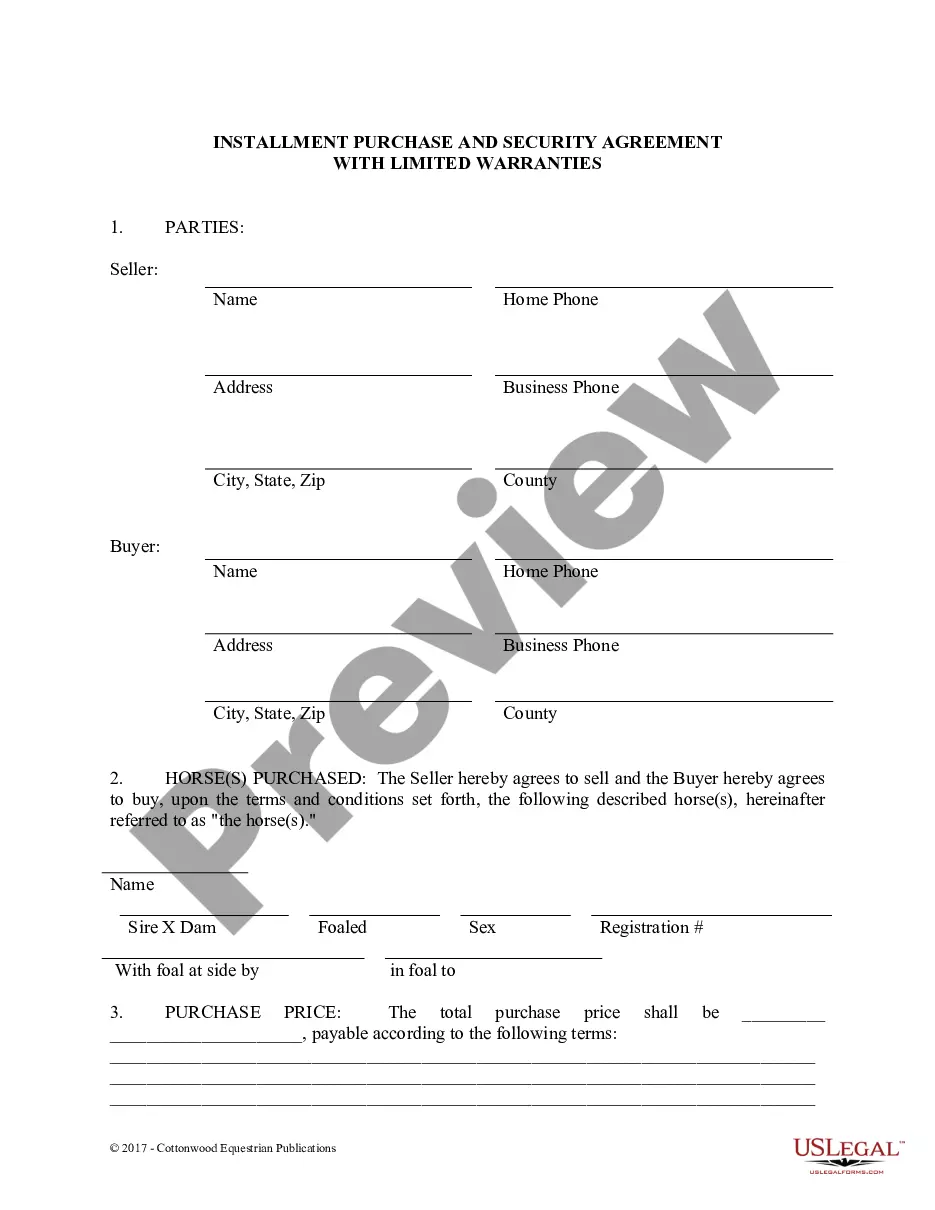

New York Letter in Lieu of Transfer Order Directing Payment to Lender

Description

How to fill out Letter In Lieu Of Transfer Order Directing Payment To Lender?

US Legal Forms - one of several most significant libraries of legal kinds in the States - offers an array of legal document themes you are able to down load or produce. While using website, you may get a large number of kinds for organization and person reasons, categorized by categories, claims, or keywords and phrases.You can find the latest variations of kinds like the New York Letter in Lieu of Transfer Order Directing Payment to Lender in seconds.

If you currently have a monthly subscription, log in and down load New York Letter in Lieu of Transfer Order Directing Payment to Lender in the US Legal Forms catalogue. The Acquire button will show up on every single form you see. You get access to all in the past saved kinds from the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, listed below are simple guidelines to help you began:

- Be sure you have chosen the proper form for the city/region. Click the Review button to analyze the form`s articles. Read the form outline to ensure that you have chosen the correct form.

- In the event the form doesn`t match your specifications, use the Research area towards the top of the screen to discover the one which does.

- When you are happy with the form, validate your decision by clicking the Get now button. Then, opt for the pricing strategy you want and supply your qualifications to register for an account.

- Method the transaction. Utilize your credit card or PayPal account to accomplish the transaction.

- Find the formatting and down load the form on the gadget.

- Make alterations. Fill up, change and produce and indicator the saved New York Letter in Lieu of Transfer Order Directing Payment to Lender.

Each web template you added to your money lacks an expiry date and it is your own property for a long time. So, if you wish to down load or produce another copy, just visit the My Forms section and click in the form you want.

Gain access to the New York Letter in Lieu of Transfer Order Directing Payment to Lender with US Legal Forms, by far the most comprehensive catalogue of legal document themes. Use a large number of skilled and condition-distinct themes that fulfill your organization or person needs and specifications.