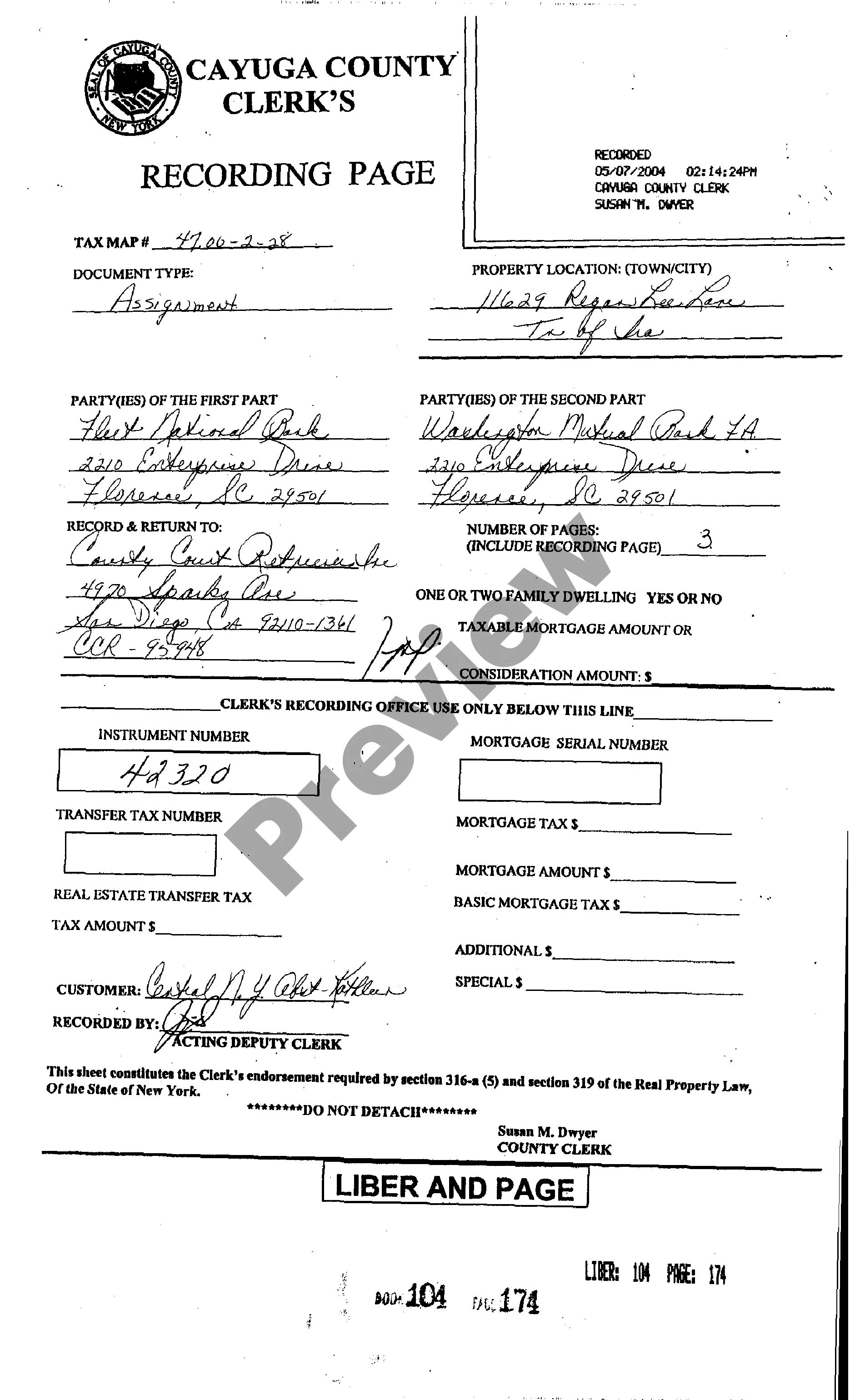

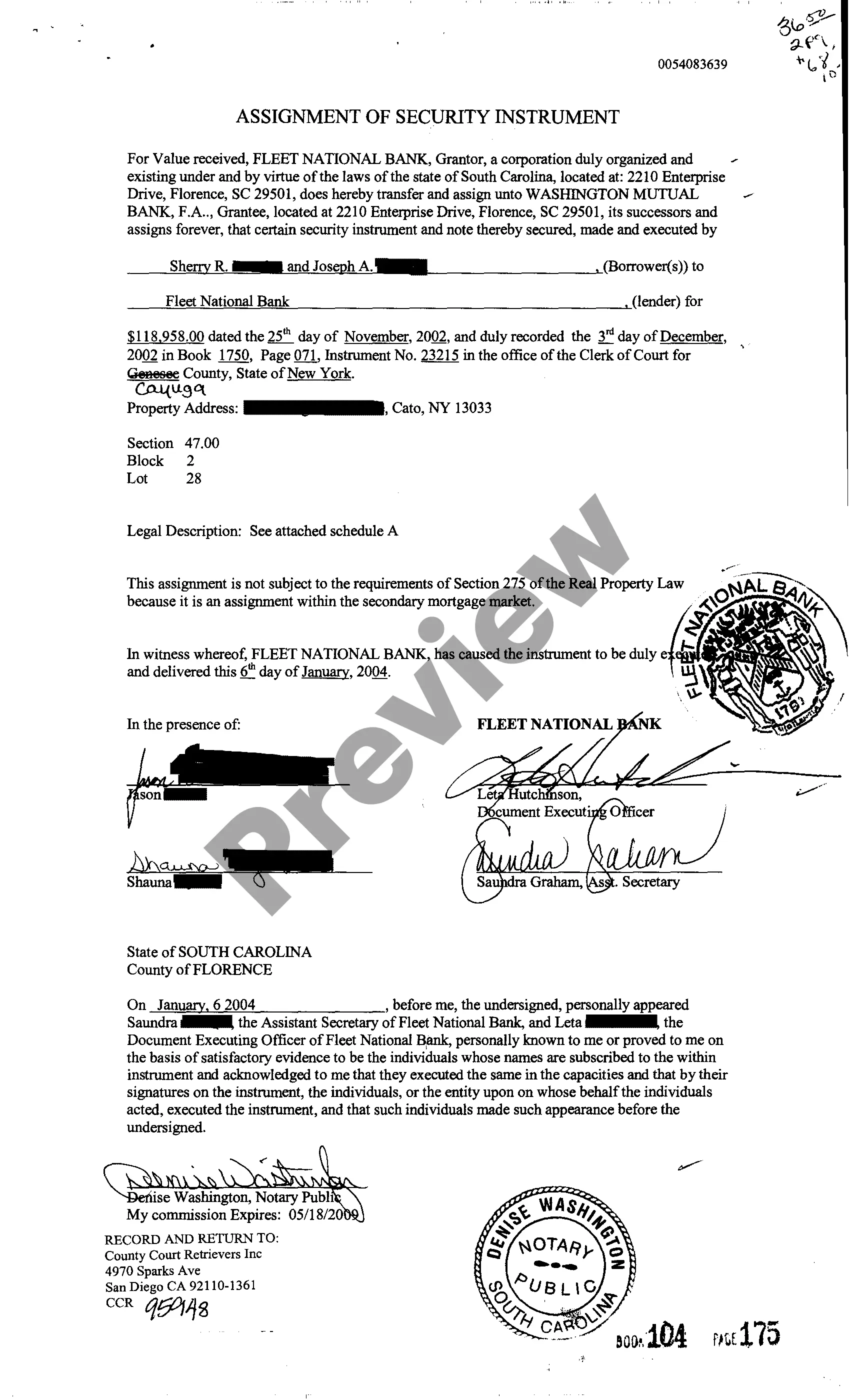

New York Assignment of Security Interest

Description

How to fill out New York Assignment Of Security Interest?

Among lots of paid and free examples which you find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they are skilled enough to take care of what you require those to. Always keep relaxed and use US Legal Forms! Get New York Assignment of Security Interest templates made by professional legal representatives and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and then paying them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access your earlier saved templates in the My Forms menu.

If you’re utilizing our service the first time, follow the instructions listed below to get your New York Assignment of Security Interest quick:

- Make sure that the file you see applies in the state where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another example using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and purchased your subscription, you can utilize your New York Assignment of Security Interest as often as you need or for as long as it remains valid where you live. Edit it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Attachment is essentially the moment when a security interest becomes enforceable against a Debtor.

The most typical way to perfect a security interest is by filing notice in a public office. The filing of a public notice puts other creditors on notice of the attached security interest in property of the creditor. The required filing most frequently is a financing statement.

File a UCC-1 financing statement; or. take actual possession of the lease by creating and taking physical possession of an original chattel-paper counterpart to the lease.

An assignment of record of a security interest in a fixture covered by a record of a mortgage which is effective as a financing statement filed as a fixture filing under Section 9-502(c) may be made only by an assignment of record of the mortgage in the manner provided by law of this State other than the Uniform

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

By filing a financing statement with the appropriate public office. by possessing the collateral. by controlling the collateral; or. it's done automatically upon attachment of the security interest.

Article 9 contains a statute of frauds which requires a security agreement to be in writing unless it is pledged.The "perfection" of a security agreement allows a secured party to gain priority to the collateral over any third party. To perfect a security agreement, the filing of a public notice is usually required.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.