New York Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

How to fill out Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

Are you presently in the placement the place you need papers for both organization or individual purposes almost every day? There are tons of authorized file templates available on the Internet, but getting types you can rely is not easy. US Legal Forms provides a large number of kind templates, such as the New York Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease, which are composed in order to meet federal and state specifications.

Should you be already acquainted with US Legal Forms site and also have a free account, just log in. Next, you are able to acquire the New York Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease web template.

Should you not provide an bank account and need to begin using US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is for the correct town/county.

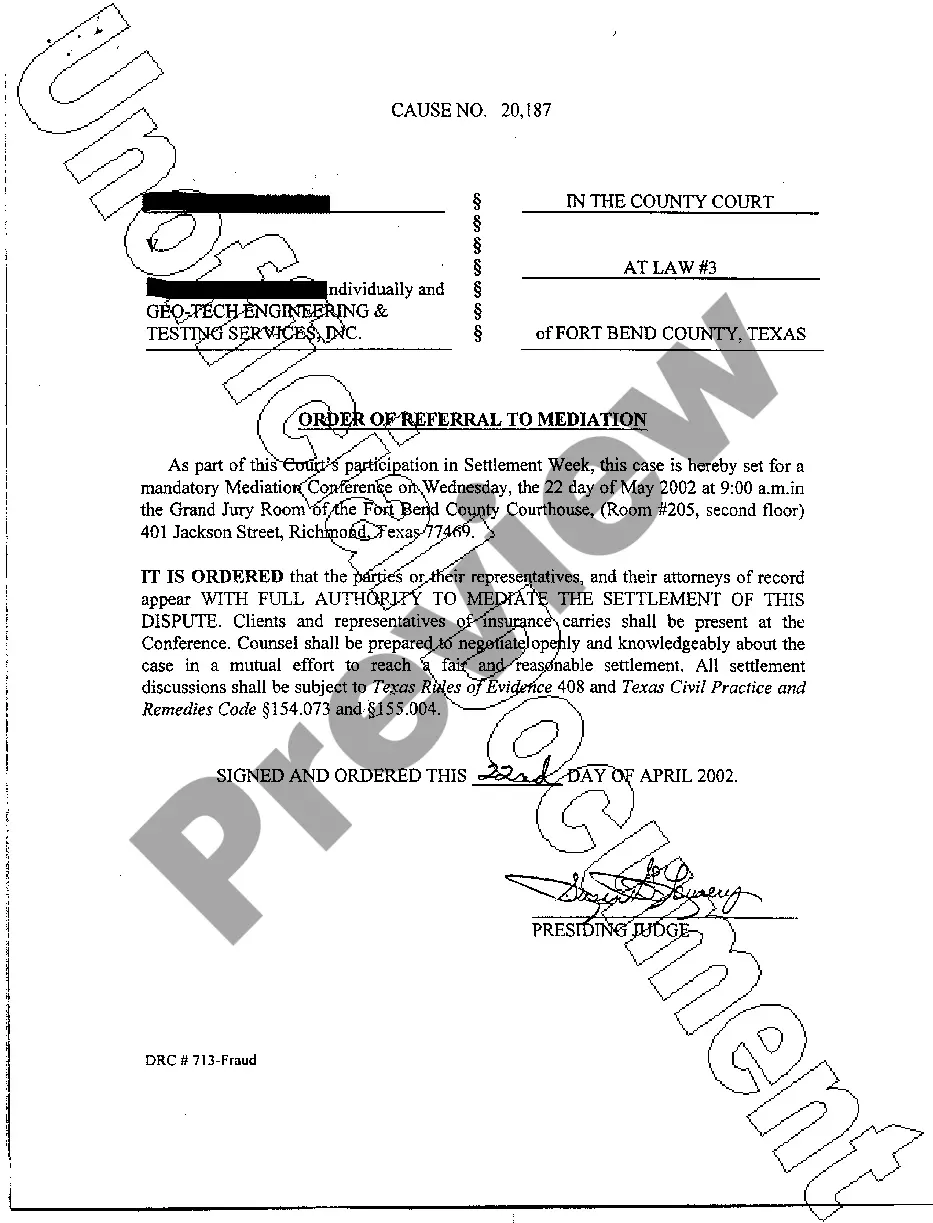

- Take advantage of the Review option to examine the form.

- Browse the description to actually have chosen the correct kind.

- When the kind is not what you`re looking for, take advantage of the Lookup area to find the kind that suits you and specifications.

- If you get the correct kind, simply click Acquire now.

- Select the costs program you want, fill out the specified information and facts to generate your bank account, and pay for your order making use of your PayPal or charge card.

- Select a handy document file format and acquire your copy.

Find each of the file templates you possess purchased in the My Forms menus. You may get a further copy of New York Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease anytime, if required. Just go through the required kind to acquire or print out the file web template.

Use US Legal Forms, by far the most comprehensive selection of authorized varieties, to save lots of time and prevent mistakes. The support provides appropriately created authorized file templates that can be used for a range of purposes. Produce a free account on US Legal Forms and begin creating your life a little easier.