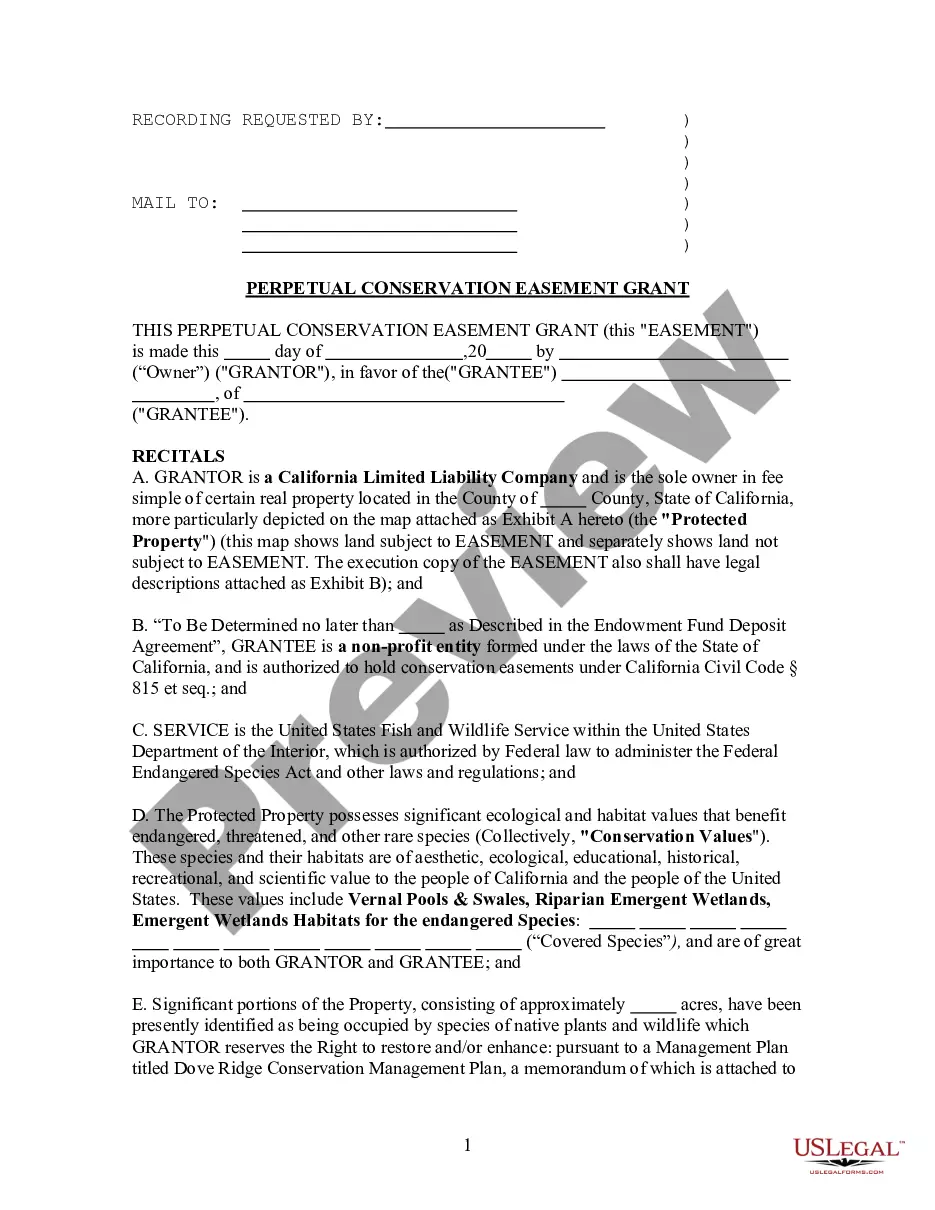

A New York Private Investigator Agreement — Self-Employed Independent Contractor is a legally binding contract between a private investigator and a client in New York, where the investigator operates as a self-employed independent contractor. This agreement defines the terms and conditions of the working relationship between the two parties, ensuring clarity and protection for both sides. The agreement typically begins with an introduction section, outlining the names and addresses of both the investigator (contractor) and the client. It also identifies the purpose of the agreement and the specific services the investigator will provide. This may include surveillance, background checks, fraud investigations, skip tracing, or any other investigative work requested by the client. Next, the agreement covers the payment details. It specifies the investigator's compensation structure, whether it is an hourly rate, a flat fee, or a combination of both. It may also include any additional expenses that will be reimbursed by the client, such as travel or equipment costs. The agreement further addresses the timeline and deadlines for completing the investigation. It ensures that the investigator will work diligently and promptly to deliver the desired results within an agreed-upon timeframe. It may include provisions for extensions if needed. Additionally, confidentiality and non-disclosure clauses are crucial components of this agreement. They safeguard the client's sensitive information and ensure that the investigator will not disclose any confidential details or use the obtained information for personal gain. If there are different types of New York Private Investigator Agreement — Self-Employed Independent Contractor, they may include variations based on the scope of services, the length of the agreement, or the specific industries the investigator specializes in. For example: 1. Surveillance Agreement: Explicitly outlines the terms and conditions specific to surveillance activities, including limitations, hours of operation, and equipment used. 2. Background Check Agreement: Focuses on conducting background investigations of individuals or companies, including criminal history, employment verification, financial records, and other relevant information. 3. Fraud Investigation Agreement: Tailored towards investigating fraudulent activities, such as insurance fraud, workers' compensation fraud, or financial fraud. It may outline the methodologies and techniques used to detect and gather evidence. 4. Skip Tracing Agreement: Primarily deals with locating missing persons or individuals who have intentionally concealed their whereabouts. It may specify the necessary databases, resources, and techniques employed by the investigator. In conclusion, a New York Private Investigator Agreement — Self-Employed Independent Contractor is a comprehensive contract that establishes the working relationship between a private investigator and a client. By clearly defining the terms, obligations, and protections of both parties, this agreement ensures a smooth and professional collaboration throughout the investigative process.

New York Private Investigator Agreement - Self-Employed Independent Contractor

Description

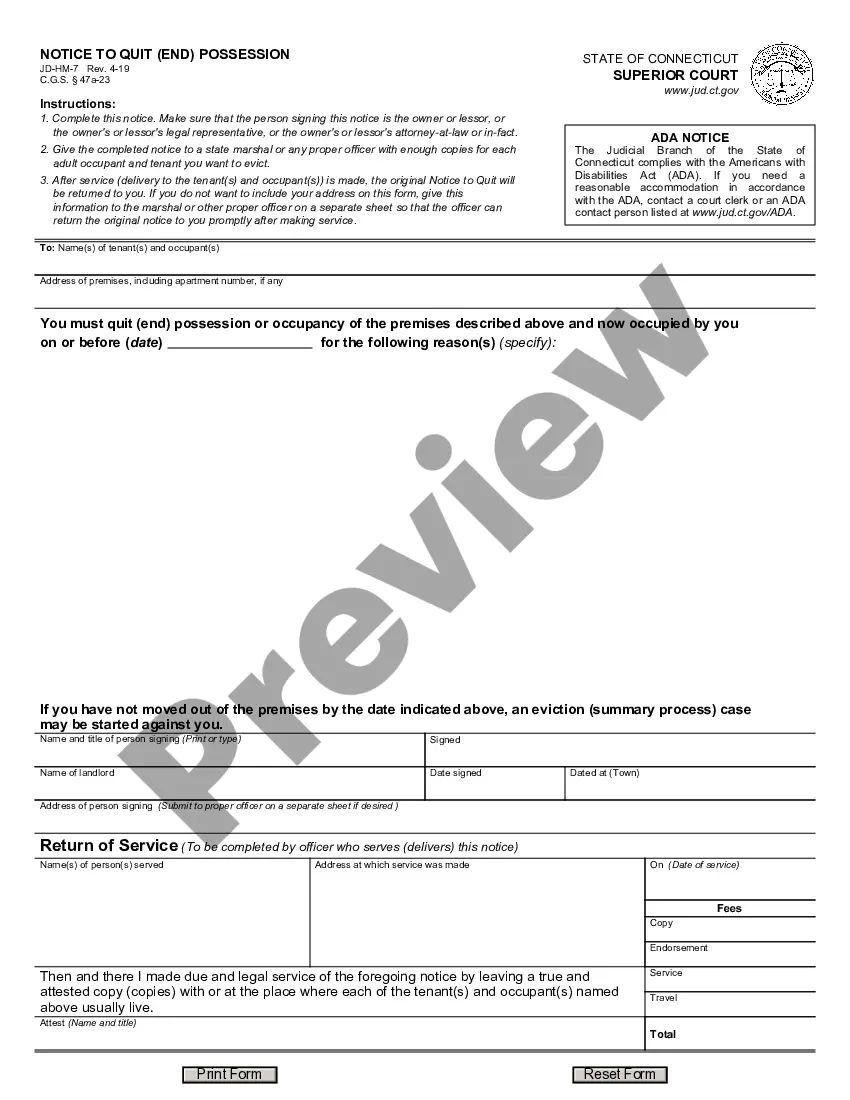

How to fill out New York Private Investigator Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the most significant libraries of authorized kinds in America - gives an array of authorized file layouts you are able to acquire or produce. Making use of the internet site, you may get a large number of kinds for enterprise and specific uses, categorized by types, suggests, or search phrases.You can get the most up-to-date versions of kinds much like the New York Private Investigator Agreement - Self-Employed Independent Contractor in seconds.

If you already have a membership, log in and acquire New York Private Investigator Agreement - Self-Employed Independent Contractor from the US Legal Forms catalogue. The Obtain switch will show up on every single kind you view. You have accessibility to all in the past saved kinds inside the My Forms tab of your respective account.

In order to use US Legal Forms the very first time, listed here are easy directions to obtain started off:

- Be sure to have selected the right kind for your town/region. Go through the Review switch to review the form`s content material. Browse the kind description to ensure that you have chosen the appropriate kind.

- If the kind doesn`t fit your requirements, take advantage of the Look for discipline on top of the display to find the one who does.

- In case you are pleased with the shape, verify your choice by clicking the Purchase now switch. Then, pick the prices program you prefer and provide your accreditations to register to have an account.

- Method the transaction. Make use of charge card or PayPal account to perform the transaction.

- Pick the structure and acquire the shape in your device.

- Make changes. Complete, modify and produce and indicator the saved New York Private Investigator Agreement - Self-Employed Independent Contractor.

Every single template you put into your account lacks an expiry time and is also yours permanently. So, if you would like acquire or produce an additional backup, just proceed to the My Forms portion and then click about the kind you will need.

Gain access to the New York Private Investigator Agreement - Self-Employed Independent Contractor with US Legal Forms, the most considerable catalogue of authorized file layouts. Use a large number of professional and state-certain layouts that meet your company or specific needs and requirements.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

Some 1099 workers only work on one project at a time, but many serve multiple clients, providing a service within their expertise. Independent contractors, such as freelancers and consultants, are self-employed, so they're business owners themselves.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.