New York Notice of Petition For Appointment of Successor Executor And Citation (P-17)

Description

How to fill out New York Notice Of Petition For Appointment Of Successor Executor And Citation (P-17)?

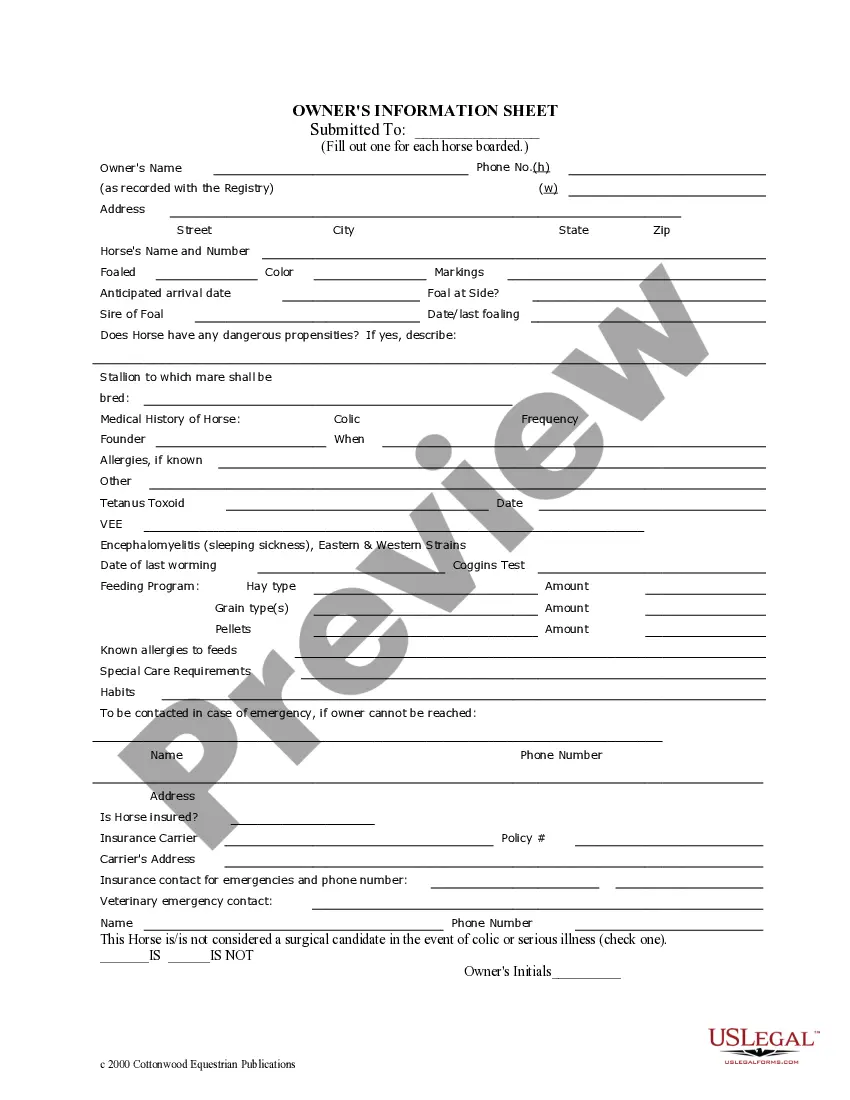

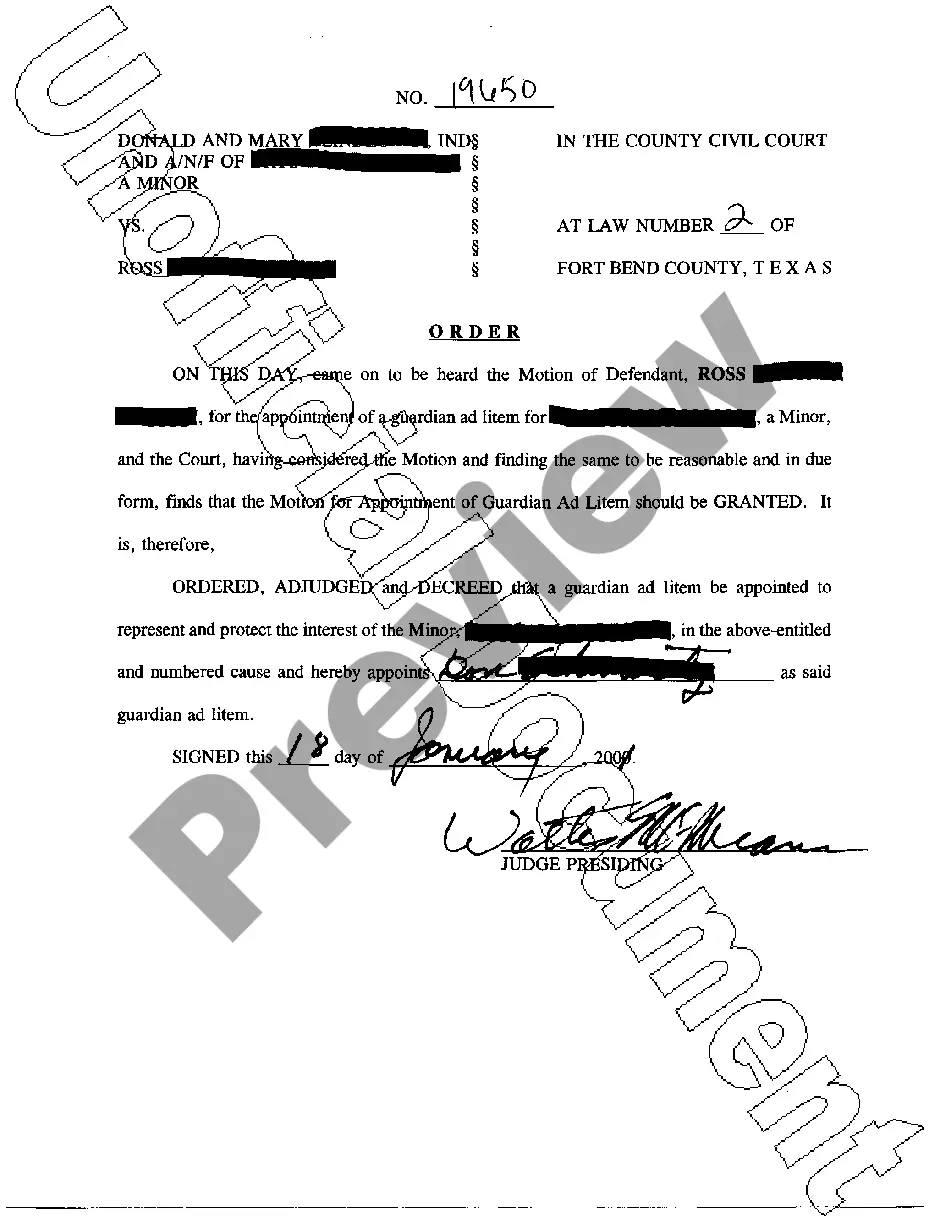

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state laws and are examined by our specialists. So if you need to fill out New York Notice of Petition For Appointment of Successor Executor And Citation (P-17), our service is the best place to download it.

Getting your New York Notice of Petition For Appointment of Successor Executor And Citation (P-17) from our catalog is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the proper template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it satisfies your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Notice of Petition For Appointment of Successor Executor And Citation (P-17) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Six months: By the sixth month, the executor must ensure creditors are paid, resolve disputes and file Federal Income Tax return forms 1040 and 1041. Nine months: In an ideal case, the court should distribute benefits to heirs, discharge the personal representative and close the estate.

If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit. Beneficiaries can petition the court to have the executor removed from their positon if they can prove they should be removed for one of the reasons listed above.

Citation?Probate (DE-122) Tells a person that they are required to come to a hearing relating to a case in probate court, such as a case about an estate (the property of a deceased person) or a trust (an arrangement where property is given to someone to be held for the benefit of another person).

In New York, the Executor of an Estate is entitled to executor commissions which are statutory in nature. Under the New York Surrogate's Court Procedure Act §2307 (?SCPA?), executor fees are based on the value of the probate estate and range between 2% and 5% of the value of applicable assets received and paid out.

How Do I Become an Administrator or Executor? In New York, the Executor / Administrator is appointed by the Surrogate's Court located in the county where the decedent resided. Once the Will is admitted to probate, the Executor is appointed and may proceed to administer the estate.

A party seeking to have an executor, administrator or a trustee removed, must file a petition requesting revocation of the fiduciary's letters pursuant to NY Surrogate's Court Procedure Act (SCPA) 711, 712 or 719. The petition must state in clear terms the grounds to revoke the letters.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.

In New York State, an estate should remain open for seven months before distributions are made. After this seven month period, the executor may be able to start making distributions to the beneficiaries, if all expenses and taxes are paid. g.