New York Clerical Staff Agreement - Self-Employed Independent Contractor

Description

How to fill out New York Clerical Staff Agreement - Self-Employed Independent Contractor?

It is possible to devote hrs on-line trying to find the legal papers format which fits the federal and state demands you will need. US Legal Forms offers thousands of legal varieties that happen to be reviewed by specialists. It is simple to download or produce the New York Clerical Staff Agreement - Self-Employed Independent Contractor from our support.

If you already have a US Legal Forms account, you may log in and click the Obtain key. Afterward, you may full, edit, produce, or signal the New York Clerical Staff Agreement - Self-Employed Independent Contractor. Each legal papers format you acquire is the one you have eternally. To obtain yet another copy of the acquired type, proceed to the My Forms tab and click the related key.

If you are using the US Legal Forms web site the first time, adhere to the basic guidelines listed below:

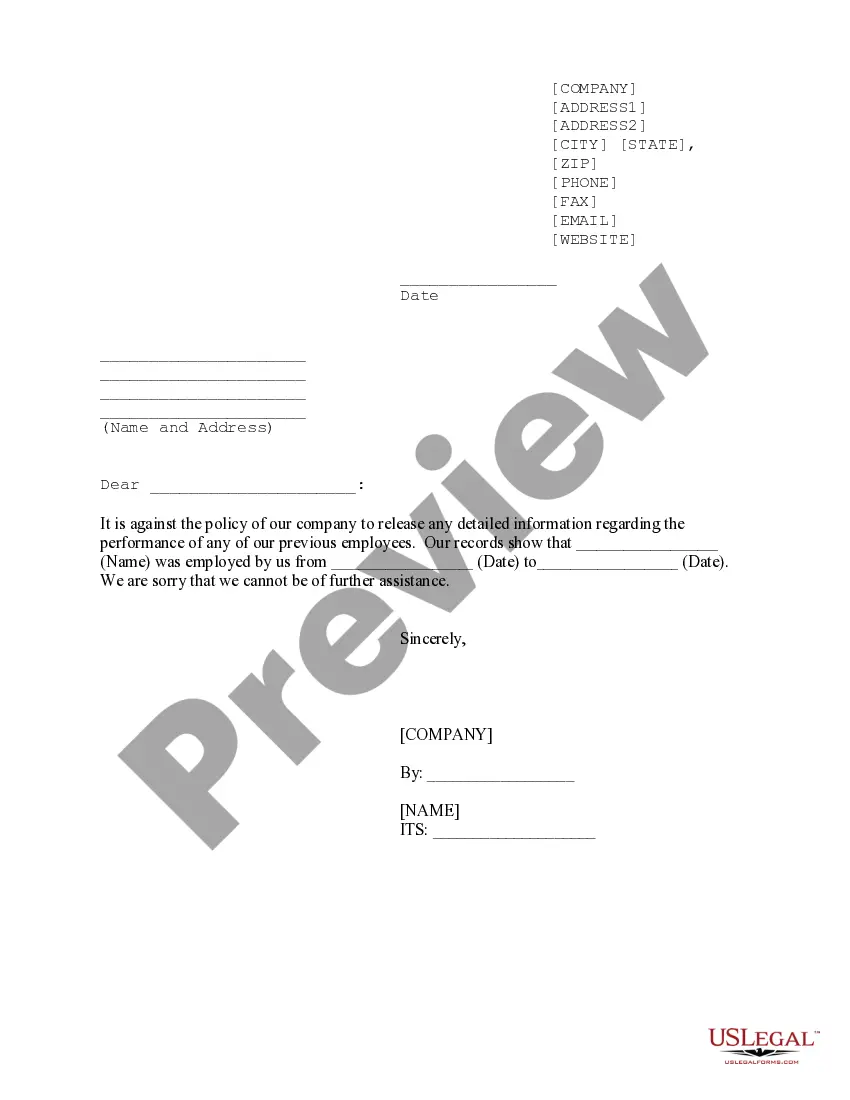

- Initially, be sure that you have selected the right papers format for that county/town of your liking. Look at the type explanation to ensure you have chosen the proper type. If readily available, utilize the Review key to appear with the papers format also.

- If you wish to find yet another edition of your type, utilize the Research industry to obtain the format that meets your requirements and demands.

- Upon having discovered the format you need, simply click Purchase now to move forward.

- Select the costs prepare you need, enter your references, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal account to purchase the legal type.

- Select the file format of your papers and download it for your gadget.

- Make changes for your papers if needed. It is possible to full, edit and signal and produce New York Clerical Staff Agreement - Self-Employed Independent Contractor.

Obtain and produce thousands of papers templates making use of the US Legal Forms website, which offers the largest selection of legal varieties. Use professional and status-certain templates to tackle your business or person demands.

Form popularity

FAQ

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

You may discover that by law they are considered employees and that you are liable for unemployment insurance contributions and interest. Whether the relationship is one of employer-employee will depend on several factors. These include how much supervision, direction, and control you have over the services.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.