This office lease clause lists a way to provide for variances between the rentable area of a "to be built" demised premises and the actual area after construction.

New York Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built

Description

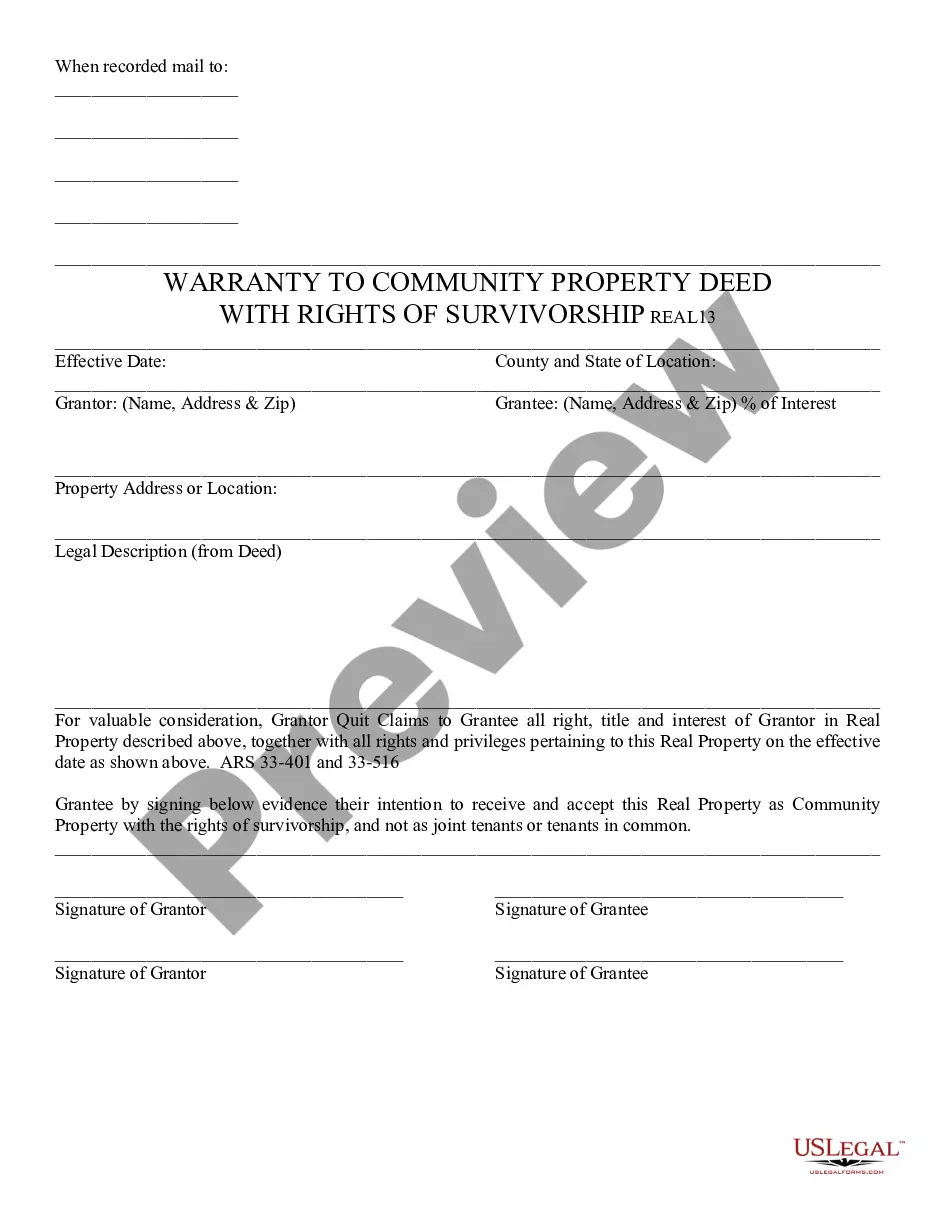

How to fill out Remeasurement Clause Used When Variances Exist Between The Rentable And Actual Area Of A Space To Be Built?

Have you been in the position that you will need documents for sometimes enterprise or personal reasons virtually every day time? There are plenty of authorized document web templates accessible on the Internet, but locating kinds you can trust is not effortless. US Legal Forms offers 1000s of form web templates, just like the New York Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built, that are published to fulfill federal and state demands.

In case you are previously knowledgeable about US Legal Forms website and possess a merchant account, merely log in. After that, you are able to download the New York Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built format.

If you do not provide an account and would like to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is to the appropriate area/county.

- Make use of the Review key to analyze the form.

- See the outline to ensure that you have selected the appropriate form.

- If the form is not what you`re trying to find, utilize the Lookup area to discover the form that meets your needs and demands.

- When you get the appropriate form, simply click Get now.

- Pick the costs strategy you want, fill in the desired information to generate your money, and pay money for your order using your PayPal or credit card.

- Decide on a handy file format and download your version.

Get each of the document web templates you might have purchased in the My Forms menu. You can aquire a extra version of New York Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built at any time, if required. Just select the required form to download or printing the document format.

Use US Legal Forms, one of the most comprehensive assortment of authorized varieties, to save some time and avoid errors. The support offers appropriately created authorized document web templates which you can use for a selection of reasons. Generate a merchant account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

A Standard Clause defining the leased premises for a commercial real estate lease with language allowing the parties to remeasure the premises. A tenant's right to remeasure is generally a tenant-favorable concept, but this Standard Clause offers a landlord-friendly alternative for remeasurement.

Tenant's Premises . A portion of the first floor of the Building in ance with the floor plan attached hereto as Exhibit E and incorporated herein by reference.

Gross Lease Gross leases are most common for commercial properties such as offices and retail space. The tenant pays a single, flat amount that includes rent, taxes, utilities, and insurance. The landlord is responsible for paying taxes, utilities, and insurance from the rent fees.

Leased Premises means an area forming part of the Property, assigned to the LESSEE for its exclusive use under this Contract, per Lease Schedule.