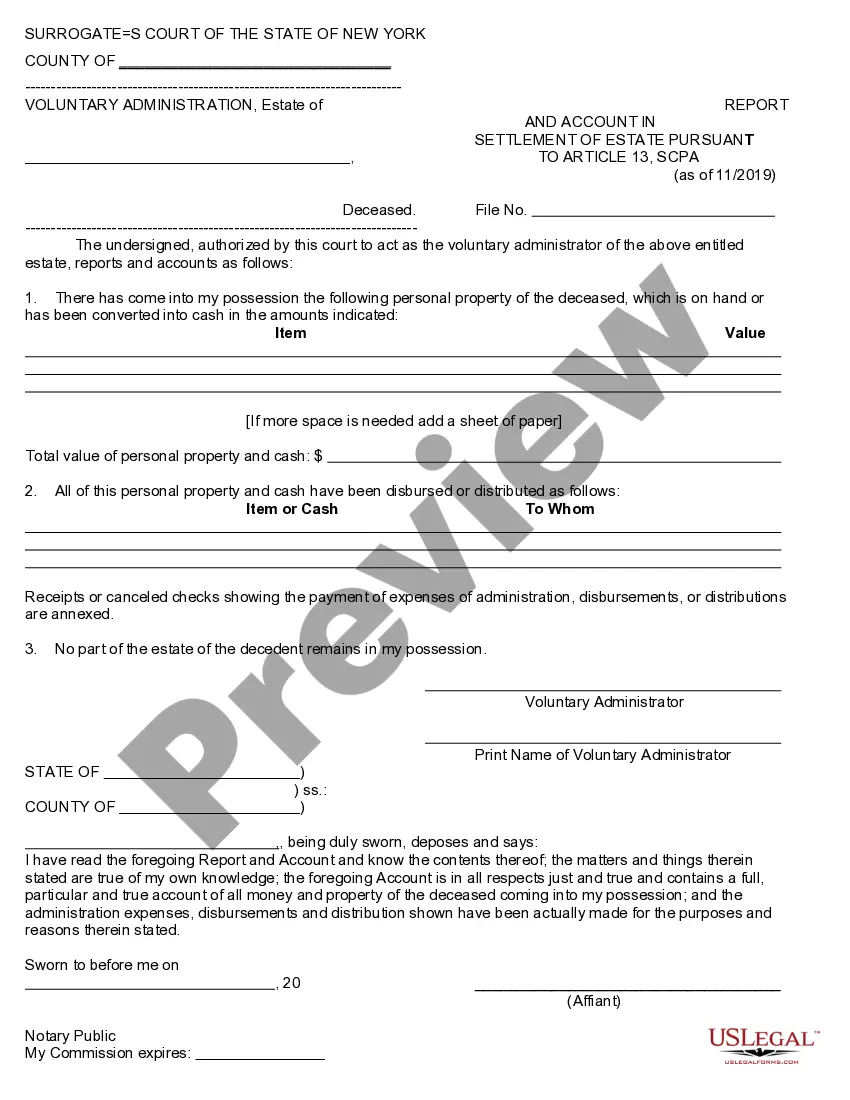

New York Report And Account In Settlement of Estate Pursuant To Article 13 SPCA

Description

How to fill out New York Report And Account In Settlement Of Estate Pursuant To Article 13 SPCA?

In terms of submitting New York Report and Account in Settlement of Estate, you almost certainly imagine an extensive procedure that requires choosing a ideal form among hundreds of very similar ones and after that being forced to pay a lawyer to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific document within just clicks.

In case you have a subscription, just log in and click Download to find the New York Report and Account in Settlement of Estate form.

If you don’t have an account yet but need one, keep to the point-by-point guide listed below:

- Be sure the file you’re downloading applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and through clicking on the Preview function (if available) to view the form’s content.

- Simply click Buy Now.

- Select the proper plan for your financial budget.

- Sign up for an account and select how you would like to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Professional lawyers draw up our templates to ensure that after downloading, you don't need to bother about enhancing content outside of your individual details or your business’s information. Sign up for US Legal Forms and get your New York Report and Account in Settlement of Estate sample now.

Form popularity

FAQ

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

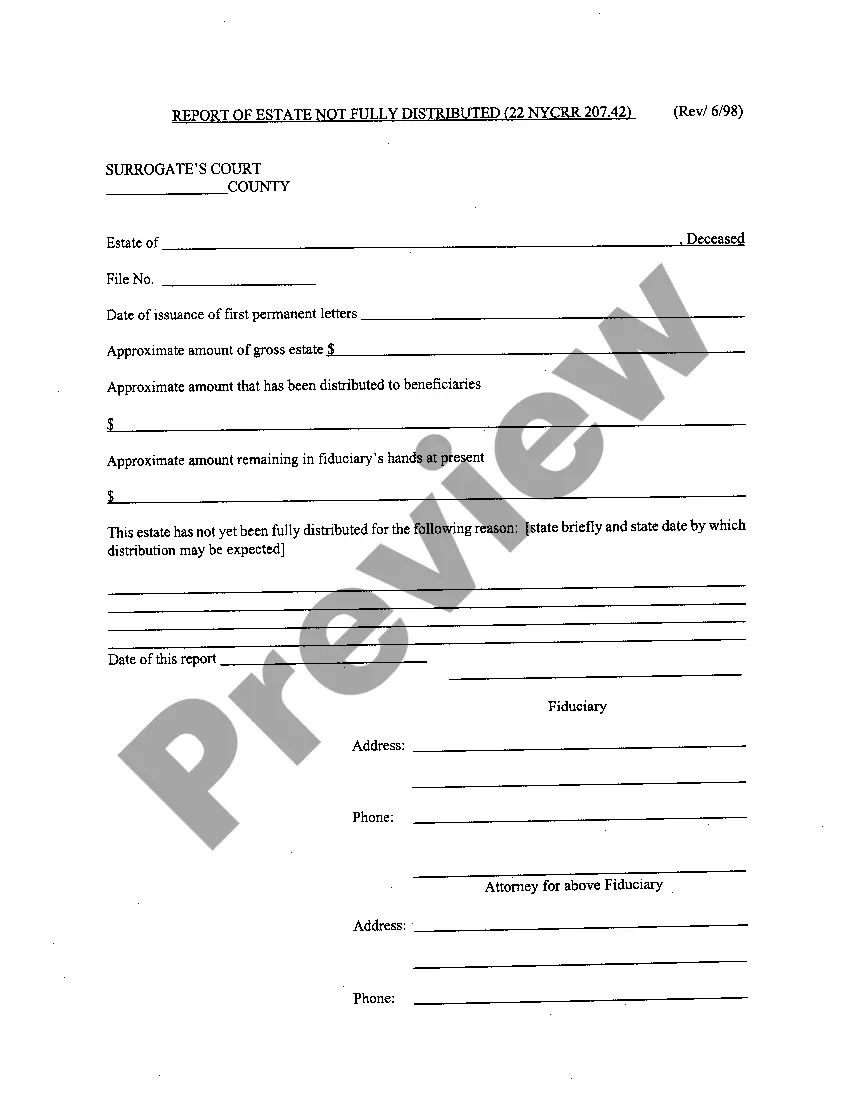

CLOSING THE ESTATE: FORM 207.42 must be prepared and executed by the fiduciary and the attorney and filed after 7 months or by the end of 2 years from the date of fiduciary appointment. RELEASES from all beneficiaries of the estate must be executed and filed at this time, if not already filed.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

Filing for Administration The closest distributee files a copy of the paid funeral bill, a certified copy of the death certificate with the Petition for Letters of Administration and other supporting documents in the Surrogate's Court in the county where the Decedent had their primary residence.

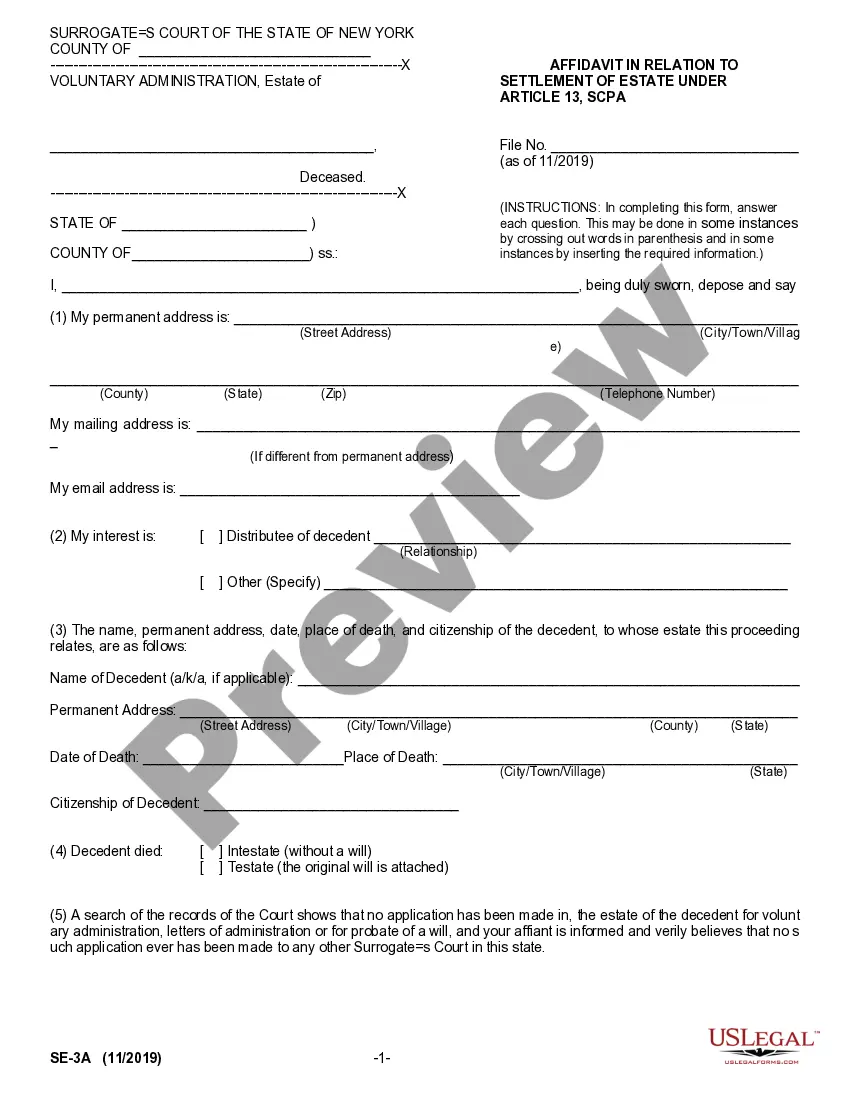

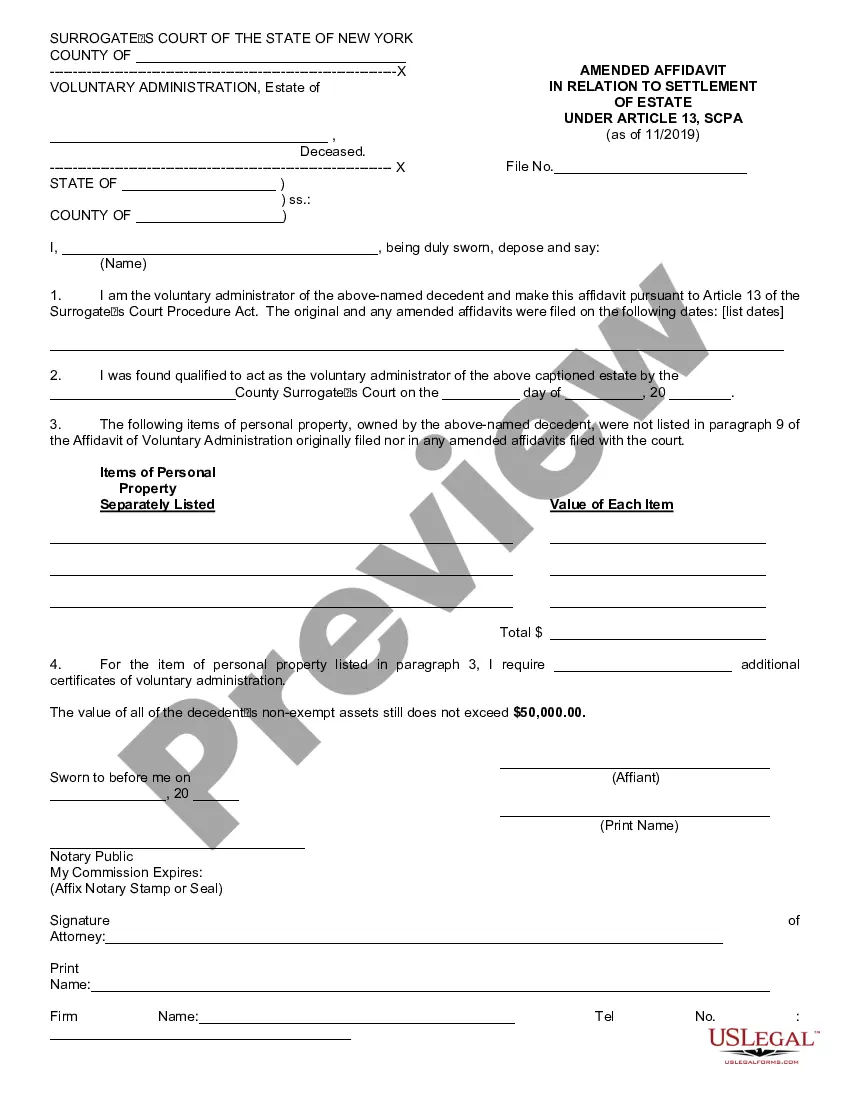

When a Decedent (the person who died) had less than $50,000 of personal property then it's considered a small estate, and is formally called a voluntary administration. It does not matter if the Decedent had a Will or not. Personal property are things that belong to a person not including real property.