Petition Small Claims Assessment Review is a legal process that is available in counties outside of New York City. This process is used to challenge and appeal property tax assessments. It is also known as a tax grievance. Generally, the property owner files a written petition with the county Board of Assessment Review (BAR) to contest the assessed value of their property. The BAR will review the petition and the property record to determine the correct value. If the BAR finds that the assessment is incorrect, they will reduce the assessment and the resulting tax liability. There are two types of Petition Small Claims Assessment Review in counties outside of New York City: Class 1 and Class 2. Class 1 is used to challenge assessment increases of less than 15%. Class 2 is used to challenge assessment increases of 15% or more. Both classes require a petition to be filed with the BAR. The BAR will then conduct a hearing and review the evidence presented. The BAR may reduce or increase the assessment depending on the outcome of the hearing.

Petition Small Claims Assessment Review In Counties Outside New York City

Description

How to fill out Petition Small Claims Assessment Review In Counties Outside New York City?

If you’re looking for a way to appropriately complete the Petition Small Claims Assessment Review In Counties Outside New York City without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Petition Small Claims Assessment Review In Counties Outside New York City:

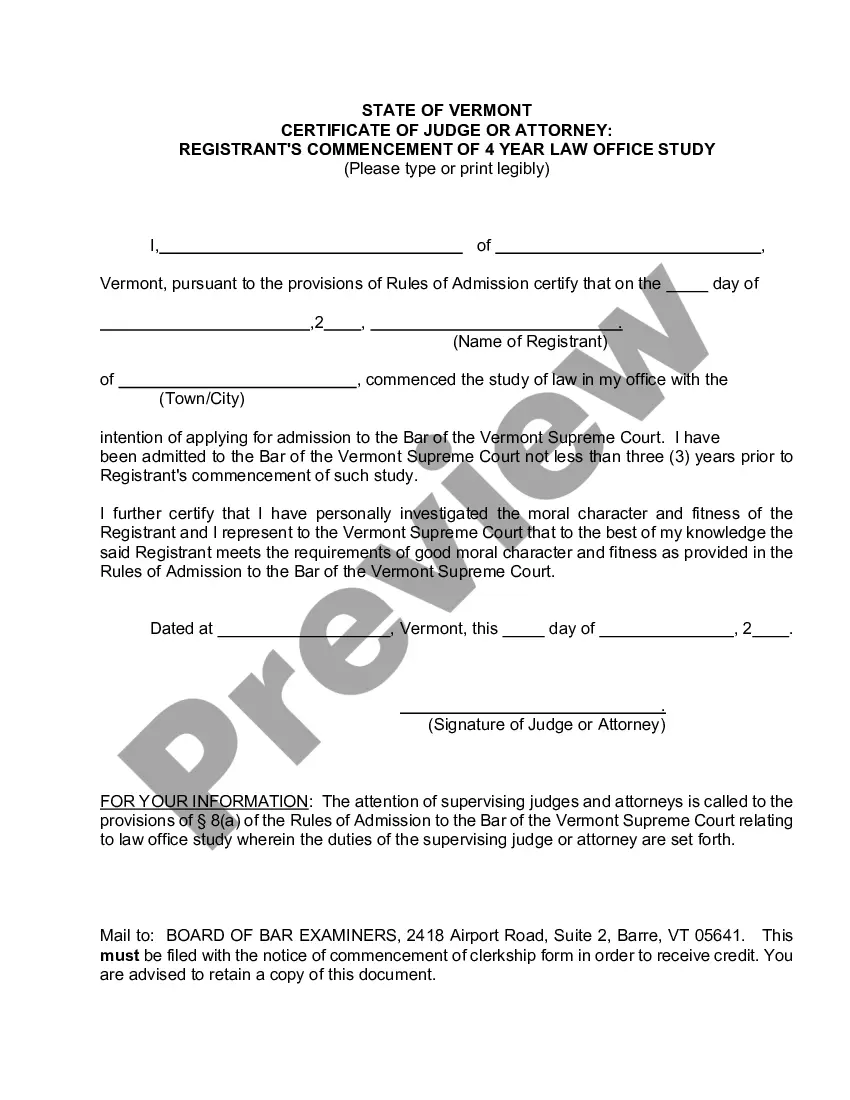

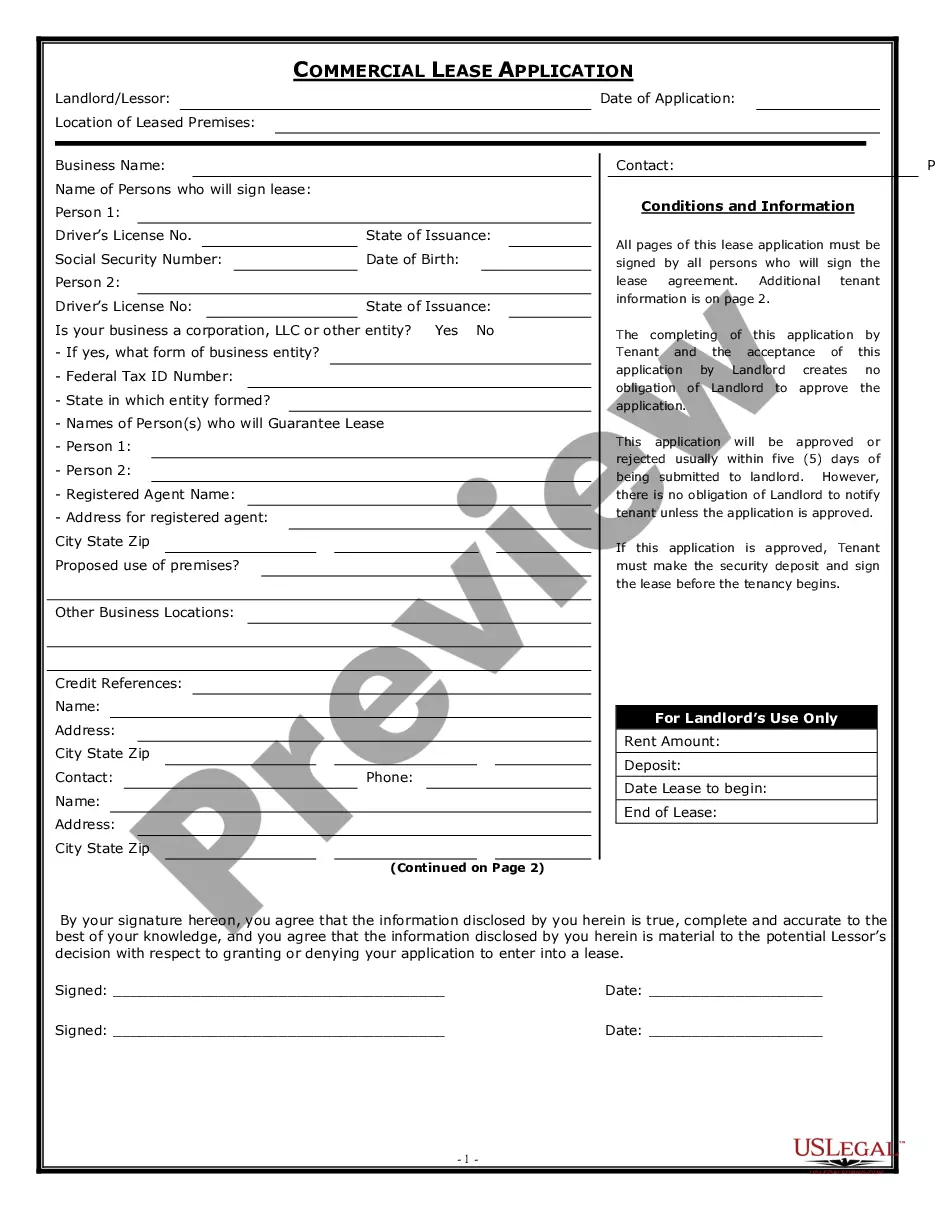

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Petition Small Claims Assessment Review In Counties Outside New York City and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

After hearing all the evidence, an appeals board is required by law to determine the value of your property, which means that they can leave the value the same, decrease the value, or increase the value of your property.

Filing the grievance form 516-571-2391. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town. If your property is located in a village that assesses property, you will have two assessments, one for the village and one for the town.

State the reason(s) for protesting. Common reasons for protests are that a property has been assessed more than once (called a double assessment), an assessed location has been recently closed, or the stated value is too high.

Your Assessed Value is based on a percentage of your Market Value. This percentage is known as the Level of Assessment or Assessment Ratio. Your Assessment Ratio depends on your tax class. Limits on Increases for Class 1, 2a, 2b and 2c properties.

Taxpayers who feel their assessments are unequal, excessive, unlawful or that their property is misclassified, have a right to have their assessments reviewed by the Board of Assessment Review, or, if necessary, by the courts.

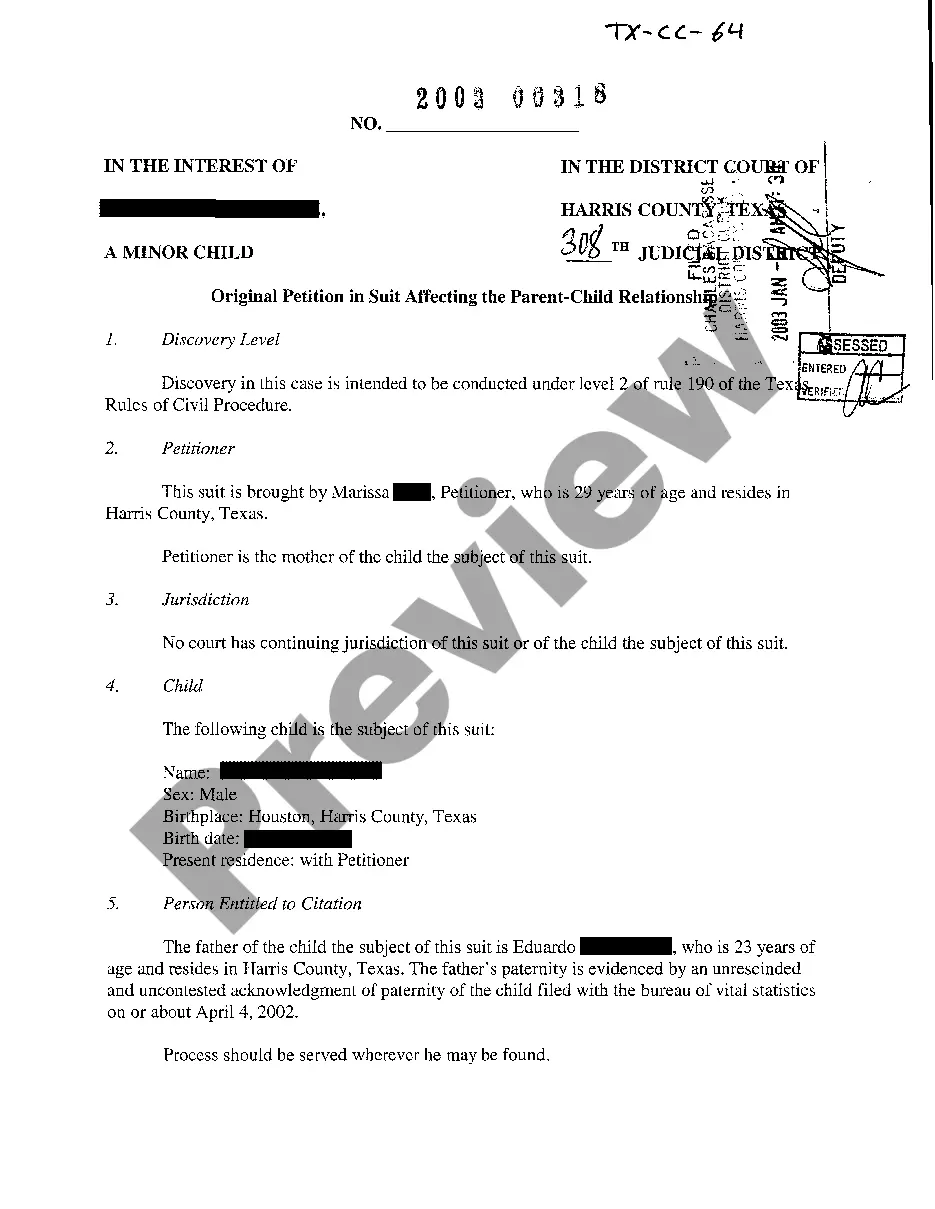

The Small Claims Assessment Review is a procedure that provides property owners with an opportunity to challenge the assessment on their real property as determined by the Board of Assessment Review (in counties outside Nassau and NYC) or the Assessment Review Commission (Nassau County) or the New York City Tax

SCAR E-Filing Instructions Complete & sign your SCAR petition. Save document as a pdf. Go to Log-in Start a New Case then Select Case Type Other Real Property (Select an option): SCAR. Key in homeowner's information then proceed to $30.00 payment (AMEX & VISA/MC) County Clerk will assign a SCAR number (ER2335x)

SCAR stands for "Small Claims Assessment Review" and refers to the process which allows owner-occupants of residential property to file a court case to challenge a tax assessment. This can only be done after a property tax assessment grievance has been turned down by the local Board of Assessment review.