New York Self-Employed Independent Contractor Consideration For Hire Form

Description

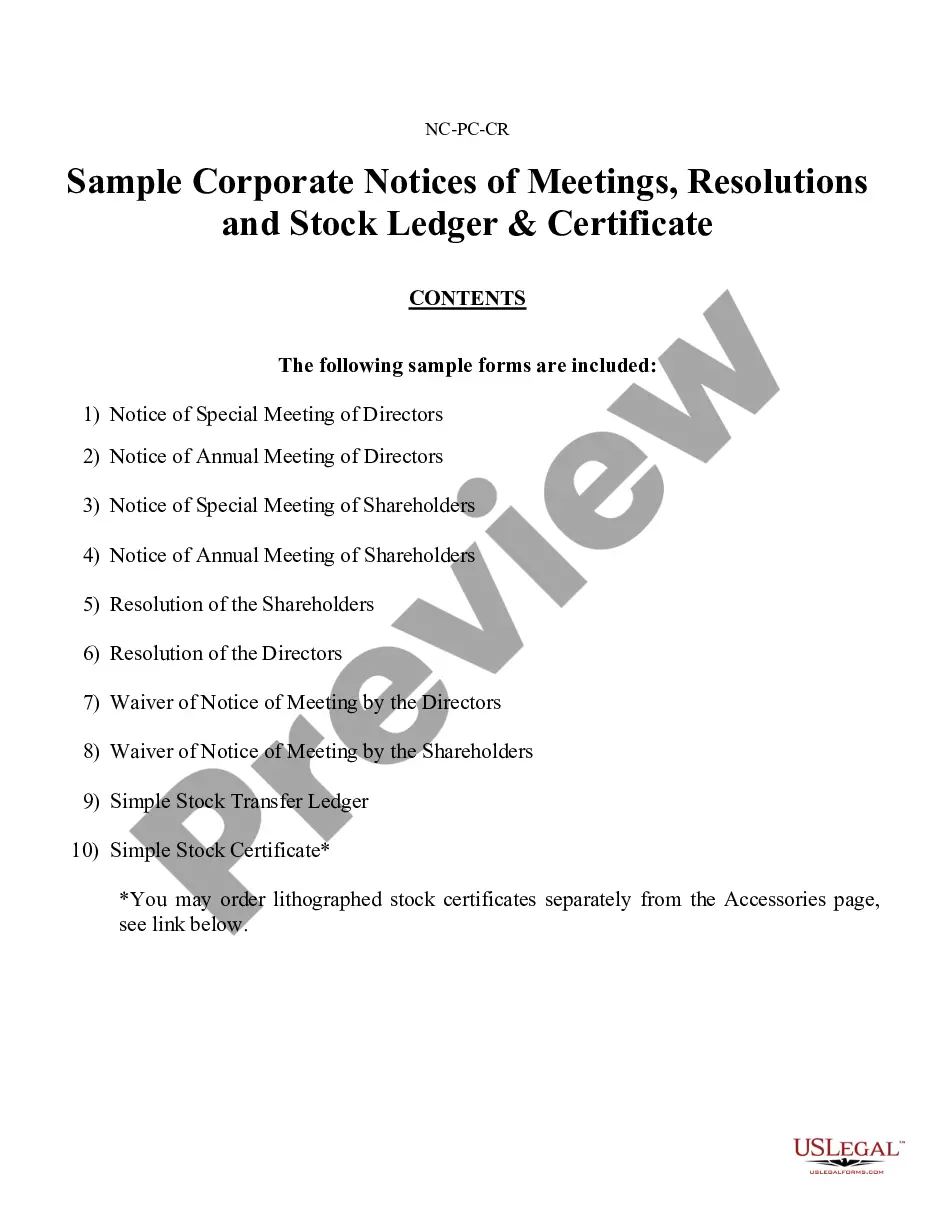

How to fill out New York Self-Employed Independent Contractor Consideration For Hire Form?

You may devote hrs on the web looking for the authorized record design which fits the state and federal specifications you need. US Legal Forms provides a huge number of authorized types which are evaluated by experts. It is simple to obtain or print the New York Self-Employed Independent Contractor Consideration For Hire Form from our support.

If you currently have a US Legal Forms account, you can log in and then click the Down load option. Following that, you can total, revise, print, or signal the New York Self-Employed Independent Contractor Consideration For Hire Form. Every single authorized record design you get is the one you have forever. To have yet another backup associated with a bought form, proceed to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms site the very first time, stick to the easy directions beneath:

- Initial, ensure that you have selected the correct record design for your region/city that you pick. Read the form information to ensure you have picked out the appropriate form. If available, take advantage of the Review option to look throughout the record design at the same time.

- If you would like find yet another variation in the form, take advantage of the Look for area to obtain the design that meets your requirements and specifications.

- After you have discovered the design you would like, click on Acquire now to proceed.

- Find the costs plan you would like, type in your references, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal account to fund the authorized form.

- Find the file format in the record and obtain it for your product.

- Make adjustments for your record if possible. You may total, revise and signal and print New York Self-Employed Independent Contractor Consideration For Hire Form.

Down load and print a huge number of record themes using the US Legal Forms Internet site, which provides the biggest variety of authorized types. Use expert and express-distinct themes to tackle your small business or person needs.

Form popularity

FAQ

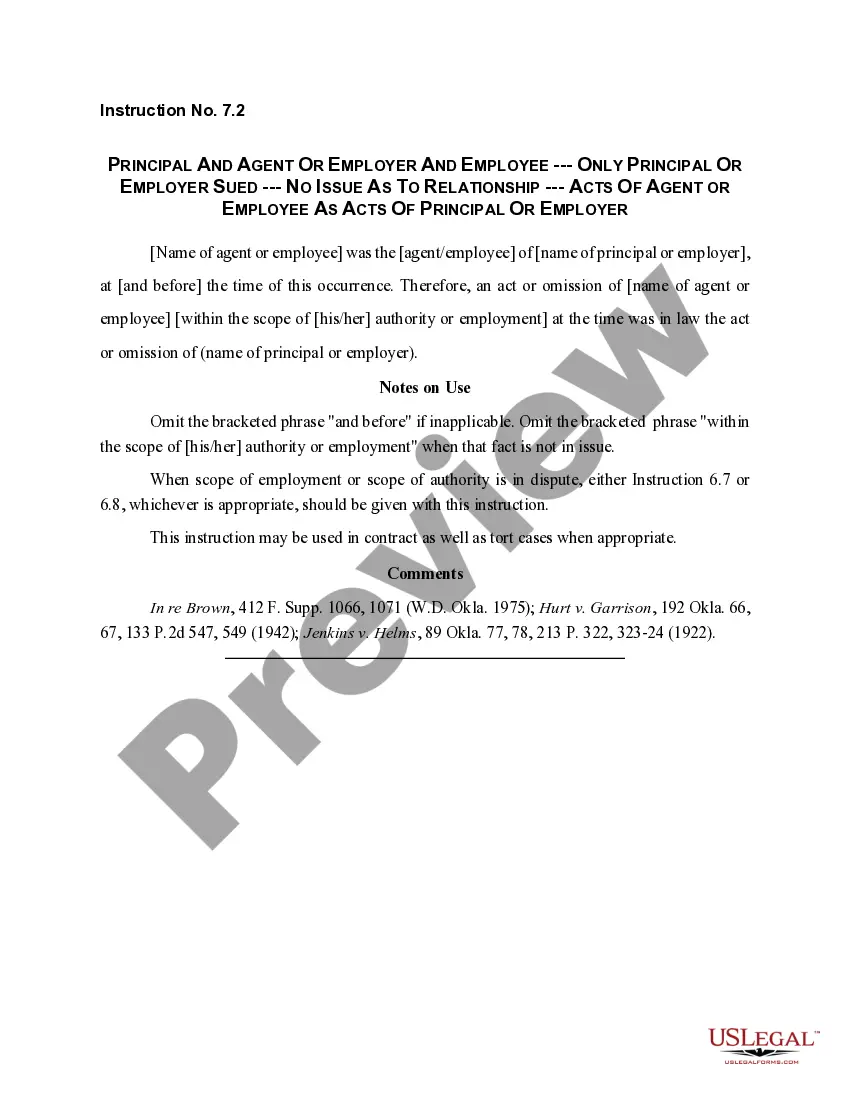

1099 contractors are easier to hireyou simply draft up an agreement and get working. There are very few legal ramifications; you can let them go at any time. And importantly, 1099 contractors may be less expensive than hiring a permanent full-time person.

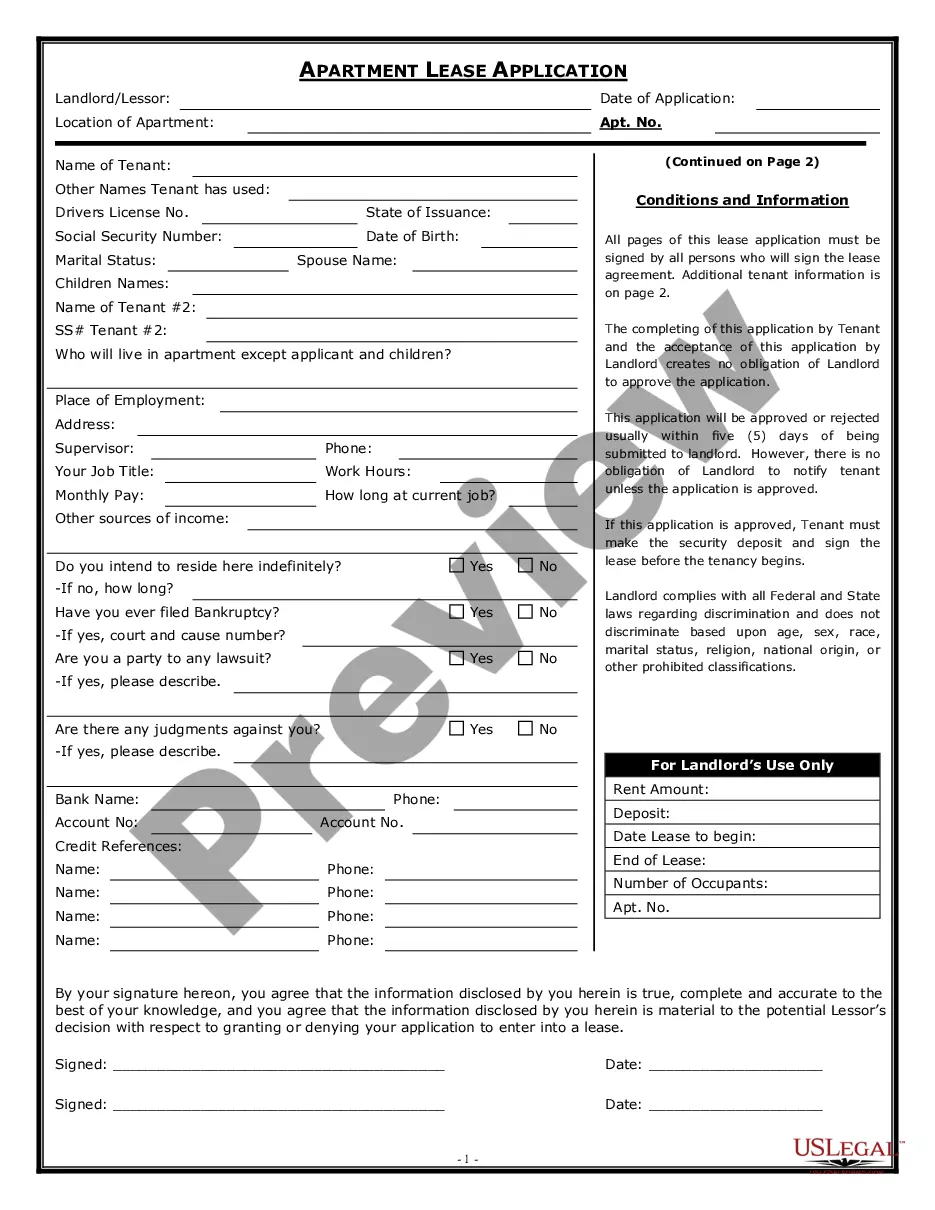

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

All 1099 employees pay a 15.3% self-employment tax. There are two parts to this tax: 12.4% goes to Social Security and 2.9% goes to Medicare. It's your responsibility to set aside money to cover these costs as clients aren't required to withhold these taxes from your paycheck.

Form 1099-NEC & Independent Contractors.

IRS Tax Form 1099-NEC. As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

How to hire a 1099 employeeCorrectly classify the individual.Check credentials and employment history.Create a contract.Have them fill out the proper forms.Integrate into company.

The 1099-NEC is now used to report independent contractor income. But the 1099-MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney. Although the 1099-MISC is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099-NEC.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.