New York Appliance Refinish Services Contract - Self-Employed

Description

How to fill out New York Appliance Refinish Services Contract - Self-Employed?

US Legal Forms - one of many most significant libraries of authorized kinds in the USA - gives a wide array of authorized document themes it is possible to download or produce. Making use of the web site, you may get 1000s of kinds for business and personal reasons, categorized by types, suggests, or keywords and phrases.You can get the most recent models of kinds such as the New York Appliance Refinish Services Contract - Self-Employed within minutes.

If you already possess a monthly subscription, log in and download New York Appliance Refinish Services Contract - Self-Employed in the US Legal Forms collection. The Download button will show up on every develop you perspective. You have access to all formerly acquired kinds within the My Forms tab of your own account.

If you wish to use US Legal Forms the first time, here are simple instructions to help you started out:

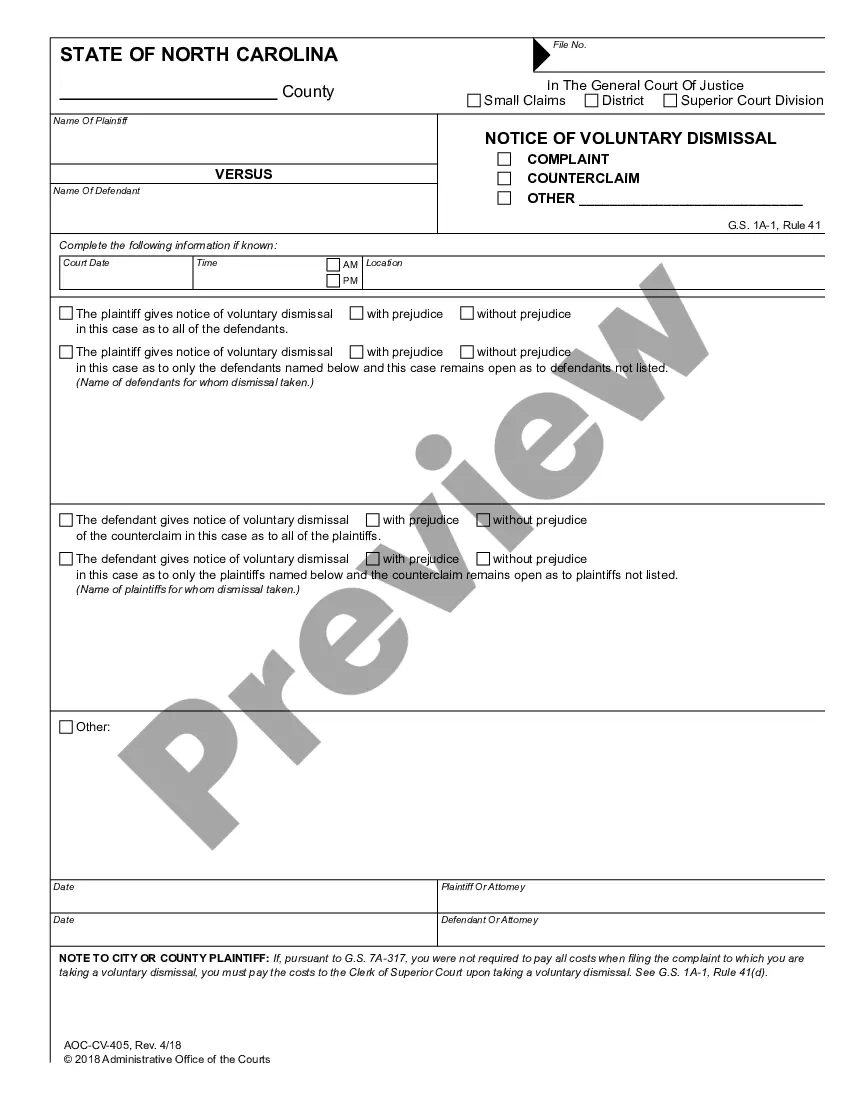

- Be sure you have picked out the correct develop for your metropolis/area. Select the Preview button to examine the form`s information. See the develop explanation to actually have selected the appropriate develop.

- In case the develop does not match your requirements, use the Search area on top of the display screen to get the the one that does.

- When you are satisfied with the form, confirm your selection by visiting the Acquire now button. Then, select the rates plan you prefer and give your credentials to sign up for an account.

- Procedure the financial transaction. Make use of charge card or PayPal account to finish the financial transaction.

- Choose the structure and download the form on your own system.

- Make alterations. Complete, change and produce and indicator the acquired New York Appliance Refinish Services Contract - Self-Employed.

Each and every web template you included with your bank account lacks an expiry day which is your own property eternally. So, if you wish to download or produce one more backup, just proceed to the My Forms area and then click on the develop you want.

Gain access to the New York Appliance Refinish Services Contract - Self-Employed with US Legal Forms, one of the most substantial collection of authorized document themes. Use 1000s of skilled and status-specific themes that meet your small business or personal needs and requirements.

Form popularity

FAQ

Under California sales tax rules, cleaning or janitorial services are exempt from having to charge sales tax even when certain products (cleaning products and supplies) are used incidentally in connection with the services.

Effective June 1, 1990, a combined state and local sales tax is imposed on all charges for interior cleaning and maintenance services performed in New York State, regardless of whether performed on an as-needed (short-term) basis or long-term contractual basis.

If the project is a repair, the contractor must pay sales tax on all the materials purchased for the job. In addition, sales tax is due from the owner based on the contractor's total invoice for the labor and materials of the job.

Sales of service contracts in New York are considered to be sales of taxable repair and maintenance services. Businesses located in New York State that make sales of service contracts must be registered as New York State sales tax vendors. See Tax Bulletin How to Register for New York State Sales Tax (TB-ST-360).

All charges for materials and labor that you bill to your customer for any repair, maintenance, or installation project, including any expenses or other markups, are taxable.

Sales tax also does not apply to most services. Examples of services not subject to sales tax are capital improvements to real property, medical care, education, and personal and professional services.

Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. Sales of services are generally exempt from New York sales tax unless they are specifically taxable.

Sales of service contracts in New York are considered to be sales of taxable repair and maintenance services. Businesses located in New York State that make sales of service contracts must be registered as New York State sales tax vendors.

Laundering and dry-cleaning services are excluded from taxable maintaining, servicing, and repairing tangible personal property and real property under New York Tax Law. The Department interpreted this exclusion to also encompass the services of cleaning rugs, wall-to-wall carpeting, draperies, and upholstery.