New York Clauses Relating to Venture Ownership Interests, also known as New York venture ownership clauses, are legal provisions that govern the rights, obligations, and responsibilities of venture owners in the state of New York. These clauses are typically included in the operating agreements or partnership agreements of venture businesses and play a crucial role in determining how ownership interests are allocated and managed. There are various types of New York Clauses Relating to Venture Ownership Interests, each addressing different aspects of venture ownership. Some key types include: 1. Ownership Percentage Clause: This clause outlines the percentage of ownership that each venture partner or member holds in the business. It establishes the initial ownership distribution and provides a basis for determining future equity allocations. 2. Capital Contribution Clause: This clause specifies the amount of capital or assets that each owner must contribute to the venture. It helps to ensure fair and proportional distribution of financial resources among owners. 3. Vesting Clause: The vesting clause governs the timeframe over which an owner's ownership interest becomes fully vested. It is particularly relevant in situations where owners may earn their ownership stake over time, such as through a vesting schedule or upon meeting specific milestones. 4. Transfer or Assignment Clause: This clause addresses the conditions and restrictions related to the transfer or assignment of ownership interests. It may specify whether owners have the right to sell, assign, or transfer their ownership stake, and if so, whether any approval or consent is required from other owners or the venture itself. 5. Buy-Sell Agreement Clause: A buy-sell agreement clause outlines the provisions for the sale or purchase of ownership interests in certain circumstances, such as the death, disability, retirement, or voluntary withdrawal of an owner. It helps ensure a smooth transition of ownership and may include provisions related to valuation formulas, selling procedures, and funding mechanisms. 6. Drag-along and Tag-along Clause: These clauses regulate the rights of majority owners ("drag-along") and minority owners ("tag-along") in the event of a sale or transfer of the entire venture. A drag-along clause allows majority owners to force minority owners to join in a sale, while a tag-along clause grants minority owners the right to sell their ownership interests along with the majority owners in a given transaction. 7. Dissolution Clause: The dissolution clause addresses the procedures and consequences of terminating the venture, liquidating assets, and distributing ownership interests and proceeds to the owners. It defines the circumstances under which the venture may be dissolved and the process for winding down its affairs. These New York Clauses Relating to Venture Ownership Interests provide a comprehensive framework for governing ownership relationships within ventures. It is crucial for venture owners to have a clear understanding of these clauses and their implications to ensure fair and efficient operation of the business. Seeking legal advice is highly recommended before drafting or entering into any venture agreement.

New York Clauses Relating to Venture Ownership Interests

Description

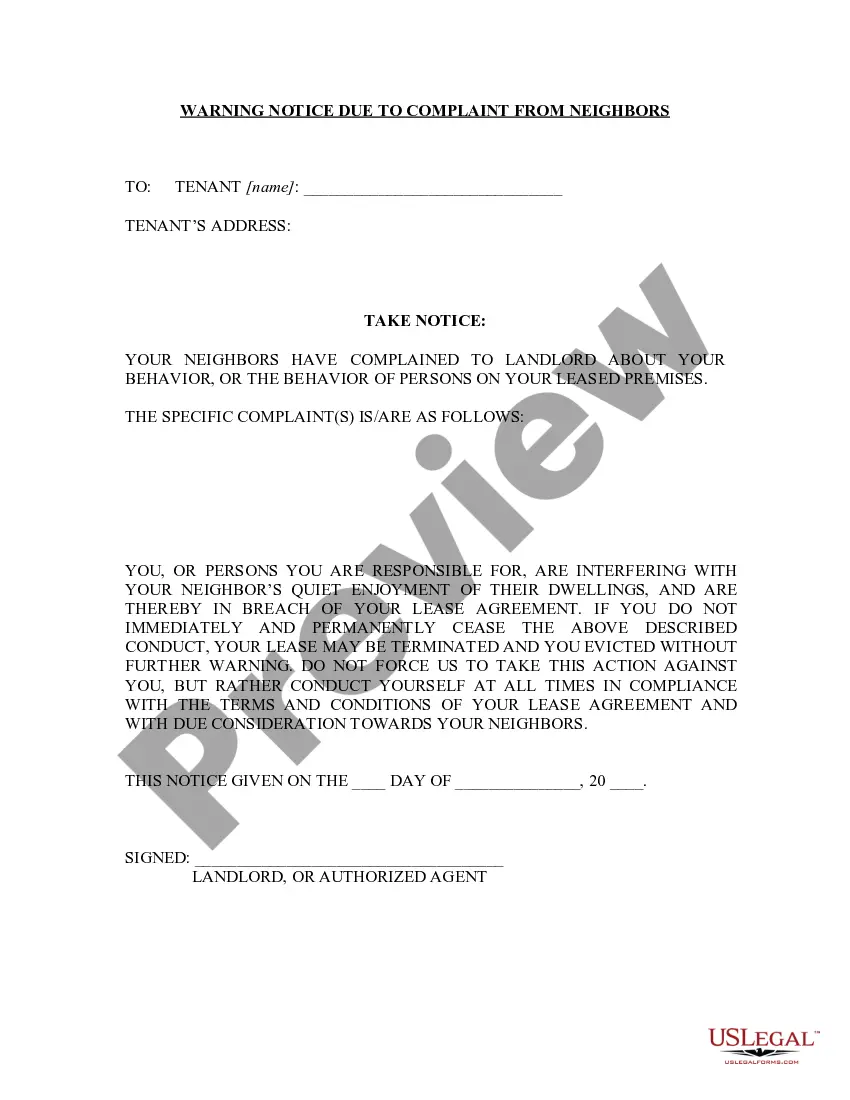

How to fill out New York Clauses Relating To Venture Ownership Interests?

Choosing the right lawful papers template can be a struggle. Obviously, there are a variety of themes available online, but how can you get the lawful form you want? Make use of the US Legal Forms site. The support delivers a large number of themes, for example the New York Clauses Relating to Venture Ownership Interests, that can be used for business and personal demands. All of the types are checked by professionals and fulfill federal and state demands.

Should you be presently registered, log in to the account and click the Download key to find the New York Clauses Relating to Venture Ownership Interests. Use your account to look throughout the lawful types you may have ordered earlier. Visit the My Forms tab of your respective account and get one more duplicate of the papers you want.

Should you be a fresh consumer of US Legal Forms, allow me to share easy instructions that you can adhere to:

- Initial, be sure you have selected the correct form for your personal metropolis/county. You may look through the form utilizing the Review key and browse the form explanation to ensure it will be the right one for you.

- In case the form will not fulfill your needs, make use of the Seach industry to obtain the appropriate form.

- Once you are certain that the form is proper, click on the Get now key to find the form.

- Pick the costs plan you would like and type in the required details. Make your account and pay money for the order utilizing your PayPal account or charge card.

- Select the submit format and acquire the lawful papers template to the device.

- Full, edit and printing and sign the obtained New York Clauses Relating to Venture Ownership Interests.

US Legal Forms will be the largest local library of lawful types for which you can see different papers themes. Make use of the company to acquire expertly-created documents that adhere to express demands.