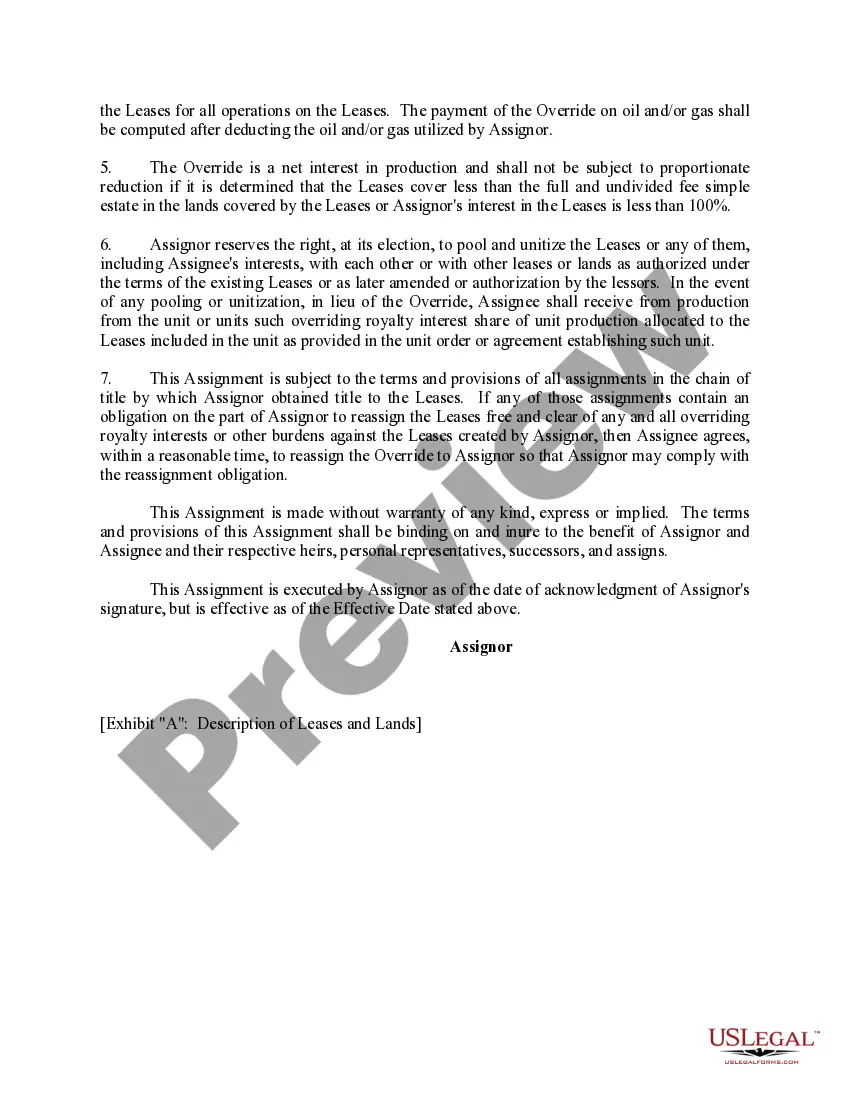

A New York Assignment of Overriding Royalty Interest (No Proportionate Reduction) is a legal document used in the oil and gas industry to transfer the rights to receive overriding royalty interest from one party to another, specifically in the state of New York. An overriding royalty interest is a share of the proceeds from an oil or gas well, typically a percentage, that is granted to a party who does not own the mineral rights to the property but is entitled to a portion of the revenue generated from the production of oil or gas. This interest is often granted to individuals or entities, such as landowners, who retain a share of the profits even after selling the mineral rights to a separate party. The New York Assignment of Overriding Royalty Interest (No Proportionate Reduction) allows for the complete transfer of these rights without any reduction in the percentage or share of the royalties owed. This means that the assignee (the party receiving the overriding royalty interest) will be entitled to the full amount of royalties specified in the agreement, regardless of any subsequent changes in production or ownership of the mineral rights. It's important to note that there may be different versions or variations of the New York Assignment of Overriding Royalty Interest (No Proportionate Reduction) to address specific terms or conditions agreed upon by the parties involved. These variations could include agreements that outline specific circumstances under which the overriding royalty interest may be terminated, modified, or assigned further. Keywords: New York, Assignment, Overriding Royalty Interest, No Proportionate Reduction, oil and gas industry, transfer, rights, revenue, mineral rights, share, royalties, production, agreement, assignee, variation, circumstances, termination, modification.

New York Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out New York Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

If you need to full, down load, or printing legal document layouts, use US Legal Forms, the largest variety of legal varieties, that can be found online. Use the site`s basic and practical search to discover the files you require. Various layouts for business and personal reasons are categorized by groups and states, or keywords. Use US Legal Forms to discover the New York Assignment of Overriding Royalty Interest (No Proportionate Reduction) in a few clicks.

If you are previously a US Legal Forms client, log in to your account and click on the Obtain option to find the New York Assignment of Overriding Royalty Interest (No Proportionate Reduction). Also you can entry varieties you earlier saved inside the My Forms tab of your own account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the appropriate metropolis/country.

- Step 2. Take advantage of the Review method to look over the form`s information. Never forget about to read the description.

- Step 3. If you are not happy together with the kind, take advantage of the Look for industry on top of the screen to locate other models from the legal kind web template.

- Step 4. Once you have found the form you require, click the Buy now option. Pick the costs plan you like and include your references to sign up on an account.

- Step 5. Method the deal. You can utilize your bank card or PayPal account to complete the deal.

- Step 6. Select the structure from the legal kind and down load it on the product.

- Step 7. Complete, change and printing or indication the New York Assignment of Overriding Royalty Interest (No Proportionate Reduction).

Each and every legal document web template you acquire is the one you have forever. You have acces to each and every kind you saved within your acccount. Go through the My Forms segment and choose a kind to printing or down load again.

Remain competitive and down load, and printing the New York Assignment of Overriding Royalty Interest (No Proportionate Reduction) with US Legal Forms. There are millions of specialist and state-distinct varieties you can use for your business or personal needs.

Form popularity

FAQ

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.