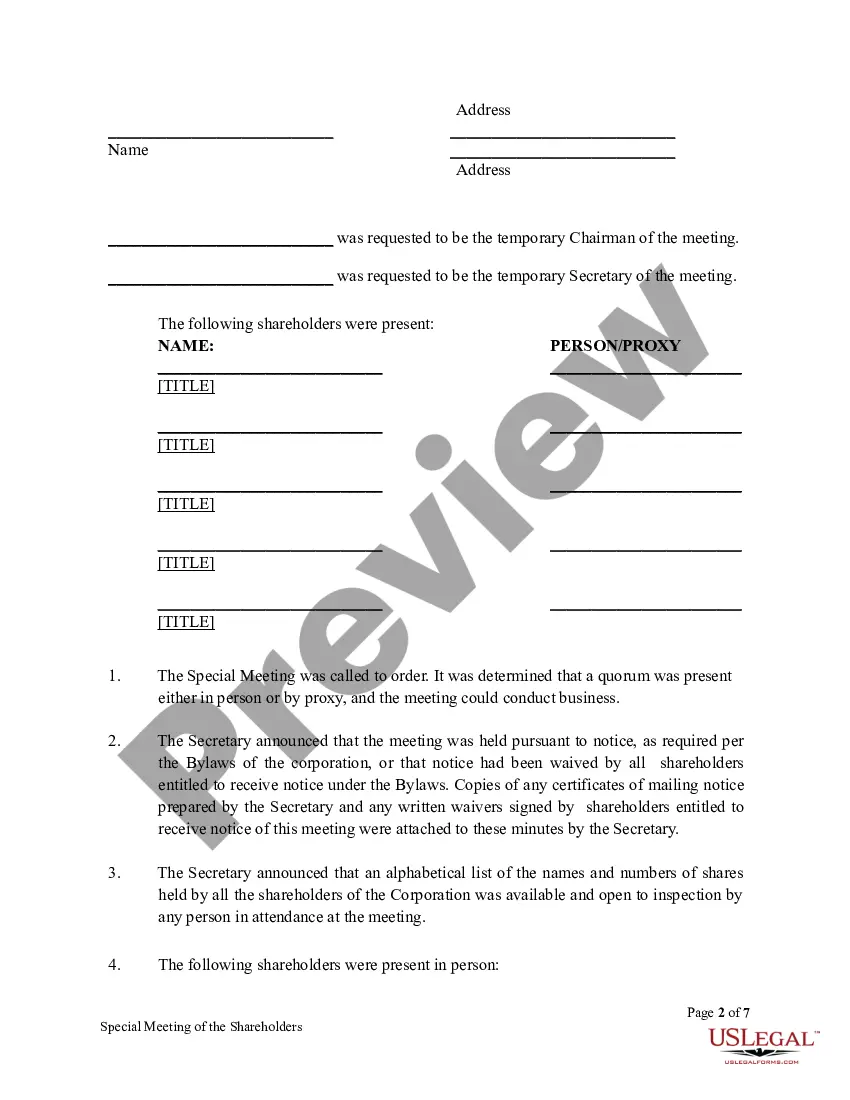

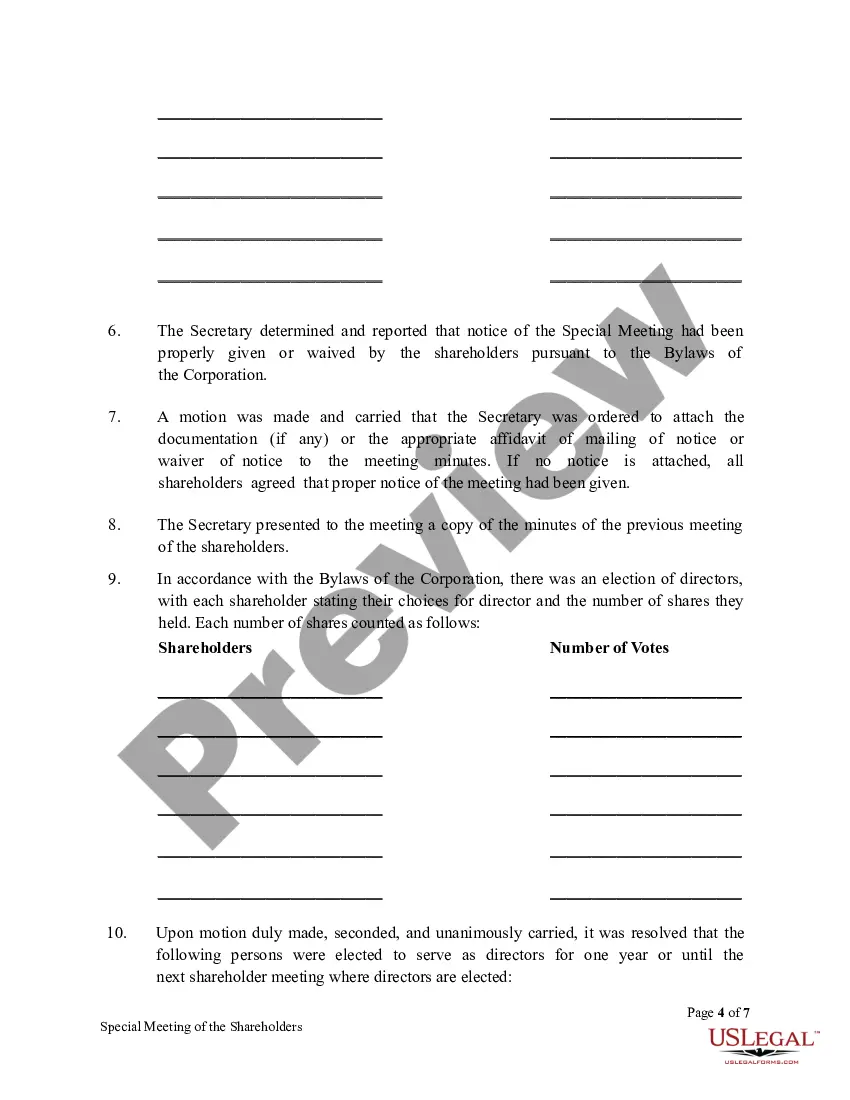

New York Special Meeting Minutes of Shareholders: In the bustling financial hub of New York, Special Meeting Minutes of Shareholders hold paramount importance for corporations seeking to comply with legal obligations and ensure transparency in decision-making. These minutes serve as a comprehensive record of significant discussions, resolutions, and actions taken during a special meeting, specifically convened outside of regular annual meetings. Regular annual meetings often focus on routine matters, whereas special meetings are called to address specific topics of critical importance to the company or its shareholders. These minutes are meticulously documented and maintained by the corporation's secretary or a designated individual in accordance with New York state law. By capturing essential details, the meeting minutes protect the rights of shareholders and provide a factual and legal record of the proceedings. They are later made available for review by stakeholders, regulatory authorities, auditors, and potential investors. These New York Special Meeting Minutes of Shareholders typically include the following key elements: 1. Date, time, and location of the meeting: These minutes commence with the essential logistical details regarding when and where the meeting took place. This information helps establish the validity and authenticity of the recorded minutes. 2. Attendance and quorum: The names of attendees, including directors, officers, and shareholders, are listed to acknowledge their presence and ensure that a quorum, the minimum number of shareholders required for decision-making, was met. 3. Call to order: The minutes stipulate when the meeting officially began and who presided over it, usually the chairman of the board or another appointed officer. 4. Agenda items: A comprehensive list of topics discussed and decisions made during the special meeting is included. Common agenda items may involve proposing amendments to articles of incorporation, mergers and acquisitions, issuance of new shares, major capital investments, executive appointments, or other crucial matters as necessitated by the corporation's needs. 5. Discussion and resolutions: Detailed notes on debates, opinions presented, and resolutions passed are meticulously recorded. These minutes provide a clear account of stakeholders' viewpoints and the final determinations reached regarding each agenda item. 6. Voting records: If voting occurred during the special meeting, the minutes include a breakdown of how each shareholder cast their votes on specific resolutions. This information ensures transparency and accountability, particularly when disputes or controversies arise. 7. Adjournment: The official end of the special meeting is noted, signifying the conclusion of discussions and decision-making. Different types of New York Special Meeting Minutes of Shareholders may be categorized based on the nature of the discussion, purpose, or industry-specific requirements. Examples include: 1. Merger and Acquisition Meeting Minutes: When corporations are considering merging with or acquiring another entity, special meetings are held to discuss the potential transaction and its implications. These minutes outline the details of the deal, negotiation strategies, due diligence reports, approval procedures, and voting results. 2. Capital Investment Meeting Minutes: When a company plans to make significant capital investments or strategic financial decisions, such as expanding into new markets, developing new products, or funding large-scale projects, a special meeting is called. The minutes of such meetings detail the proposal, financial analysis, risk assessment, and results of shareholder voting. 3. Leadership Appointment Meeting Minutes: In the event of electing or appointing key executives, special meetings may be convened to discuss candidates, review their qualifications, and make the final decisions. These minutes document the deliberations, candidates' profiles, voting outcomes, and any additional resolutions related to leadership succession. In conclusion, New York Special Meeting Minutes of Shareholders uphold corporate governance principles and facilitate effective decision-making. They serve as factual records of proceedings that deal with crucial matters, ensuring transparency, accountability, and compliance with legal requirements.

New York Special Meeting Minutes of Shareholders

Description

How to fill out New York Special Meeting Minutes Of Shareholders?

US Legal Forms - one of many biggest libraries of lawful varieties in America - delivers an array of lawful file web templates it is possible to obtain or printing. Utilizing the web site, you can get a huge number of varieties for organization and person functions, sorted by groups, claims, or key phrases.You can get the latest models of varieties like the New York Special Meeting Minutes of Shareholders within minutes.

If you currently have a subscription, log in and obtain New York Special Meeting Minutes of Shareholders in the US Legal Forms catalogue. The Acquire button will show up on each kind you see. You have accessibility to all earlier saved varieties from the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, allow me to share easy recommendations to help you began:

- Ensure you have chosen the best kind for your personal area/county. Go through the Review button to examine the form`s content. Look at the kind information to actually have selected the correct kind.

- If the kind doesn`t fit your requirements, utilize the Research field near the top of the screen to discover the one which does.

- If you are satisfied with the form, affirm your selection by clicking the Purchase now button. Then, opt for the prices prepare you favor and provide your references to register for an account.

- Approach the purchase. Make use of charge card or PayPal account to finish the purchase.

- Find the file format and obtain the form on your product.

- Make adjustments. Load, edit and printing and signal the saved New York Special Meeting Minutes of Shareholders.

Each template you included in your bank account does not have an expiry date and is also the one you have permanently. So, in order to obtain or printing another duplicate, just visit the My Forms area and then click in the kind you need.

Get access to the New York Special Meeting Minutes of Shareholders with US Legal Forms, by far the most comprehensive catalogue of lawful file web templates. Use a huge number of specialist and state-specific web templates that satisfy your company or person demands and requirements.