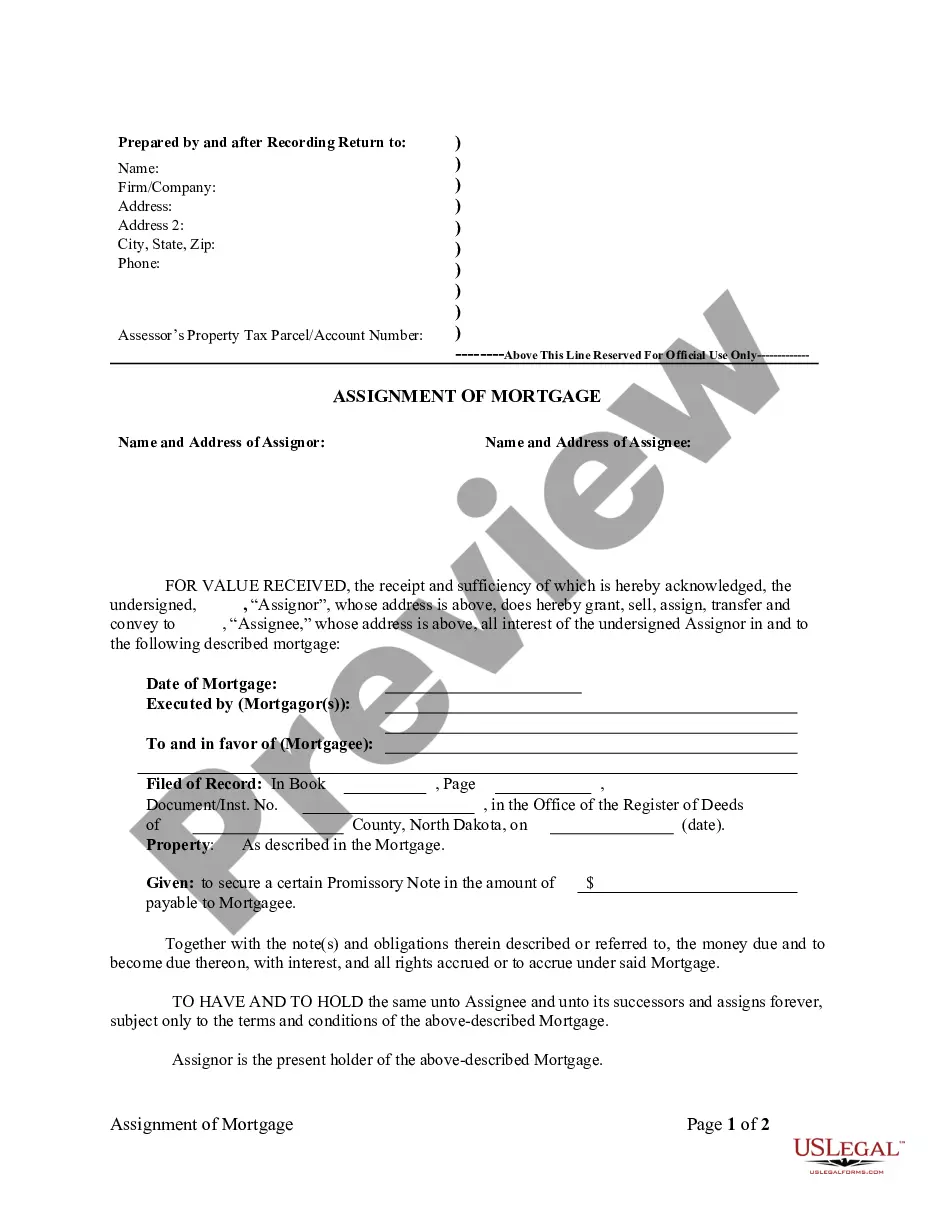

This office lease states the conditions of the annual rental rate currently specified to be paid by the tenant (the "Base Rent"). This shall be used as a basis to calculate additional rent as of the times and in the manner set forth in this form to be paid by the tenant.

New York Consumer Price Index

Description

How to fill out Consumer Price Index?

Choosing the best legal papers template might be a struggle. Needless to say, there are tons of layouts accessible on the Internet, but how can you obtain the legal kind you want? Use the US Legal Forms web site. The service provides a large number of layouts, for example the New York Consumer Price Index, which you can use for company and personal requires. Each of the forms are examined by specialists and fulfill federal and state requirements.

Should you be already registered, log in for your profile and click the Download option to obtain the New York Consumer Price Index. Make use of profile to appear through the legal forms you may have ordered in the past. Proceed to the My Forms tab of the profile and obtain yet another backup from the papers you want.

Should you be a whole new customer of US Legal Forms, listed below are straightforward recommendations for you to follow:

- Initially, make certain you have selected the right kind to your metropolis/area. You can look through the form making use of the Preview option and read the form information to ensure this is basically the right one for you.

- If the kind does not fulfill your preferences, use the Seach discipline to get the appropriate kind.

- Once you are positive that the form is proper, click on the Acquire now option to obtain the kind.

- Opt for the prices strategy you need and enter the needed details. Design your profile and pay money for the transaction utilizing your PayPal profile or Visa or Mastercard.

- Choose the data file formatting and obtain the legal papers template for your system.

- Comprehensive, change and print and indication the received New York Consumer Price Index.

US Legal Forms is the most significant library of legal forms where you can discover various papers layouts. Use the service to obtain appropriately-manufactured paperwork that follow status requirements.

Form popularity

FAQ

Basic Info. US Consumer Price Index is at a current level of 307.48, up from 306.27 last month and up from 296.54 one year ago. This is a change of 0.40% from last month and 3.69% from one year ago.

Basic Info. New York-Newark-Jersey City, NY-NJ-PA Consumer Price Index is at a current level of 325.61, up from 324.38 last month and up from 313.88 one year ago. This is a change of 0.38% from last month and 3.74% from one year ago.

Consumer Price Index, Los Angeles area ? September 2023 MonthAll itemsAll items less food and energyDec 20224.94.5Jan 20235.84.5Feb 20235.14.5Mar 20233.74.333 more rows

Not seasonally adjusted CPI measures The Consumer Price Index for All Urban Consumers (CPI-U) increased 3.7 percent over the last 12 months to an index level of 307.789 (1982-84=100). For the month, the index increased 0.2 percent prior to seasonal adjustment.

CPI Inflation Report Hits And Misses The core CPI, which strips out volatile food and energy prices, rose 0.2% vs. September levels, trailing 0.3% estimates. The annual core inflation rate ticked down to 4% vs. forecasts of 4.1%. The core CPI inflation rate peaked at a 40-year-high 6.6% in September 2022.

Harvard. Australian Bureau of Statistics 2023, Monthly CPI indicator rose 5.2% annually to August 2023, ABS, viewed 12 November 2023, < >.

The Consumer Prices Index (CPI) rose by 4.6% in the 12 months to October 2023, down from 6.7% in September.