New York Term Nonparticipating Royalty Deed from Mineral Owner

Description

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

Have you been in a position in which you will need papers for both organization or specific functions almost every working day? There are tons of authorized document web templates available on the Internet, but discovering kinds you can rely isn`t simple. US Legal Forms delivers a large number of develop web templates, such as the New York Term Nonparticipating Royalty Deed from Mineral Owner, which can be written to fulfill federal and state specifications.

In case you are currently knowledgeable about US Legal Forms website and have a merchant account, basically log in. Afterward, you are able to obtain the New York Term Nonparticipating Royalty Deed from Mineral Owner web template.

If you do not provide an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the develop you require and make sure it is for that appropriate city/area.

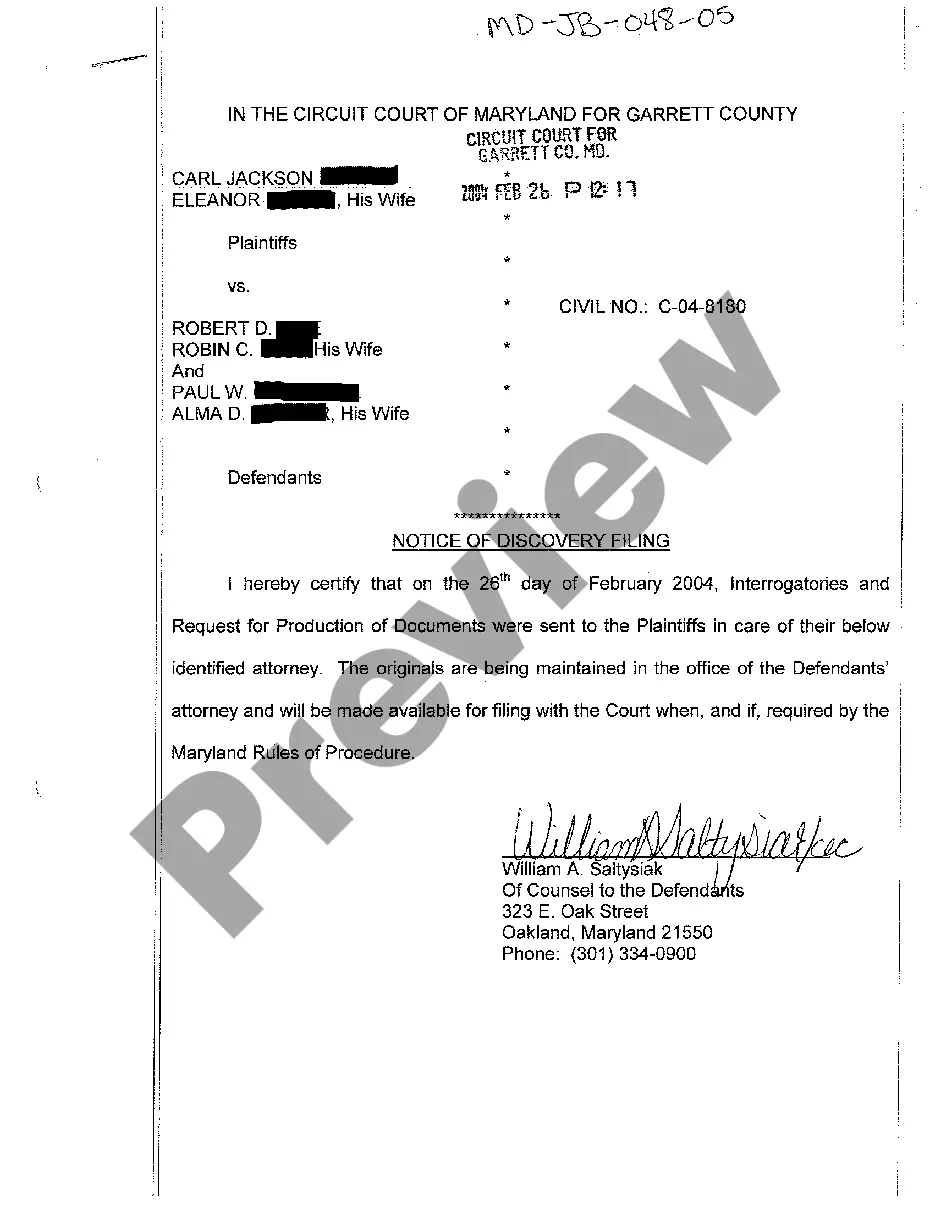

- Take advantage of the Preview button to examine the shape.

- Look at the outline to ensure that you have selected the right develop.

- If the develop isn`t what you`re trying to find, utilize the Research industry to get the develop that meets your needs and specifications.

- If you obtain the appropriate develop, click Get now.

- Select the prices prepare you desire, fill in the specified details to make your bank account, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Select a convenient paper file format and obtain your copy.

Get every one of the document web templates you may have bought in the My Forms menu. You can obtain a additional copy of New York Term Nonparticipating Royalty Deed from Mineral Owner any time, if needed. Just click on the essential develop to obtain or print the document web template.

Use US Legal Forms, probably the most considerable assortment of authorized varieties, in order to save time and avoid faults. The services delivers professionally made authorized document web templates that you can use for a selection of functions. Create a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

What is an NPRI? A non-participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.