"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

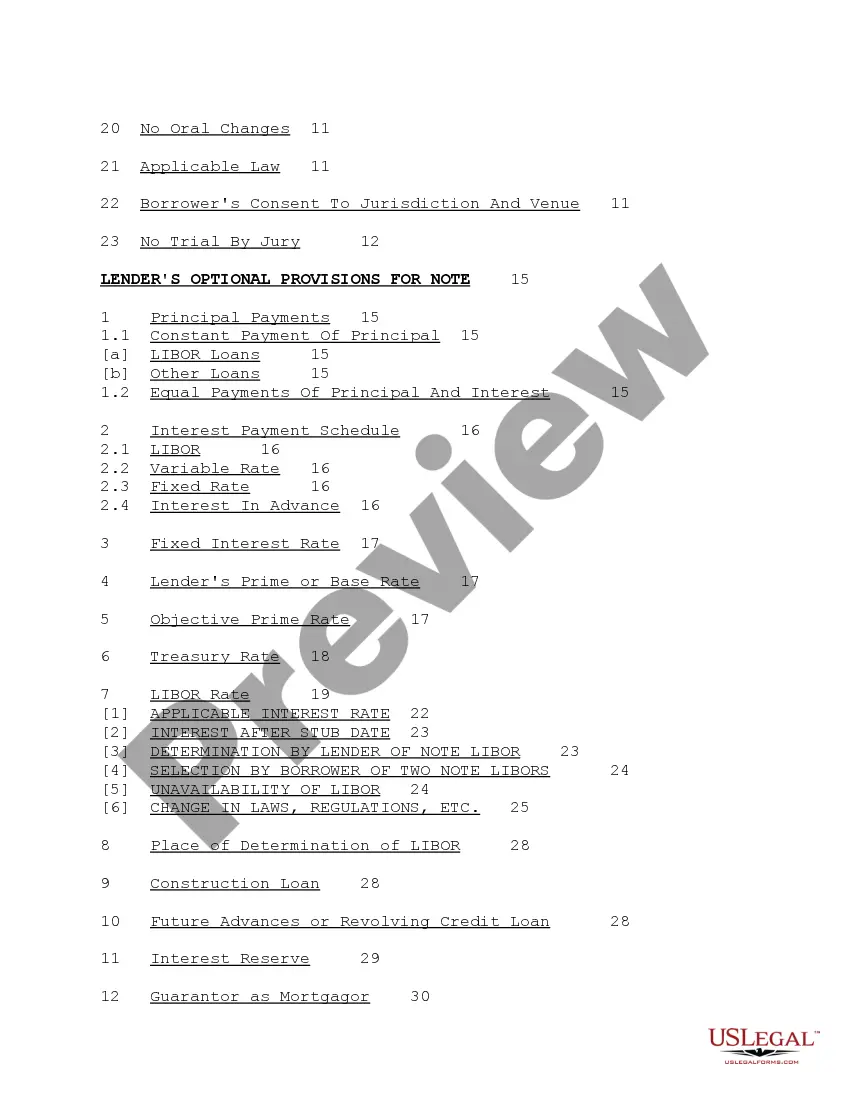

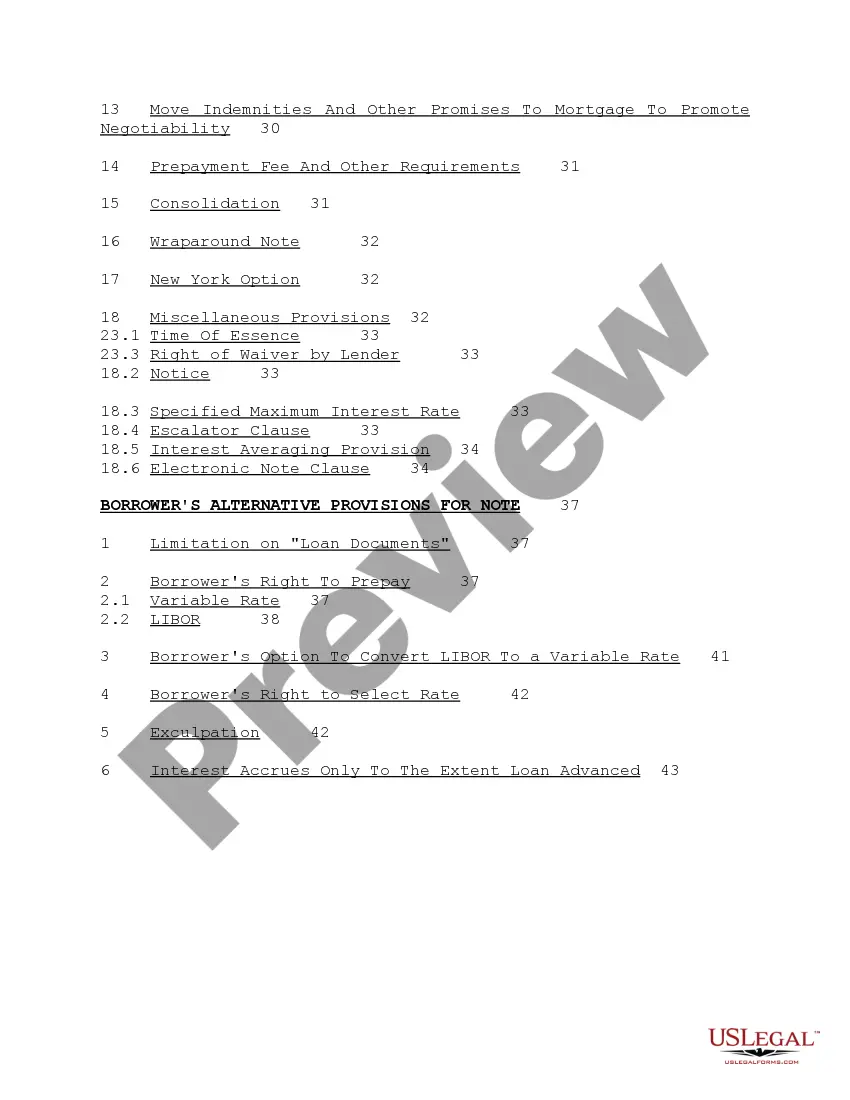

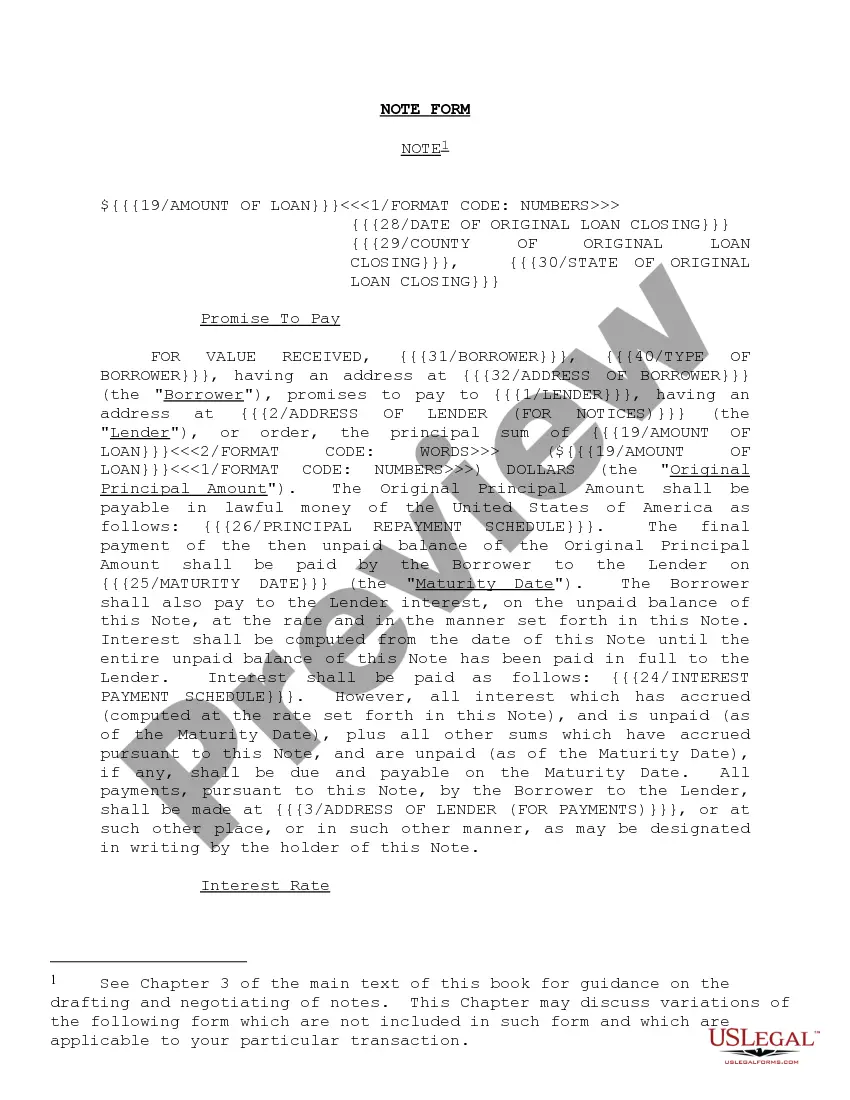

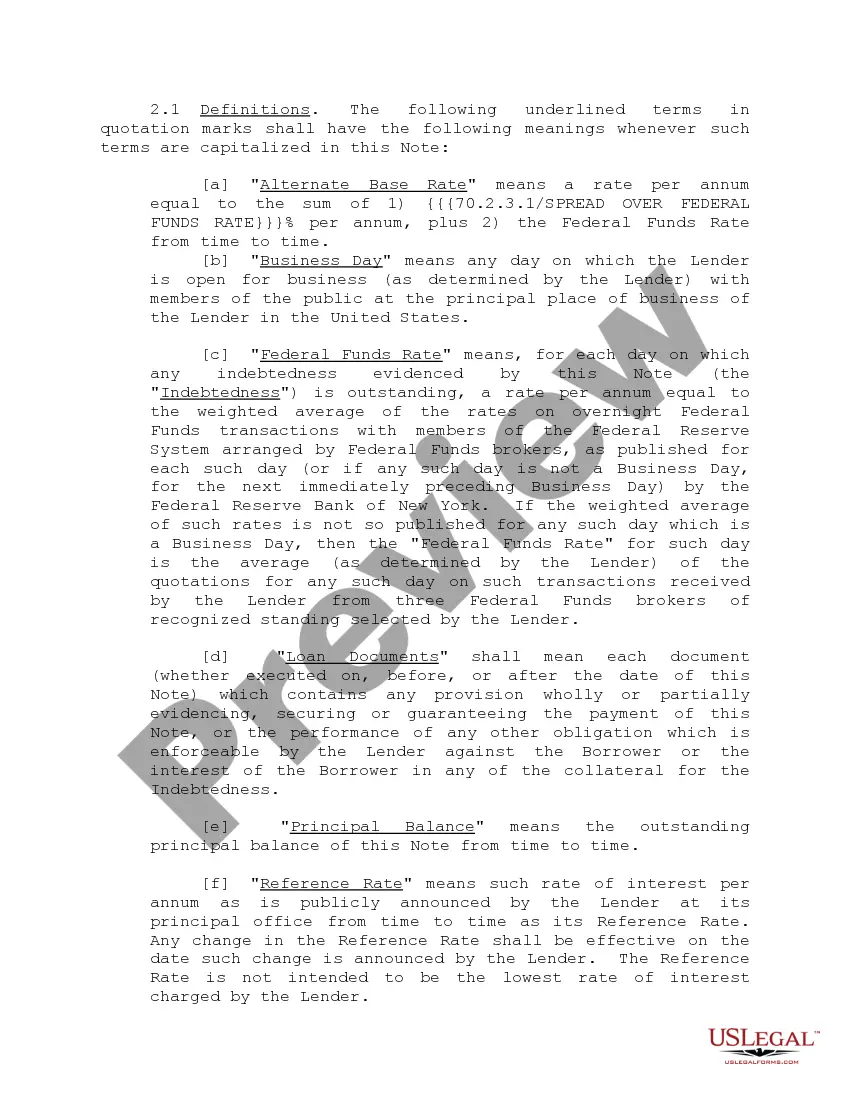

New York Note Form and Variations

Description

How to fill out Note Form And Variations?

Choosing the best legitimate file format might be a have a problem. Obviously, there are a variety of web templates available on the net, but how will you obtain the legitimate kind you want? Utilize the US Legal Forms web site. The assistance offers a huge number of web templates, including the New York Note Form and Variations, that can be used for organization and personal requirements. All of the forms are checked by experts and fulfill federal and state specifications.

When you are already listed, log in in your profile and click the Acquire button to have the New York Note Form and Variations. Utilize your profile to look with the legitimate forms you may have purchased in the past. Visit the My Forms tab of your own profile and obtain one more backup in the file you want.

When you are a whole new consumer of US Legal Forms, listed below are simple guidelines for you to stick to:

- First, ensure you have selected the right kind for your personal town/state. You are able to look over the form while using Preview button and read the form outline to make sure it will be the best for you.

- In case the kind does not fulfill your expectations, take advantage of the Seach industry to find the right kind.

- When you are sure that the form is suitable, select the Buy now button to have the kind.

- Pick the costs strategy you need and enter the needed information. Make your profile and purchase your order using your PayPal profile or credit card.

- Select the submit file format and acquire the legitimate file format in your gadget.

- Comprehensive, change and produce and indication the attained New York Note Form and Variations.

US Legal Forms will be the greatest library of legitimate forms in which you can discover various file web templates. Utilize the service to acquire expertly-made papers that stick to express specifications.

Form popularity

FAQ

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. IRS W4 Form Instructions: How many allowance should you claim on your... marca.com ? personal-finance ? 2023/02/14 marca.com ? personal-finance ? 2023/02/14

"FLI" indicates Family Leave Insurance.

New York State Disability Insurance.

220: Passthrough entity tax (PTET) deduction addback (IT112R, New York State Resident Credit)

The 2022 New York state standard deduction is $8,000 for single filers and those married filing separately, $11,200 for heads of household, and $16,050 for those married filing jointly. New York state income tax returns were due by April 18, 2023, or Oct. 16, 2023 with a tax extension.

The amount of excess business interest deduction claimed for federal purposes over the amount of business interest deduction allowable for New York State would be on your IT-558. What is an IT 558 tax form in New york? And is it required to fill out, before ... intuit.com ? after-you-file ? discussion ? what-... intuit.com ? after-you-file ? discussion ? what-...

New York Addition: The Income which is not reported in Federal but taxable in the state return is New York State Additions. New York Subtraction: The Income which is reported in Federal but not taxable in the state return is New York State Subtractions. New York Individual Tax Filing Forms - TaxGarden.com taxgarden.com ? state ? ny-tax-forms taxgarden.com ? state ? ny-tax-forms

Claiming more allowances will lower the amount of income tax that's taken out of your check. Conversely, if the total number of allowances you're claiming is zero, that means you'll have the most income tax withheld from your take-home pay. W-4 Basics utah.edu ? Steps-to-Filling-out-a-W4-v.2-1.pdf utah.edu ? Steps-to-Filling-out-a-W4-v.2-1.pdf