New York Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

Are you presently in a situation that necessitates documents for possibly company or personal activities almost every day.

There are numerous legal document templates accessible online, however locating ones you can rely on is challenging.

US Legal Forms offers a vast array of document templates, such as the New York Self-Employed Part-Time Employee Agreement, which are designed to comply with federal and state regulations.

Once you have found the appropriate document, click Purchase now.

Select the pricing option you want, complete the necessary information to finalize your order, and process the payment using your PayPal or credit card.

Choose a convenient file format and download your copy.

Retrieve all the document templates you have purchased in the My documents section. You can acquire an additional copy of the New York Self-Employed Part-Time Employee Agreement at any time, if needed. Simply click on the required document to download or print the template.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid errors. The service provides expertly crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Self-Employed Part-Time Employee Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/state.

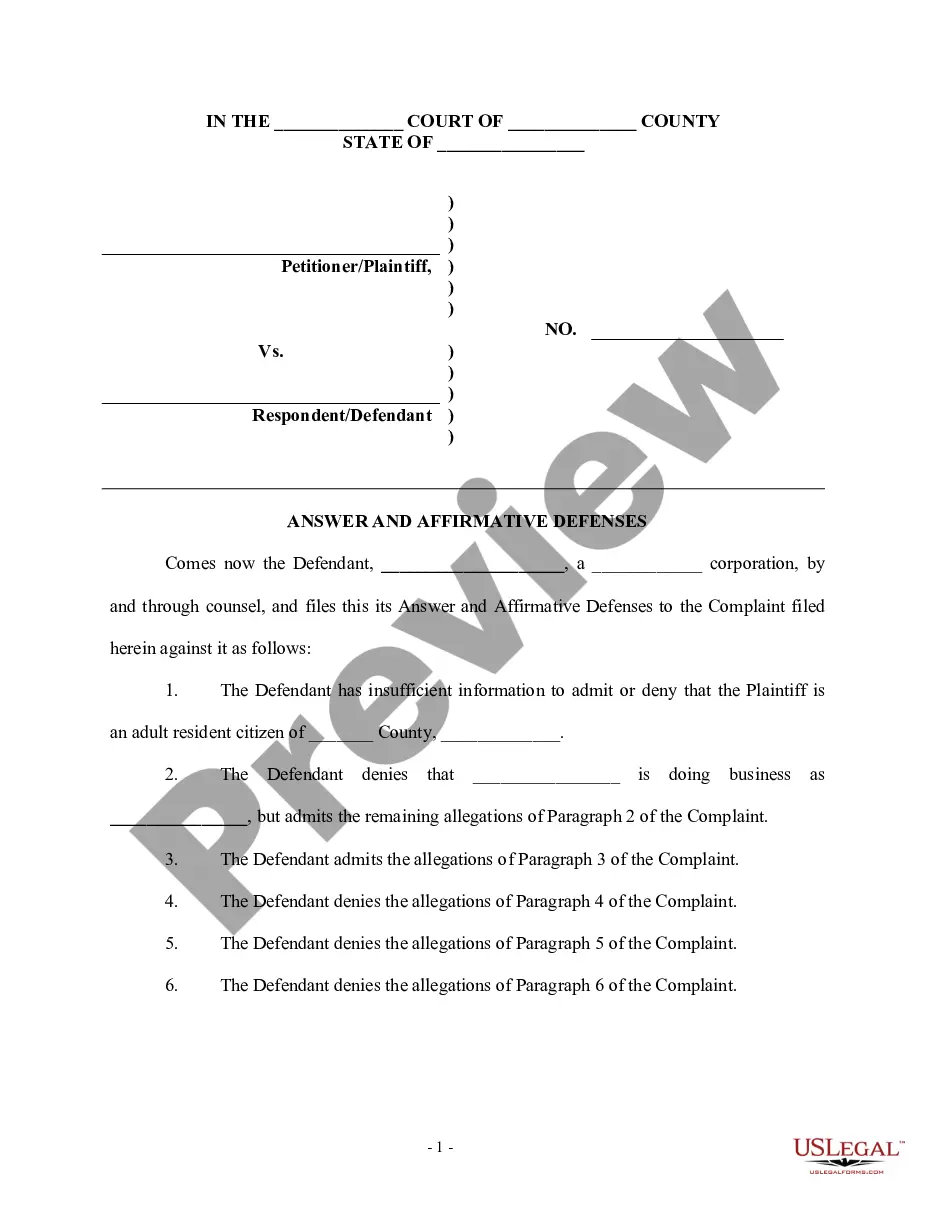

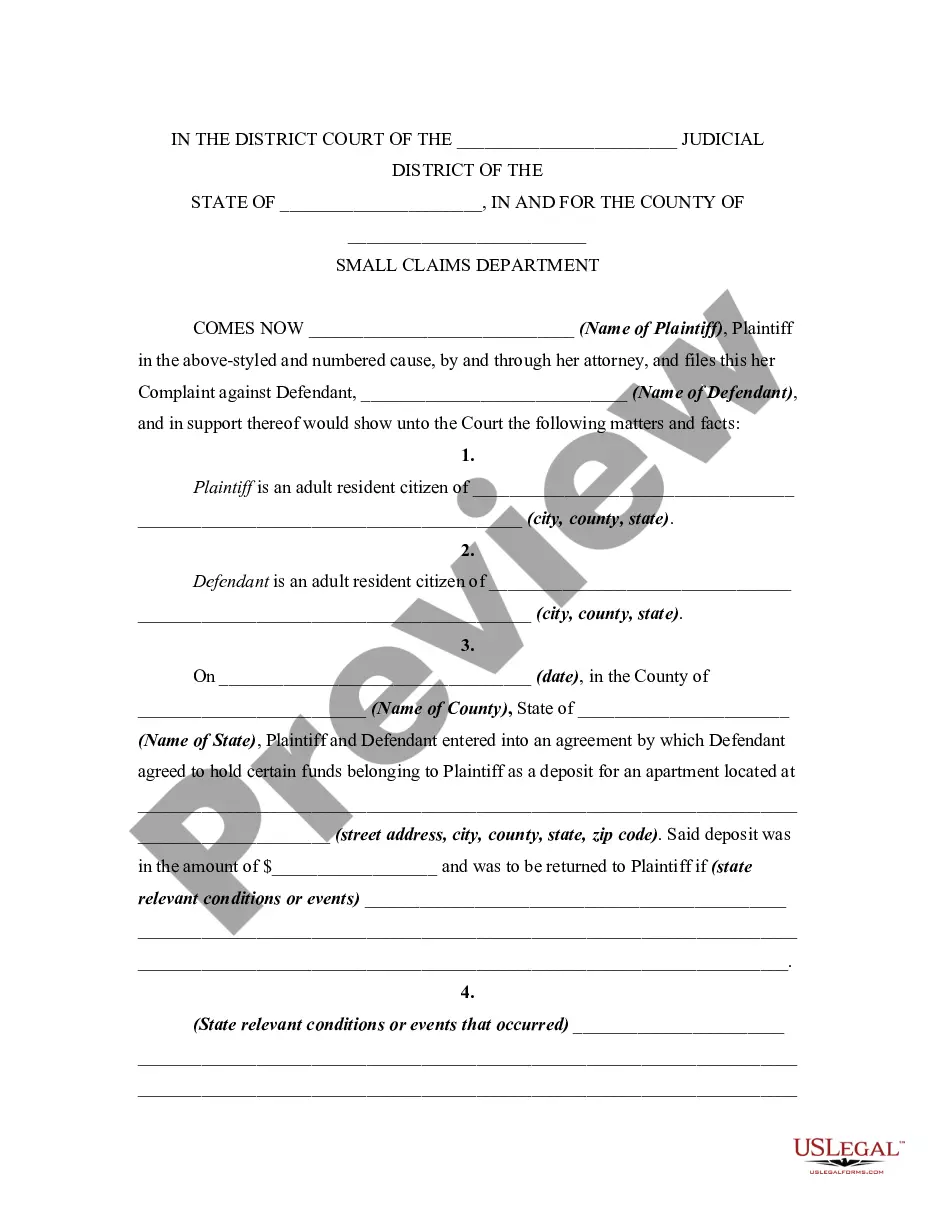

- Utilize the Preview button to examine the document.

- Read the description to confirm you have selected the appropriate document.

- If the document is not what you need, use the Search field to find the form that meets your criteria.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

There is no requirement that you have to enter into a written employee contract with every employee that you have. However, there are some situations in which it makes sense to enter into an employment contract with your employees.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

time contract is similar to a fulltime contract, the main difference being the agreed working hours. time worker will work less than 35 hours per week. The agreed amount of hours required to work each week needs to be visible in the contract.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Contract employees Often, contractors work for multiple organizations in order to make a living. These workers may make more money than part-time employees in the short term; however, they also have to pay self-employment taxes on their earnings, which can add up over time.

Employment contracts are valid for as long as an individual is employed with your company. There is typically no need to re-write employment contracts each year under most circumstances. If an employee is promoted, you may consider updating their job description and request they sign the updated form.