New York Self-Employed Roofing Services Agreement

Description

How to fill out New York Self-Employed Roofing Services Agreement?

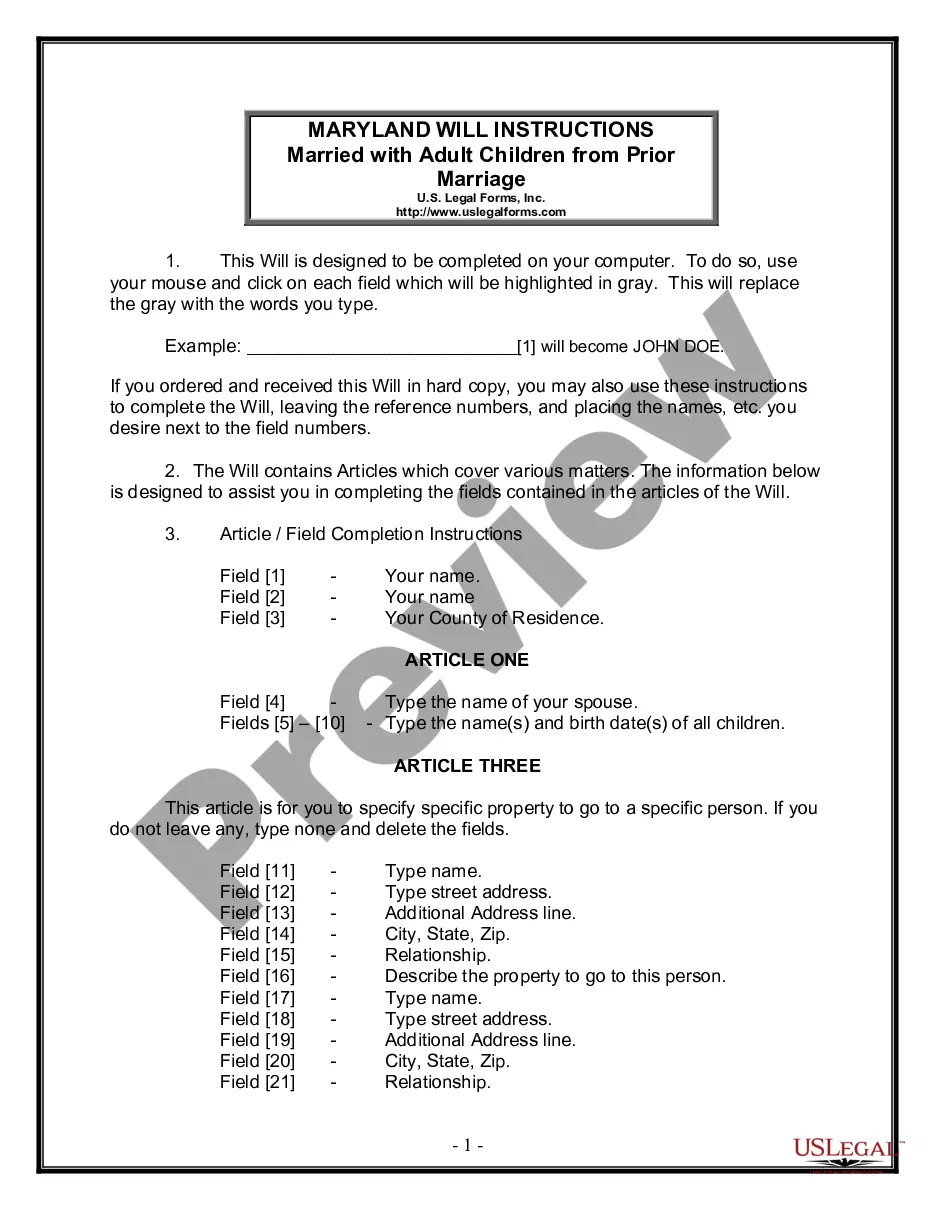

Discovering the right legal file web template can be a have a problem. Obviously, there are a lot of templates available on the net, but how will you get the legal form you want? Use the US Legal Forms internet site. The support delivers a huge number of templates, like the New York Self-Employed Roofing Services Agreement, that can be used for business and personal needs. All of the kinds are inspected by specialists and fulfill federal and state needs.

Should you be currently signed up, log in for your bank account and then click the Down load switch to have the New York Self-Employed Roofing Services Agreement. Utilize your bank account to appear with the legal kinds you might have bought earlier. Proceed to the My Forms tab of the bank account and obtain an additional duplicate of your file you want.

Should you be a fresh end user of US Legal Forms, here are straightforward recommendations that you should adhere to:

- Initial, ensure you have selected the correct form for your personal city/region. You are able to check out the shape making use of the Preview switch and study the shape description to guarantee this is basically the right one for you.

- In the event the form does not fulfill your needs, utilize the Seach area to discover the proper form.

- When you are positive that the shape is acceptable, go through the Buy now switch to have the form.

- Pick the costs program you would like and enter the essential information. Design your bank account and purchase the order with your PayPal bank account or charge card.

- Pick the data file structure and acquire the legal file web template for your gadget.

- Total, revise and print and sign the attained New York Self-Employed Roofing Services Agreement.

US Legal Forms will be the biggest library of legal kinds for which you can discover numerous file templates. Use the company to acquire skillfully-produced paperwork that adhere to express needs.

Form popularity

FAQ

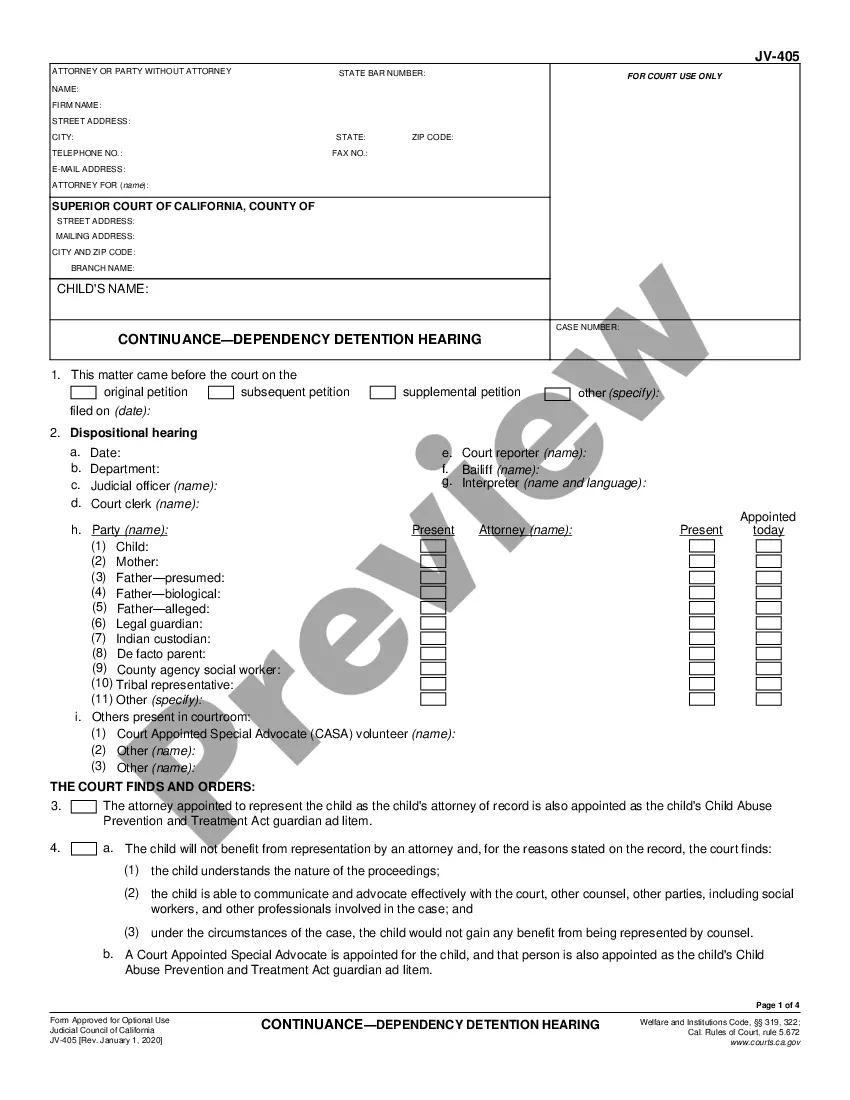

New York City law requires that any person or business that solicits, canvasses, sells, performs, or obtains home improvement work where all costs (including labor, materials, etc.) come to more than $200 total must get an HIC license from the Department of Consumer Affairs.

Avoid paying in cash. Contractors cannot ask for a deposit of more than 10 percent of the total cost of the job or $1,000, whichever is less. (This applies to any home improvement project, including swimming pools.) Stick to your schedule of payments and don't let payments get ahead of the completed work.

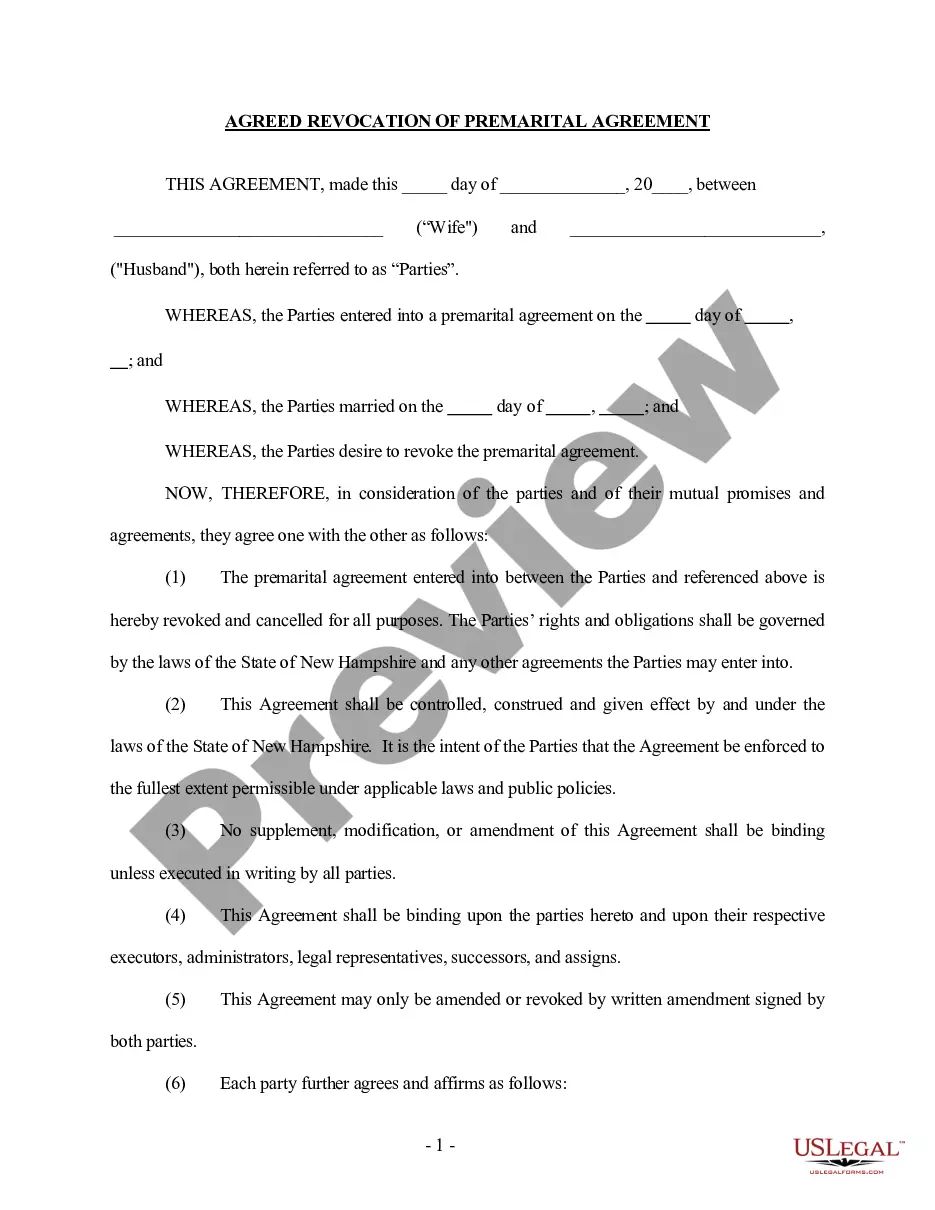

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Payment Schedule In Your Contract Before any work begins, a contractor will ask a homeowner to secure the job with a down payment. It shouldn't be more than 10-20 percent of the total cost of the job. Homeowners should never pay a contractor more than 10-20% before they've even stepped foot in their home.

Asking for more than half of the project cost up front, though, is a big red flag. A reputable and established contractor should have the wherewithal to purchase enough materials to get the job started without relying on your down payment. I recommend tying payments to progress made during the job.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

If a contractor asks for more than 50% upfront, this could be a potential red flag. More than half of all contractors who responded to a nationwide Angi poll said they require down payments for projects, with most saying they are willing to negotiate on down payment terms.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?