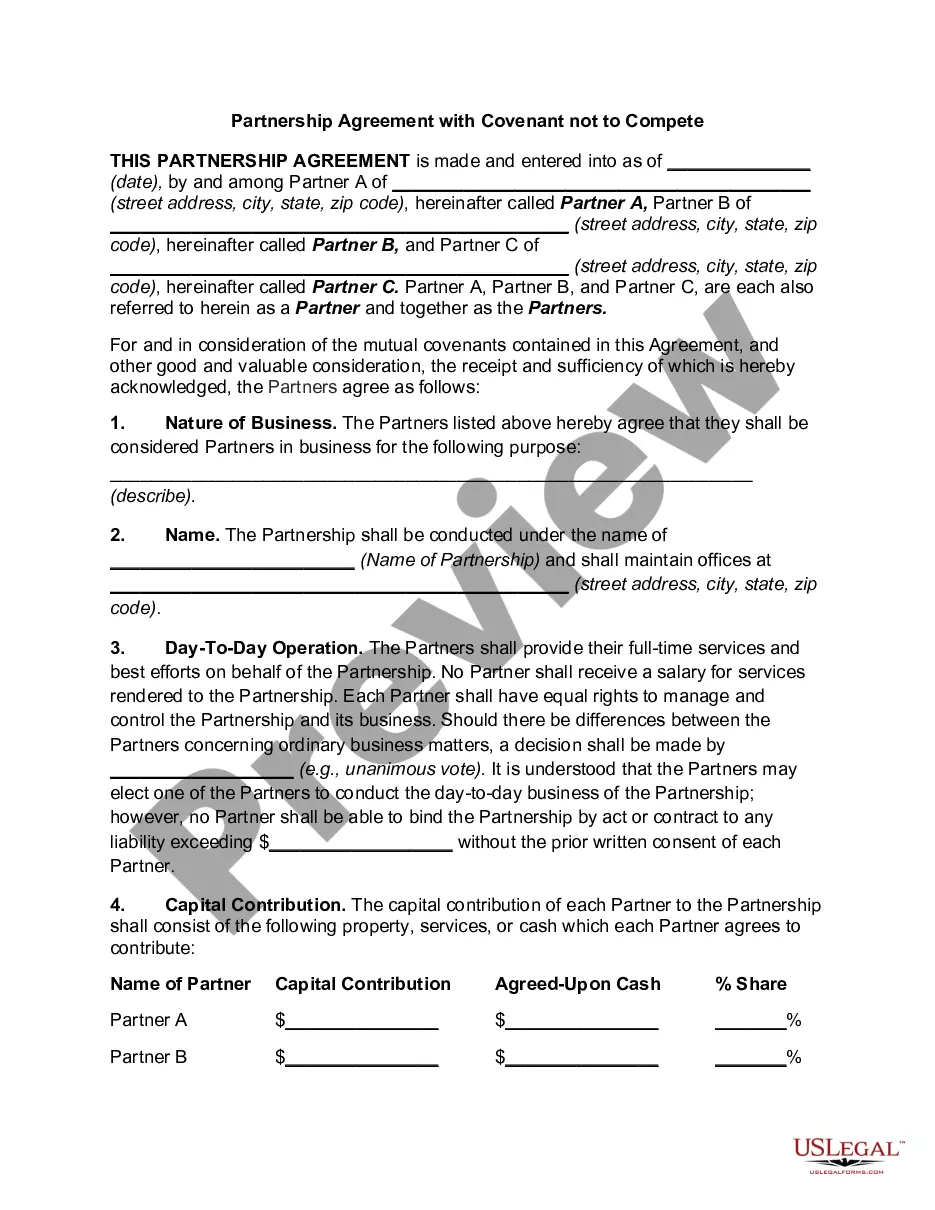

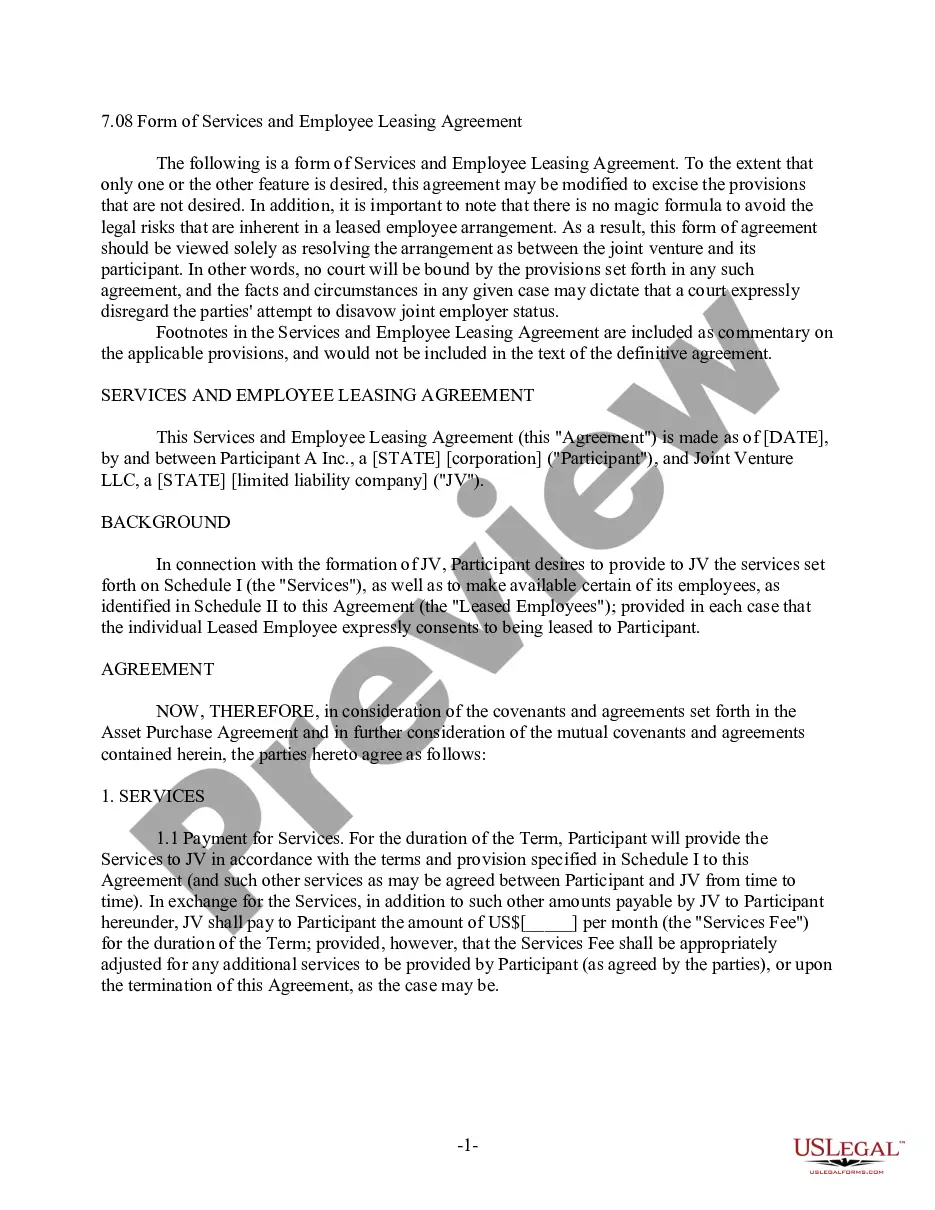

This is an example of an Employee Benefits Covenant for a Joint Venture that leases employees from the parent entities to the joint venture.

New York Employee Benefits Covenant

Description

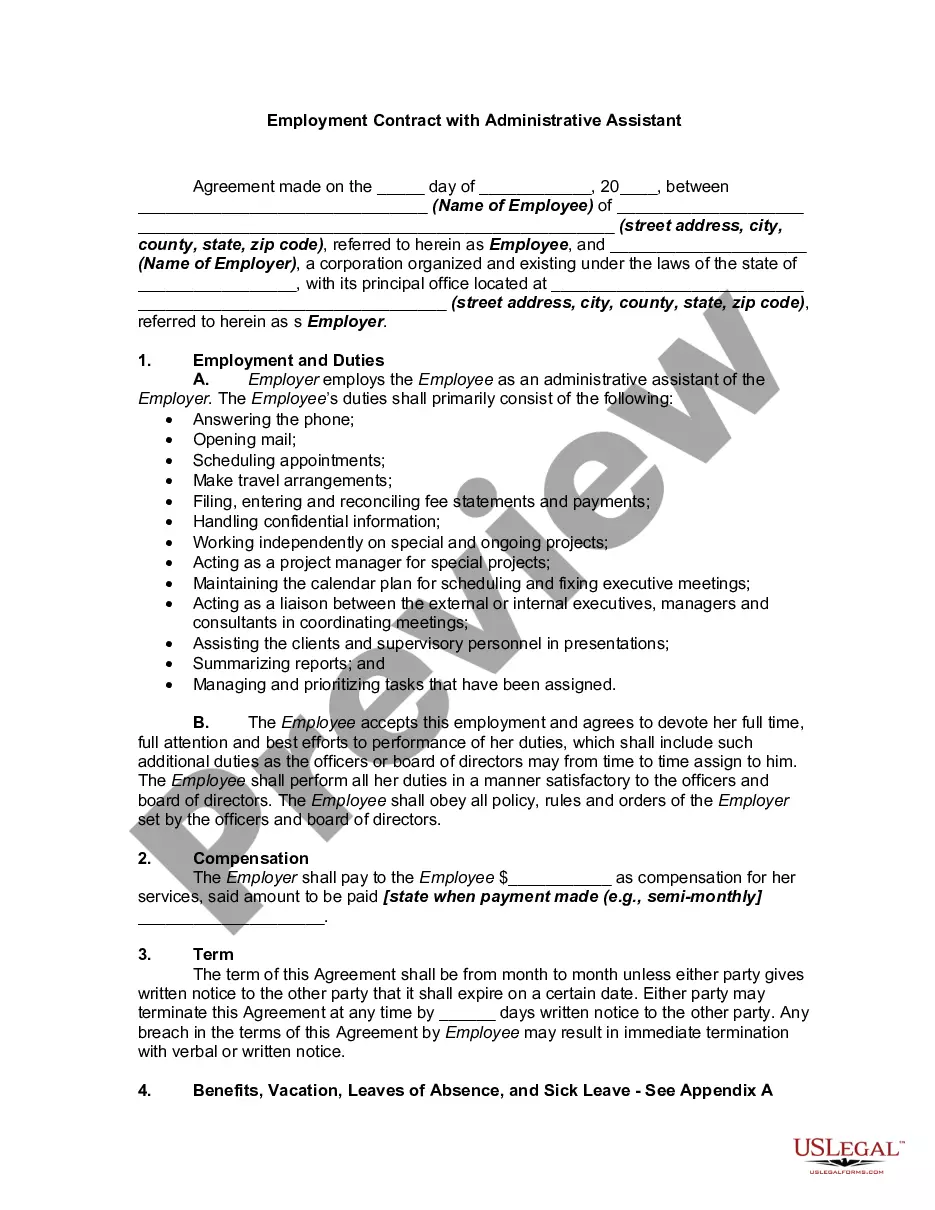

How to fill out Employee Benefits Covenant?

Finding the right authorized record design can be quite a battle. Naturally, there are tons of layouts available on the net, but how will you find the authorized develop you want? Utilize the US Legal Forms internet site. The services delivers thousands of layouts, including the New York Employee Benefits Covenant, which can be used for organization and private needs. All the types are checked by professionals and fulfill federal and state specifications.

Should you be previously listed, log in in your accounts and click on the Download key to find the New York Employee Benefits Covenant. Use your accounts to check from the authorized types you may have purchased previously. Proceed to the My Forms tab of your accounts and obtain one more copy in the record you want.

Should you be a brand new customer of US Legal Forms, listed below are simple guidelines so that you can stick to:

- Initially, be sure you have chosen the right develop to your area/state. You are able to look through the shape utilizing the Preview key and study the shape explanation to guarantee this is basically the right one for you.

- When the develop fails to fulfill your expectations, use the Seach field to discover the correct develop.

- When you are certain that the shape is suitable, click the Acquire now key to find the develop.

- Select the pricing program you need and enter in the required information and facts. Build your accounts and buy your order making use of your PayPal accounts or bank card.

- Choose the data file structure and obtain the authorized record design in your system.

- Complete, revise and produce and indicator the received New York Employee Benefits Covenant.

US Legal Forms may be the greatest collection of authorized types that you can find numerous record layouts. Utilize the company to obtain appropriately-made papers that stick to express specifications.

Form popularity

FAQ

As an employer with employees working in New York State, you may be required to provide insurance coverage for your employees including workers' compensation, disability benefits and New York Paid Family Leave.

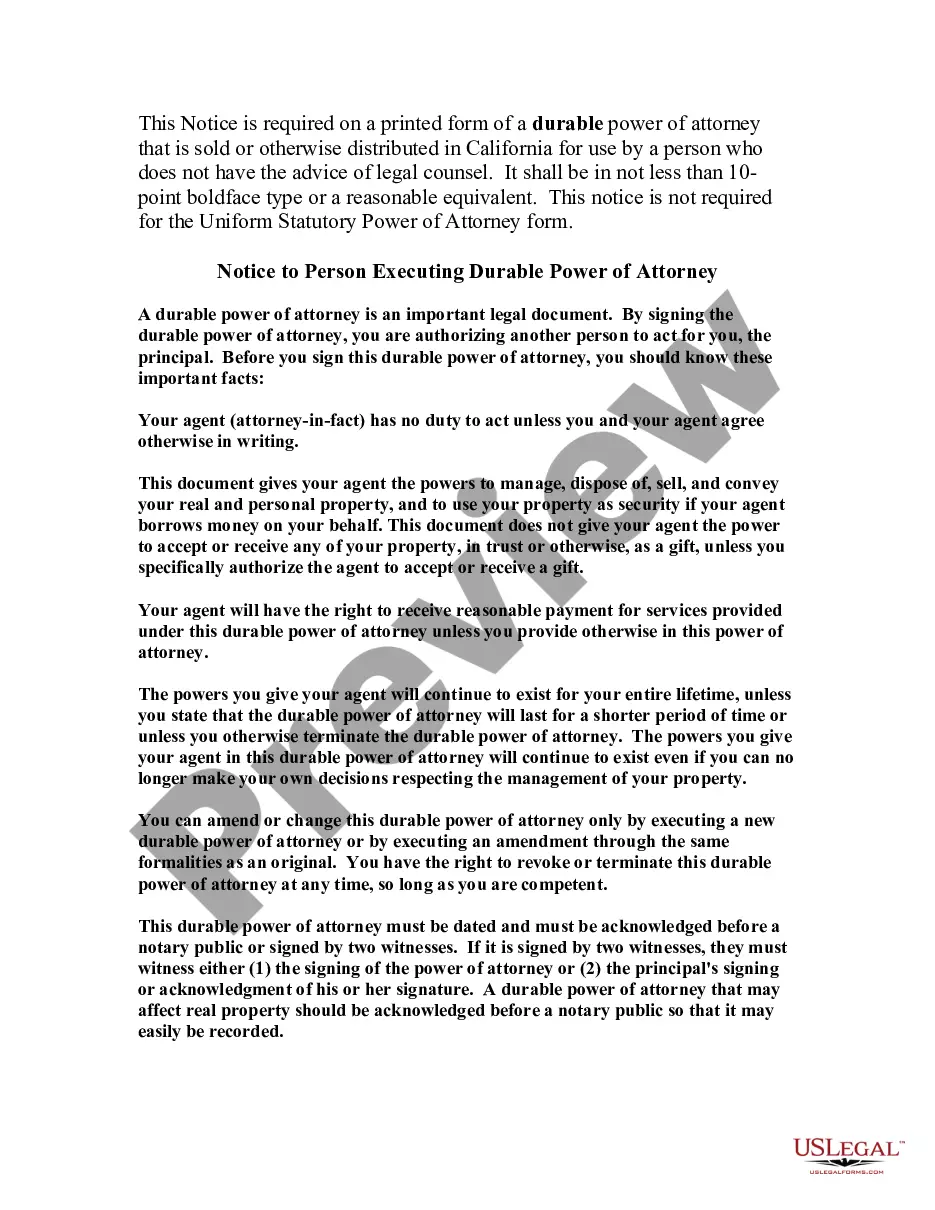

Under section 78 of the Law of Property Act 1925 the benefit of a covenant entered into on or after 1 January 1926, relating to any land of the covenantee, is deemed to be made with the covenantee, its successors in title (which includes owners and occupiers) and those deriving title under either.

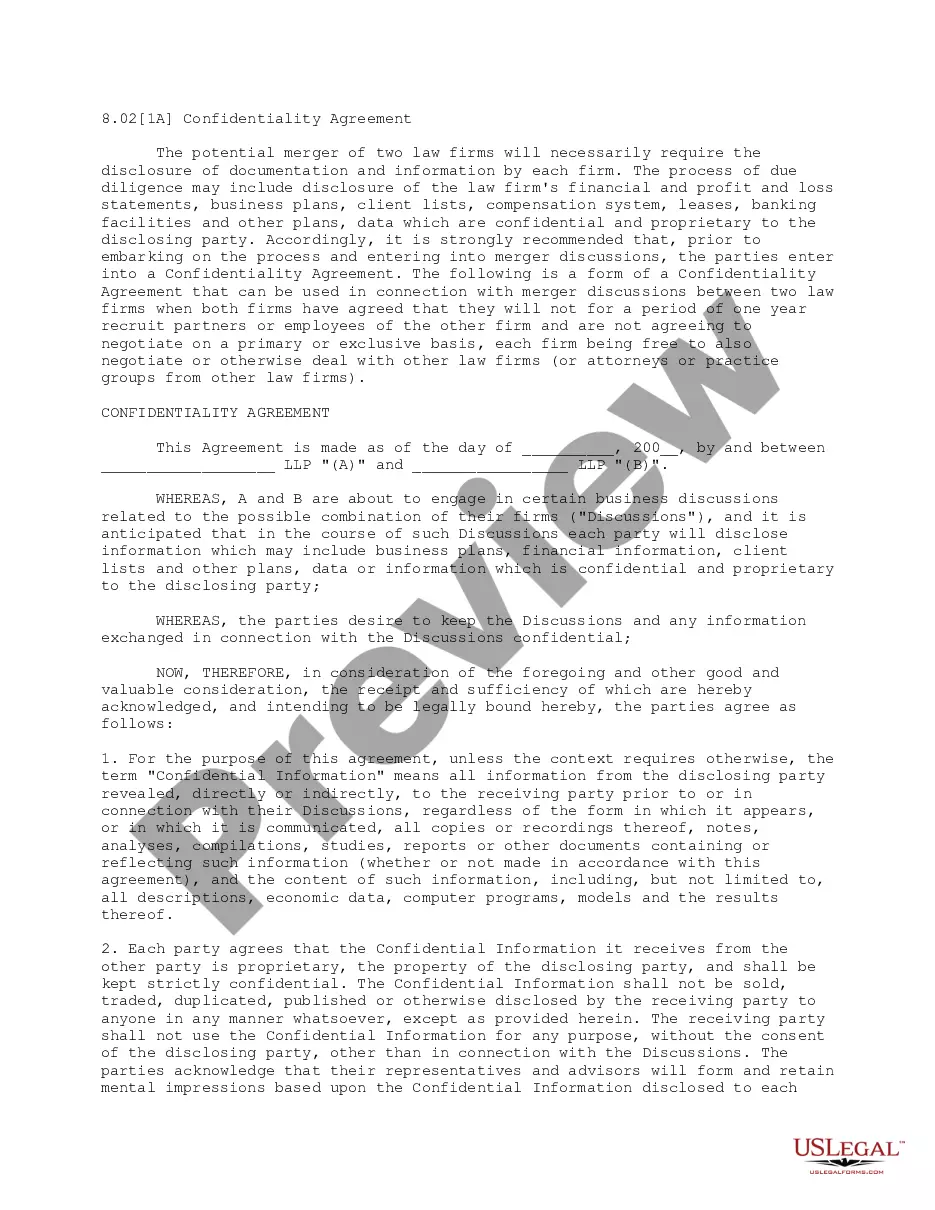

Restrictive covenants may contain 4 different types of promises: (1) a promise not to compete with one's former employer; (2) a promise not to solicit or accept business from customers of the former employer; (3) a promise not to recruit or hire away employees of the former employer; and (4) the promise not to use or ...

Restrictive covenants may contain 4 different types of promises: (1) a promise not to compete with one's former employer; (2) a promise not to solicit or accept business from customers of the former employer; (3) a promise not to recruit or hire away employees of the former employer; and (4) the promise not to use or ...

Restrictive covenants can generally be found in one of three forms: non-disclosure, non-solicitation, and non-compete clauses. Sometimes their usage is a reasonable attempt to ensure the success of the business.

Are non-competes legal? A non-compete is only allowed and enforceable to the extent it (1) is necessary to protect the employer's legitimate interests, (2) does not impose an undue hardship on the employee, (3) does not harm the public, and (4) is reasonable in time period and geographic scope.

An example of a contractual covenant is a non-compete agreement. Examples of common covenants in property law include agreements not to build a fence or agreements to maintain a shared driveway.

Employee Benefits Regular Work Schedule. Thirteen (13) Paid Holidays. Twenty (20) Paid Vacation Days in the First Year. Twenty-seven (27) Paid Vacation Days by the Seventh Year. Excellent Retirement Benefits including NYS Pension and Deferred Compensation Option. Comprehensive Health Insurance.