New York Real Estate Transfer Tax Return For Public Utility Companies' and Governmental Agencies' Easements and Licenses is a form used to report and pay real estate transfer taxes associated with the sale or transfer of an easement or license granted by a public utility company or governmental agency in New York State. It is used to report the transfer of any type of easement or license, such as a utility easement, roadway easement, right of way, license for operation of a business, or a license for use of public land. There are three types of New York Real Estate Transfer Tax Return For Public Utility Companies' and Governmental Agencies' Easements and Licenses: Form TP-584-E, Form TP-584-G, and Form TP-584-L. Form TP-584-E is used to report the transfer of a utility easement; Form TP-584-G is used to report the transfer of a roadway or right of way easement; and Form TP-584-L is used to report the transfer of a license for operation of a business or use of public land. All three forms require information about the transferor and transferee, details about the easement or license being transferred, and other relevant information. The form must be completed and submitted, along with the appropriate payment, to the New York State Department of Taxation and Finance.

New York Real Estate Transfer Tax Return For Public Utility Companies' and Governmental Agencies' Easements and Licenses

Description

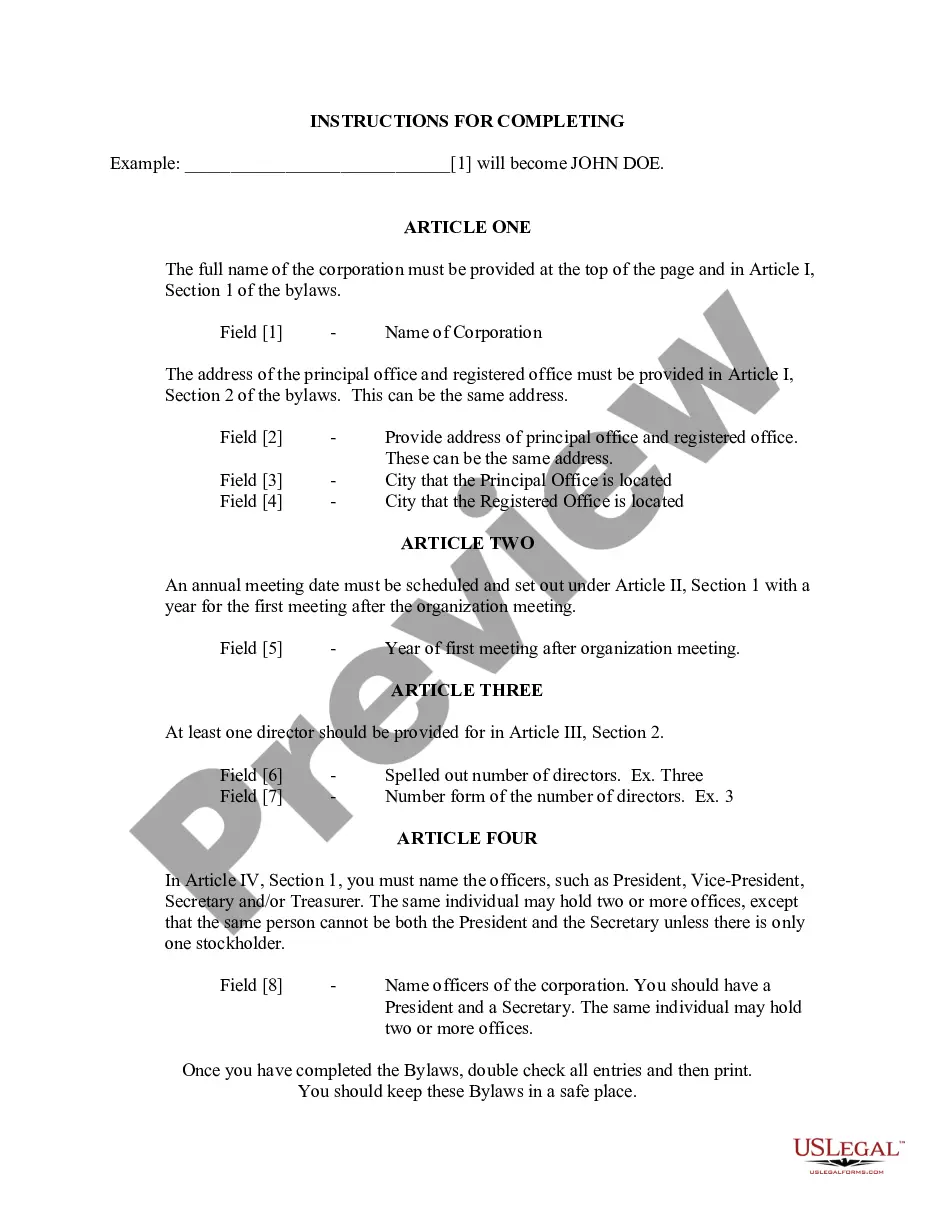

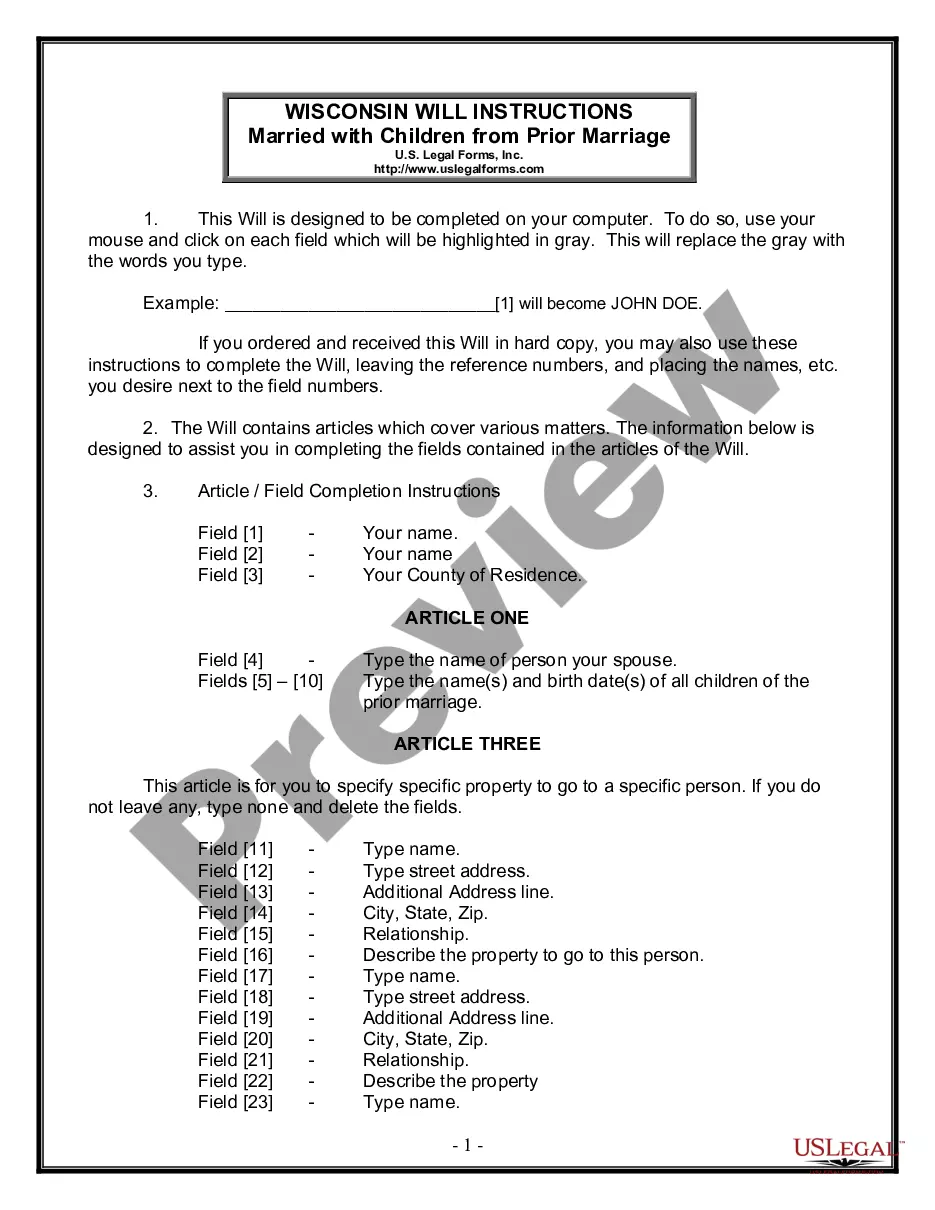

How to fill out New York Real Estate Transfer Tax Return For Public Utility Companies' And Governmental Agencies' Easements And Licenses?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our experts. So if you need to fill out New York Real Estate Transfer Tax Return For Public Utility Companies' and Governmental Agencies' Easements and Licenses, our service is the perfect place to download it.

Getting your New York Real Estate Transfer Tax Return For Public Utility Companies' and Governmental Agencies' Easements and Licenses from our catalog is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the correct template. Later, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance verification. You should carefully review the content of the form you want and ensure whether it satisfies your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your New York Real Estate Transfer Tax Return For Public Utility Companies' and Governmental Agencies' Easements and Licenses and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

If you do not pay your tax when due, we will charge you a penalty in addition to interest. The penalty may be waived if you can show reasonable cause for paying late. The penalty charge is: 0.5% of the unpaid amount for each month (or part of a month) it is not paid, up to a maximum of 25%

Are Transfer Taxes Deductible? Whether you buy or sell, the IRS doesn't allow you to deduct transfer taxes?or any other taxes involved in the sale of a personal home. This includes other costs like the recording tax paid on each mortgage.

TP-584 Fill-in. TP-584-I (Instructions) Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax; See notice about address change. See information about the STAR credit.

The mansion tax (additional tax) and supplemental tax are paid by the buyer. If the buyer doesn't pay the tax or is exempt, the seller must pay the tax. In the case where the seller has the duty to pay the tax because the buyer has failed to pay, the tax becomes the joint and several liability of the seller and buyer.

How To Avoid Paying NYC Transfer Tax? The only way to avoid paying NYC transfer tax is by selling your property through a 1031 exchange. A 1031 exchange allows investors to defer capital gains taxes on investment properties by reinvesting the proceeds from the sale into another qualifying property.

The tax is usually paid as part of closing costs at the sale or transfer of property. Residential Type 1 or Type 2 sales or transfers: If the consideration is $500,000 or less, the rate is 1% of the consideration. If the consideration is more than $500,000 the rate is 1.425%

Who pays the real estate transfer tax in New York? The tax is generally paid for by the seller and can't be imposed on the buyer. However, there are certain exceptions to this rule (new construction often transfers the obligation to the buyer).

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.