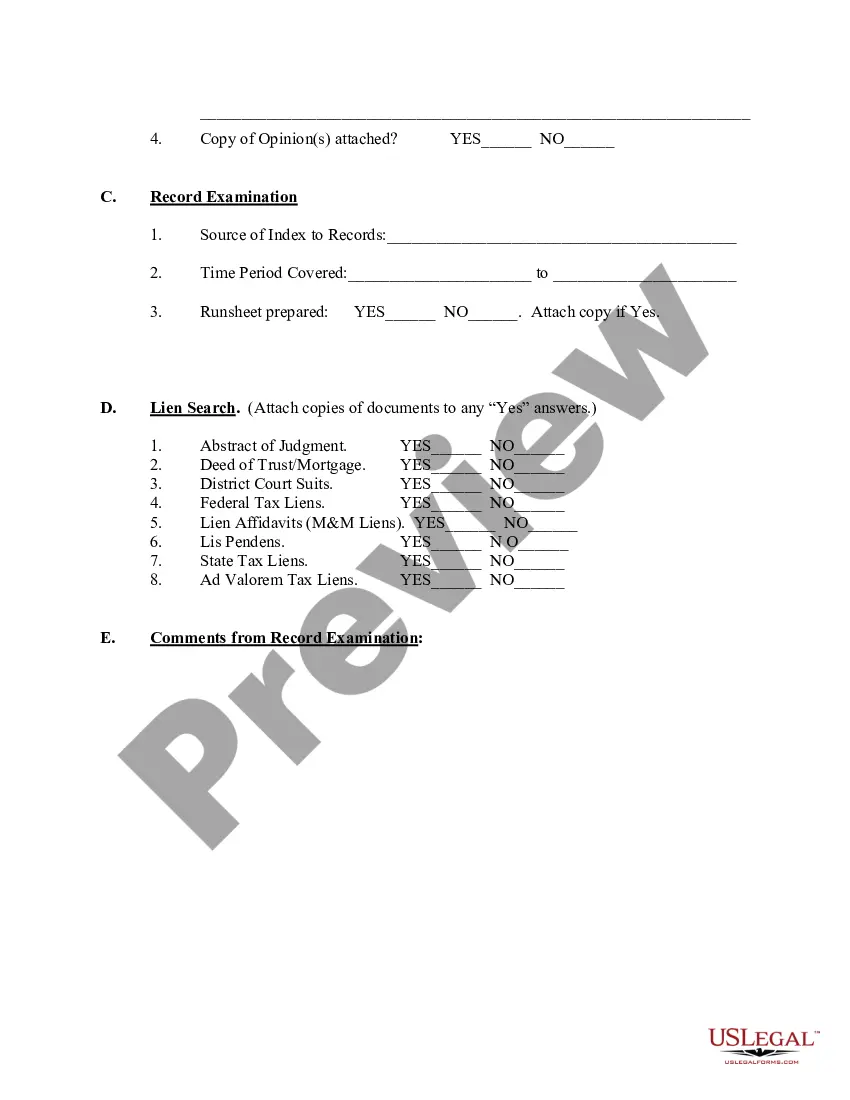

New York Due Diligence Field Review and Checklist is a comprehensive process used to evaluate and examine various aspects of a property or project in the state of New York. It involves conducting a thorough investigation to assess the current condition, potential risks, and compliance with legal requirements related to real estate transactions or development projects. The New York Due Diligence Field Review and Checklist typically encompass a range of factors, such as: 1. Physical Inspection: This involves examining the property in person, assessing its structural integrity, identifying any necessary repairs or upgrades, and evaluating its overall condition. 2. Environmental Considerations: This aspect focuses on identifying potential environmental risks such as soil contamination, water pollution, hazardous materials, or other environmental liabilities surrounding the property. 3. Legal and Regulatory Compliance: The due diligence process ensures compliance with relevant zoning laws, building codes, permits, licenses, and regulations from local, state, and federal authorities. 4. Financial Analysis: A financial assessment includes analyzing revenue streams, occupancy rates, market trends, rental agreements, and evaluating the potential return on investment (ROI). 5. Title Search and Ownership Verification: This entails conducting a thorough search of public records to verify the property's ownership, liabilities, encumbrances, and any legal disputes or judgments. 6. Market Analysis: Evaluating the property's market value, comparable sales, and identifying potential risks or opportunities related to current market conditions. 7. Tenant and Lease Analysis: This involves reviewing lease agreements, rental income, tenant profiles, lease terms, and assessing any pending legal disputes or outstanding obligations. 8. Insurance Coverage and Risk Assessment: Identifying necessary insurance coverage and evaluating potential risks associated with the property, including its location, natural disasters, or other potential liabilities. Different types of New York Due Diligence Field Reviews and Checklists may exist, tailored to specific properties or project types. Examples include: 1. Residential Due Diligence: Focusing on single-family homes, condominiums, cooperative apartments, or multi-unit residential buildings. 2. Commercial Due Diligence: Suitable for offices, retail spaces, industrial properties, or mixed-use developments. 3. Land Development Due Diligence: Emphasizing evaluation of vacant land or properties intended for development, assessing feasibility, zoning restrictions, and potential risks. 4. Real Estate Acquisition Due Diligence: Conducted when purchasing an existing property, evaluating financial viability, physical conditions, legal compliance, and potential liabilities. In conclusion, the New York Due Diligence Field Review and Checklist is a crucial process for assessing the various aspects of a property or project within the state. It ensures thorough evaluation of physical, legal, financial, and market factors, thereby mitigating risks and enabling informed decision-making for real estate transactions or development endeavors.

New York Due Diligence Field Review and Checklist

Description

How to fill out New York Due Diligence Field Review And Checklist?

If you want to full, obtain, or print lawful papers templates, use US Legal Forms, the largest assortment of lawful forms, that can be found on the Internet. Use the site`s simple and handy search to obtain the documents you will need. A variety of templates for business and personal uses are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the New York Due Diligence Field Review and Checklist with a number of click throughs.

Should you be presently a US Legal Forms customer, log in to the bank account and click on the Download switch to obtain the New York Due Diligence Field Review and Checklist. You can even access forms you in the past delivered electronically inside the My Forms tab of your bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the appropriate town/country.

- Step 2. Use the Preview solution to look over the form`s content material. Do not forget to read the information.

- Step 3. Should you be not happy using the form, take advantage of the Research industry on top of the display to discover other versions of the lawful form design.

- Step 4. When you have identified the shape you will need, go through the Purchase now switch. Choose the costs program you choose and put your references to sign up for an bank account.

- Step 5. Method the purchase. You can utilize your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Choose the structure of the lawful form and obtain it on the product.

- Step 7. Total, change and print or indicator the New York Due Diligence Field Review and Checklist.

Each and every lawful papers design you buy is yours forever. You may have acces to every single form you delivered electronically in your acccount. Click the My Forms section and pick a form to print or obtain once more.

Remain competitive and obtain, and print the New York Due Diligence Field Review and Checklist with US Legal Forms. There are many specialist and express-certain forms you can use for the business or personal needs.