New York Clauses Relating to Accounting Matters

Description

How to fill out Clauses Relating To Accounting Matters?

Are you in a placement the place you need to have paperwork for possibly enterprise or specific functions almost every day? There are plenty of lawful record layouts available on the net, but finding kinds you can depend on isn`t easy. US Legal Forms delivers 1000s of type layouts, like the New York Clauses Relating to Accounting Matters, that happen to be composed to fulfill federal and state requirements.

When you are previously acquainted with US Legal Forms internet site and have a free account, just log in. After that, it is possible to download the New York Clauses Relating to Accounting Matters template.

Unless you have an profile and would like to begin using US Legal Forms, follow these steps:

- Find the type you will need and ensure it is for your appropriate area/region.

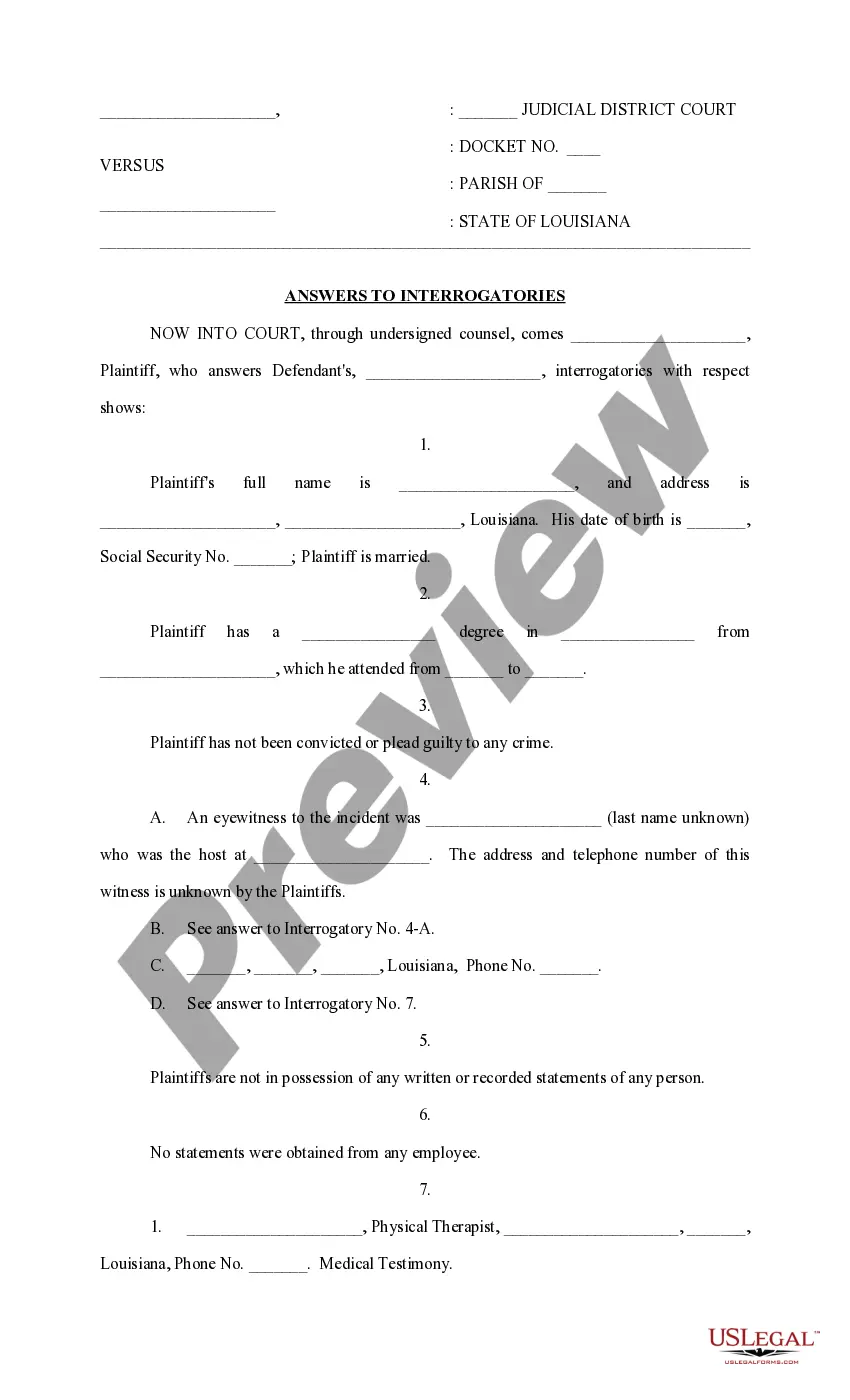

- Utilize the Review button to examine the form.

- Read the explanation to ensure that you have chosen the correct type.

- In the event the type isn`t what you are searching for, utilize the Look for discipline to get the type that fits your needs and requirements.

- When you find the appropriate type, just click Buy now.

- Select the costs plan you need, fill out the necessary details to create your bank account, and pay for the order with your PayPal or bank card.

- Select a practical data file file format and download your version.

Find all the record layouts you possess purchased in the My Forms food list. You can obtain a additional version of New York Clauses Relating to Accounting Matters whenever, if necessary. Just select the needed type to download or print out the record template.

Use US Legal Forms, the most comprehensive variety of lawful forms, to save time and stay away from errors. The services delivers appropriately created lawful record layouts which you can use for a range of functions. Make a free account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

The regulation of professional accountants in the United States is primarily carried out by the state boards of accountancy, which coordinate through the National Association of State Boards of Accountancy, and the Public Company Accounting Oversight Board (PCAOB) for firms auditing public business entities.

Accountants, including Certified Public Accountants (CPAs), must be licensed to practice in New York State. This license is issued by the New York State Department of Education (NYSDOE). Accountants must have a license to use the title CPA.

?In order to be granted an inactive registration status, the New York CPA must complete the Public Accountancy Registration Renewal Addendum Form and submit it to the Board Office at cpabd@nysed.gov .

Email: cpabd@nysed.gov , Phone: 518-474-3817, Press 1 then ext. 160, Fax: 518-474-6375.

What should I do if I have a complaint about an accountant or actuary? You should complain to the accountant (or their firm) or actuary first. If you are unhappy with their response you should complain to their professional body, if they have one.

If you're aware of a tax preparer who has or is engaged in illegal or improper conduct, file a tax preparer complaint. The Tax Department will review your complaint promptly and, where appropriate, take corrective action, which may include sanctions. by phone at 518-530-HELP (select option #2).

An action for an accounting is a suit in equity for a determination of the amount owed to the plaintiff when the amount to which the plaintiff is entitled is uncertain and cannot be calculated based on the information available to the plaintiff.