New York Correction Assignment to Correct Amount of Interest

Description

How to fill out Correction Assignment To Correct Amount Of Interest?

You may devote hrs on the web searching for the legal record web template which fits the state and federal demands you will need. US Legal Forms gives a large number of legal varieties which can be examined by experts. It is simple to download or produce the New York Correction Assignment to Correct Amount of Interest from the support.

If you already have a US Legal Forms account, you can log in and then click the Obtain button. Next, you can total, edit, produce, or indication the New York Correction Assignment to Correct Amount of Interest. Every legal record web template you buy is your own property eternally. To have one more copy for any obtained develop, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site the very first time, adhere to the straightforward guidelines below:

- Initial, be sure that you have chosen the best record web template for the region/metropolis of your choice. Look at the develop description to make sure you have picked the right develop. If available, make use of the Preview button to look throughout the record web template as well.

- In order to get one more variation in the develop, make use of the Lookup field to discover the web template that meets your requirements and demands.

- Upon having found the web template you want, just click Purchase now to continue.

- Choose the prices plan you want, enter your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal account to purchase the legal develop.

- Choose the structure in the record and download it to your product.

- Make alterations to your record if required. You may total, edit and indication and produce New York Correction Assignment to Correct Amount of Interest.

Obtain and produce a large number of record layouts while using US Legal Forms Internet site, that offers the largest selection of legal varieties. Use skilled and express-particular layouts to tackle your company or specific requirements.

Form popularity

FAQ

The average New York State Department of Corrections and Community Supervision hourly pay ranges from approximately $24 per hour for a Correctional Officer to $25 per hour for a Corrections Officer.

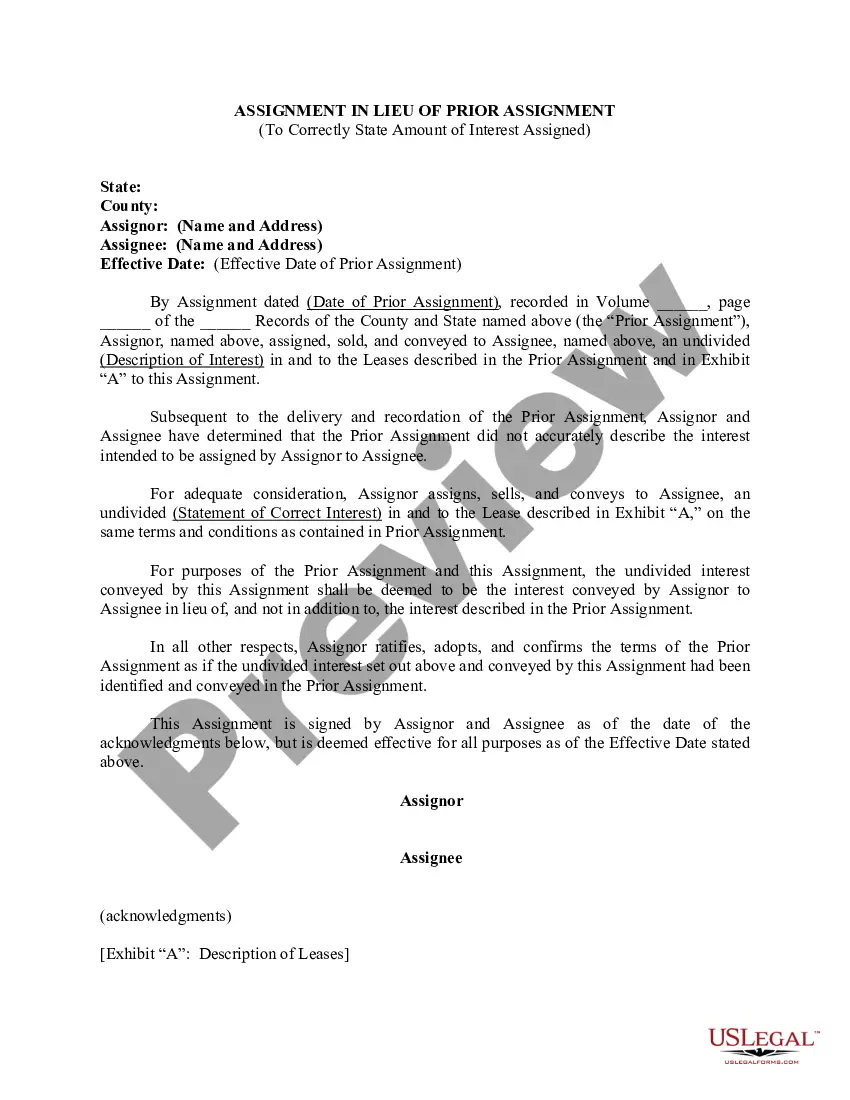

The corrective document needs to include a copy of the original assignment paperwork with the requested changes noted. The party who wishes to convey the interest needs to initial the corrections and date them. A Recordation Form Cover Sheet (form PTO-1595) must accompany the corrective document.

As of , the average annual pay for a Federal Correctional Officer in New York City is $54,549 a year.

As of , the average annual pay for a Correctional Officer Trainee in New York is $70,591 a year. Just in case you need a simple salary calculator, that works out to be approximately $33.94 an hour. This is the equivalent of $1,357/week or $5,882/month.

High Paying Correctional Officer Jobs ADC DCC Advisor. Salary range: $101,000-$103,000 per year. ... Correctional Program Officer. Salary range: $44,000-$90,000 per year. ... Transportation Officer. Salary range: $34,000-$73,500 per year. ... Jail Officer. ... Correctional Security Officer. ... Detention Officer. ... Jailer.

Highest paying cities for Correctional Officers near New York State Buffalo, NY. $35.00 per hour. 5 salaries reported. Albany, NY. $34.60 per hour. 5 salaries reported. Queens, NY. $28.72 per hour. 5 salaries reported. New York, NY. $27.59 per hour. 10 salaries reported. Bronx, NY. $24.95 per hour. ... Show more nearby cities.

At the line (worker bee) level, ranks correspond roughly to military ranks, with the lowest at Correctional Officer (addressed as "Officer" or "C.O."). From there, it would normally go Sergeant, Lieutenant, Captain, and possibly Major, Lieutenant Colonel and Colonel.

The entry-level annual salary of NYC correction officers is $37,579 with regular raises up to $76,488 after five years.