New York Surface Lease (to Store Materials) is a legally binding agreement that grants an individual or a company the right to use a designated portion of land in New York for the purpose of storing materials. This lease is specifically designed to cater to businesses or individuals who require additional space to store their goods, equipment, or any other materials necessary for their operations. The New York Surface Lease (to Store Materials) offers a practical solution for businesses that may not have sufficient storage capacity on their own premises. By leasing a designated area, they can conveniently store their materials in proximity to their business operations, allowing for easy access and efficient management. Key Features and Benefits: 1. Size and Location: The lease identifies the specific size and location of the surface area available for storage, ensuring that it meets the leaseholder's requirements. This ensures that businesses can adequately manage their storage needs without worrying about space limitations. 2. Duration: The lease agreement specifies the duration of the lease, ensuring clarity regarding the agreed-upon time frame that the lessee can utilize the storage space. This allows businesses to plan their storage needs in advance and make necessary arrangements accordingly. 3. Terms and Conditions: The lease includes comprehensive terms and conditions that both parties must adhere to, ensuring a legally binding agreement that protects the rights and obligations of both the lessor and the lessee. This ensures that all parties understand their responsibilities and can avoid any potential disputes or misunderstandings. 4. Security Measures: To protect the stored materials, the lease may require the lessee to implement specific security measures such as surveillance systems, access controls, or other reasonable precautions. These measures provide peace of mind, assuring the lessee that their goods are stored securely. Types of New York Surface Lease (to Store Materials): 1. Commercial Surface Lease: This type of lease is specifically designed for businesses operating in commercial sectors such as retail, manufacturing, or logistics. It allows businesses to temporarily store materials in a designated area within the same locality. 2. Industrial Surface Lease: Industrial businesses, such as factories or production facilities, may require additional storage space to store raw materials, equipment, or finished goods. The Industrial Surface Lease provides them with the necessary space to fulfill their storage needs. 3. Construction Surface Lease: Construction companies often need extra space to store construction materials, machinery, and equipment during the course of a project. This lease allows them temporary access to designated land for construction material storage purposes until the project's completion. In summary, New York Surface Lease (to Store Materials) is a flexible solution for businesses or individuals requiring additional space to store their materials. It offers a range of benefits such as size and location flexibility, clear duration, comprehensive terms and conditions, and security measures. Different types of surface leases cater to specific industries like commercial, industrial, or construction, providing tailored solutions to meet varying storage needs.

New York Surface Lease (to Store Materials)

Description

How to fill out New York Surface Lease (to Store Materials)?

Discovering the right legitimate document design could be a struggle. Obviously, there are plenty of web templates available on the net, but how do you find the legitimate develop you want? Take advantage of the US Legal Forms web site. The support delivers a large number of web templates, for example the New York Surface Lease (to Store Materials), that you can use for company and private demands. Each of the types are inspected by pros and meet up with federal and state requirements.

In case you are already authorized, log in in your accounts and then click the Obtain switch to get the New York Surface Lease (to Store Materials). Make use of your accounts to look from the legitimate types you may have purchased previously. Proceed to the My Forms tab of your accounts and obtain an additional version of the document you want.

In case you are a new consumer of US Legal Forms, listed here are simple guidelines that you can stick to:

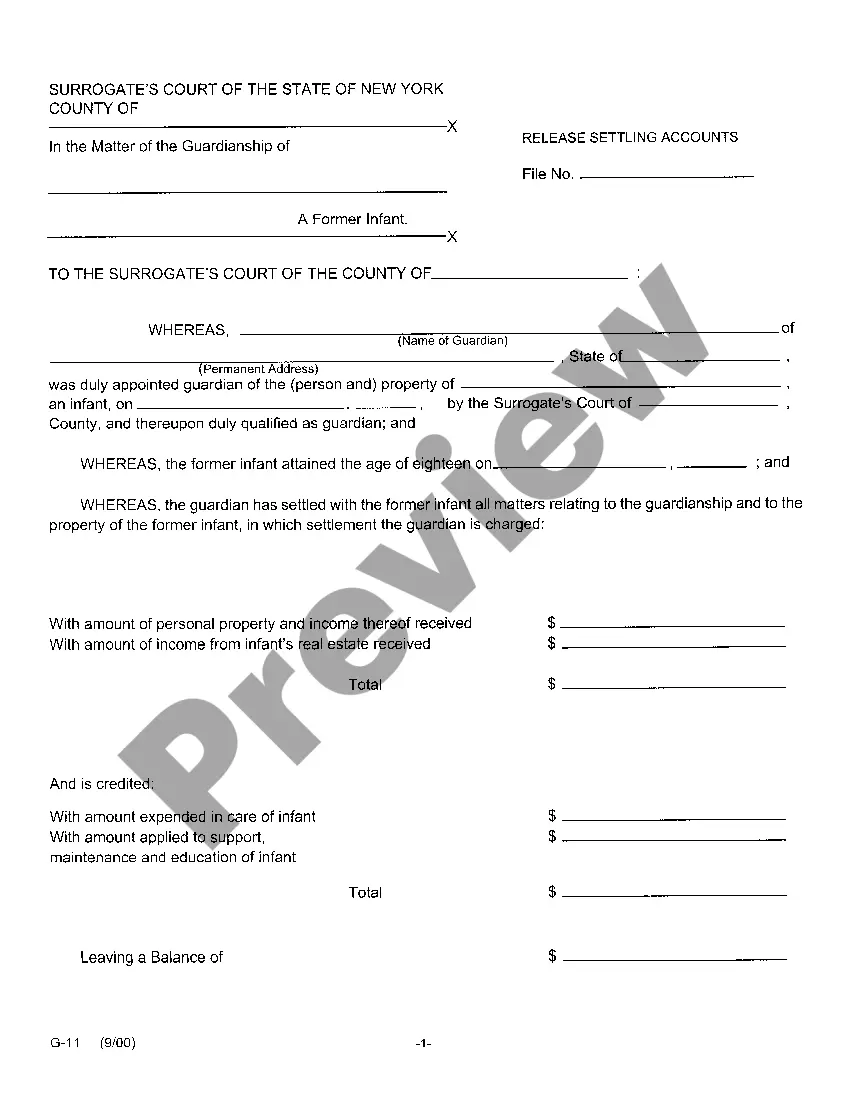

- Initial, be sure you have chosen the correct develop for your area/state. You are able to look through the shape using the Preview switch and study the shape information to make certain it will be the right one for you.

- If the develop fails to meet up with your requirements, utilize the Seach industry to obtain the proper develop.

- When you are sure that the shape is suitable, go through the Acquire now switch to get the develop.

- Opt for the rates program you desire and enter in the necessary information. Design your accounts and purchase your order with your PayPal accounts or bank card.

- Choose the document structure and down load the legitimate document design in your product.

- Full, modify and produce and signal the acquired New York Surface Lease (to Store Materials).

US Legal Forms may be the biggest library of legitimate types in which you can find numerous document web templates. Take advantage of the service to down load professionally-made paperwork that stick to condition requirements.

Form popularity

FAQ

To report any New York additions and subtractions to federal adjusted gross income that do not have their own line on your return, complete Form IT-225 and submit it with your return.

If you are filing an amended return for any purpose, mark an X in the Amended return box on page 1 of the return. If you file an amended federal return, you must file an amended New York State return within 90 days thereafter. You must file using the correct year's return for the tax year being amended. Instructions for Form CT-3 - Tax.NY.gov ny.gov ? pdf ? current_forms ? ct ny.gov ? pdf ? current_forms ? ct

Purchases and billing Generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible personal property you purchase (see Tax-exempt customers, below).

No additional extension of time to file Form CT-3-S or Form CT-4-S will be granted beyond six months. Mail returns to: NYS Corporation Tax, Processing Unit, PO Box 1909, Albany NY 12201-1909. If you use a delivery service other than the U.S. Postal Service, see Private delivery services below. Instructions for Forms CT-3-S, CT-4-S, and CT-3-S-ATT zillionforms.com ? ... zillionforms.com ? ... PDF

Form CT-3-M, General Business Corporation Metropolitan Transportation Authority Surcharge Return, must be filed by any corporation taxable under Article 9-A that does business, employs capital, owns or leases property, maintains an office, or derives receipts from activity, in the Metropolitan Commuter Transportation ... Instructions for Form CT-3 - Tax.NY.gov ny.gov ? forms ? current-forms ? ct ny.gov ? forms ? current-forms ? ct

S CORPORATIONS An S corporation is subject to the General Cor- poration Tax (GCT) and must file either Form NYC-4S, NYC-4S-EZ or NYC-3L, whichever is applicable. Under certain limited circum- stances, an S corporation may be permitted or required to file a combined return (Form NYC- 3A).

Department of Taxation and Finance. New York S Corporation Franchise Tax Return.