New York Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out New York Tutoring Agreement - Self-Employed Independent Contractor?

Are you presently in the position where you need to have documents for sometimes business or individual uses virtually every day time? There are tons of legitimate document templates available on the net, but locating types you can trust isn`t effortless. US Legal Forms delivers a huge number of develop templates, such as the New York Tutoring Agreement - Self-Employed Independent Contractor, which can be published to meet federal and state specifications.

When you are previously informed about US Legal Forms internet site and also have an account, just log in. Next, you may obtain the New York Tutoring Agreement - Self-Employed Independent Contractor design.

Should you not have an account and would like to start using US Legal Forms, follow these steps:

- Obtain the develop you want and ensure it is to the proper town/region.

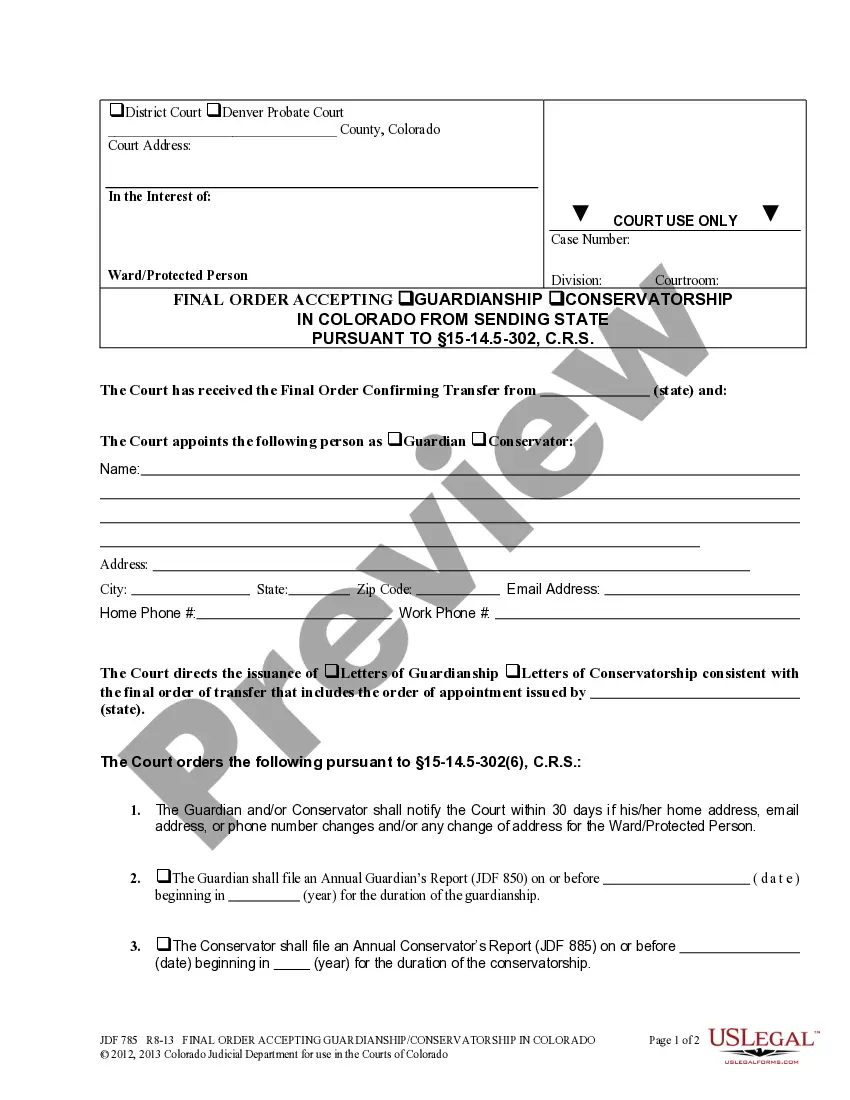

- Utilize the Preview button to examine the shape.

- Look at the information to actually have chosen the right develop.

- In the event the develop isn`t what you`re trying to find, make use of the Look for discipline to find the develop that meets your requirements and specifications.

- Once you discover the proper develop, just click Get now.

- Opt for the pricing program you need, fill out the desired information to generate your money, and purchase your order using your PayPal or Visa or Mastercard.

- Select a convenient file format and obtain your copy.

Locate all the document templates you might have bought in the My Forms menus. You may get a more copy of New York Tutoring Agreement - Self-Employed Independent Contractor anytime, if possible. Just click on the required develop to obtain or printing the document design.

Use US Legal Forms, one of the most extensive assortment of legitimate kinds, in order to save time as well as avoid blunders. The service delivers skillfully produced legitimate document templates which can be used for an array of uses. Make an account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Yes, tutoring is normally an activity that is classified by the IRS as self-employment, because you don't receive a W-2 from an employer for doing it. If you wish to report business expenses as a reduction to business income, then you will need the TurboTax online Self-Employment program.

If you're actively running your own tutoring business, and not working for an agency or other employer, you're self-employed. That's true even if you have a full-time day job. In the eyes of the Internal Revenue Service, being self-employed classifies you as a 1099 independent contractor.

Depends on the structure of how you're working. Generally if you get a 1099 or see clients individually, you are self employed. Even if you work for just one company under 1099, you are still technically self employed (according to the government).

That said, you'll need to file Schedule C (Form 1040), Profit or Loss From Business, as a self-employed person. Yes, tutoring is normally an activity that is classified by the IRS as self-employment, because you don't receive a W-2 from an employer for doing it.

In becoming a private tutor, you are classed as a self-employed sole trader. Working as a sole trader entails certain responsibilities, such as adhering to tax laws and reporting what you earn to HMRC without delay. This is called a tax return, and can be done online.

The glib answer is yes. Webster's defines tutor as a person employed to instruct another, esp. privately. California wage order 15 says a tutor may be considered a household employee, along with other staff such as maids.

Working as a private tutor will entail being self-employed, and with that will come the need to deal with your tax return.

If you are running a tutoring business and not working under any employer, you are billed as self-employed. You may even work a full day job but still count as a self-employed tutor. According to IRS (Internal Revenue Service), you fall under the 1099 independent contractor category as a self-employed individual.

The glib answer is yes. Webster's defines tutor as a person employed to instruct another, esp. privately. California wage order 15 says a tutor may be considered a household employee, along with other staff such as maids.

Ans.:- If your income from home tuitions as well as from all the other sources is more than basic exemption limit (i.e. Rs. 2,50,000 in case of individual) in the whole financial year, then you are required to file Income-tax return. E.g. - Say, your income from home tuitions is Rs.