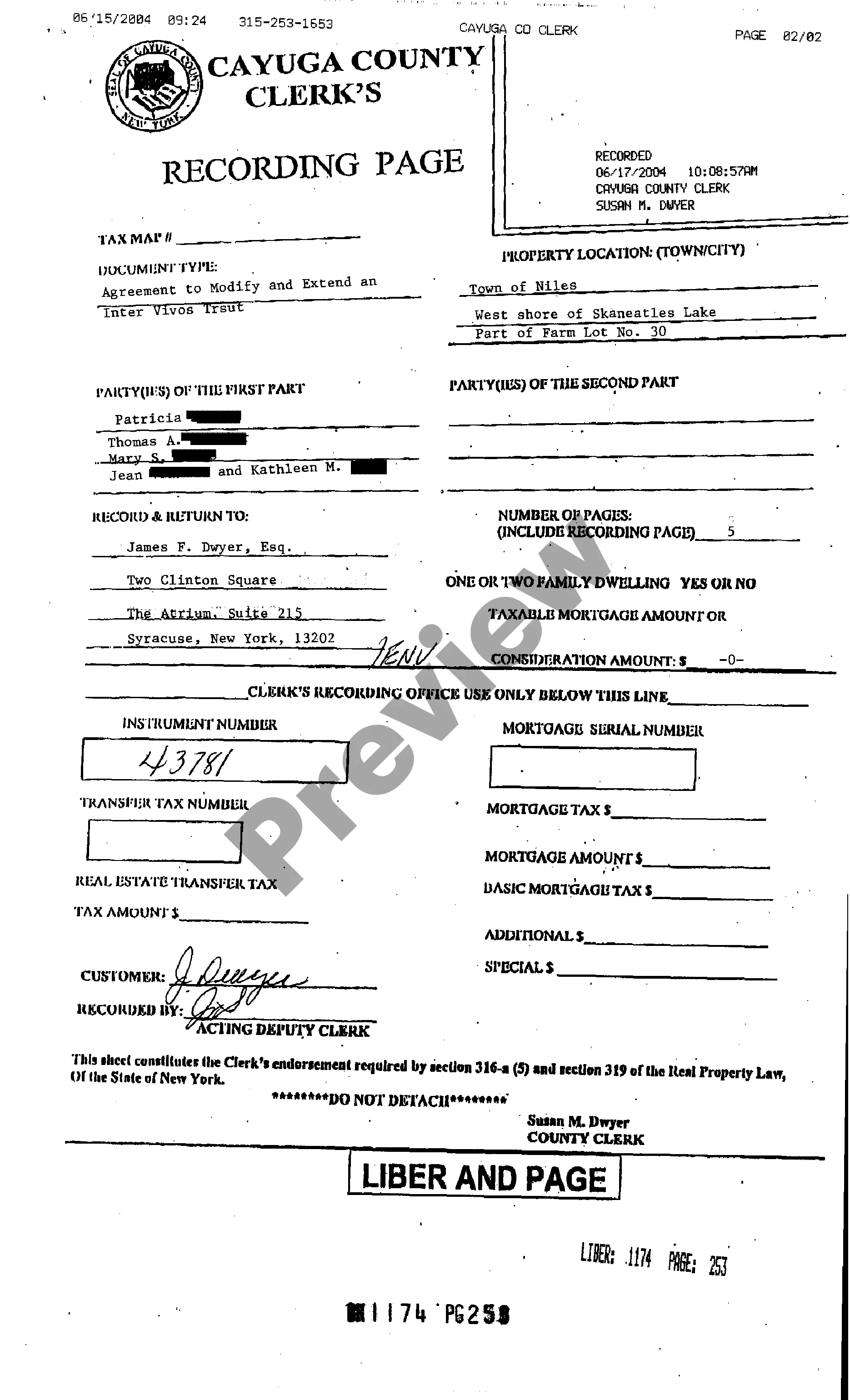

New York Inter Vivos Trust Agreement

Description

How to fill out New York Inter Vivos Trust Agreement?

Among hundreds of paid and free samples that you find online, you can't be sure about their accuracy and reliability. For example, who made them or if they are competent enough to deal with the thing you need those to. Always keep calm and make use of US Legal Forms! Discover New York Inter Vivos Trust Agreement templates made by skilled legal representatives and avoid the expensive and time-consuming procedure of looking for an lawyer and after that having to pay them to write a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access your earlier acquired files in the My Forms menu.

If you’re utilizing our website the very first time, follow the instructions listed below to get your New York Inter Vivos Trust Agreement quick:

- Ensure that the file you discover is valid in the state where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or look for another example utilizing the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you’ve signed up and bought your subscription, you can use your New York Inter Vivos Trust Agreement as often as you need or for as long as it continues to be active where you live. Change it with your preferred editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

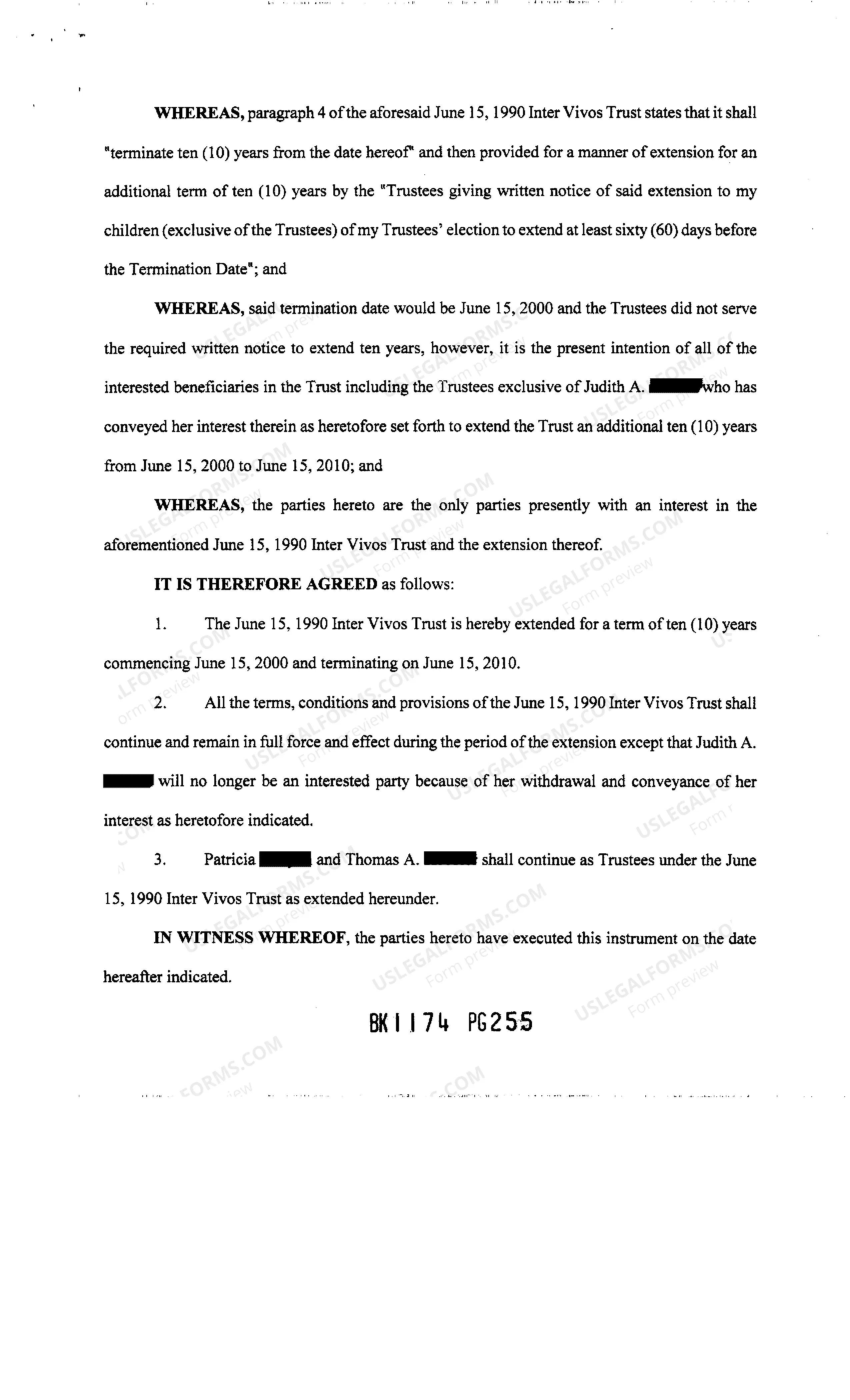

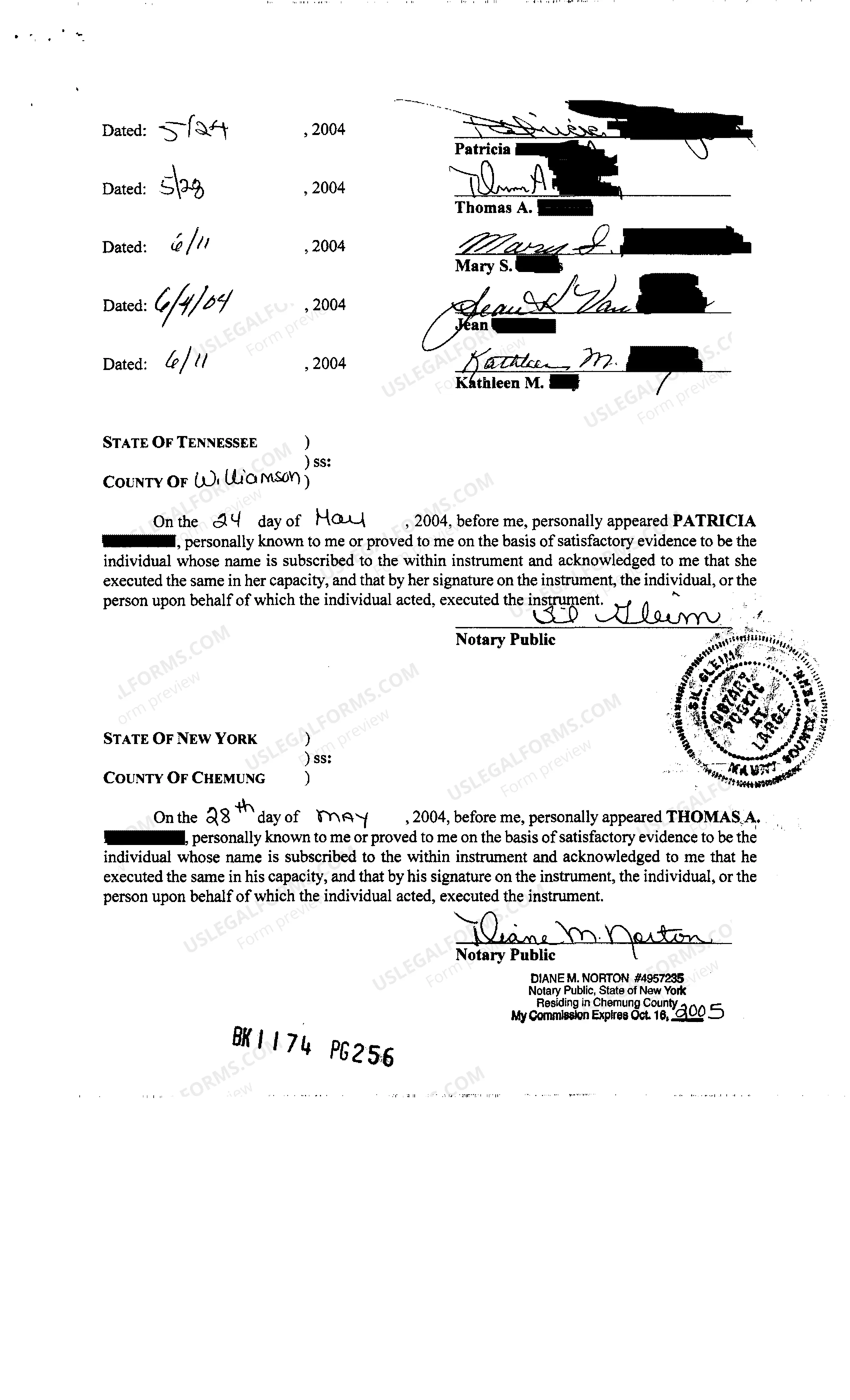

In many cases, unfortunately, if the Grantor is deceased or incapacitated and the trust does not state that co-trustees can act independently, the co-trustees may be powerless to act on the account without legal action to amend the Trust or signing some agreement with the bank and contravenes the explicit terms of the

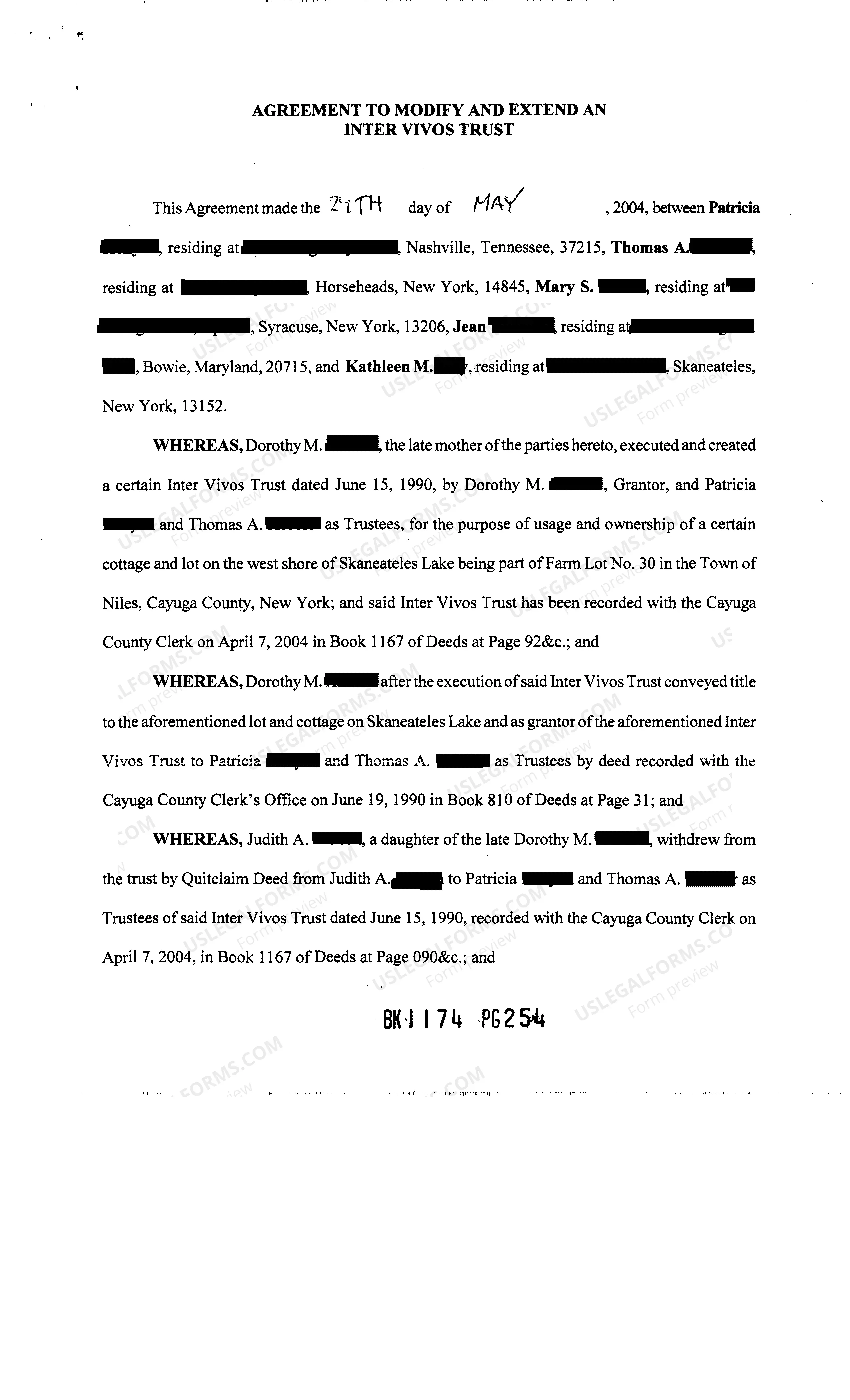

An inter vivos trust is a legal document created while the individual for which the trust is drawn up is still living.Once the trust owner passes away, the designated beneficiaries of the trust are granted access to the assets, which are then managed by a successor trustee.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

By the settlor transferring property to another person as trustee during the settlor's lifetime, by will, or by other disposition that takes effect on the settlor's death; By the owner of property declaring that he or she holds identifiable property as trustee;

With an inter vivos trust, the assets are titled in the name of the trust by the owner and are used or spent down by him or her, while they are alive. When the trust owner passes away, the remainder beneficiaries are granted access to the assets, which are then managed by a successor trustee.

In order to set up a living trust, you should first create a document stating your intention to create a trust, and name the people who you want to benefit from the trust. You should then create another document that states the property that you want to begin the creation of the trust with.

Inter vivos (living) trusts are created while an individual is still alive in order to name the beneficiaries of property and assets upon death while avoiding probate. These trusts may revocable or irrevocable.

An Inter Vivos Trust is one created by a living person for the benefit of another person. Also known as a living trust, this trust has a duration that is determined at the trust's creation and can entail the distribution of assets to the beneficiary during or after the trustor's lifetime.