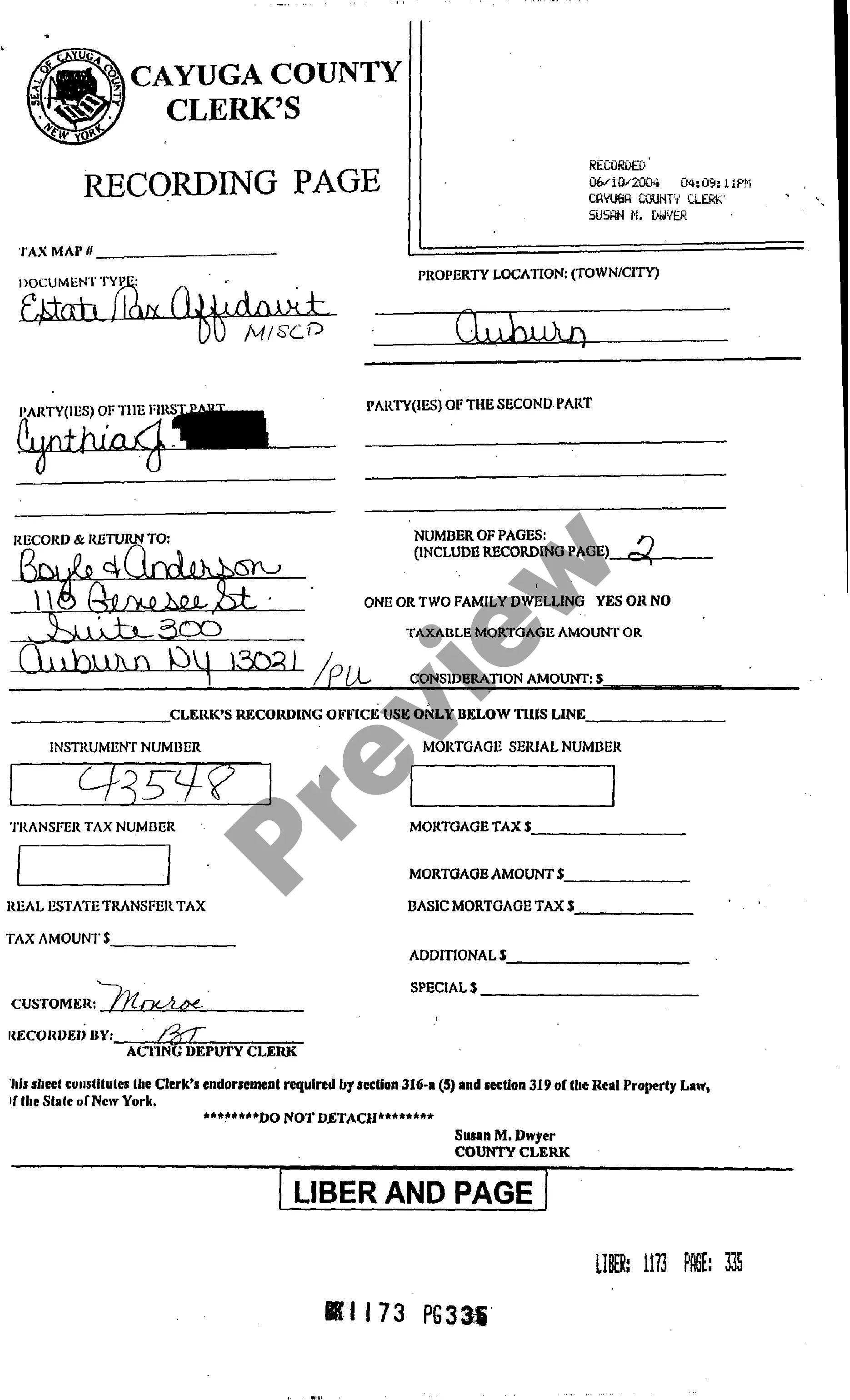

New York Federal Estate Tax Affidavit

Description

Key Concepts & Definitions

Federal Estate Tax: A tax imposed by the federal government on the transfer of the taxable estate of a deceased person, whether such property is transferred via will, according to state laws of intestacy, or through other means. An affidavit related to federal estate tax may be required to assert the value of the estate and the applicable taxes owed.

Step-by-Step Guide

- Gather Necessary Documents: Collect all required documentation such as death certificates, last will and testament, and asset valuations.

- Calculate the Gross Estate: Sum up all the assets of the deceased to determine the gross estate value.

- Deduct Allowable Deductions: Apply deductions such as funeral expenses, debts, and legal fees to find the taxable estate.

- Fill Out the Federal Estate Tax Affidavit: Complete the affidavit with accurate information regarding the estate's value and resultant taxes.

- Submit Affidavit: File the affidavit with the appropriate federal tax authority, following any specific regional guidelines.

Risk Analysis

- Underestimating Estate Value: Incorrectly estimating the estate's value can lead to underpayment of taxes and potential legal penalties.

- Overestimation: Overestimating might cause the estate to pay more taxes than necessary, decreasing the inheritance.

- Documentation Errors: Inaccurate or incomplete documentation can delay the processing of estate taxes or result in legal challenges.

Best Practices

- Accurate Documentation: Ensure all financial documents and valuations are accurate and fully documented.

- Legal Consultation: Work with a tax attorney or an estate planner to comply with all federal regulations and avoid common mistakes.

- Timely Filing: Submit all necessary forms and affidavits before the deadline to avoid penalties.

Common Mistakes & How to Avoid Them

- Ignoring Tax Exemptions: Be aware of and apply applicable tax exemptions to reduce the federal estate tax burden.

- Failing to Keep Updated Records: Regularly update estate records and plans to reflect current laws and asset values.

- Delay in Filing: Avoid delays in filing the necessary tax documents to prevent accruing interest and penalties on unpaid taxes.

FAQ

- Who needs to file a federal estate tax affidavit? The executor or administrator of an estate typically files the affidavit if the estate exceeds the federal exemption amount.

- What is the current federal exemption amount for estate tax? The exemption amount can vary by year, so it is essential to consult up-to-date resources or a tax professional.

- Can the federal estate tax be avoided? While it cannot be entirely avoided for estates exceeding the exemption, proper planning can significantly reduce the tax owed.

Summary

Understanding and correctly handling the federal estate tax affidavit is crucial for executors of substantial estates. Accurate valuation, adherence to legal guidelines, and proper drafting and submission of the affidavit ensure compliance and optimal handling of the deceased's estate under U.S. federal law.

How to fill out New York Federal Estate Tax Affidavit?

Among countless free and paid samples that you’re able to find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re competent enough to deal with what you require these people to. Keep calm and use US Legal Forms! Discover New York Federal Estate Tax Affidavit samples created by professional legal representatives and avoid the high-priced and time-consuming procedure of looking for an attorney and then having to pay them to draft a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all your previously downloaded samples in the My Forms menu.

If you are utilizing our platform for the first time, follow the instructions below to get your New York Federal Estate Tax Affidavit fast:

- Make sure that the file you see is valid where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another sample utilizing the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you’ve signed up and purchased your subscription, you may use your New York Federal Estate Tax Affidavit as many times as you need or for as long as it remains valid in your state. Edit it in your favored online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Despite the large Federal Estate Tax exclusion amount, New York State's estate tax exemption for 2021 is $5.93 million. New York State still does not recognize portability.

The current New York estate tax exemption amount is $5,930,000 for 2021. Under current law, this number will remain until January 1, 2022, at which point it will rise again with inflation.

The exemption level is indexed for inflation reaching $11.4 million in 2019 and $11.58 million in 2020 (and twice those amounts for married couples). The 40 percent top tax rate remains in place.

If you've inherited money or property after a loved one dies, you may be subject to an inheritance tax.The main difference between an inheritance and estate taxes is the person who pays the tax. . Unlike an inheritance tax, estate taxes are charged against the estate regardless of who inherits the deceased's assets.

Does New York have an estate tax? Yes. New York, like several other states, has a state estate tax. This means that when someone dies a resident of New York, or with property physically located in New York, his or her estate may be subject to tax not only by the federal government, but also by New York.

The estate tax rate in New York ranges from 3.06% to 16%. Estates over $5.25 million are subject to this tax.

For deaths occurring after January 1, 2020, New York will tax estates valued at more than $5,850,000. Even if your estate is not large enough to owe federal estate tax (currently, the exemption amount is $11,580,000 for an individual), you may still owe an estate tax to the great state of New York.

New York does not have an inheritance tax, so there wouldn't be an inheritance tax owed on property owned in New York.A federal estate tax may also be incurred on estates that exceed the federal exemption, presently $11.85 million for decedents dying in 2020.

The exemption level is indexed for inflation reaching $11.4 million in 2019 and $11.58 million in 2020 (and twice those amounts for married couples). The 40 percent top tax rate remains in place. The tax rates and exemption levels have varied dramatically over the past two decades.