A New York Gift Deed of Mineral Interest with No Warranty is a legal document that allows a person (the granter) to transfer ownership of their mineral rights to another person (the grantee) without any warranty or guarantee of title. This type of deed is commonly used in real estate transactions involving the transfer of mineral interests in properties located in New York State. Keywords: New York, Gift Deed, Mineral Interest, No Warranty, Transfer, Ownership, Title, Real Estate, Properties. There are two main types of New York Gift Deeds of Mineral Interest with No Warranty: 1. New York Gift Deed of Mineral Interest with No Warranty for Individual Ownership: This type of deed is used when an individual owns the mineral rights in a property and wishes to gift those rights to another individual or organization. The granter, in this case, does not provide any warranty or guarantee of the title, meaning they are not responsible for any claims or disputes that may arise regarding the ownership of the mineral rights. 2. New York Gift Deed of Mineral Interest with No Warranty for Family Trust: This type of deed is used when the mineral rights are owned by a family trust and the trustee wishes to transfer those rights as a gift. The grantee can be an individual, another family trust, or any other organization. Similarly, the granter does not provide any warranty or guarantee of the title, making the recipient responsible for any potential legal issues that may arise in the future. It is important to note that a New York Gift Deed of Mineral Interest with No Warranty should be executed and recorded as per the regulations set by the New York State law. Due to the complexities involved in mineral rights transactions, it is highly recommended consulting with a qualified real estate attorney before preparing or executing such a deed to ensure compliance with all legal requirements and to protect the interests of both parties involved.

New York Gift Deed of Mineral Interest with No Warranty

Description

How to fill out New York Gift Deed Of Mineral Interest With No Warranty?

If you have to comprehensive, acquire, or produce legitimate file web templates, use US Legal Forms, the biggest variety of legitimate forms, that can be found on-line. Use the site`s simple and easy hassle-free look for to find the files you will need. Various web templates for company and specific reasons are categorized by classes and states, or keywords. Use US Legal Forms to find the New York Gift Deed of Mineral Interest with No Warranty in a number of clicks.

If you are presently a US Legal Forms client, log in to your profile and click the Obtain key to get the New York Gift Deed of Mineral Interest with No Warranty. You can also accessibility forms you formerly delivered electronically inside the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions listed below:

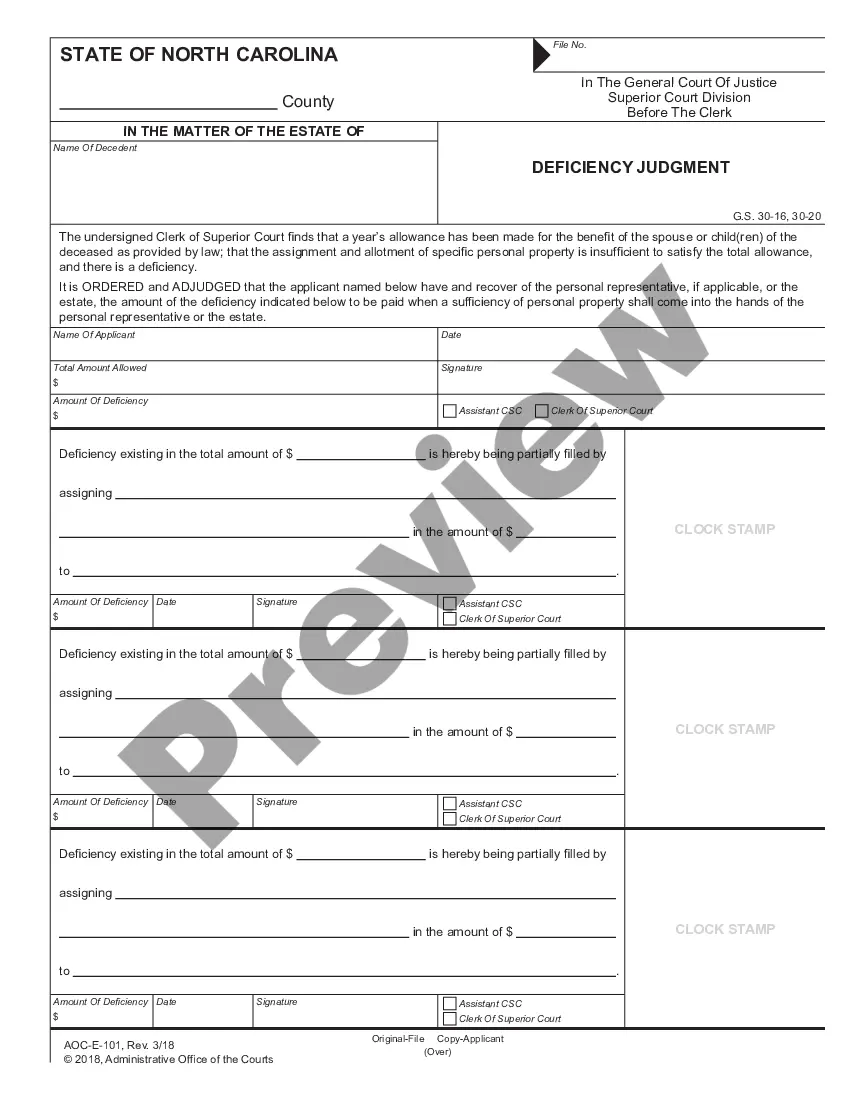

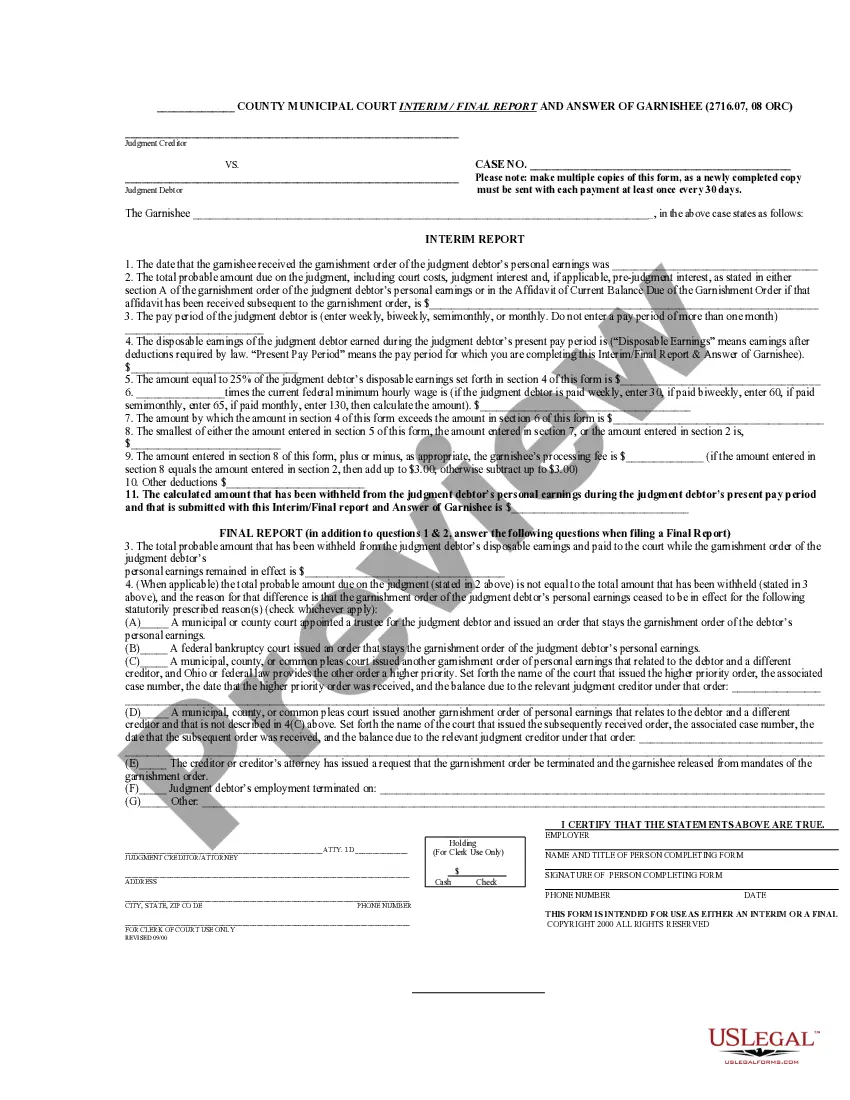

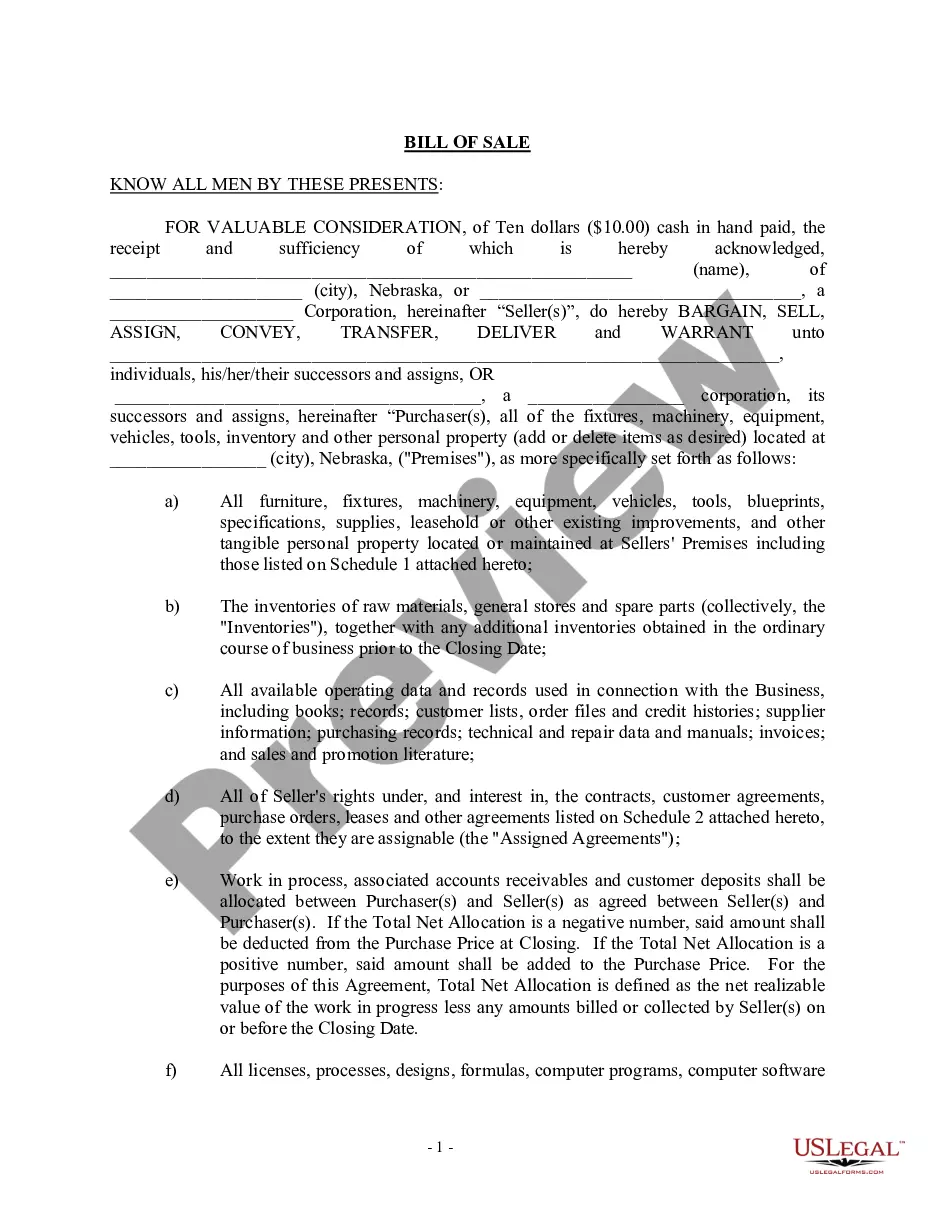

- Step 1. Be sure you have selected the shape for that proper city/land.

- Step 2. Make use of the Preview method to check out the form`s content material. Never neglect to learn the information.

- Step 3. If you are unsatisfied using the develop, make use of the Search industry on top of the display to find other models from the legitimate develop template.

- Step 4. Upon having located the shape you will need, select the Purchase now key. Choose the prices prepare you choose and include your references to sign up to have an profile.

- Step 5. Process the purchase. You should use your credit card or PayPal profile to complete the purchase.

- Step 6. Choose the format from the legitimate develop and acquire it on your own system.

- Step 7. Full, modify and produce or signal the New York Gift Deed of Mineral Interest with No Warranty.

Each and every legitimate file template you buy is your own eternally. You have acces to each and every develop you delivered electronically within your acccount. Click the My Forms portion and choose a develop to produce or acquire once again.

Be competitive and acquire, and produce the New York Gift Deed of Mineral Interest with No Warranty with US Legal Forms. There are thousands of specialist and status-certain forms you may use for your company or specific requires.

Form popularity

FAQ

Yes. Most people instruct a solicitor who can incorporate the deed of gift into the transfer of equity process. Although you can do it yourself, the process can get complicated. There could be tax implications if you make an error.

The real property transfer report (RP-5217) fee is $125.00 for residential or farm properties. The real property transfer report (RP-5217) fee is $250.00 for commercial properties. The transfer tax affidavit (TP-584) fee is $5.00 or $10.00, depending on the county.

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. File the completed deed in the land records at the local recording office.

Under New York Tax Law, the NYS transfer tax is imposed on each transfer when the consideration (usually the purchase price) is greater than $500. But by its very nature, a gift does not include the exchange of consideration (because no money exchanges hands) and thus no transfer tax is required to be paid.

A New York general warranty deed, also known as a ?deed with full covenants,? is a document used to transfer the ownership of real estate. The deed provides a warranty from the seller (grantor) that the title is clean, and that if any unforeseen claims to it arise, the seller will defend the buyer.

In New York State, a quitclaim deed is often the easiest and quickest way to convey the property, but it's not necessarily the best. This type of deed is often used to convey property between family members as a gift, as a result of divorce, or to place the real property into a trust.

A Deed of Gift is a great way to formalise an intention to gift money or assets to someone. A Deed of Gift is particularly effective for recording a gift from parents to children for the purpose of purchasing a home.

New York Estate and Gift Taxes This threshold is called the exclusion, and in 2021, it stands at $5.93 million. The rate of this tax is a graduated rate that starts at 3.06 percent, and it maxes out at 16 percent. You can potentially give gifts to avoid the New York estate tax because there is no gift tax.